Vermont Subscription Agreement for an Equity Fund: A Comprehensive Guide A Vermont Subscription Agreement for an Equity Fund is a legally binding contract between an investor and an equity fund. It outlines the terms and conditions of an investor's subscription to the fund, including the method and amount of investment, rights and responsibilities of both parties, and any associated risks or limitations. This agreement serves as a tool to ensure transparency and protect the interests of both the investor and the equity fund management. It governs the relationship between the two parties, providing a framework for the fund's operations and investments. Key Elements of a Vermont Subscription Agreement: 1. Parties Involved: The agreement identifies the equity fund, its management company, and the investor(s) subscribing to the fund. Full legal names, addresses, and contact details are typically included. 2. Subscription Details: It specifies the investment amount, currency, and the preferred payment method (bank transfer, wire transfer, etc.). The agreement may also include any minimum or maximum investment requirements set by the fund. 3. Representations and Warranties: The investor typically provides representations and warranties confirming their eligibility to participate in the fund, declaring that they understand the risks associated with the investment, and ensuring that all information provided is accurate and complete. 4. Terms and Conditions: This section covers important details such as the duration of the agreement, any right to withdraw or redeem investments, and the fund's discretion to reject or accept a subscription. The agreement may also outline management fees, expenses, and the fund's investment strategy. 5. Confidentiality and Non-Disclosure: Investors, as part of the subscription agreement, often commit to keeping information about the equity fund confidential, preventing disclosure to third parties without the written consent of the fund. 6. Governing Law and Jurisdiction: Vermont Subscription Agreements usually detail the state laws that govern the agreement and specify the jurisdiction where any disputes will be resolved. Types of Vermont Subscription Agreements for an Equity Fund: 1. Individual Subscription Agreement: Typically used when individuals invest their personal funds into an equity fund. 2. Institutional Subscription Agreement: Designed for institutional investors, such as pension funds, corporations, endowments, or foundations, that allocate substantial capital into equity funds. 3. Private Placement Subscription Agreement: This type of subscription agreement is used when the equity fund conducts a private placement offering, targeting a select group of sophisticated investors who meet specific eligibility criteria. 4. Limited Partnership Subscription Agreement: If an equity fund operates as a limited partnership, this type of subscription agreement is employed, outlining the rights and responsibilities of limited and general partners. In conclusion, a Vermont Subscription Agreement for an Equity Fund lays out the terms and conditions surrounding the investment in an equity fund. It acts as a legally binding contract, providing clarity and protection for both investors and equity fund management. The agreement ensures transparency and fosters a mutually beneficial relationship by outlining the rights, responsibilities, and constraints of all involved parties.

