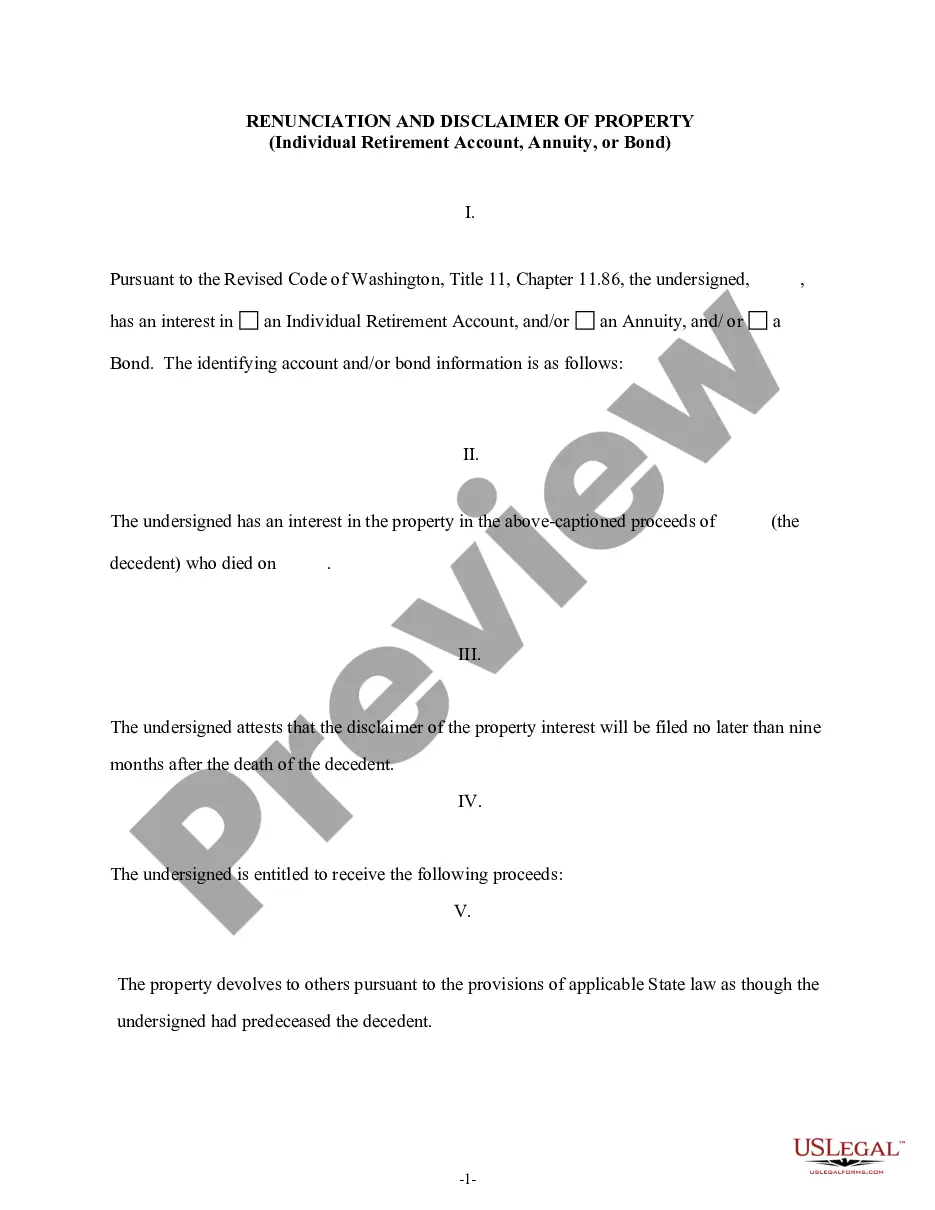

Renunciation And Disclaimer of Property - Community Property Interest

Disclaimer of Property Interest-Washington

Revised Code of Washington

Title 11 PROBATE AND TRUST LAW

Chapter 11.86 Disclaimer of interests

Definitions.

