A Vermont Tax Release Authorization is a legal document that allows an individual or organization to authorize the release of their tax information to a designated party. This authorization grants access to sensitive tax-related data that would otherwise be confidential. It is an essential document used in situations where the taxpayer wants to allow a third party, such as a tax preparer, attorney, or financial advisor, to have access to their tax records and information. Vermont offers different types of Tax Release Authorizations to cater to various needs and requirements. Some key types of Tax Release Authorizations in Vermont include: 1. Vermont Individual Tax Release Authorization: This type of authorization is used by individuals who want to grant access to their personal tax information to a designated person or entity. It allows the authorized party to obtain the taxpayer's tax return copies, account transcripts, tax payment records, and other relevant tax documents. 2. Vermont Business Tax Release Authorization: This type of authorization is specifically designed for businesses and allows them to authorize a third party to access their business tax records, including tax returns, financial statements, payroll information, and other tax-related documents. It is commonly used by businesses that hire tax professionals or accountants to handle their tax matters. 3. Vermont Power of Attorney and Tax Information Authorization: This is a comprehensive authorization that combines the powers of a traditional Power of Attorney and Tax Release Authorization. It grants the authorized person or entity the ability to act on behalf of the taxpayer in tax matters, including signing tax returns, responding to IRS inquiries, and accessing tax records. It's important to note that a Vermont Tax Release Authorization is a legally binding document, and the authorized party must use the disclosed information solely for the purpose stated in the authorization. Taxpayers should exercise caution and only grant this authorization to trustworthy individuals or entities who have a legitimate need for accessing their tax information. In conclusion, a Vermont Tax Release Authorization grants permission to a designated person or entity to access a taxpayer's confidential tax information. Different types of authorizations are available in Vermont, including Individual Tax Release Authorization, Business Tax Release Authorization, and Power of Attorney and Tax Information Authorization. It is crucial to ensure that the authorized party is trustworthy and will handle the taxpayer's information responsibly.

Vermont Tax Release Authorization

Description

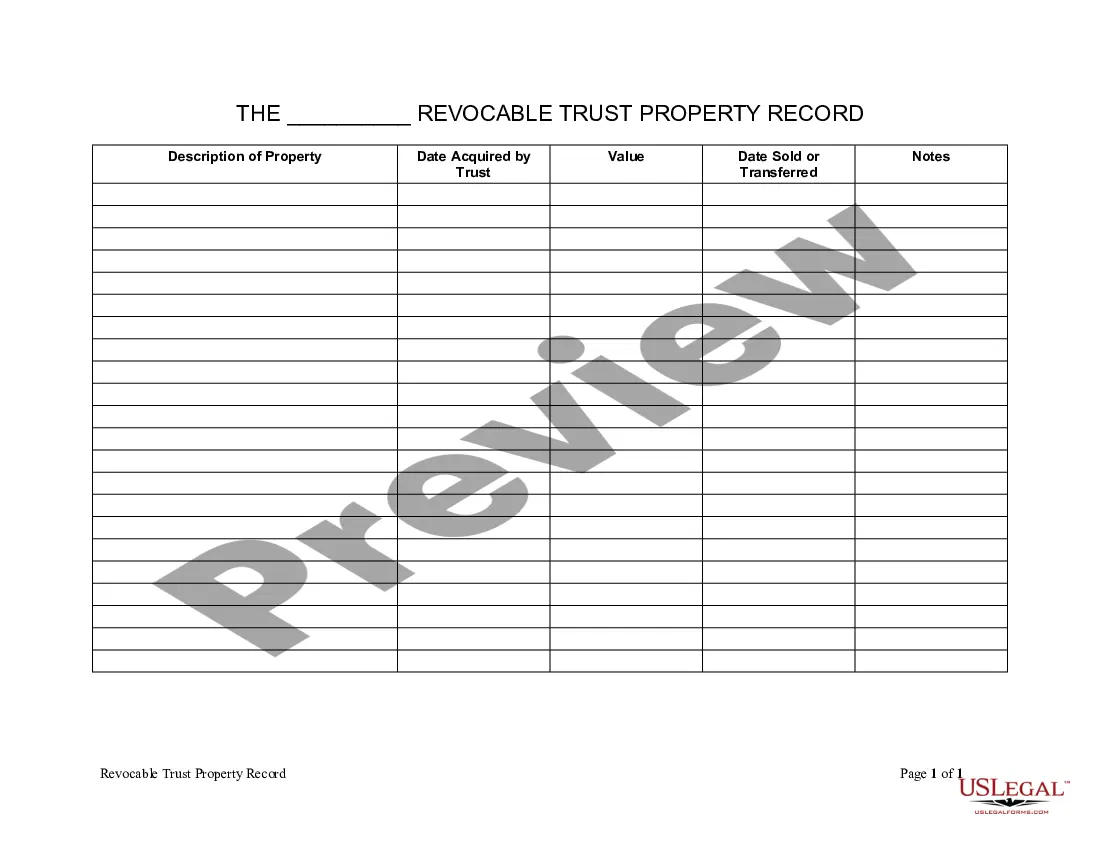

How to fill out Vermont Tax Release Authorization?

Finding the right legal file template can be quite a have a problem. Obviously, there are plenty of themes available on the net, but how can you get the legal form you want? Take advantage of the US Legal Forms web site. The assistance provides a huge number of themes, such as the Vermont Tax Release Authorization, that you can use for organization and personal needs. Every one of the types are inspected by specialists and meet state and federal specifications.

Should you be already registered, log in in your bank account and click on the Obtain key to get the Vermont Tax Release Authorization. Make use of bank account to check with the legal types you might have ordered formerly. Visit the My Forms tab of your bank account and acquire an additional copy in the file you want.

Should you be a brand new user of US Legal Forms, listed here are basic guidelines for you to stick to:

- Initial, ensure you have selected the appropriate form to your city/region. You can examine the shape using the Review key and look at the shape information to ensure it will be the best for you.

- If the form is not going to meet your preferences, utilize the Seach industry to get the right form.

- When you are sure that the shape is acceptable, go through the Get now key to get the form.

- Opt for the pricing prepare you need and type in the essential info. Design your bank account and buy your order with your PayPal bank account or Visa or Mastercard.

- Pick the submit file format and down load the legal file template in your product.

- Full, revise and print and signal the attained Vermont Tax Release Authorization.

US Legal Forms is definitely the largest library of legal types where you can find numerous file themes. Take advantage of the service to down load expertly-created documents that stick to condition specifications.

Form popularity

FAQ

The income of S-Corporations, Partnerships and Limited Liability Companies attributable to Vermont passes through to the shareholders, partners, or members and is taxed at the individual or corporate income tax rate.

Tax Information Authorization You can use Form 8821 to allow the IRS to discuss your tax matters with designated third parties and, where necessary, to disclose your confidential tax return information to those designated third parties on matters other than just the processing of your current tax return.

Remote Work If you are a non-resident but you are temporarily living and working in Vermont, you have an obligation to pay Vermont income taxes on the income earned while you were living and performing work in Vermont, regardless of your employer's location.

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

Generally, the Department processes e-filed returns in about 6-8 weeks, while paper returns typically take about 8-12 weeks.

File Form 8821 to: Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form.

File Form 8821 to: Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form.

A tax information authorization gives that person the legal right to review some confidential taxpayer information.