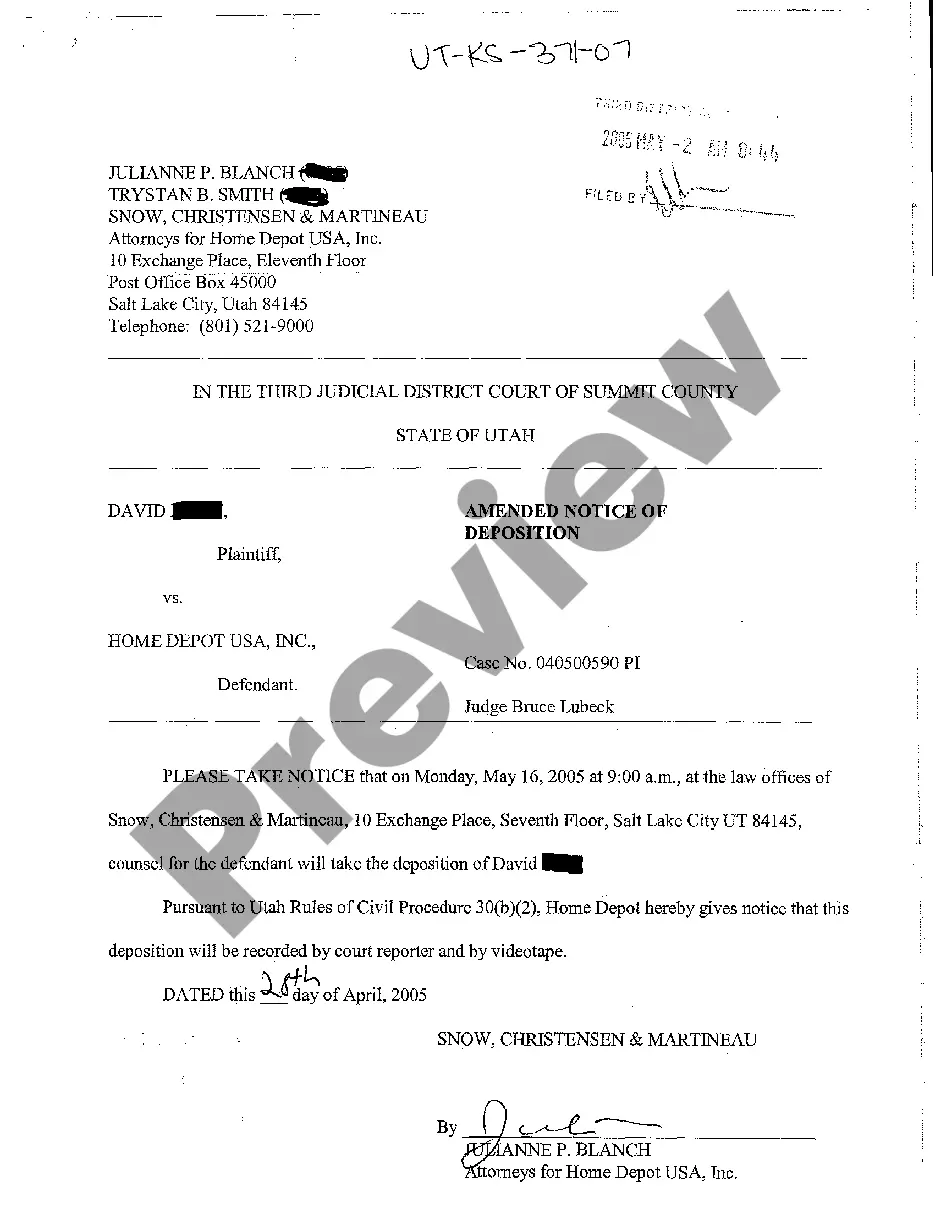

This is an official Washington court form for use in Garnishment cases, a Notice to Federal Government Garnishee. Available in Word or rich text format.

Washington WPF GARN 01.0400 - Notice to Federal Government Garnishee

Description

How to fill out Washington WPF GARN 01.0400 - Notice To Federal Government Garnishee?

Out of the large number of services that offer legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing templates prior to buying them. Its extensive library of 85,000 templates is grouped by state and use for efficiency. All of the forms on the platform have already been drafted to meet individual state requirements by accredited legal professionals.

If you already have a US Legal Forms subscription, just log in, search for the form, hit Download and obtain access to your Form name from the My Forms; the My Forms tab keeps all of your downloaded forms.

Keep to the guidelines below to obtain the form:

- Once you see a Form name, ensure it’s the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the template.

- Look for a new template via the Search field in case the one you have already found is not appropriate.

- Click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

After you have downloaded your Form name, it is possible to edit it, fill it out and sign it with an web-based editor of your choice. Any form you add to your My Forms tab might be reused many times, or for as long as it remains to be the most updated version in your state. Our platform provides quick and easy access to templates that suit both attorneys and their clients.

Form popularity

FAQ

In general terms, to attempt to have a wage garnishment ended, modified or reversed, you have the following options. First, you could attempt to negotiate a monthly payment agreement with the creditor/collector.Third, you could file an appeal with the court if you do not agree with the garnishment.

If your wages are being garnished or you are about to be garnished and you live in Washington State, give Symmes Law Group a call at 206-682-7975 to stop your wage garnishment immediately or use our contact form to tell us about your case.

1) Quit Your Job Of course, when you learn that your creditors have won a garnishment order against you, you always have the option of quitting your job.As such, while quitting your job is certainly a legal option, you may do well to consider other recourse alternatives.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

Consumer debt includes medical debt. The proclamation prohibits garnishments of wages, consumer bank accounts, or other income, including stimulus payments received under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, to satisfy these consumer debt judgments.

A wage garnishment, or "continuing lien on earnings", is effective for 60 days from the date of service of the writ.