Unless the context clearly requires otherwise,

the definitions in this section apply throughout this chapter.

(1) "Beneficiary" means the person entitled, but for the

person's disclaimer, to take an interest.

(2) "Interest" includes the whole of any property, real or personal,

legal or equitable, or any fractional part, share, or particular portion

or specific assets thereof, any vested or contingent interest in any such

property, any power to appoint, consume, apply, or expend property, or

any other right, power, privilege, or immunity relating to property. "Interest"

includes, but is not limited to, an interest created in any of the following

manners:

(h) By an inter vivos gift, whether outright or in trust;

(i) By surviving the death of a depositor of a trust or P.O.D. account

within the meaning of RCW 30.22.040;

(m) Under an individual retirement account, annuity, or bond;

(o) Any other interest created by any testamentary or inter vivos

instrument or by operation of law.

(3) "Creator of the interest" means a person who establishes, declares,

or otherwise creates an interest.

(4) "Disclaimer" means any writing which declines, refuses, renounces,

or disclaims any interest that would otherwise be taken by a beneficiary.

(5) "Disclaimant" means a beneficiary who executes a disclaimer

on his or her own behalf or a person who executes a disclaimer on behalf

of a beneficiary.

(6) "Person" means an individual, corporation, government, governmental

subdivision or agency, business trust, estate, trust, partnership, association,

or other entity.

(7) "Date of the transfer" means:

(a) For an inter vivos transfer, the date of the creation

of the interest; or

(b) For a transfer upon the death of the creator of the interest,

the date of the death of the creator.

A joint tenancy interest of a deceased joint tenant

shall be deemed to be transferred at the death of the joint tenant rather

than at the creation of the joint tenancy.

Title 11, Chap. 11.86, §11.86.011

Disclaimer of interest authorized.

(1) A beneficiary may disclaim an interest in whole or

in part, or with reference to specific parts, shares or assets, in the

manner provided in RCW 11.86.031.

(2) Likewise, a beneficiary may so disclaim through an agent or

attorney so authorized by written instrument.

(3) A personal representative, guardian, attorney in fact if authorized

under a durable power of attorney under chapter 11.94 RCW, or other legal

representative of the estate of a minor, incompetent, or deceased beneficiary,

may so disclaim on behalf of the beneficiary, with or without court order,

if:

(a) The legal representative deems the disclaimer to be

in the best interests of those interested in the estate of the beneficiary

and of those who take the disclaimed interest because of the disclaimer,

and not detrimental to the best interests of the beneficiary; and

(b) In the case of a guardian, no order has been issued under RCW

11.92.140 determining that the disclaimer is not in the best interests

of the beneficiary.

Title 11, Chap. 11.86, §11.86.021

Contents of disclaimer -- Time and filing requirements -- Fee.

(1) The disclaimer shall:

