This office lease form does not prevent the insurer from asserting any right it might have to recover its losses from a tortfeasor. A better way to approach this can be done by both obtaining an endorsement from the insurance company to waive its recovery rights and by inserting a clause in the lease to this effect.

Vermont Waivers of Subrogation

Description

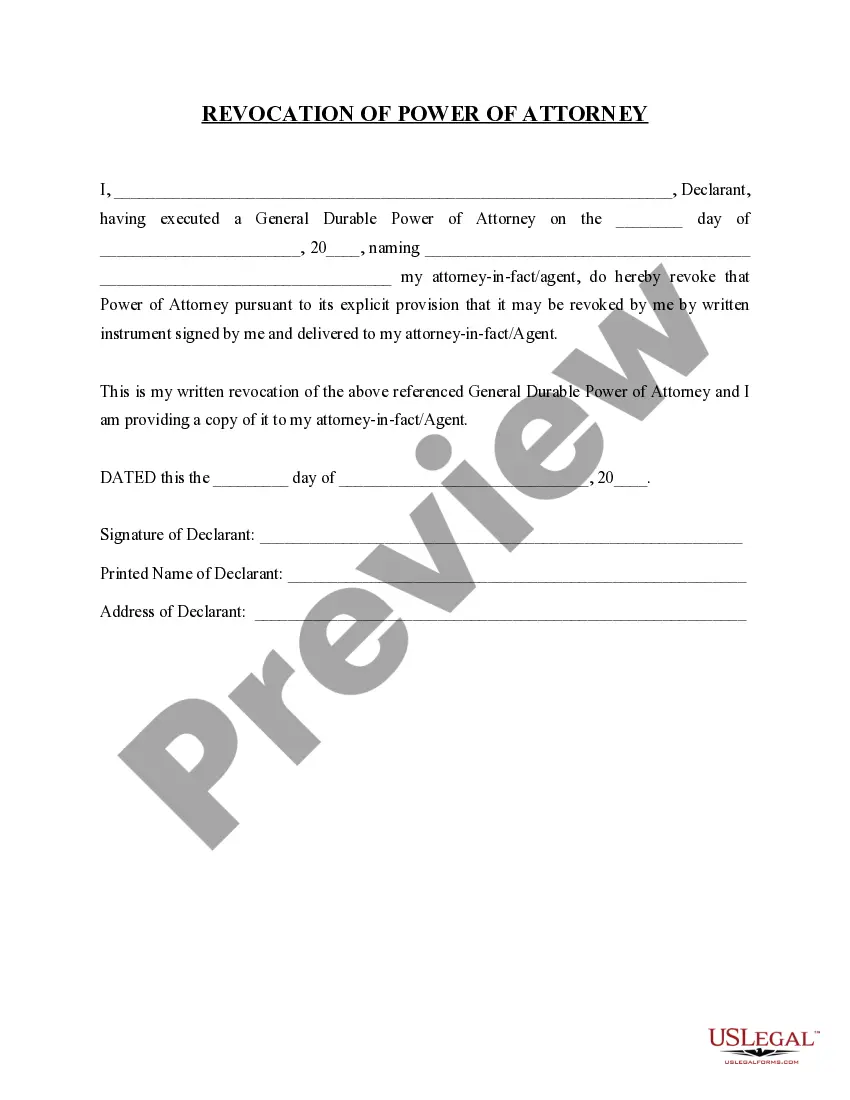

How to fill out Waivers Of Subrogation?

Have you been in a placement in which you will need paperwork for possibly enterprise or person purposes virtually every time? There are plenty of authorized document themes available online, but discovering kinds you can trust is not simple. US Legal Forms delivers thousands of kind themes, such as the Vermont Waivers of Subrogation, which are created to meet state and federal demands.

When you are previously acquainted with US Legal Forms internet site and get a merchant account, just log in. Following that, it is possible to download the Vermont Waivers of Subrogation design.

Should you not come with an account and need to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you want and make sure it is for that right town/area.

- Take advantage of the Review switch to check the form.

- Look at the outline to actually have selected the appropriate kind.

- In case the kind is not what you`re looking for, utilize the Lookup discipline to discover the kind that meets your requirements and demands.

- When you discover the right kind, just click Acquire now.

- Pick the rates strategy you desire, fill out the required details to produce your bank account, and pay for the transaction utilizing your PayPal or bank card.

- Decide on a practical document file format and download your backup.

Discover all the document themes you may have bought in the My Forms food list. You can aquire a extra backup of Vermont Waivers of Subrogation whenever, if required. Just select the needed kind to download or produce the document design.

Use US Legal Forms, by far the most considerable collection of authorized types, to save some time and steer clear of faults. The support delivers professionally manufactured authorized document themes which you can use for a selection of purposes. Make a merchant account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

Subrogation is a term describing a right held by most insurance carriers to legally pursue a third party that caused an insurance loss to the insured. This is done in order to recover the amount of the claim paid by the insurance carrier to the insured for the loss.

Clients may want your business to waive your right of subrogation so they will not be held liable for damages if they are partially responsible for a loss. When you waive your right of subrogation, your business (and your insurance company) are prevented from seeking a share of any damages paid.

A waiver of subrogation is a contractual provision whereby an insured waives the right of their insurance carrier to seek redress or seek compensation for losses from a negligent third party. Typically, insurers charge an additional fee for a waiver of subrogation endorsement.

Waivers of subrogation are intended to protect each party from claims by the other; additional insured status is protection against third party claims.

A waiver of subrogation states that if both you and one of your customers are sued, and the insurance provider pays a judgment as a result, the insurance company cannot seek to recover part of the judgment from your customer. Clients may ask you for a waiver of subrogation before doing business with you.

While primary and non-contributory endorsements protect additional insureds from having to make contributions during a claim, a waiver of subrogation prevents an insurance company from seeking contributions from a negligent third party to reimburse amounts already paid to a claim.

A hold harmless agreement differs in that it shifts liability. While a waiver of subrogation is protection from liability, it doesn't shift the liability as a hold harmless agreement does.