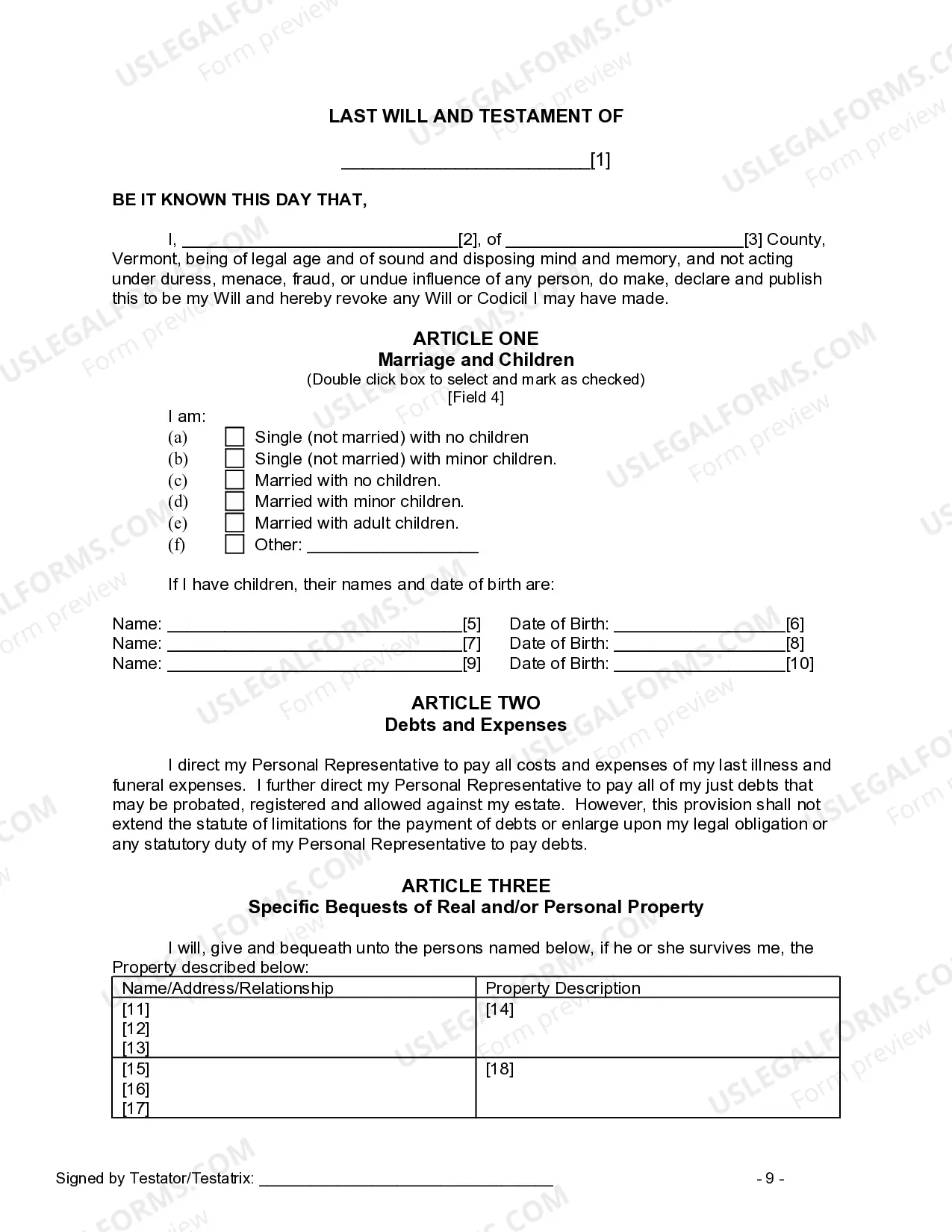

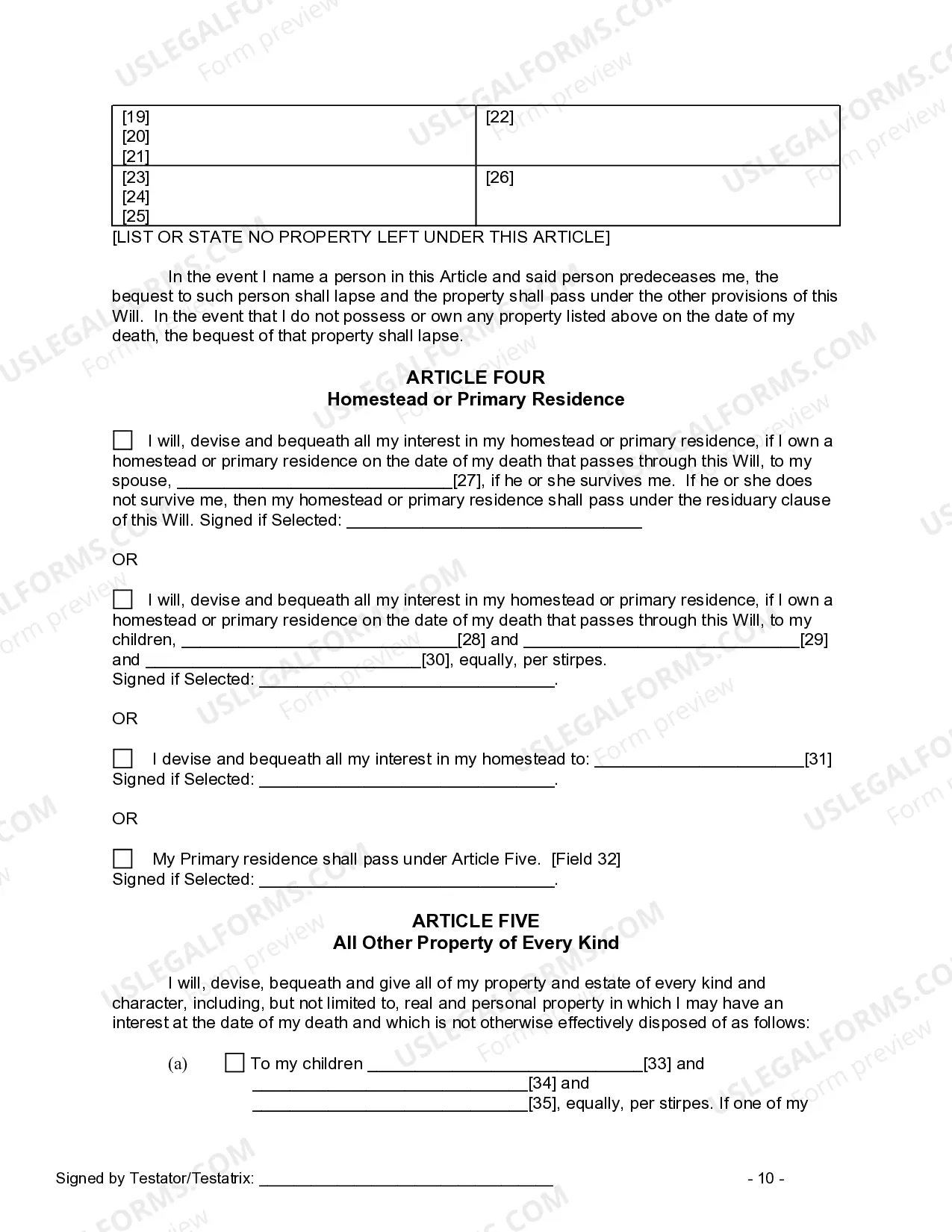

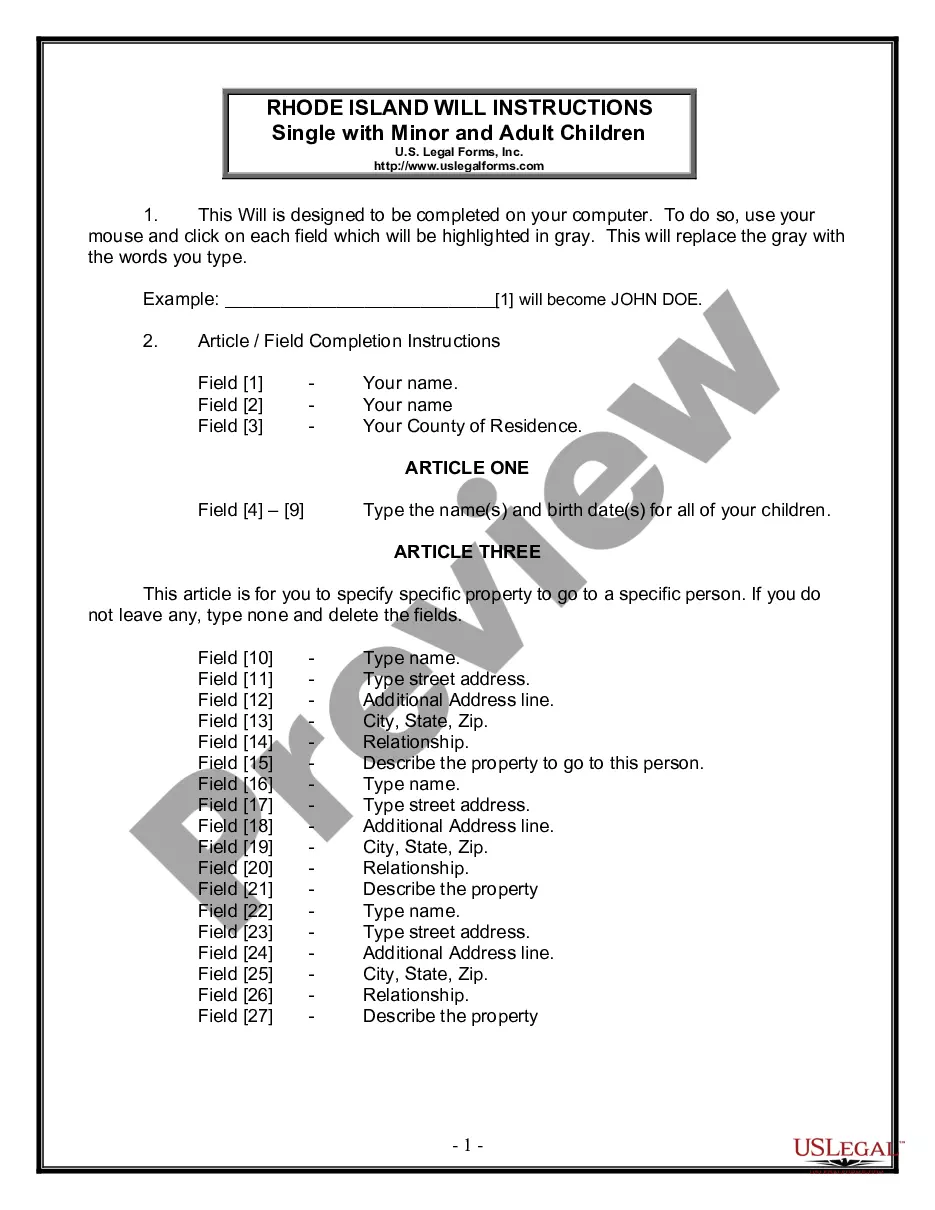

This form, a Last Will and Testament for other Persons, is for use if you cannot locate another document to fit your current needs. A will is a document that provides who is to receive your property at death, who will administer your estate, the appointment of trustees and guardians, if applicable, and other provisions. This is a will for anyone residing in the state of Vermont. This will is specifically designed to be completed on your computer.

Vermont Last Will and Testament for other Persons

Description

How to fill out Vermont Last Will And Testament For Other Persons?

Looking for a Vermont Last Will and Testament for other Persons online might be stressful. All too often, you find files that you just believe are fine to use, but discover later they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional legal professionals in accordance with state requirements. Get any form you’re searching for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll automatically be added in to the My Forms section. In case you do not have an account, you must sign up and pick a subscription plan first.

Follow the step-by-step recommendations below to download Vermont Last Will and Testament for other Persons from the website:

- See the document description and press Preview (if available) to check whether the template meets your expectations or not.

- In case the form is not what you need, get others with the help of Search field or the listed recommendations.

- If it is appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms library. In addition to professionally drafted templates, users will also be supported with step-by-step instructions on how to find, download, and complete forms.