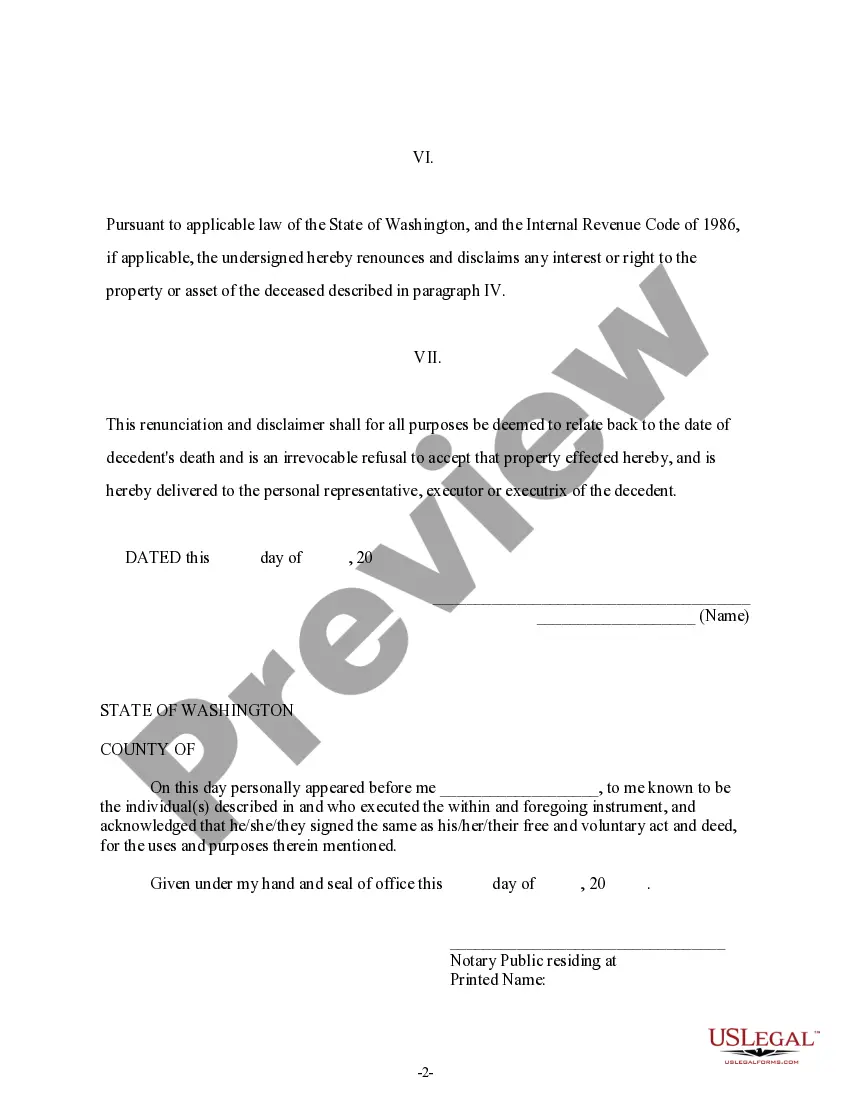

(2) The disclaimer shall be delivered or mailed as provided in subsection

(3) of this section at any time after the creation of the interest, but

in all events by nine months after the latest of:

(c) The date that the beneficiary is finally ascertained and the

beneficiary's interest is indefeasibly vested.

(3) The disclaimer shall be mailed by first-class mail, or otherwise

delivered, to the creator of the interest, the creator's legal representative,

or the holder of the legal title to the property to which the interest

relates or, if the creator is dead and there is no legal representative

or holder of legal title, to the person having possession of the property.

(4) If the date of the transfer is the date of the death of the

creator of the interest, a copy of the disclaimer may be filed with the

clerk of the probate court in which the estate of the creator is, or has

been, administered, or, if no probate administration has been commenced,

then with the clerk of the court of any county provided by law as the place

for probate administration of such person, where it shall be indexed under

the name of the decedent in the probate index upon the payment of a fee

established under RCW 36.18.016.

(5) The disclaimer of an interest in real property may be recorded,

but shall constitute notice to all persons only from and after the date

of recording. If recorded, a copy of the disclaimer shall be recorded in

the office of the auditor in the county or counties where the real property

is situated.

Title 11, Chap. 11.86, §11.86.031

Disposition of disclaimed interest.

(1) Unless the instrument creating an interest directs

to the contrary, the interest disclaimed shall pass as if the beneficiary

had died immediately prior to the date of the transfer of the interest.

The disclaimer shall relate back to this date for all purposes.

(2) Unless the beneficiary provides otherwise in the disclaimer,

in addition to the interests disclaimed, the beneficiary shall also be

deemed to have disclaimed the minimum of all interests in the disclaimed

property necessary to make the disclaimer a qualified disclaimer for purposes

of section 2518 of the Internal Revenue Code.

