Vermont Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease

Description

How to fill out Commingling And Entirety Agreement By Royalty Owners Where Royalty Ownership Varies In Lands Subject To Lease?

Are you currently in the place the place you will need paperwork for sometimes company or person purposes nearly every day time? There are a lot of lawful papers themes available on the net, but getting types you can rely isn`t easy. US Legal Forms gives 1000s of type themes, like the Vermont Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease, which are written in order to meet federal and state specifications.

When you are already informed about US Legal Forms internet site and also have an account, merely log in. Next, you may download the Vermont Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease design.

If you do not have an accounts and need to start using US Legal Forms, follow these steps:

- Get the type you need and make sure it is to the appropriate city/county.

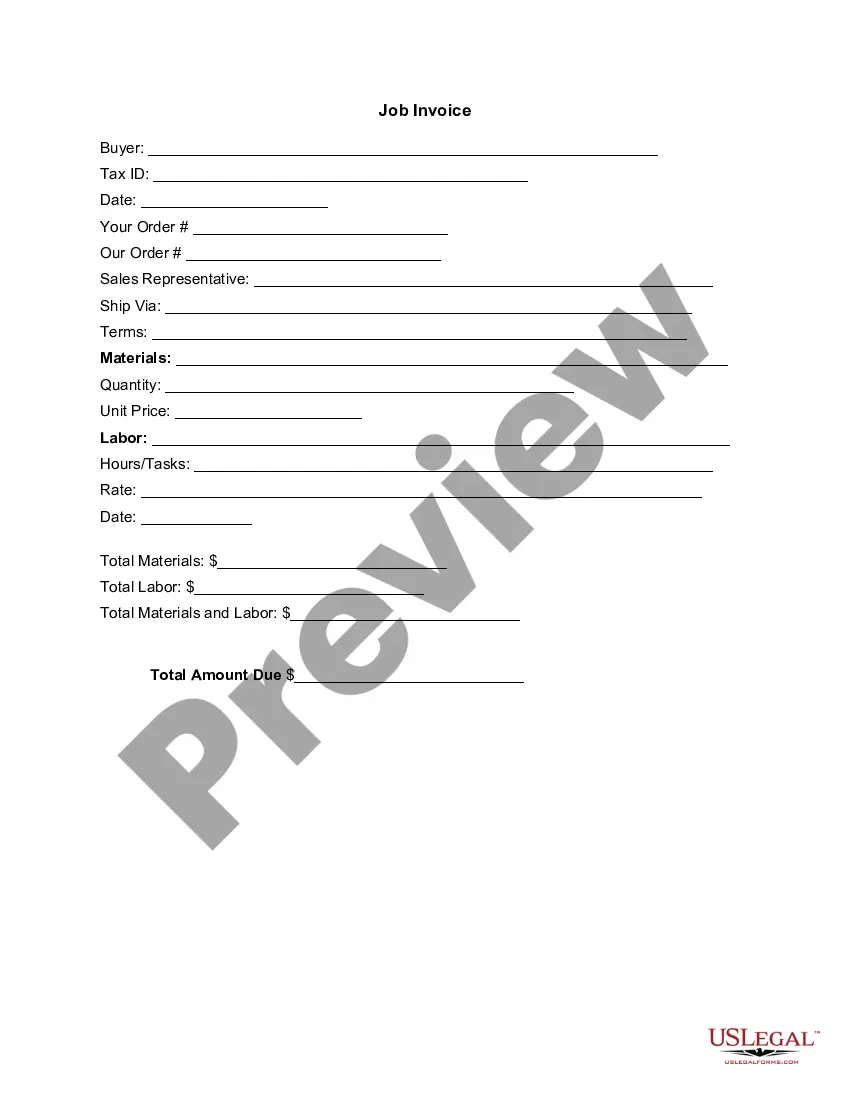

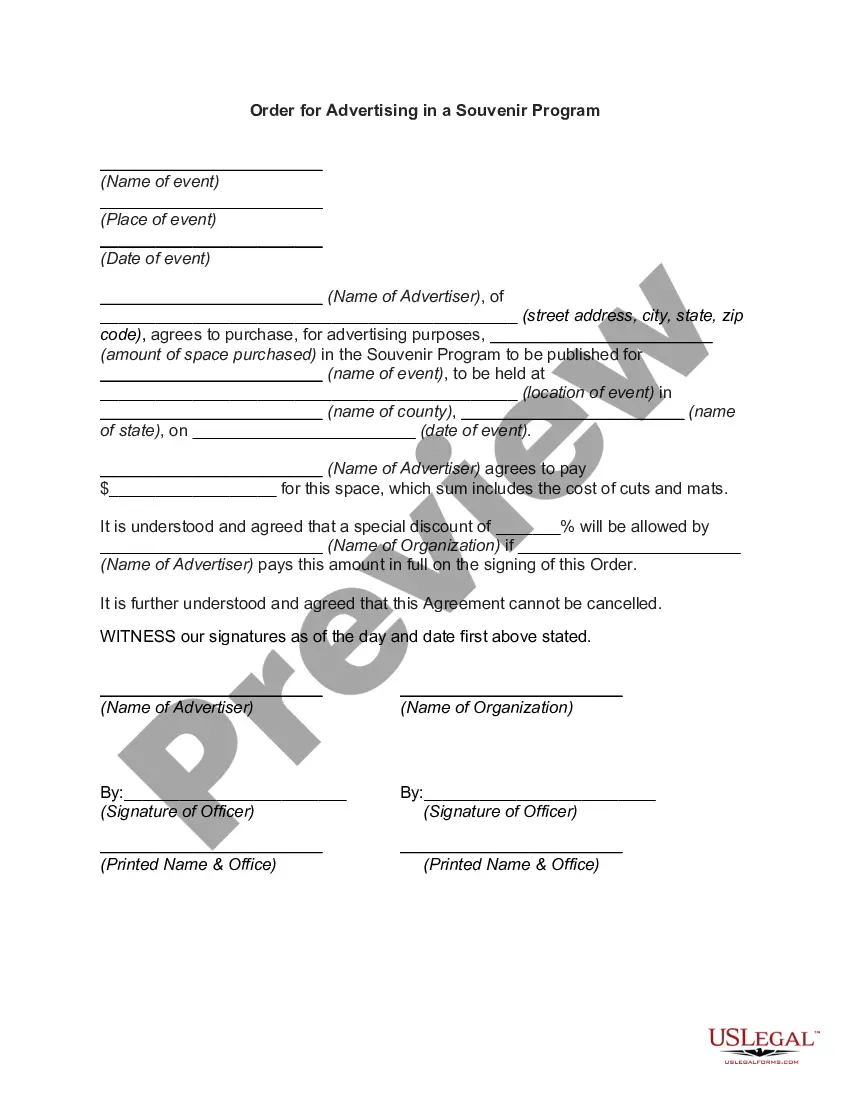

- Use the Review button to review the shape.

- Browse the explanation to actually have chosen the appropriate type.

- When the type isn`t what you are searching for, take advantage of the Look for discipline to discover the type that meets your needs and specifications.

- Whenever you find the appropriate type, just click Acquire now.

- Select the prices prepare you desire, fill in the specified information and facts to produce your account, and pay money for your order making use of your PayPal or credit card.

- Choose a convenient data file file format and download your copy.