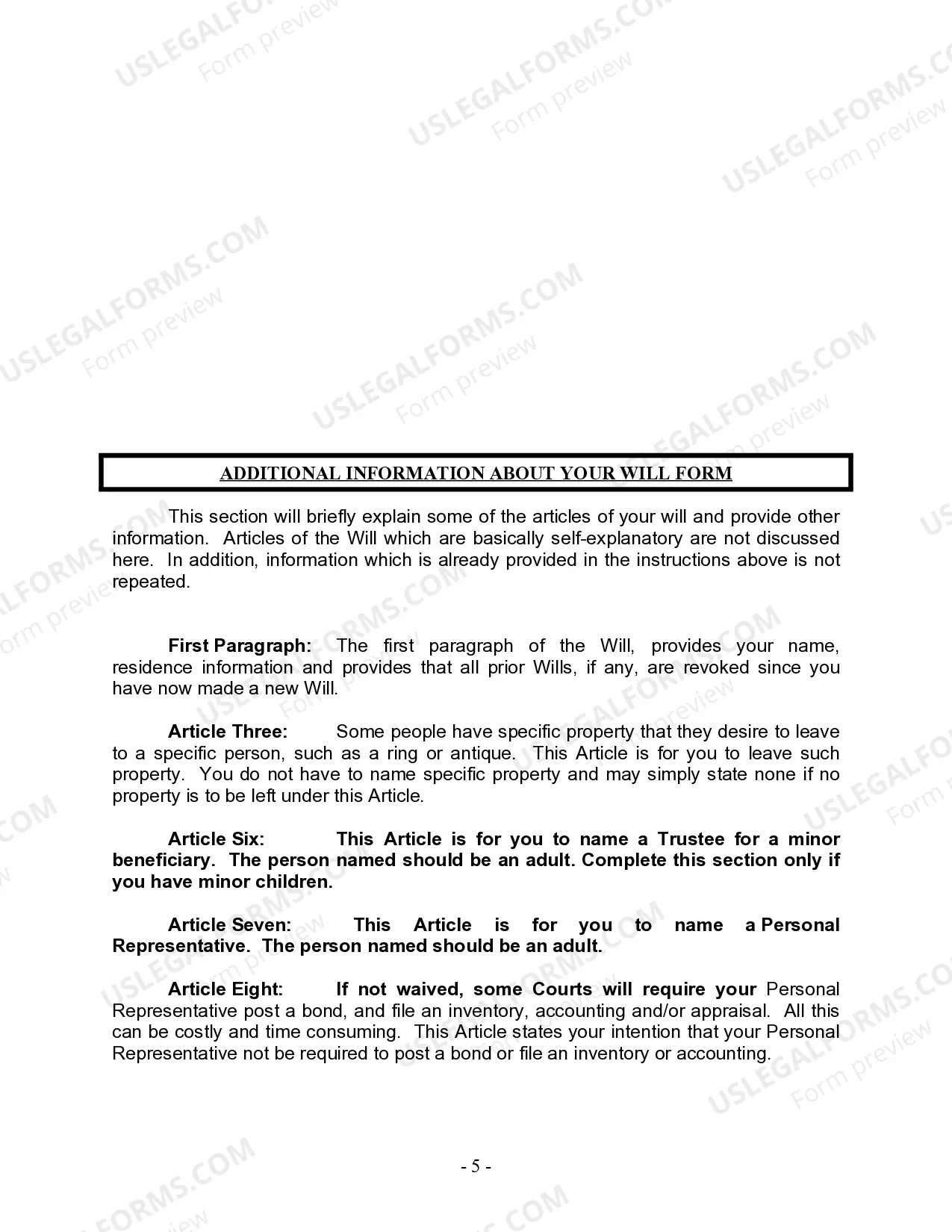

Form popularity

FAQ

As an aside, Vermont Statute Title 32 § 1143 states that executors may be paid $4 per day spent in court, but this is geared towards the court paying appointed agents, and that amount was set in 1866.

In California, estates valued over $150,000, and that don't qualify for any exemptions, must go to probate.If a person dies and owns real estate, regardless of value, either in his/her name alone or as a "tenant in common" with another, a probate proceeding is typically required to transfer the property.

Every financial institution will have a different threshold as to the amount they will transfer without a Grant of Probate. To provide you some guidance, a balance of somewhere in the vicinity of $20,000.00 $50,000.00 will not require a Grant of Probate.

In Vermont, you can make a living trust to avoid probate for virtually any asset you own -- real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

The testator or person making the will must be at least 18 years of age; 2022 the testator must be of sound mind; 2022 the will must be in writing; 2022 the will must be signed by the testator or the testator's name is written by another person in the testator's presence and at the testator's express direction; 2022 the

Retirement accountsIRAs or 401(k)s, for examplefor which a beneficiary was named. Life insurance proceeds (unless the estate is named as beneficiary, which is rare) Property held in a living trust. Funds in a payable-on-death (POD) bank account.

Write a Living Trust. The most straightforward way to avoid probate is simply to create a living trust. Name Beneficiaries on Your Retirement and Bank Accounts. For some, a last will is often a better fit than a trust because it is a more straightforward estate planning document. Hold Property Jointly.

No, in Vermont, you do not need to notarize your will to make it legal. However, Vermont allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that. A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.