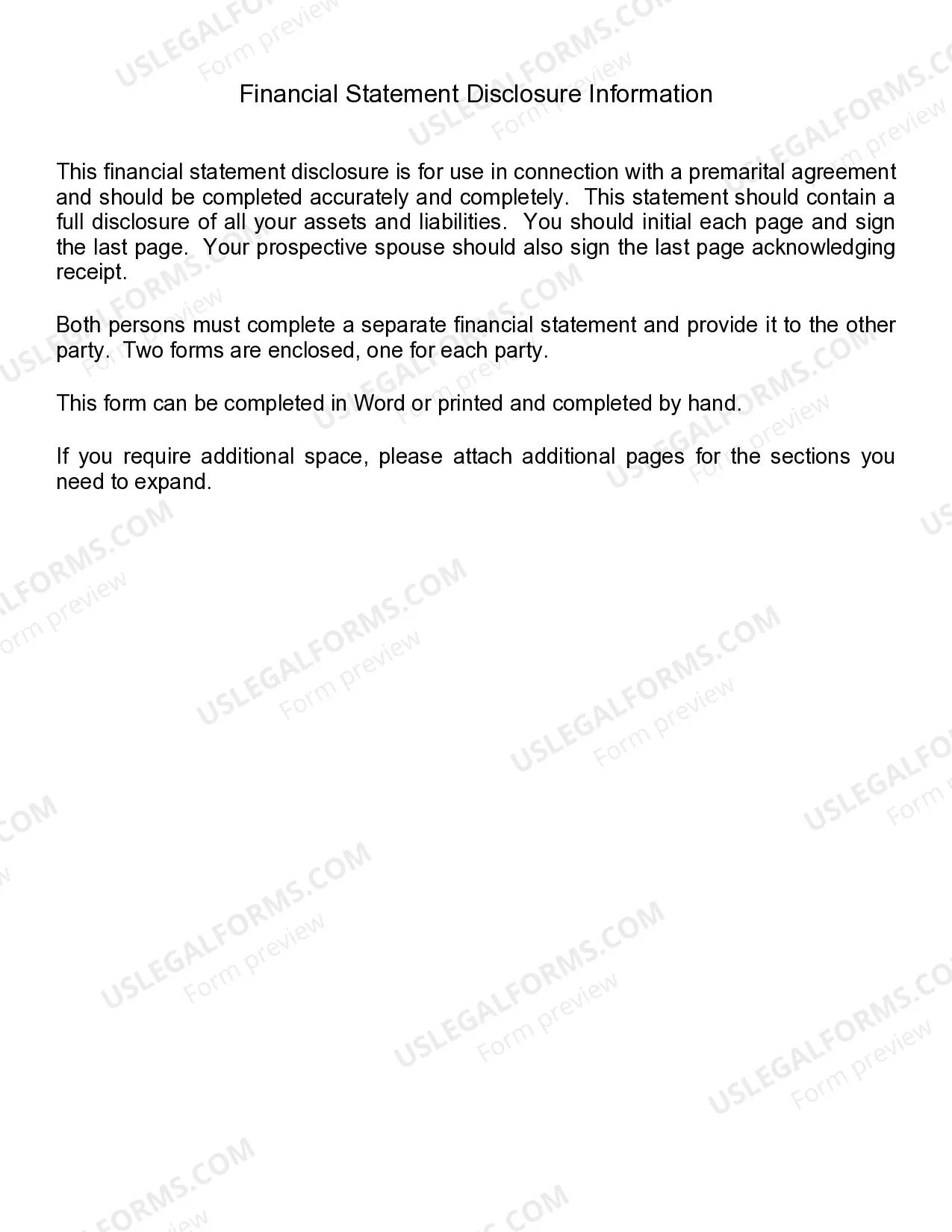

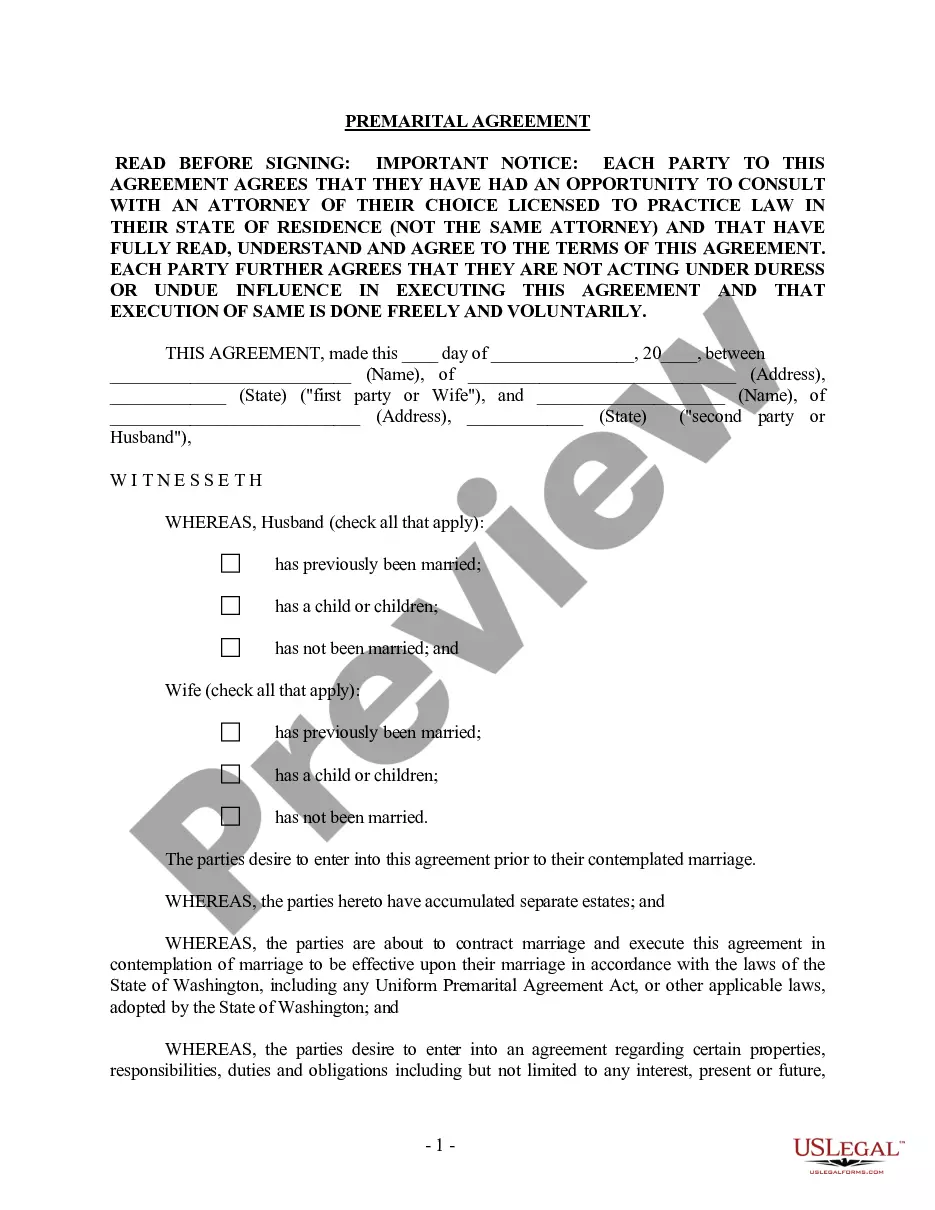

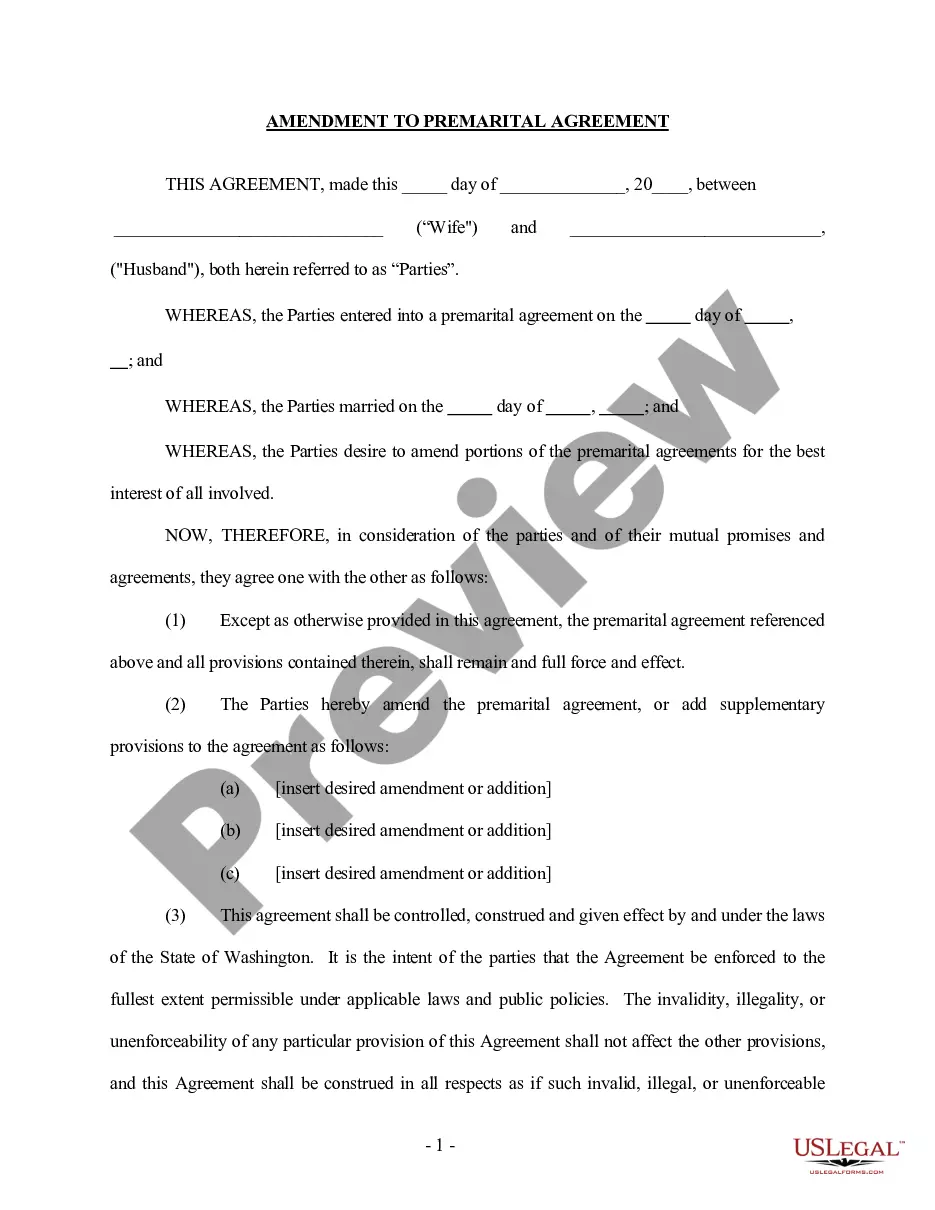

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

Washington Prenuptial Premarital Agreement with Financial Statements

Description

How to fill out Washington Prenuptial Premarital Agreement With Financial Statements?

Out of the multitude of platforms that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms before buying them. Its comprehensive catalogue of 85,000 samples is categorized by state and use for efficiency. All the documents available on the platform have been drafted to meet individual state requirements by qualified legal professionals.

If you already have a US Legal Forms subscription, just log in, search for the template, click Download and gain access to your Form name from the My Forms; the My Forms tab keeps your saved documents.

Stick to the guidelines listed below to get the document:

- Once you see a Form name, make sure it is the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the sample.

- Search for a new sample using the Search engine if the one you have already found is not proper.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

Once you’ve downloaded your Form name, you are able to edit it, fill it out and sign it in an web-based editor that you pick. Any document you add to your My Forms tab might be reused many times, or for as long as it continues to be the most up-to-date version in your state. Our service provides quick and simple access to templates that suit both attorneys as well as their clients.

Form popularity

FAQ

The purpose of a prenup is to opt out of certain provisions that the couple would otherwise be entering into under the laws of their state, Wasser said. You design a couple's own contract for how they want their money to be treated if they are to divorce in the future.

The average cost of a prenup ranges from about $1,200 for low-cost, simple agreements to $10,000 for more complicated situations.

Here are the top 10 reasons why a prenup could be invalid: There Isn't A Written Agreement: Premarital agreements are required to be in writing to be enforced. Not Correctly Executed: Each party is required to sign a premarital agreement prior to the wedding for the agreement to be deemed valid.