(3) Any future interest taking effect in possession or enjoyment

after termination of the interest disclaimed takes effect as if the beneficiary

had died prior to the date of the beneficiary's final ascertainment as

a beneficiary and the indefeasible vesting of the interest.

(4) The disclaimer is binding upon the beneficiary and all persons

claiming through or under the beneficiary.

(5) Unless the instrument creating the interest directs to the contrary,

a beneficiary whose interest in a devise or bequest under a will has been

disclaimed shall be deemed to have died for purposes of RCW 11.12.110.

(6) In the case of a disclaimer of property over which the disclaimant

has any power to direct the beneficial enjoyment of the disclaimed property,

the disclaimant shall also be deemed to have disclaimed any power to direct

the beneficial enjoyment of the disclaimed property, unless the power is

limited by an ascertainable standard relating to the health, education,

support, or maintenance of any person as described in section 2041 or 2514

of the Internal Revenue Code and applicable regulations adopted under those

sections. This subsection applies unless the disclaimer specifically provides

otherwise. This subsection shall not be deemed to otherwise prevent such

a disclaimant from acting as trustee or personal representative over disclaimed

property.

Title 11, Chap. 11.86, §11.86.041

When disclaimer barred -- Exception.

(1) A beneficiary may not disclaim an interest if:

(b) The beneficiary has assigned, conveyed, encumbered, pledged,

or otherwise transferred the interest, or has contracted therefor;

(d) The beneficiary has waived the right to disclaim in writing.

The written waiver of the right to disclaim also is binding upon all persons

claiming through or under the beneficiary.

(2) Notwithstanding the provisions of subsection (1)(a) through (c)

of this section, a beneficiary's receipt of a benefit from property shall

not necessarily bar such beneficiary's disclaimer of an interest in the

same property when, prior to the date of the transfer of the interest to

be disclaimed, the beneficiary already owned an interest in such property

in joint tenancy, as community property, or otherwise. Any such receipt,

in the absence of clear and convincing evidence to the contrary, shall

be presumed to be an enjoyment or use of the interest the beneficiary already

owned, and only after such interest and any benefit from such interest

have been exhausted, shall the beneficiary be deemed to have received or

accepted any part of the interest to be disclaimed.

Title 11, Chap. 11.86, §11.86.051

Effect of spendthrift or similar restriction.

A beneficiary may disclaim under this chapter

notwithstanding any limitation on the interest of the beneficiary in the

nature of a spendthrift provision or similar restriction.

Title 11, Chap. 11.86, §11.86.061

Liability for distribution -- Effect of disclaimer.

No legal representative of a creator of the

interest, holder of legal title to property an interest in which is disclaimed,

or person having possession of the property shall be liable for any otherwise

proper distribution or other disposition made without actual knowledge

of the disclaimer, or in reliance upon the disclaimer and without actual

knowledge that the disclaimer is barred as provided in RCW 11.86.051.

Title 11, Chap. 11.86, §11.86.071

Rights under other statutes or rules not abridged.

This chapter shall not abridge the right of

any person, apart from this chapter, under any existing or future statute

or rule of law, to disclaim any interest or to assign, convey, release,

renounce or otherwise dispose of any interest.

Title 11, Chap. 11.86, §11.86.080

Interests existing on June 7, 1973.

Any interest which exists on June 7, 1973 but

which has not then become indefeasibly vested, or the taker of which has

not then become finally ascertained, or of the existence of the transfer

of which the beneficiary lacks knowledge, may be disclaimed after June

7, 1973 in the manner provided in RCW 11.86.031. However, for the purposes

of RCW 11.86.031(2), the date on which the beneficiary first knows of the

existence of the transfer shall be deemed to be the date of the transfer.

Title 11, Chap. 11.86, §11.86.090