Vermont General Response to Affirmative Matter

Description

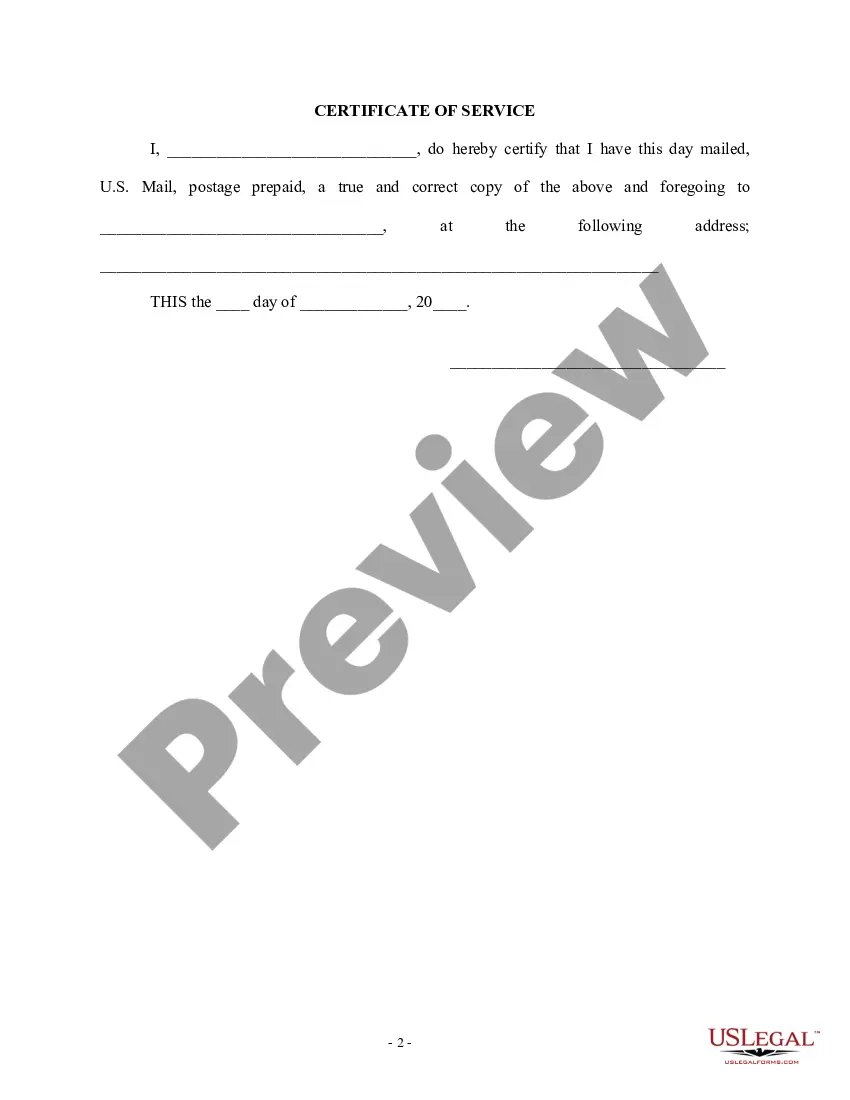

How to fill out General Response To Affirmative Matter?

If you want to complete, acquire, or print lawful document layouts, use US Legal Forms, the most important collection of lawful kinds, which can be found on the Internet. Use the site`s basic and practical search to get the documents you want. Different layouts for enterprise and person functions are categorized by categories and claims, or keywords. Use US Legal Forms to get the Vermont General Response to Affirmative Matter in a handful of mouse clicks.

Should you be presently a US Legal Forms buyer, log in to the accounts and click on the Download button to find the Vermont General Response to Affirmative Matter. Also you can entry kinds you earlier acquired from the My Forms tab of your respective accounts.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the shape for that proper area/country.

- Step 2. Utilize the Preview solution to look through the form`s articles. Do not neglect to see the information.

- Step 3. Should you be not happy with the form, take advantage of the Look for discipline near the top of the screen to locate other types of the lawful form web template.

- Step 4. Once you have found the shape you want, click on the Acquire now button. Choose the pricing strategy you prefer and put your qualifications to sign up for the accounts.

- Step 5. Procedure the deal. You may use your credit card or PayPal accounts to perform the deal.

- Step 6. Choose the format of the lawful form and acquire it on your own product.

- Step 7. Full, modify and print or signal the Vermont General Response to Affirmative Matter.

Every lawful document web template you get is your own permanently. You might have acces to each form you acquired in your acccount. Click on the My Forms portion and select a form to print or acquire once again.

Contend and acquire, and print the Vermont General Response to Affirmative Matter with US Legal Forms. There are millions of skilled and condition-particular kinds you can utilize to your enterprise or person needs.

Form popularity

FAQ

Rule 9.2 (a) requires that a complaint for eviction of a tenant of residential housing must contain or be accompanied by a declaration showing either compliance with that 30-day notice requirement, or that the dwelling from which eviction is sought is not located on or in a ?covered property? as defined in 15 U.S.C.

In Vermont, eminent domain gives the government the power to take your property, even if you don't want to sell. But under the Fifth Amendment, eminent domain must be for a ?public use,? which traditionally meant projects like roads or bridges.

Subchapter 002 : Pleadings Generally A party may file a response to the motion not more than 15 days after the motion is served on the party.

A party shall state in short and plain terms his defenses to such claim asserted and shall admit or deny the averments upon which the adverse party relies. If he is without knowledge or information sufficient to form a belief as to the truth of an averment, he shall so state and this has the effect of a denial.

When an action is commenced by filing, summons and complaint must be served upon the defendant within 60 days after the filing of the complaint. When an action is commenced by service, the complaint must be filed with the court within 21 days after the completion of service upon the first defendant served.

(1) Each averment of a pleading shall be simple, concise, and direct. No technical forms of pleading or motions are required. (2) A party may set forth two or more statements of a claim or defense alternately or hypothetically, either in one count or defense or in separate counts or defenses.

The modified comparative negligence rule means that injured people cannot recover any money at trial if they are more at fault than the defendant. In other words, in Vermont courts, if you are even slightly more responsible for causing your injury than the defendant, you recover nothing.

A party may set out 2 or more statements of a claim or defense alternatively or hypothetically, either in a single count or defense or in separate ones. If a party makes alternative statements, the pleading is sufficient if any one of them is sufficient.