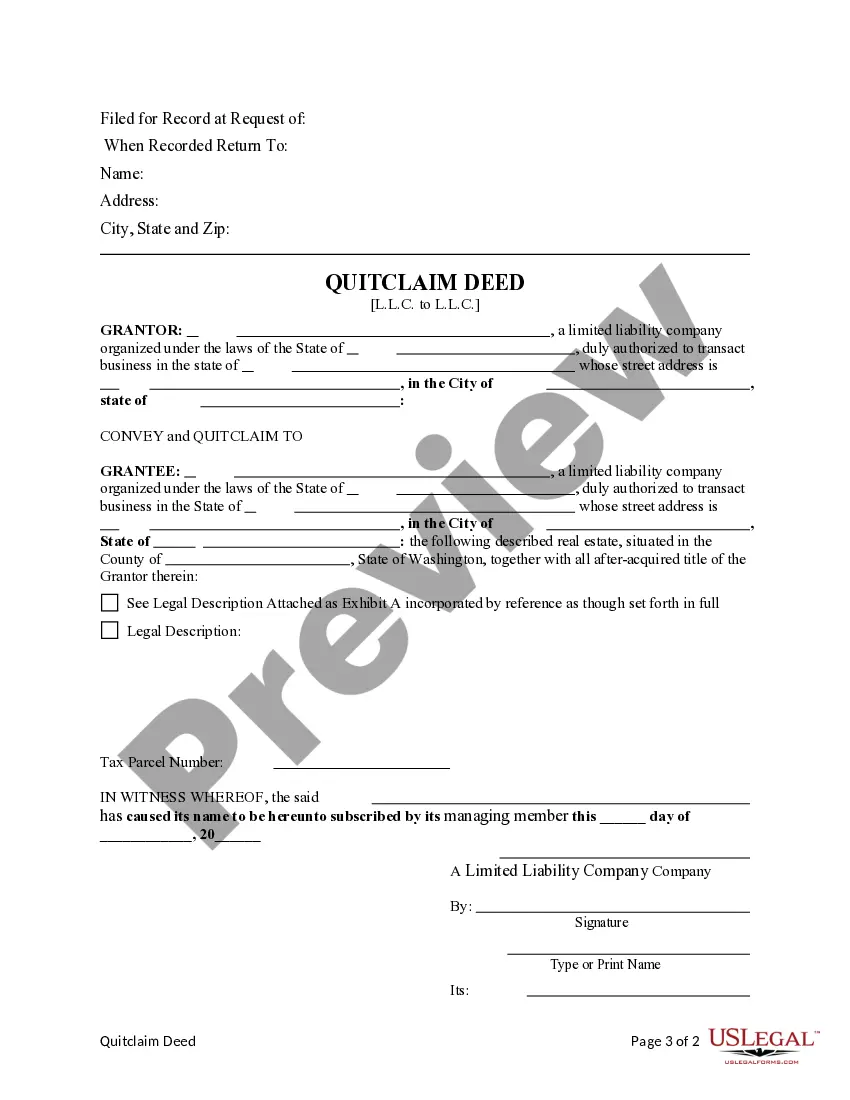

This Quitclaim Deed form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is an LLC. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Washington Quitclaim Deed from LLC to LLC

Description

How to fill out Washington Quitclaim Deed From LLC To LLC?

Out of the multitude of platforms that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates before purchasing them. Its extensive library of 85,000 templates is grouped by state and use for simplicity. All of the documents available on the service have been drafted to meet individual state requirements by licensed lawyers.

If you have a US Legal Forms subscription, just log in, look for the form, hit Download and get access to your Form name from the My Forms; the My Forms tab keeps your downloaded forms.

Keep to the tips below to obtain the form:

- Once you see a Form name, make certain it’s the one for the state you really need it to file in.

- Preview the template and read the document description just before downloading the template.

- Search for a new template through the Search engine in case the one you’ve already found isn’t appropriate.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a credit card or PayPal and download the document.

Once you’ve downloaded your Form name, you may edit it, fill it out and sign it with an web-based editor that you pick. Any form you add to your My Forms tab might be reused many times, or for as long as it remains to be the most up-to-date version in your state. Our platform offers easy and fast access to samples that suit both legal professionals as well as their clients.

Form popularity

FAQ

The Washington quit claim deed form gives the new owner whatever interest the current owner has in the property when the deed is signed and delivered. It makes no promises about whether the current owner has clear title to the property.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

You can't transfer your real estate property, or any other personal property, into your LLC or corporation until you've actually formed a new legal entity.Typically you'll need to register a business name and file the LLC or corporation paperwork with your secretary of state's office.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.