Vermont Subscription Agreement for an Equity Fund

Description

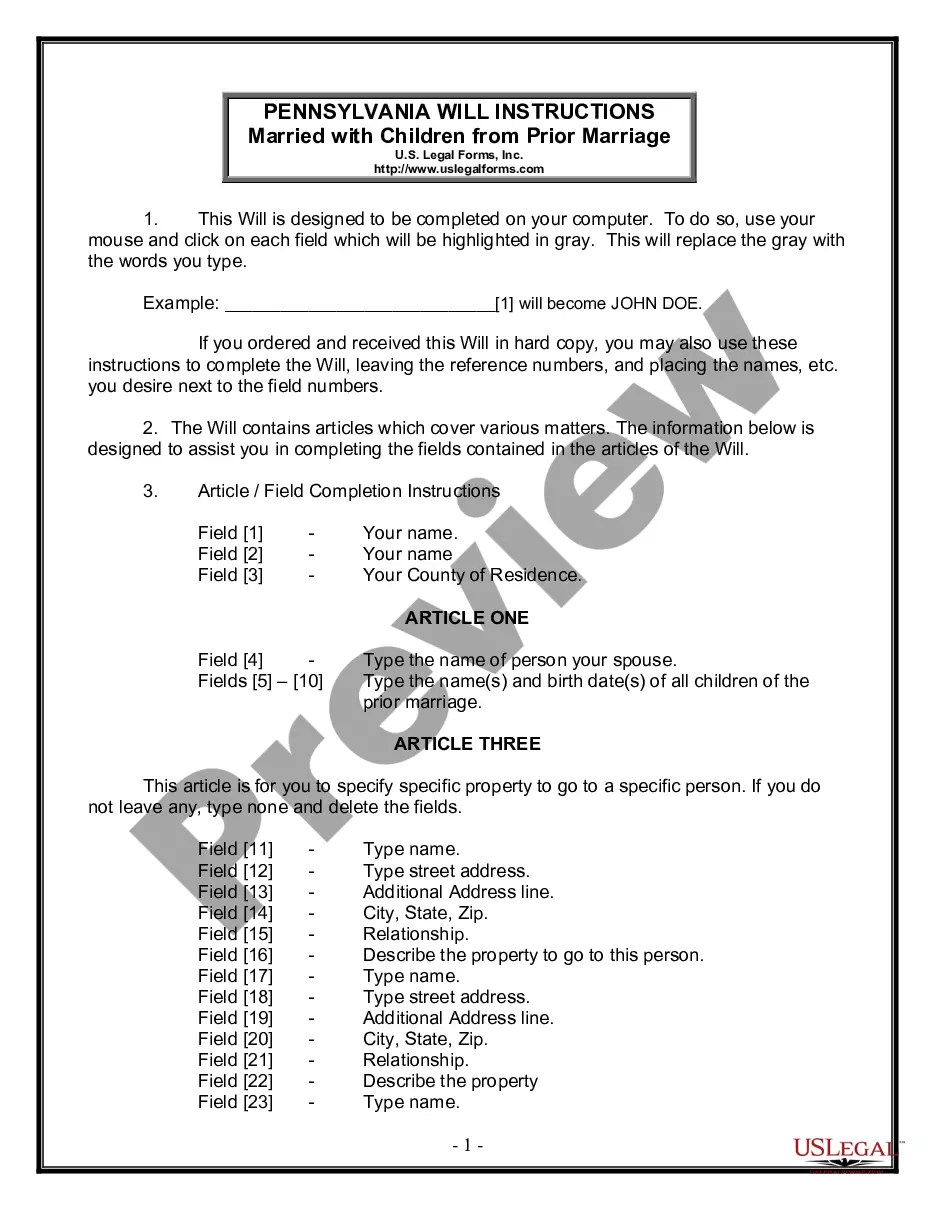

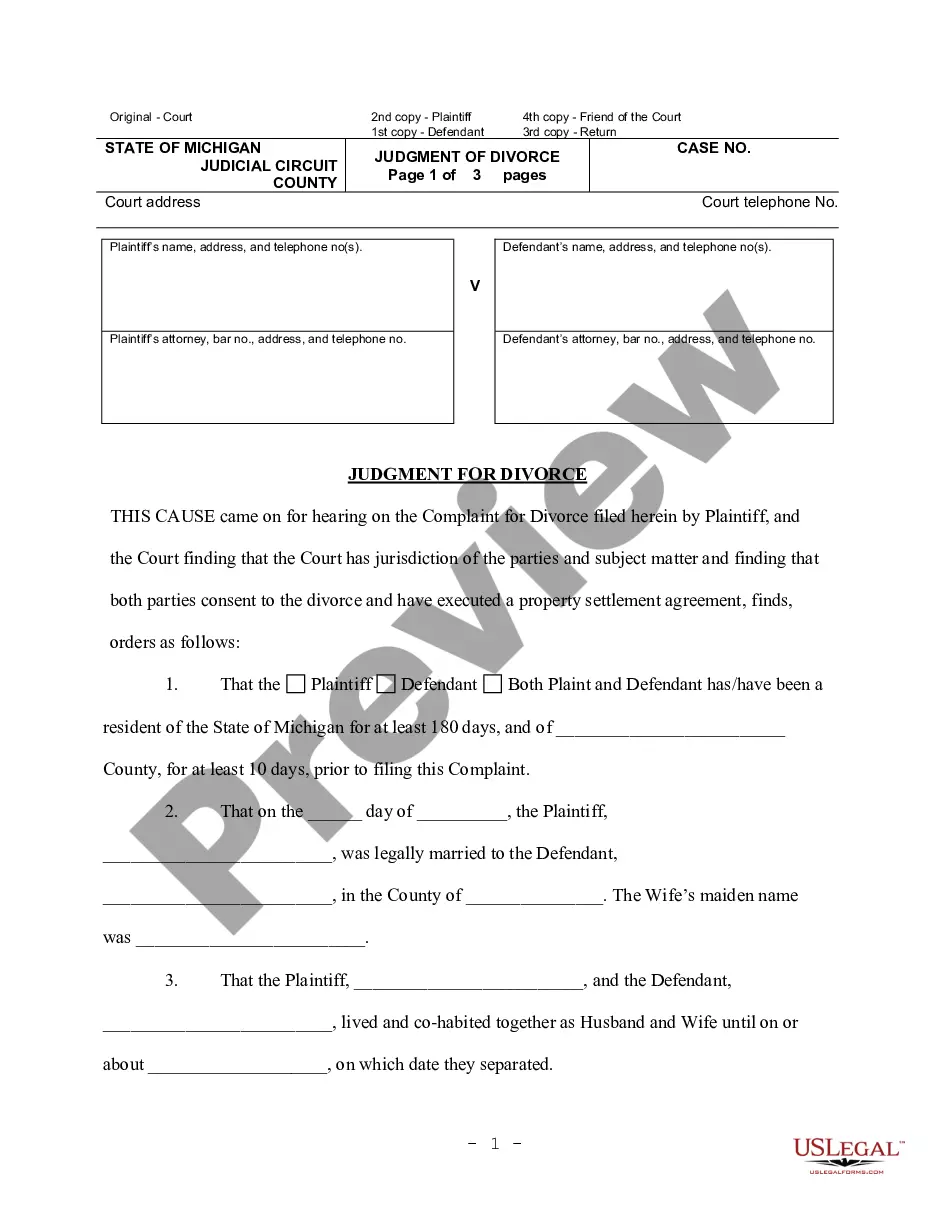

How to fill out Vermont Subscription Agreement For An Equity Fund?

It is possible to devote time on the Internet attempting to find the lawful document template that meets the federal and state needs you will need. US Legal Forms offers thousands of lawful types which are examined by pros. You can actually download or printing the Vermont Subscription Agreement for an Equity Fund from my assistance.

If you currently have a US Legal Forms bank account, you may log in and click on the Download key. After that, you may comprehensive, revise, printing, or indicator the Vermont Subscription Agreement for an Equity Fund. Every lawful document template you purchase is your own property forever. To have one more backup associated with a bought develop, go to the My Forms tab and click on the corresponding key.

If you are using the US Legal Forms internet site the very first time, follow the basic directions listed below:

- Initial, ensure that you have selected the right document template for your county/area of your choice. Read the develop outline to ensure you have picked out the right develop. If offered, utilize the Preview key to search throughout the document template at the same time.

- In order to discover one more version from the develop, utilize the Search field to get the template that fits your needs and needs.

- Upon having located the template you need, click Buy now to move forward.

- Find the pricing program you need, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Comprehensive the deal. You should use your credit card or PayPal bank account to cover the lawful develop.

- Find the formatting from the document and download it to your gadget.

- Make alterations to your document if possible. It is possible to comprehensive, revise and indicator and printing Vermont Subscription Agreement for an Equity Fund.

