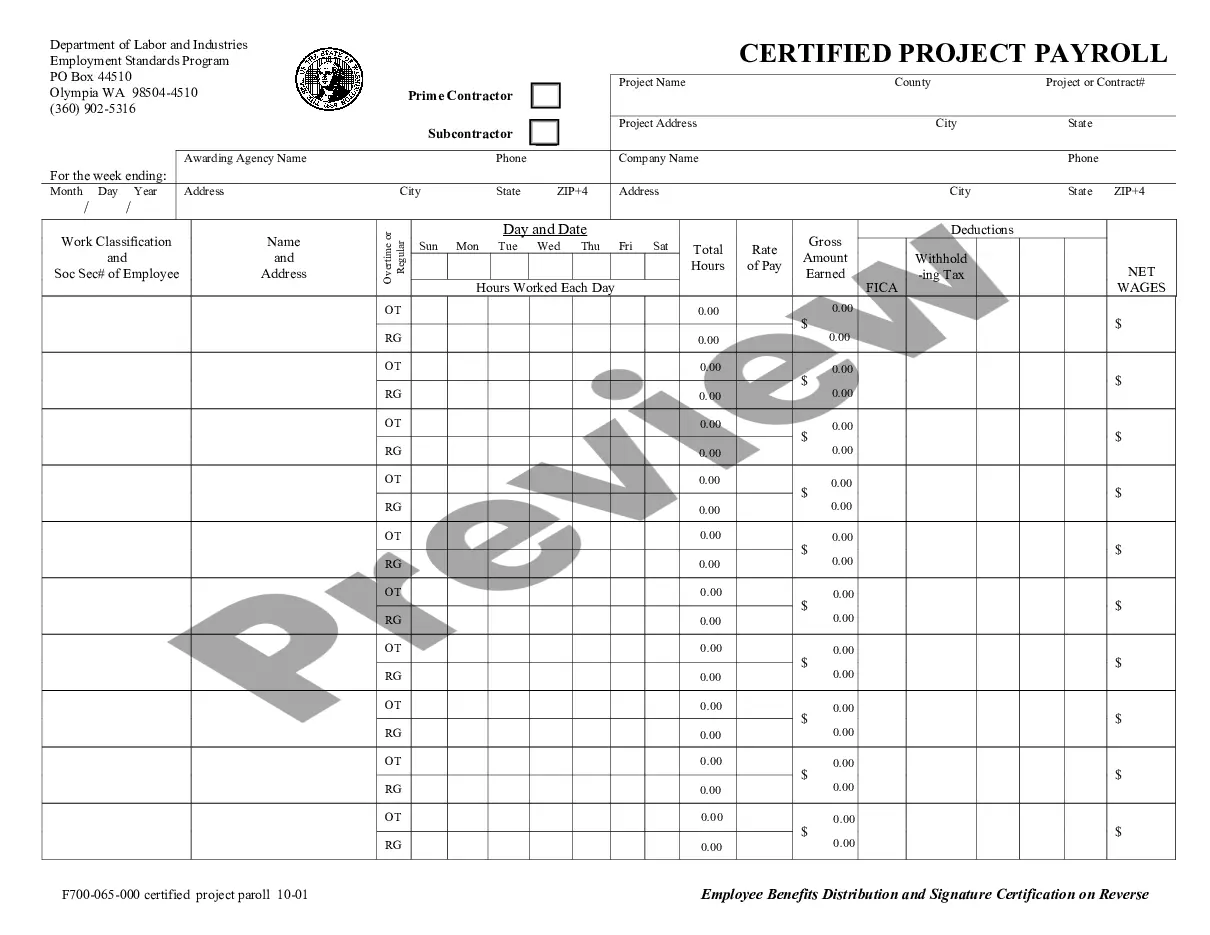

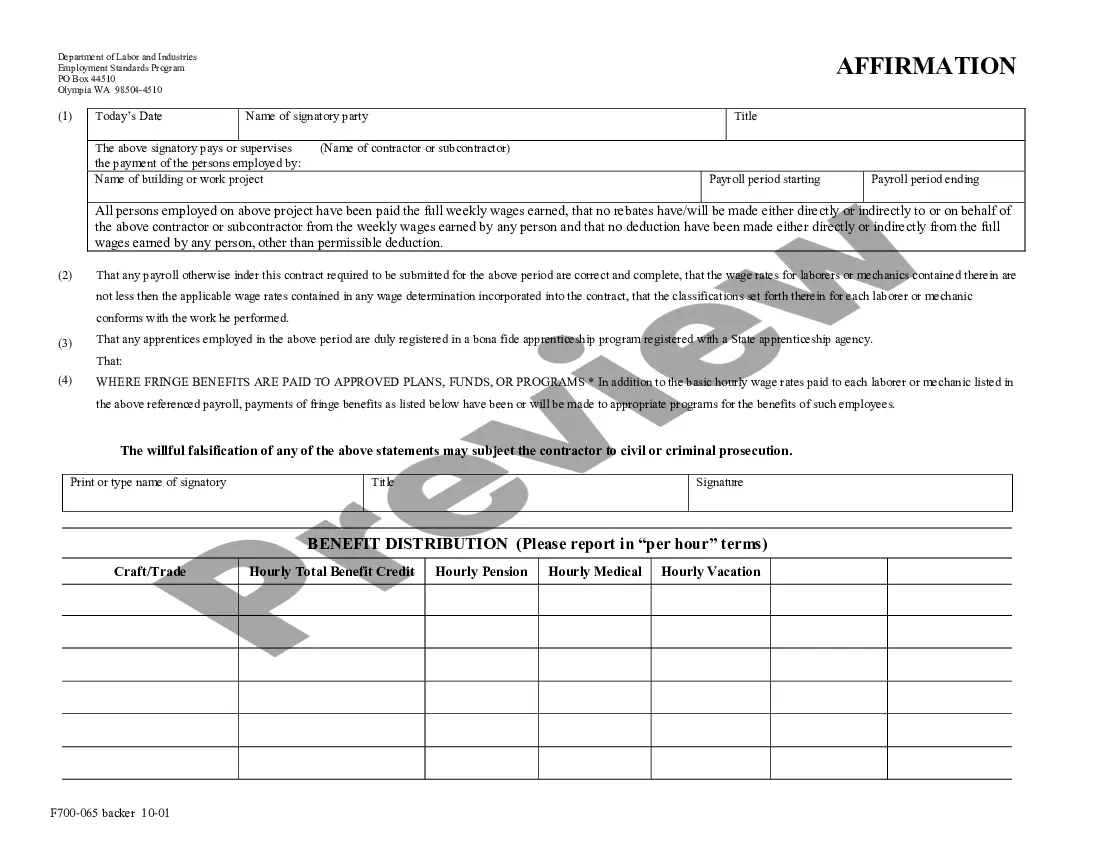

This Washington Weekly Payroll Record allows the contractor to record and track payroll payments made to employees on a particular project. This record may also be certified when required by the state for compliance with Washington law.

Washington Weekly Payroll Record

Description

How to fill out Washington Weekly Payroll Record?

Out of the multitude of services that provide legal templates, US Legal Forms provides the most user-friendly experience and customer journey while previewing forms before buying them. Its comprehensive library of 85,000 samples is grouped by state and use for simplicity. All the documents available on the service have been drafted to meet individual state requirements by certified legal professionals.

If you have a US Legal Forms subscription, just log in, search for the form, click Download and access your Form name from the My Forms; the My Forms tab holds your downloaded forms.

Follow the guidelines listed below to get the form:

- Once you find a Form name, make certain it’s the one for the state you really need it to file in.

- Preview the form and read the document description prior to downloading the sample.

- Look for a new template through the Search field in case the one you’ve already found isn’t proper.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

When you’ve downloaded your Form name, you can edit it, fill it out and sign it with an web-based editor of your choice. Any form you add to your My Forms tab can be reused many times, or for as long as it remains the most updated version in your state. Our platform provides quick and simple access to samples that suit both lawyers and their clients.

Form popularity

FAQ

These records include records of wages paid, bonuses, and payments made to benefit accounts. Keep records that wage computations are based on for at least two years. These records include time cards, work and time schedules, and records of additions to or deductions from wages.

