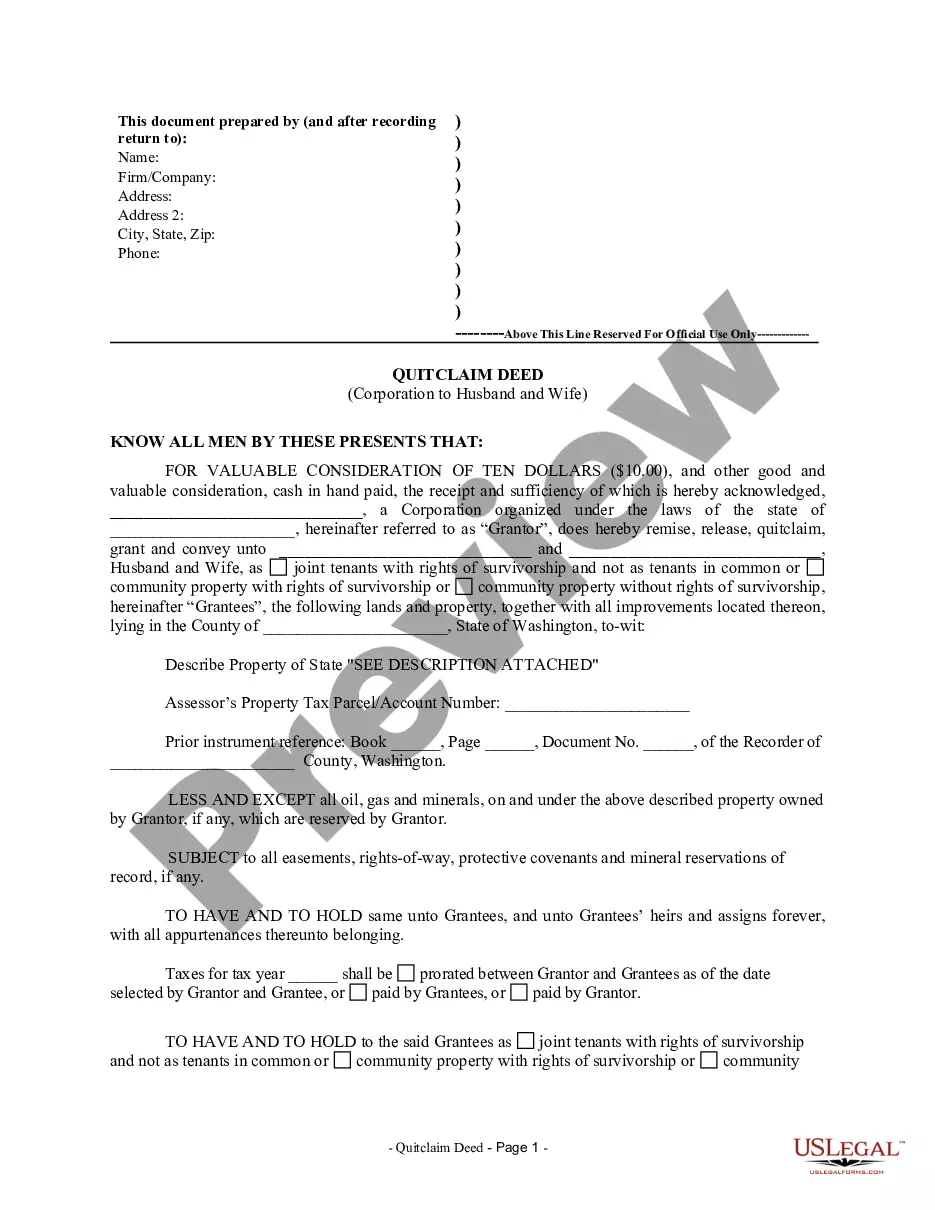

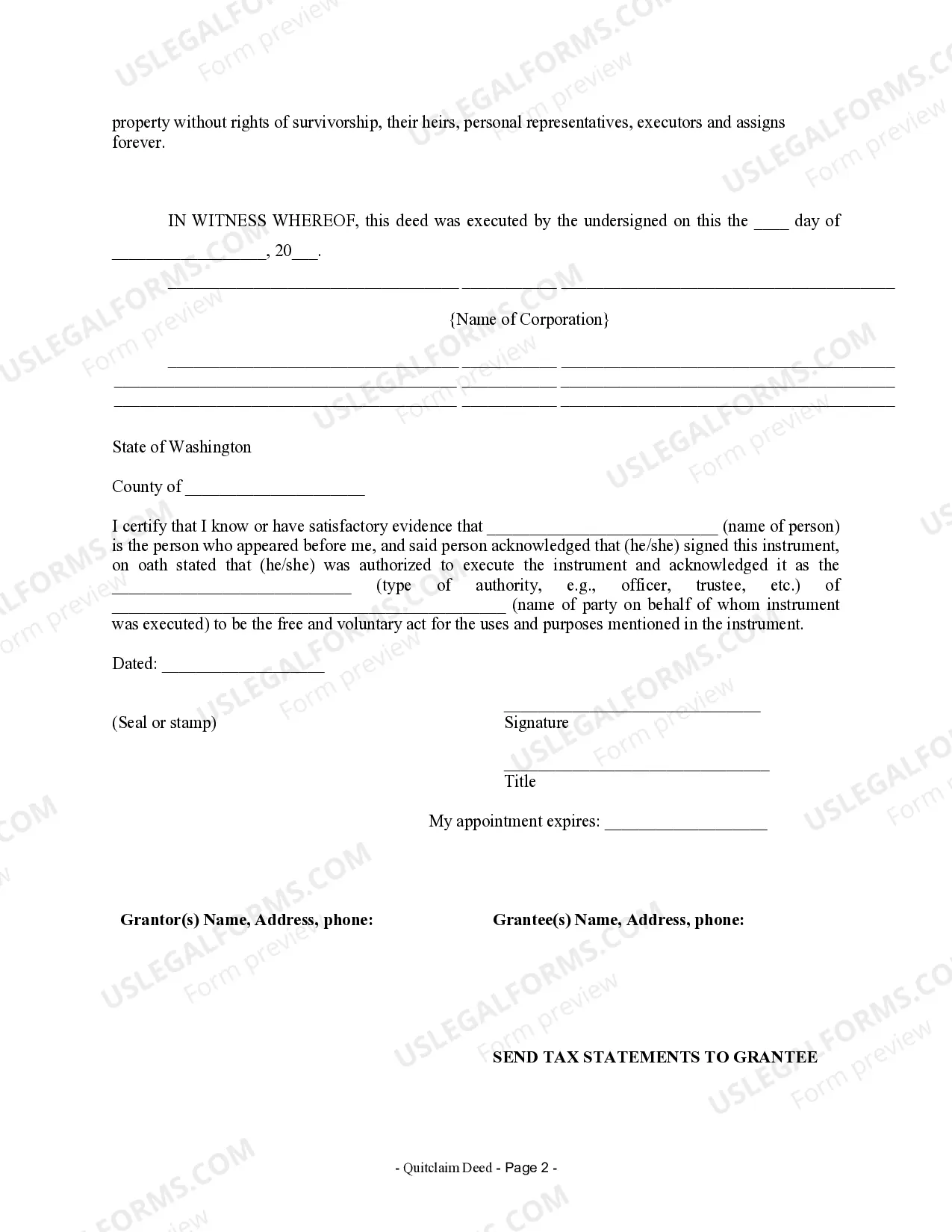

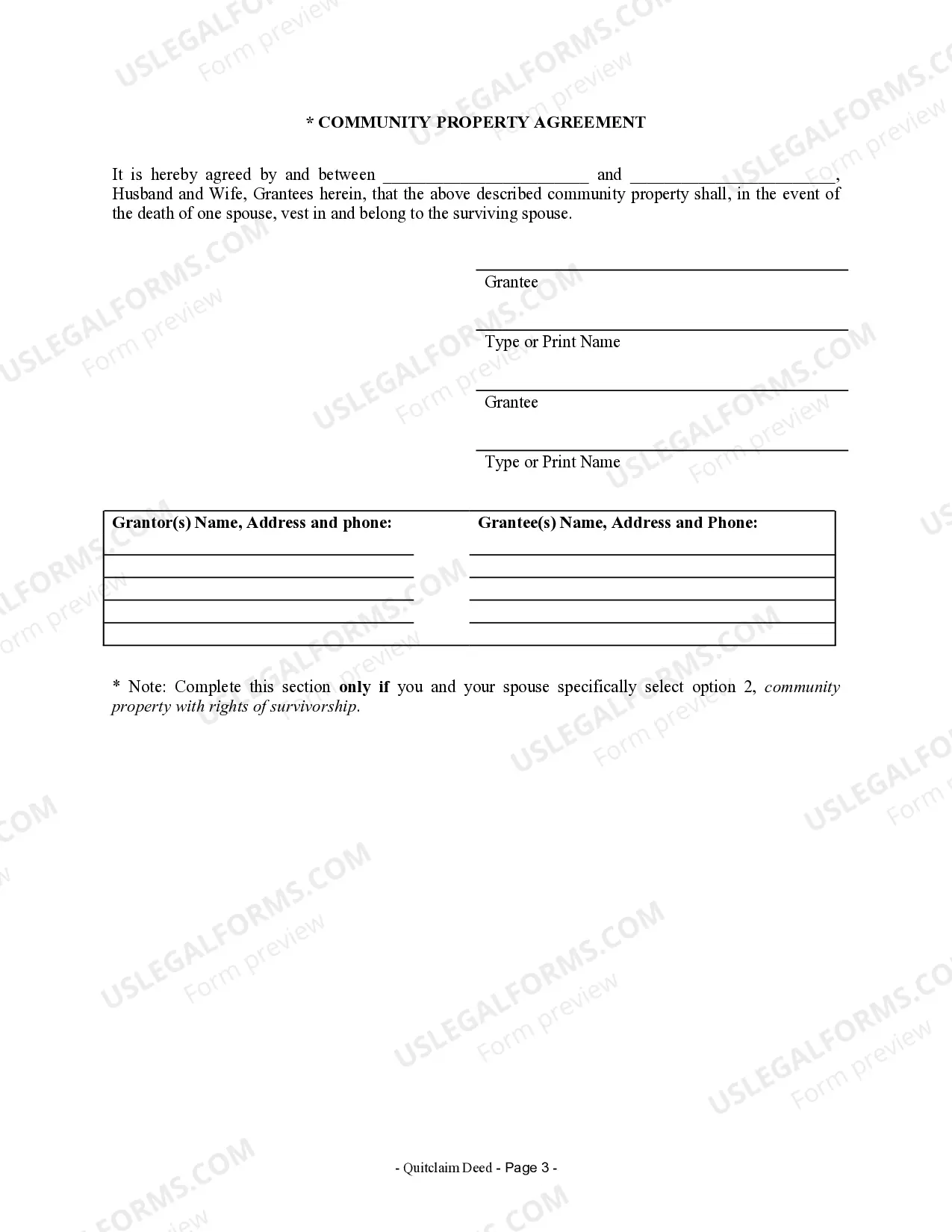

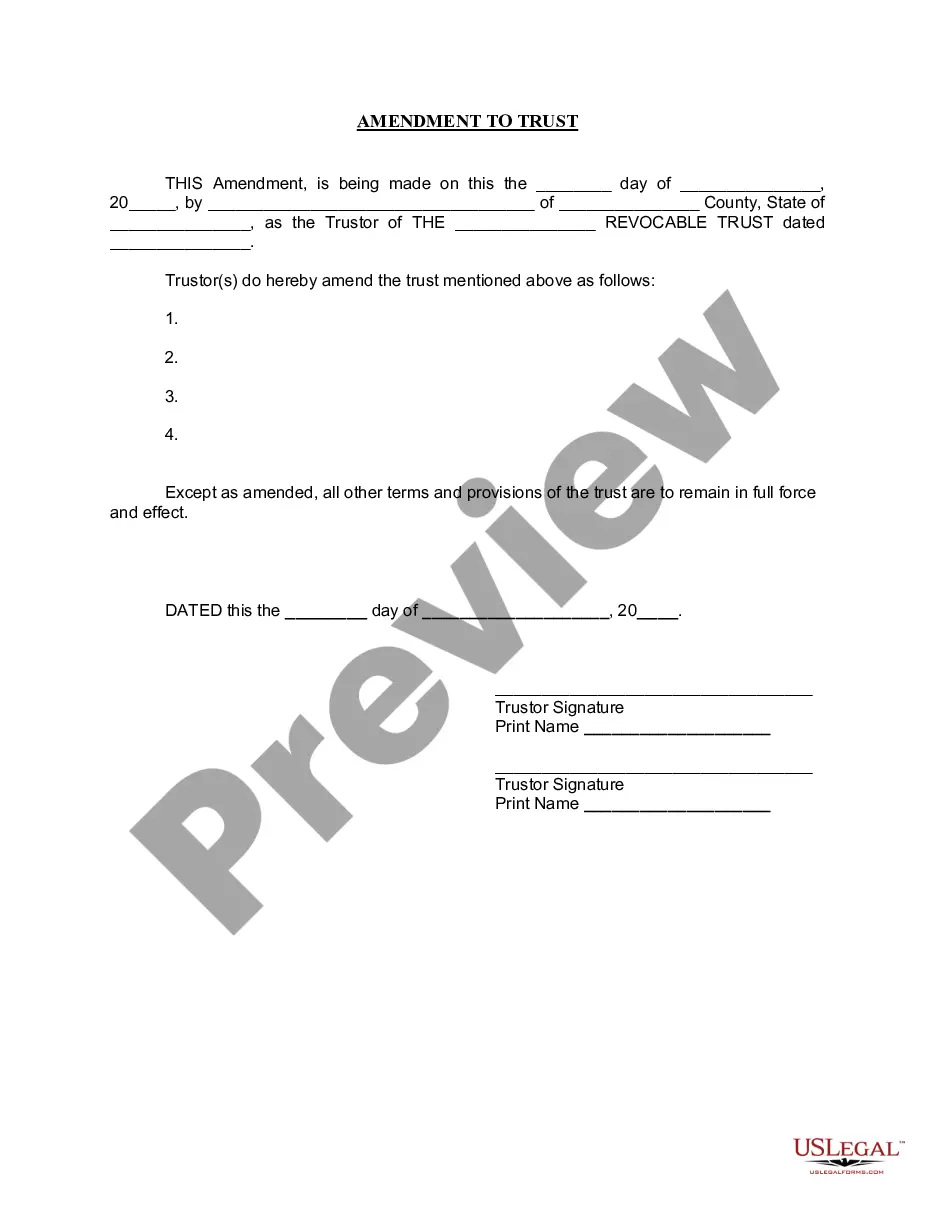

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

Washington Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out Washington Quitclaim Deed From Corporation To Husband And Wife?

Out of the large number of platforms that provide legal templates, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates before buying them. Its complete catalogue of 85,000 templates is categorized by state and use for simplicity. All the documents on the platform have been drafted to meet individual state requirements by licensed lawyers.

If you already have a US Legal Forms subscription, just log in, look for the template, click Download and get access to your Form name in the My Forms; the My Forms tab holds your downloaded forms.

Follow the tips below to get the form:

- Once you discover a Form name, ensure it’s the one for the state you need it to file in.

- Preview the template and read the document description before downloading the sample.

- Search for a new sample via the Search field if the one you have already found is not appropriate.

- Just click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the template.

Once you’ve downloaded your Form name, you may edit it, fill it out and sign it with an web-based editor that you pick. Any form you add to your My Forms tab might be reused multiple times, or for as long as it remains the most up-to-date version in your state. Our service offers fast and easy access to samples that suit both lawyers as well as their customers.

Form popularity

FAQ

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

The Washington quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.