The Vermont Release of Production Payment Created by An Assignment is a legally binding document that allows for the transfer of rights and obligations related to the production payment from the assignor to the assignee in the state of Vermont. This document outlines the details of the assignment and ensures that both parties are aware of their rights and responsibilities. In Vermont, there are different types of Release of Production Payment Created by An Assignment that may be used depending on the specific circumstances: 1. Vermont Contract Assignment: This type of assignment is commonly used when a contract holder wants to transfer their production payment rights and obligations to another party. It ensures that all parties involved are aware of the terms and conditions of the assignment and provides legal protection. 2. Vermont Lease Assignment: In situations where a lease agreement includes production payment rights, this type of assignment is used to transfer those rights and obligations to another party. It clarifies the responsibilities and ensures compliance with the terms of the lease. 3. Vermont Mortgage Assignment: Properties with production payment obligations may have mortgages attached to them. This type of assignment allows for the transfer of the mortgage and the related production payment responsibilities to another party. It ensures that the assignee understands their obligations and rights. 4. Vermont Deed of Trust Assignment: Similar to the mortgage assignment, a deed of trust assignment transfers both the ownership and production payment rights and obligations. This type of assignment is commonly used when a property is used as collateral for a loan. Regardless of the type of assignment, the Vermont Release of Production Payment Created by An Assignment is essential for ensuring a smooth transfer of rights and obligations. This document protects both the assignor and the assignee by clearly outlining the terms and conditions of the assignment and preventing any misunderstandings or disputes in the future. When using a Vermont Release of Production Payment Created by An Assignment, it is crucial to consult with a legal professional to ensure compliance with Vermont state laws and to address any specific requirements or provisions that may be necessary for your particular situation.

