This employee stock option plan grants the optionee (the employee) a non-qualified stock option under the company's stock option plan. The option allows the employee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

Vermont Employee Stock Option Agreement

Description

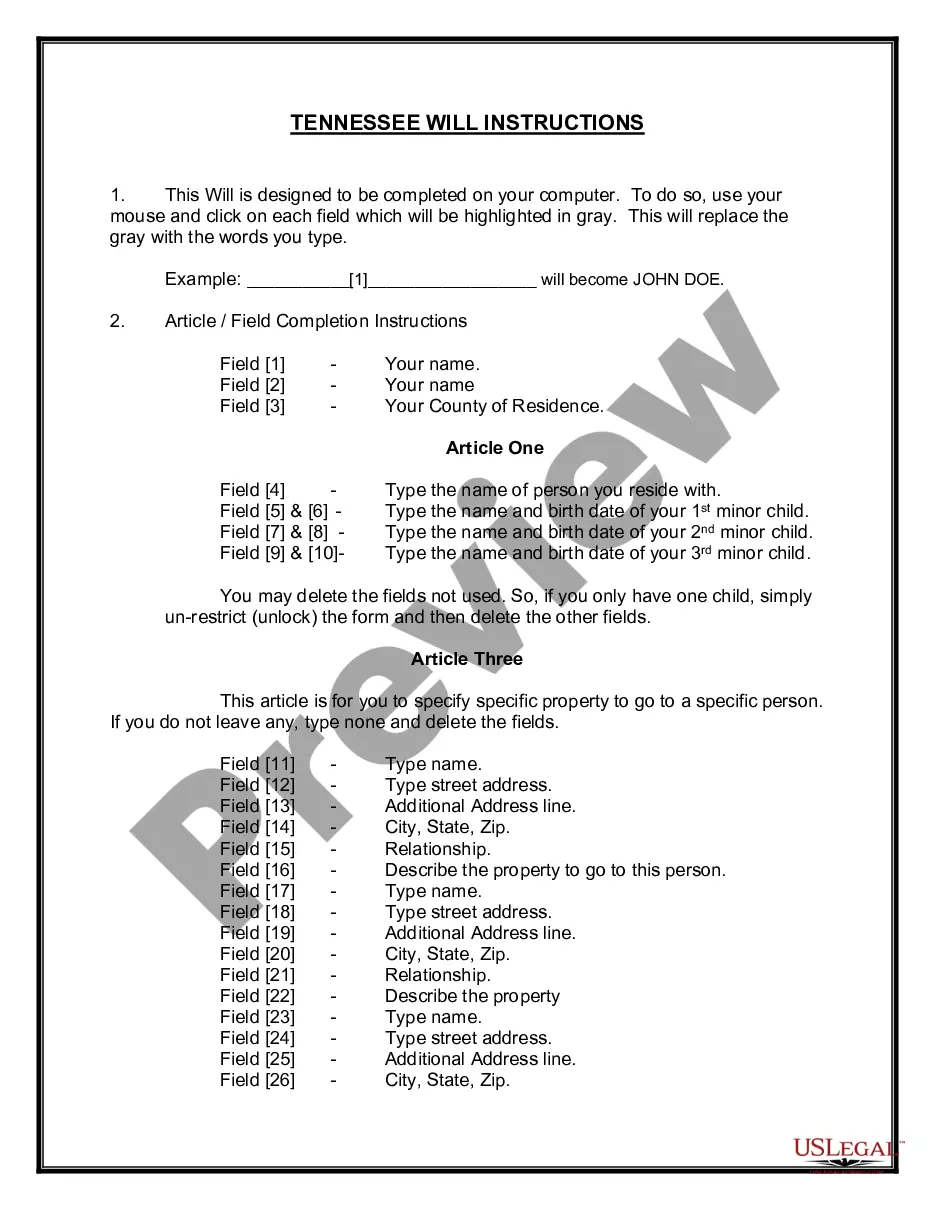

How to fill out Employee Stock Option Agreement?

It is possible to commit hrs on the web trying to find the authorized papers design that suits the federal and state requirements you want. US Legal Forms offers a large number of authorized forms that are examined by pros. You can easily acquire or print out the Vermont Employee Stock Option Agreement from our service.

If you have a US Legal Forms account, you can log in and then click the Download key. Afterward, you can full, revise, print out, or indicator the Vermont Employee Stock Option Agreement. Each and every authorized papers design you acquire is the one you have eternally. To have one more duplicate associated with a purchased develop, visit the My Forms tab and then click the related key.

If you are using the US Legal Forms website initially, stick to the easy guidelines below:

- Initial, be sure that you have selected the proper papers design to the region/city of your liking. Read the develop outline to ensure you have picked out the correct develop. If available, utilize the Preview key to appear from the papers design at the same time.

- If you would like discover one more model from the develop, utilize the Research industry to obtain the design that suits you and requirements.

- Upon having located the design you want, click on Purchase now to proceed.

- Select the rates strategy you want, key in your accreditations, and sign up for an account on US Legal Forms.

- Comprehensive the deal. You can use your bank card or PayPal account to purchase the authorized develop.

- Select the file format from the papers and acquire it to the product.

- Make modifications to the papers if needed. It is possible to full, revise and indicator and print out Vermont Employee Stock Option Agreement.

Download and print out a large number of papers layouts using the US Legal Forms Internet site, which provides the largest variety of authorized forms. Use professional and status-specific layouts to take on your business or personal needs.

Form popularity

FAQ

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.

An Employee Stock Ownership Plan (ESOP) is a tax- qualified retirement plan authorized and encouraged by federal tax and pension laws.

The term employee stock option (ESO) refers to a type of equity compensation granted by companies to their employees and executives. Rather than granting shares of stock directly, the company gives derivative options on the stock instead.

At the time of exercising the ESOPs, employees usually pay a nominal amount to buy the shares allotted to them. This, therefore, allows them to invest in the company at a preferential rate.

Participants' shares may be rolled over into the purchasing company's ESOP, if applicable; their ESOP accounts may be cashed out, with proceeds rolled into a 401(k) plan; or participants may receive a lump sum cash payment for the value of their stock.

1.Exit without exercising stock options Employees who leave the organization before completing the vesting period forfeit the right to own any stock. Even if the contract offers a partial vesting option, and they do not complete any of the conditions, they still forfeit the rights to own the stock.

How ESOPs Work. Companies set up a trust fund for employees and contribute either cash to buy company stock, contribute shares directly to the plan, or have the plan borrow money to buy shares. If the plan borrows money, the company makes contributions to the plan to enable it to repay the loan.

Identification. An ESOP qualifies as a retirement plan, such as a 401 (k) or individual retirement account, while corporations use stock options as an employee benefit, like health insurance. In an ESOP, the company contributes to employee retirement plans with its own stock.