Typically, prenups cost around $2,500, but can cost more if you spend a while haggling out various issues.

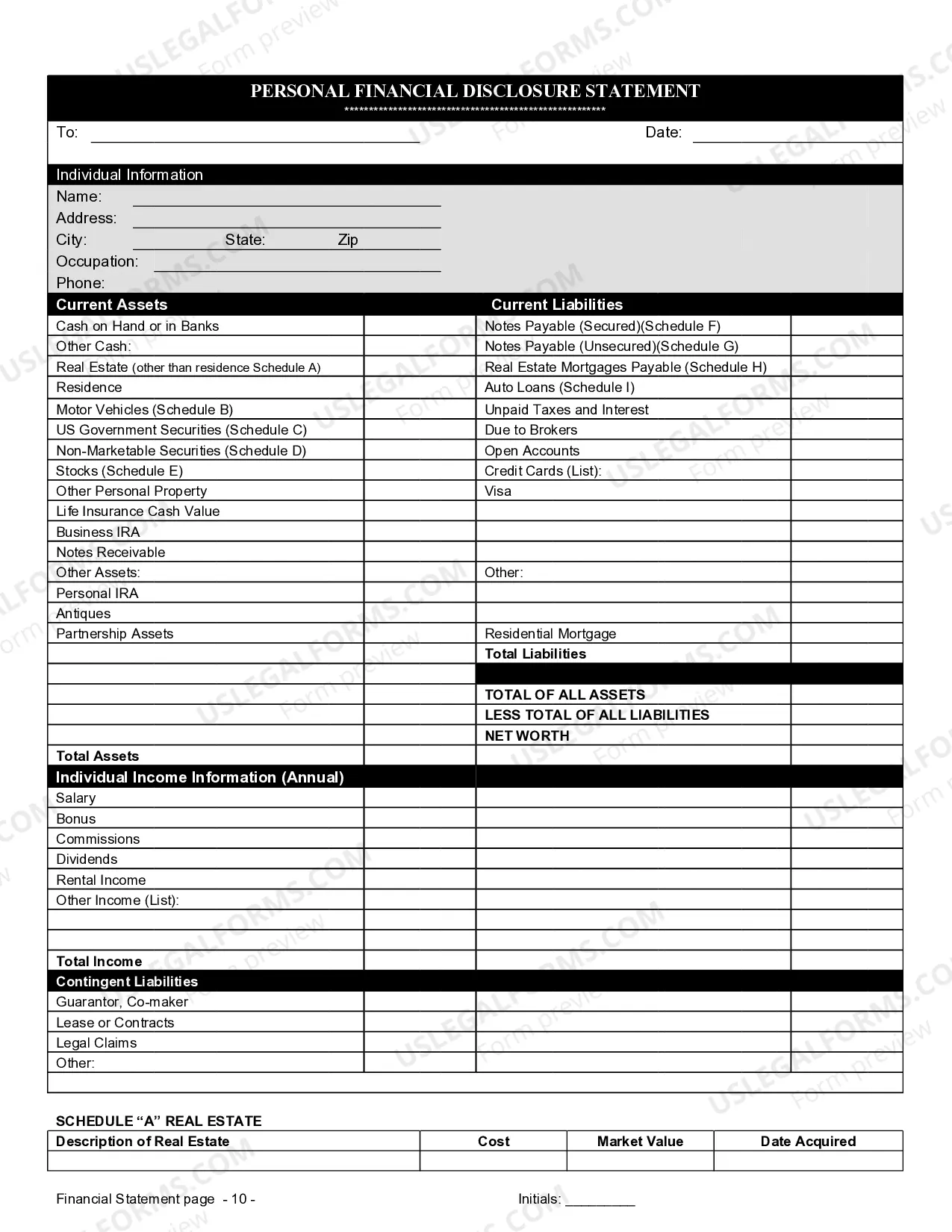

To ensure that a prenuptial agreement is fully enforceable in the Washington courts, the following requirements must be met: The agreement must be in writing.If there is no marriage, the agreement is unenforceable. The agreement should contain a list of the parties' assets, liabilities, and income.

