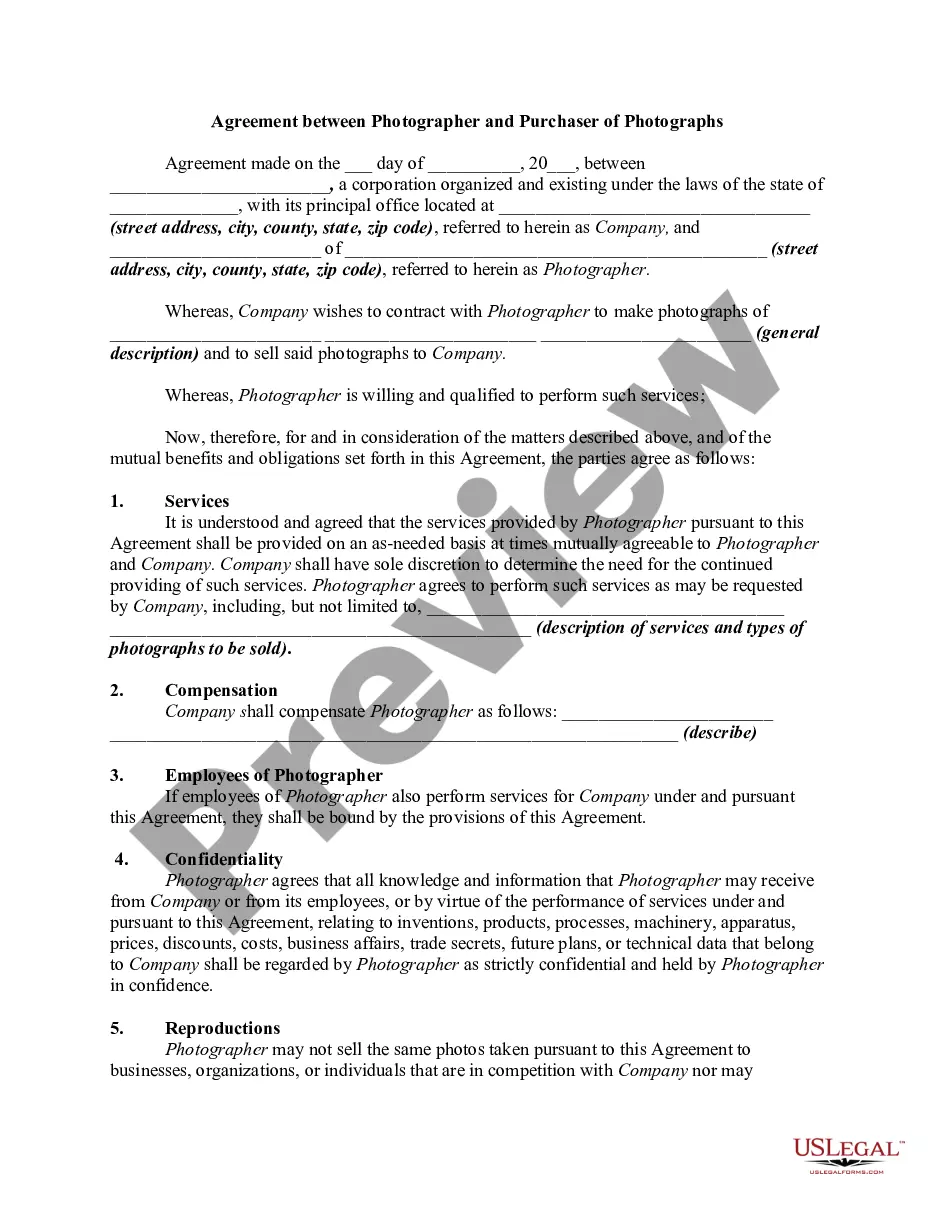

This form is a contribution agreement that provides that Company A will contribute Assets for a 51% share and Company B will contribute cash for a 49% share. This form provides that the parties enter into a separate operating agreement for the venture, as well as a liaison agreement and other documents.

Vermont Joint Venture Contribution Agreement

Description

How to fill out Joint Venture Contribution Agreement?

Have you been in a situation in which you need documents for both organization or individual uses nearly every working day? There are a variety of lawful file templates accessible on the Internet, but discovering versions you can rely on is not straightforward. US Legal Forms provides 1000s of type templates, like the Vermont Joint Venture Contribution Agreement, which are written to meet state and federal requirements.

Should you be currently familiar with US Legal Forms site and also have your account, basically log in. Following that, it is possible to down load the Vermont Joint Venture Contribution Agreement template.

Unless you have an profile and wish to begin using US Legal Forms, follow these steps:

- Discover the type you want and make sure it is for your correct city/region.

- Take advantage of the Preview button to analyze the shape.

- Look at the description to actually have chosen the correct type.

- If the type is not what you are trying to find, use the Search discipline to find the type that fits your needs and requirements.

- Whenever you find the correct type, click Get now.

- Opt for the prices strategy you desire, submit the necessary details to produce your bank account, and pay for your order making use of your PayPal or bank card.

- Select a practical file formatting and down load your backup.

Find each of the file templates you might have bought in the My Forms food list. You can get a further backup of Vermont Joint Venture Contribution Agreement at any time, if possible. Just select the required type to down load or produce the file template.

Use US Legal Forms, probably the most extensive collection of lawful types, to save lots of time as well as prevent blunders. The services provides appropriately produced lawful file templates which can be used for a selection of uses. Create your account on US Legal Forms and initiate making your lifestyle easier.

Form popularity

FAQ

There are four common types of joint ventures: project-based, functional-based, vertical, and horizontal. Project-based joint venture. A project-based joint venture has two or more parties working on a specific project. ... Functional-based joint venture. ... Vertical joint venture. ... Horizontal joint venture.

One of the better-known joint venture examples is the Caradigm venture between Microsoft Corporation and General Electric (GE) in 2011. The Caradigm project was launched to integrate a Microsoft healthcare intelligence product with various GE health-related technologies.

Since the joint venture is not a legal entity, it does not enter into contracts, hire employees, or have its own tax liabilities. These activities and obligations are handled through the co-venturers directly and are governed by contract law.

Create a joint venture agreement A written agreement should cover: the structure of the joint venture, eg whether it will be a separate business in its own right. the objectives of the joint venture. the financial contributions you will each make.

A joint venture (JV) is a business arrangement in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task. This task can be a new project or any other business activity.

Four types of joint ventures. Overall, joint ventures increase efficiency, reduce cost, and improve risk management. There are four common types of joint ventures: project-based, functional-based, vertical, and horizontal.

The common elements necessary to establish the existence of a joint venture are an express or implied contract, which includes the following elements: (1) a community of interest in the performance of the common purpose; (2) joint control or right of control; (3) a joint proprietary interest in the subject matter; (4) ...

Project Joint Venture ? this is one of the simplest, most common type of joint ventures that most companies enter. It is defined by a single specific goal set by both entities, and by the fact that the agreement ends when the project is completed and the initial goal is achieved.