This form is a Warranty Deed where the grantors are three individuals and the grantee is a trust. Grantors convey and warrant the described property to the grantee. This deed complies with all state statutory laws.

Washington Warranty Deed - Three Individuals to a Trust

Description

How to fill out Washington Warranty Deed - Three Individuals To A Trust?

Out of the great number of platforms that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates prior to buying them. Its extensive catalogue of 85,000 samples is categorized by state and use for simplicity. All of the forms available on the service have already been drafted to meet individual state requirements by licensed lawyers.

If you already have a US Legal Forms subscription, just log in, look for the template, press Download and obtain access to your Form name in the My Forms; the My Forms tab holds all your saved forms.

Follow the guidelines below to obtain the form:

- Once you discover a Form name, make certain it is the one for the state you really need it to file in.

- Preview the form and read the document description prior to downloading the template.

- Look for a new template through the Search field if the one you’ve already found isn’t correct.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the template.

When you have downloaded your Form name, you can edit it, fill it out and sign it in an web-based editor of your choice. Any document you add to your My Forms tab can be reused multiple times, or for as long as it remains to be the most updated version in your state. Our service offers quick and simple access to samples that fit both lawyers and their customers.

Form popularity

FAQ

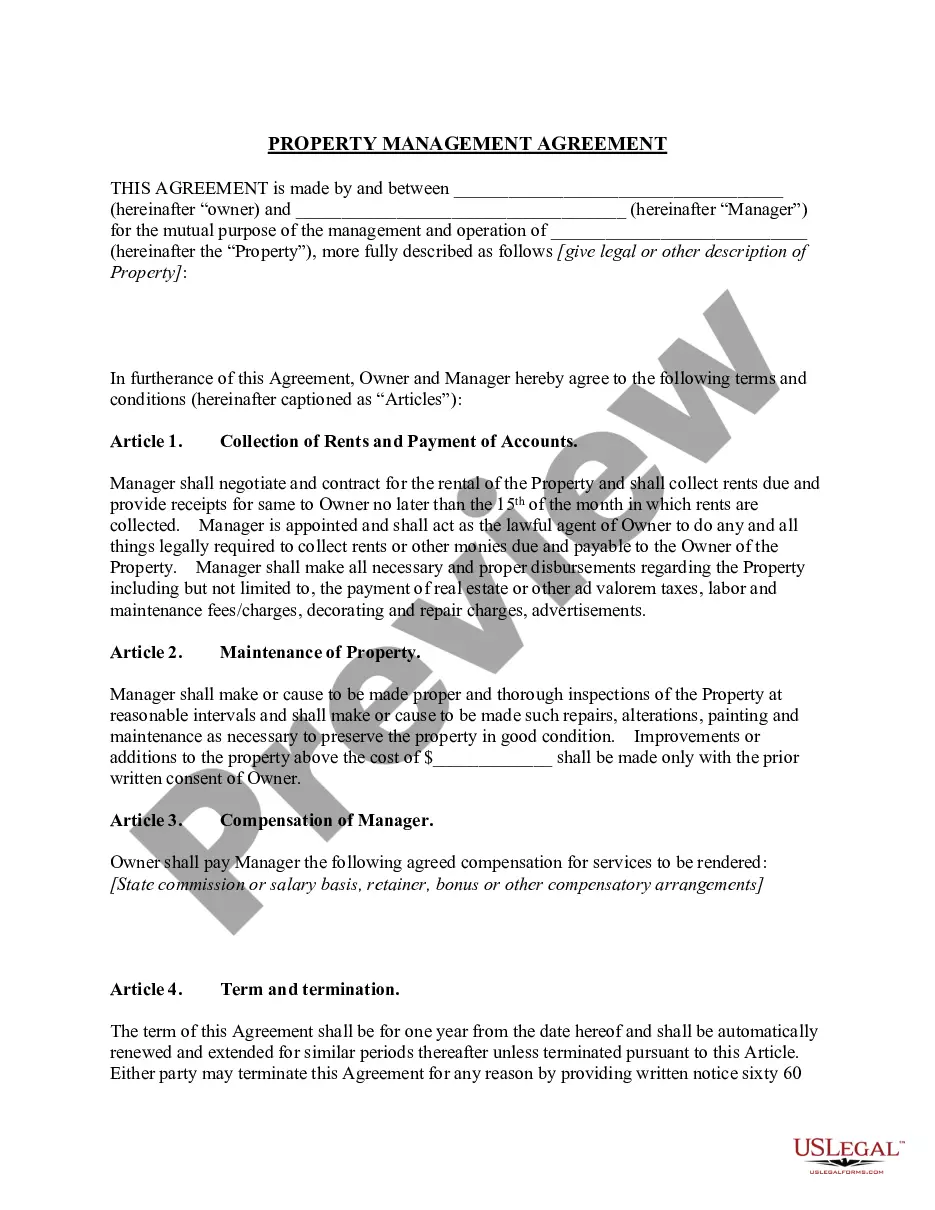

2. Organize your paperwork. Gather together documentation pertaining to your assets. This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies, and other assets you will be using to fund the trust.

If the Trust list you both as Co-Trustees, both signature are required. Make sure you have the right, as specified in the Trust Agreement, to sell the real property. Equally important, is the party entitled to the proceeds.

1Determine the Current Title and Vesting to Your Property.2Prepare a Deed.3Be Aware of Your Lender and Title Insurance.4Prepare a Preliminary Change of Ownership Report.5Execute Your Deed.6Record Your Deed.7Wait for the Deed to be Returned.8Keep the Property in the Trust.

1Locate your current deed.2Use the proper deed.3Check with your title insurance company and lender.4Prepare a new deed.5Sign in the presence of a notary.6Record the deed in the county clerk's office.7Locate the deed that's in trust.8Use the proper deed.How to Transfer a Deed in a Living Trust .com\ninfo..com > article > how-transfer-deed-living-trust

You can put jointly held property in a living trust. However, what you end up placing in the trust depends on the structure by which the property is held jointly as well as the structure of the trust. In some cases, it might be unnecessary to put the property in a trust at all.

Obtain a California grant deed from a local office supply store or your county recorder's office. Complete the top line of the deed. Indicate the grantee on the second line. Enter the trustees' names and addresses.

1Obtain a California grant deed from a local office supply store or your county recorder's office.2Complete the top line of the deed.3Indicate the grantee on the second line.4Enter the trustees' names and addresses.How to Put My House in a Trust\nhomeguides.sfgate.com > put-house-trust-46549

To transfer real estate (also called real property) into your living trust, you must prepare and sign a new deed, transferring ownership. You can usually fill out a new deed yourself.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).