Find each of the papers themes you have bought in the My Forms food list. You can aquire a more copy of Vermont Commingling and Entirety Agreement By Royalty Owners where Royalty Ownership Varies in Lands Subject to Lease whenever, if necessary. Just select the needed type to download or print out the papers design.

Use US Legal Forms, one of the most considerable assortment of lawful forms, in order to save some time and prevent faults. The service gives skillfully manufactured lawful papers themes that you can use for an array of purposes. Generate an account on US Legal Forms and begin creating your way of life easier.

Form popularity

FAQ

The amount someone pays you to use your property, after you subtract the expenses you have for the property. Royalty income includes any payments you get from a patent, a copyright, or some natural resource that you own.

Royalties can generally be described as payments you receive for the use of your property, that are based in some way on the number of units sold. The two types of royalties most commonly encountered are: Royalties for the use of copyrights, trademarks, and patents.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.

Landowner's royalty: When someone owns land and allows someone else to use it, they can get paid for it. This payment is called a landowner's royalty. It's like getting paid for sharing your toys with a friend.

A Vermont rent-to-own lease agreement provides a standard lease between a landlord and tenant as well as an option allowing the tenant to purchase the property. The tenant will be given a specific time period when they will have to buy the property.

Royalties are a form of real property ownership as defined by the IRS. As property owners, royalty investments could provide a complement to existing real estate portfolios offering similar benefits to REIT's ? including passive-cash flow and upside participation from any recovery in energy prices.