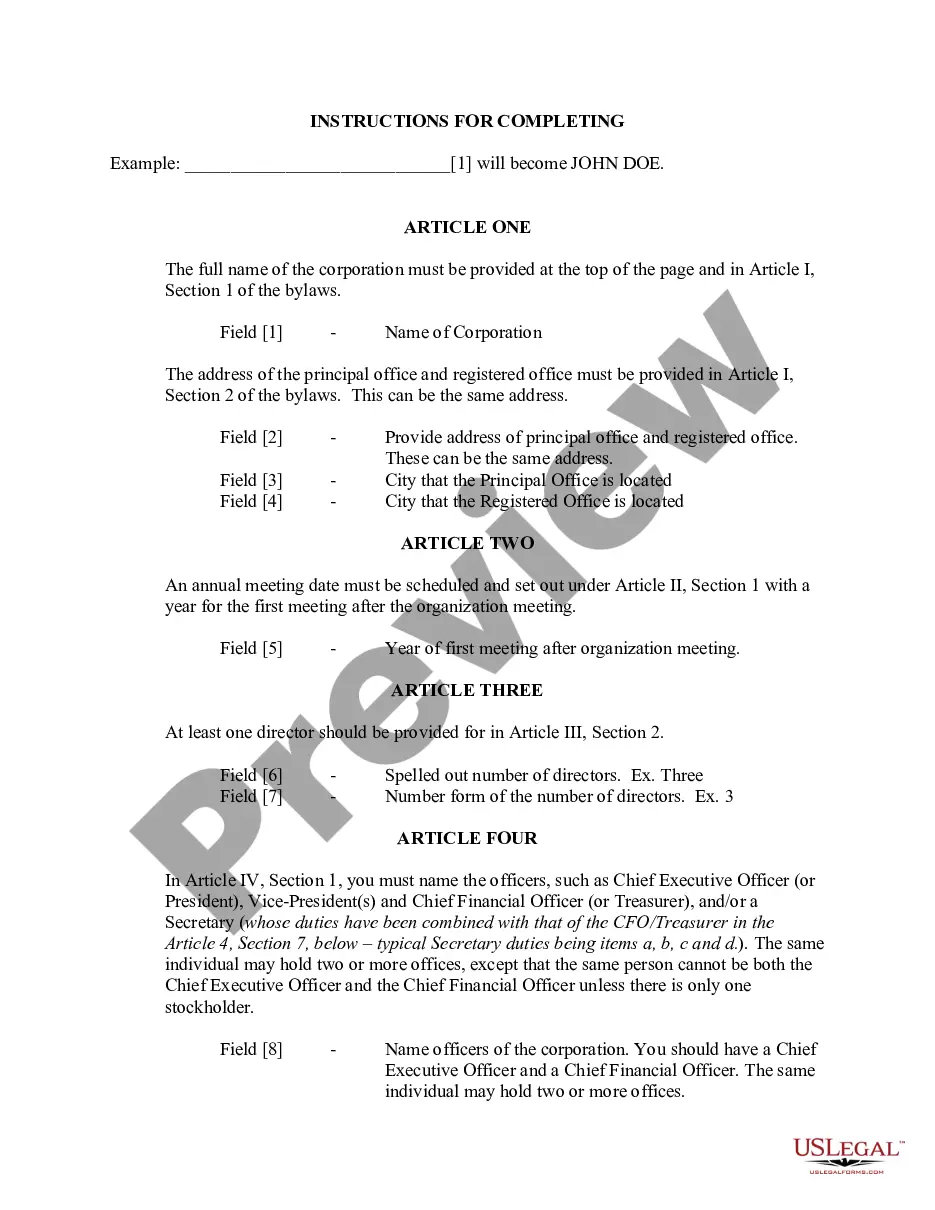

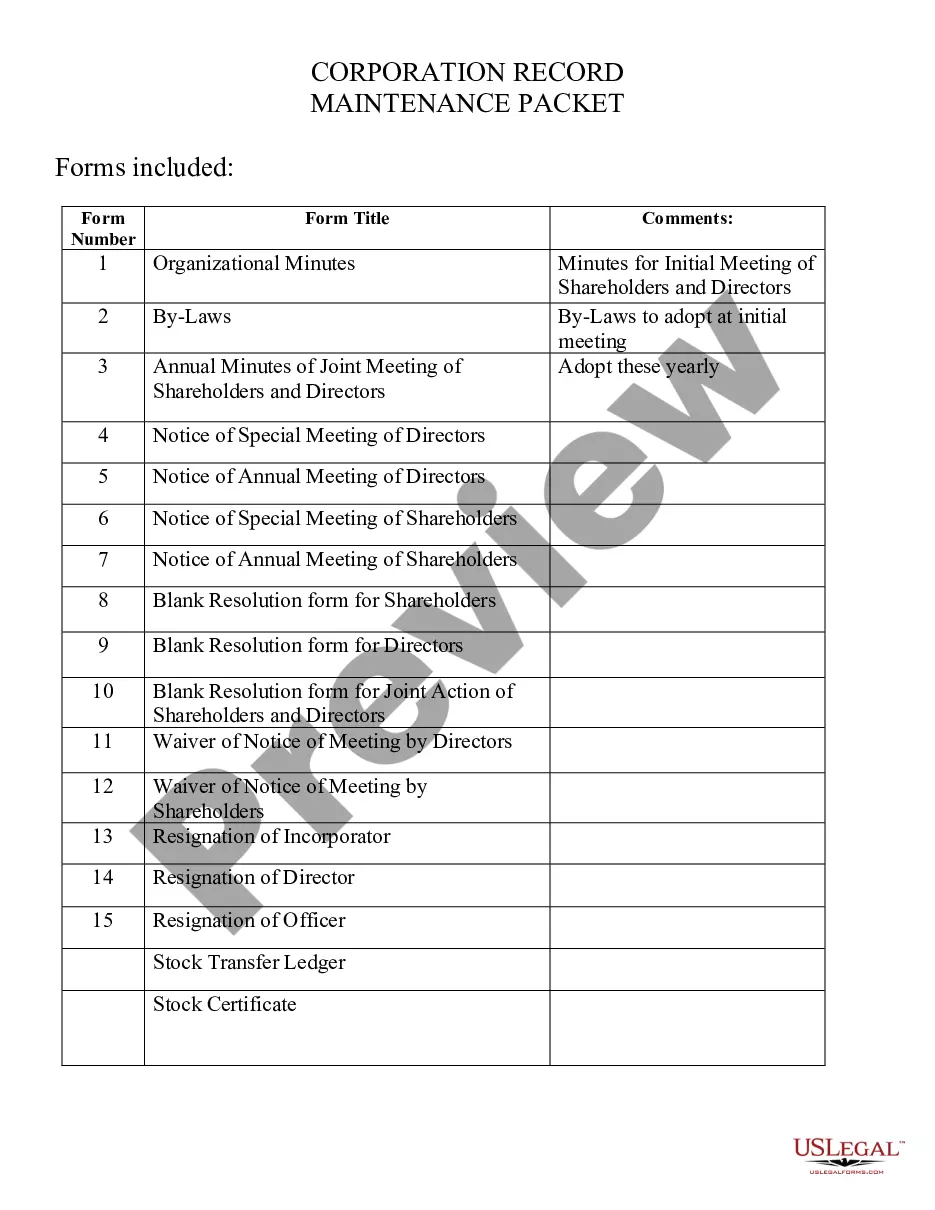

This Professional Corporations Package contains all forms and directions for filing needed in order to incorporate a Professional Corporation in your particular state. The forms included are as follows: articles on incorporation, by-laws, any other forms needed for creation and maintenance of the corporation.

Professional Corporation Package for Washington

Description

How to fill out Professional Corporation Package For Washington?

Among lots of paid and free examples that you’re able to find on the web, you can't be sure about their reliability. For example, who created them or if they are competent enough to take care of what you need these to. Keep relaxed and use US Legal Forms! Find Professional Corporation Package for Washington samples developed by professional lawyers and prevent the high-priced and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to write a document for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button near the form you are searching for. You'll also be able to access all of your earlier acquired documents in the My Forms menu.

If you are using our platform the very first time, follow the guidelines listed below to get your Professional Corporation Package for Washington quick:

- Make certain that the file you see is valid in the state where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or look for another example using the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

Once you’ve signed up and bought your subscription, you can utilize your Professional Corporation Package for Washington as many times as you need or for as long as it stays active where you live. Revise it with your favorite editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Individual Reports A partnership PLLC must file a Form 1065, Return of Partnership Income, showing income, deductions and any profit or loss. This is an informational return, and no taxes are assessed. A Schedule K-1 with the form shows each partner's share, to be reported on a personal return.