Vermont Release of Production Payment Created by An Assignment

Description

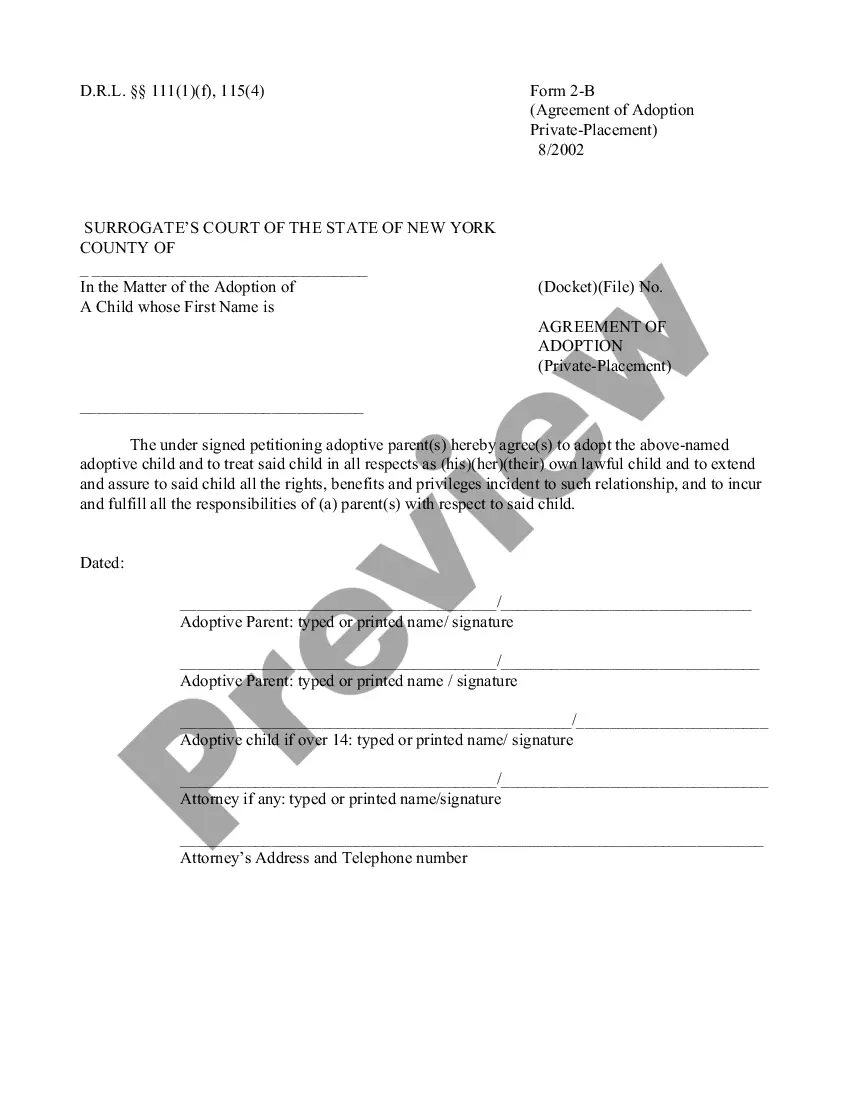

How to fill out Vermont Release Of Production Payment Created By An Assignment?

US Legal Forms - among the greatest libraries of authorized types in the USA - offers a wide array of authorized document web templates you may obtain or produce. Utilizing the site, you will get a huge number of types for enterprise and personal uses, sorted by classes, states, or key phrases.You will discover the newest types of types much like the Vermont Release of Production Payment Created by An Assignment within minutes.

If you already have a registration, log in and obtain Vermont Release of Production Payment Created by An Assignment through the US Legal Forms collection. The Obtain switch will show up on every single form you look at. You gain access to all earlier delivered electronically types in the My Forms tab of the bank account.

If you would like use US Legal Forms for the first time, listed below are simple instructions to help you started:

- Be sure you have picked out the proper form for your town/state. Click the Review switch to check the form`s content. Look at the form explanation to ensure that you have chosen the appropriate form.

- When the form doesn`t fit your requirements, take advantage of the Research industry near the top of the monitor to obtain the one who does.

- In case you are content with the shape, validate your option by simply clicking the Purchase now switch. Then, choose the costs prepare you want and provide your qualifications to register for an bank account.

- Process the deal. Utilize your charge card or PayPal bank account to finish the deal.

- Find the format and obtain the shape on your own gadget.

- Make changes. Fill out, revise and produce and indicator the delivered electronically Vermont Release of Production Payment Created by An Assignment.

Every single web template you put into your money lacks an expiration particular date and is the one you have permanently. So, in order to obtain or produce yet another duplicate, just proceed to the My Forms portion and then click about the form you will need.

Get access to the Vermont Release of Production Payment Created by An Assignment with US Legal Forms, one of the most substantial collection of authorized document web templates. Use a huge number of skilled and condition-certain web templates that meet your small business or personal requires and requirements.

Form popularity

FAQ

32 V.S.A. § 4791. Delinquent Taxes. Within 15 days after the tax due date (or within such earlier time as the voters may establish), the treasurer must issue a warrant against delinquent taxpayers for the amount of unpaid taxes.

After the town sells your home at a tax sale, you can still get your home back. This is called the redemption period. You have 12 months from the time of the tax sale to pay the town the amount of money it sold your home for at the tax sale.

A primary residence in Vermont pays at a varying rate ? 0.5% on the first $100,000 in value and then 1.45% (really 1.25% transfer tax and 0.2% clean water fee) on the remaining value. Properties other than a primary residence pay the 1.45% on all value.

There are four main types of transfer taxes: real property, gift, estate, and generation-skipping.

(1) With respect to the transfer of property to be used for the principal residence of the transferee, the tax shall be imposed at the rate of five-tenths of one percent of the first $100,000.00 in value of the property transferred and at the rate of one and one-quarter percent of the value of the property transferred ...

In Vermont, squatters can start an adverse possession process to claim legal ownership of the property they occupied after living there for 15 uninterrupted years. After this period, a squatter is no longer considered a criminal trespasser and faces no charges.