A prenuptial agreement does not have to be notarized to be valid. Often, they are notarized, so there is no question that it was actually signed by the parties. Assuming, that neither of you are contesting the validity of the agreement it should be legally viable.

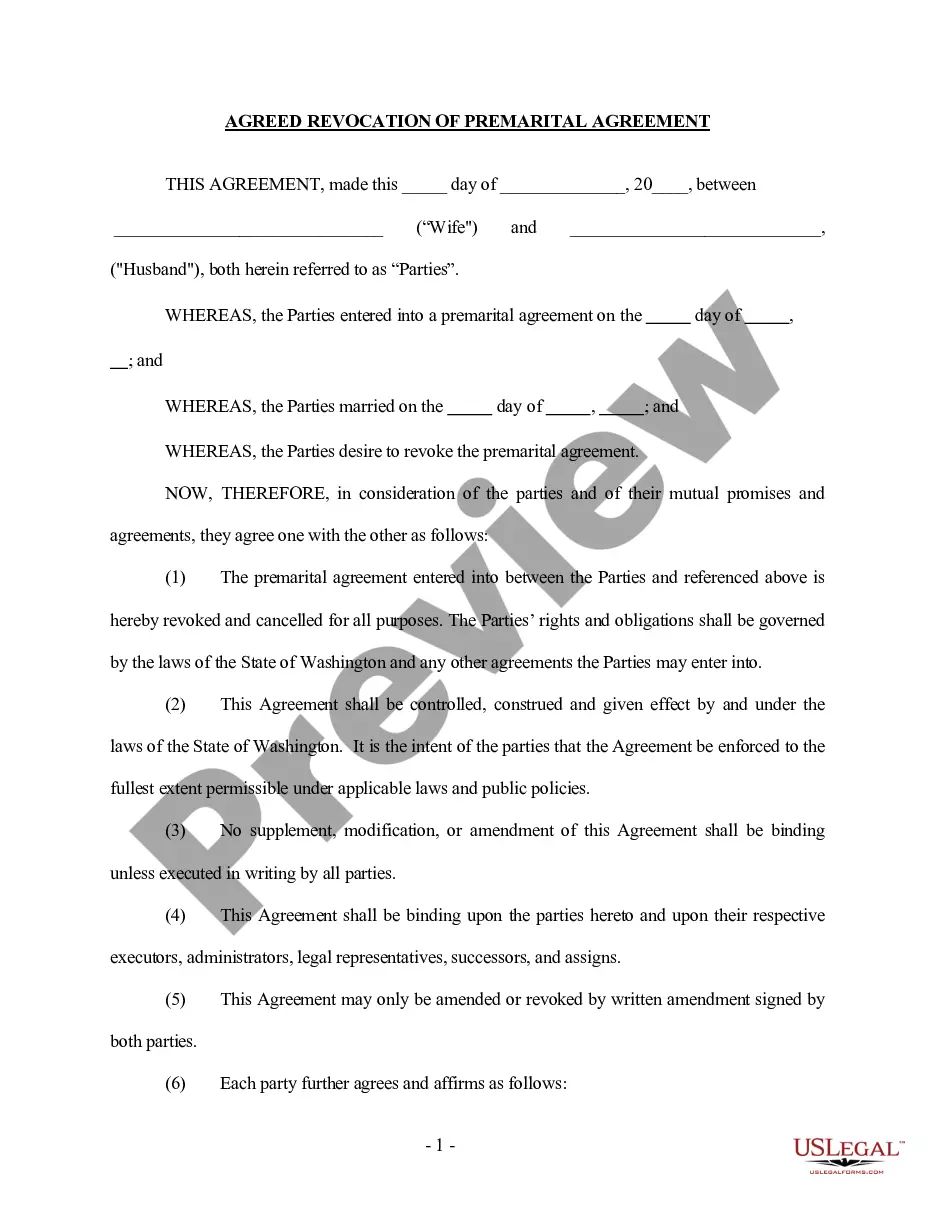

A prenup can also be overturned if one or both parties change their mind after initially signing the agreement. They may decide at that time to sign a new agreement suspending the prenup.

A good prenuptial agreement should be fair. It should be entered into between two consenting adults who know what they are doing. The agreement should be fair when it is signed and entered into, and also fair when it is be enforced, whether in the event of a divorce or death.