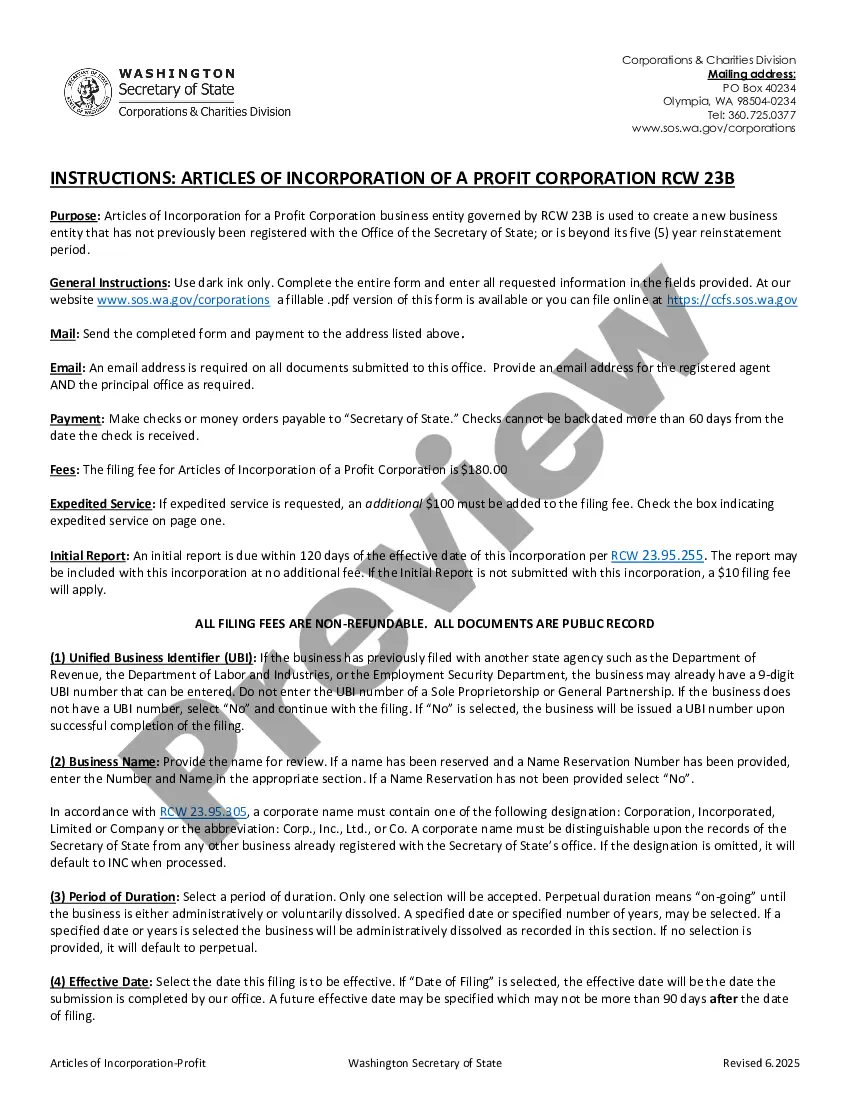

To form a PLLC, a licensed professional must sign all filing documents as well as include their professional license number and a certified copy of their license. Importantly, they must submit these documents for approval with their state licensing board before filing them with their state's secretary of state.

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

The difference between LLC and PC is straightforward. A limited liability company (LLC) combines the tax benefits of a partnership and the limited liability protection of a corporation. A professional corporation (PC) is organized according to the laws of the state where the professional is licensed to practice.

The PLLC is does not pay income taxes as an entity at the federal level. A single member PLLC is automatically treated as a disregarded tax entity, the same as a sole proprietor, giving it pass-through tax treatment. However, a single member PLLC may choose to be taxed either as a C Corporation or an S Corporation.

Members of a PLLC aren't personally liable for the malpractice of any other member. PLLC members are not personally liable for business debts and lawsuits, such as unpaid office rent. The PLLC can choose to be taxed as a pass-through entity or as a corporation.

A professional corporation is a variation of the corporate form available to entrepreneurs who provide professional servicessuch as doctors, lawyers, accountants, consultants, and architects.In a professional corporation, the owners perform services for the business as employees.

Choose a Corporate Name. File Articles of Incorporation. Appoint a Registered Agent. Prepare Corporate Bylaws. Appoint Directors and Hold First Board Meeting. File Annual Report. Obtain an EIN.

A PLLC with one member pays taxes as a sole proprietorship, while a PLLC with multiple members pays taxes as a partnership. LLCs pay income taxes by passing on the net income or loss of the LLC to its members.