Download and printing thousands of document layouts making use of the US Legal Forms web site, which provides the greatest collection of lawful types. Use expert and express-particular layouts to deal with your small business or person demands.

Form popularity

FAQ

A simple agreement for future equity (SAFE) is a financing contract that may be used by a startup company to raise capital in its seed financing rounds. The instrument is viewed by some as a more founder-friendly alternative to convertible notes.

Hear this out loud PauseSpecifically, the ?Subscription Agreement for Future Equity ? Discount only? enables investors to pay in advance the subscription price for company shares/quotas (typically pre-seed and seed funding) with such shares/quotas to be issued by the company receiving the investment at a later date, so that valuation of the ...

Hear this out loud PauseA well organized and well-structured subscription agreement will include the details about the transaction, the number of shares being sold and the price per share, and any legally binding confidentiality agreements and clauses.

Hear this out loud PauseA share subscription agreement is essentially an agreement for the purchase of shares from a company. In contrast, a shareholders agreement contains terms that govern the ongoing relationship between shareholders.

Hear this out loud Pause1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.

A simple agreement for future equity or SAFE is a financing agreement between the company and an investor which grants the investor the right to receive shares at a point in the future, based on the valuation of the company at that point (usually the next funding round, often series A).

Cons: SAFE investors assume most, if not all, of the risk, in that there is no guarantee of any equity ownership in the company. ... A SAFE holder is not entitled to any company assets in the event of a liquidation.

Subscription agreements are more fixed than SAFEs. Very simply, the startup company offers to sell a set number of shares for a specific price. If an investor agrees to those terms, that investor is officially a shareholder of the startup. This can be less nebulous than a SAFE.