Payroll refers to the employees you pay, along with employee information. Payroll is also the amount you pay employees during each pay period. Or payroll can refer to the process of actually calculating and distributing wages and taxes.

If information is wrong, call the claims center at 800-318-6022. For current claims center contact information and hours go to: https://esd.wa.gov/unemployment/unemployed-workers-contact. People with hearing or speaking impairments can call Washington Relay Service 711) to request a correction.

Payroll records are a form of documentation which must be maintained by an employer for all individuals in the workplace. This includes the number of hours worked, average pay rates, and deductions for each employee.

If you make a mistake while filing your weekly claim, you may start over any time before you hear or see, "Your claim has been accepted." In most cases, you will have the opportunity to correct mistakes while submitting your claim.

To see if we've processed your payment, sign in to your eServices account and click on UI Claim. You can also call the weekly claims line (800-318-6022 a.m. Sunday p.m. Friday, unless Friday is a holiday) and select option 3 to see if it has been processed.

Payroll records contain information about the compensation paid to employees and any deductions from their pay. These records are needed by the payroll staff to calculate gross pay and net pay for employees. Payroll records typically include information about the following items:Net wages paid. Salary rates.

If you did not work more than 17 hours in any week in your base period, you may need to look for only part-time work. Working part-time usually extends the number of weeks you can draw benefits. Additional earnings also may help you qualify for a new claim when your benefit year ends.

Total wages paid each pay period. 14. Date of payment and the pay period covered by the payment. How Long Should Records Be Retained: Each employer shall preserve for at least three years payroll records, collective bargaining agreements, sales and purchase records.