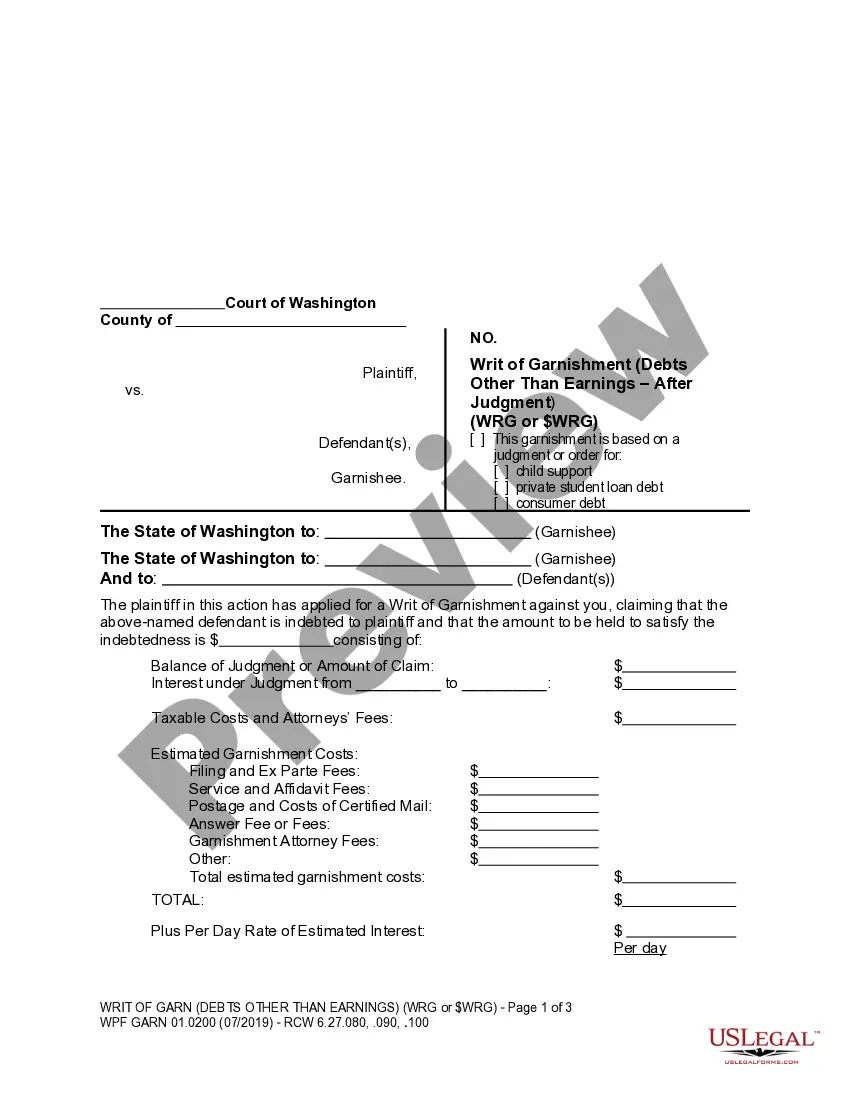

This is an official Washington court form for use in Garnishment cases, an Answer to Writ of Garnishment (Debts Other than Earnings).

Washington WPF GARN 01.0700 - Answer to Writ of Garnishment - Debts Other than Earnings

Description

How to fill out Washington WPF GARN 01.0700 - Answer To Writ Of Garnishment - Debts Other Than Earnings?

Out of the great number of platforms that provide legal templates, US Legal Forms offers the most user-friendly experience and customer journey when previewing forms prior to buying them. Its comprehensive catalogue of 85,000 samples is categorized by state and use for efficiency. All the documents on the service have already been drafted to meet individual state requirements by certified legal professionals.

If you already have a US Legal Forms subscription, just log in, look for the form, click Download and obtain access to your Form name in the My Forms; the My Forms tab holds your saved documents.

Follow the guidelines below to get the form:

- Once you discover a Form name, make certain it is the one for the state you need it to file in.

- Preview the form and read the document description before downloading the sample.

- Search for a new sample through the Search field in case the one you’ve already found is not appropriate.

- Click on Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

When you have downloaded your Form name, you may edit it, fill it out and sign it with an web-based editor that you pick. Any form you add to your My Forms tab might be reused multiple times, or for as long as it continues to be the most updated version in your state. Our service provides quick and simple access to samples that fit both legal professionals and their clients.

Form popularity

FAQ

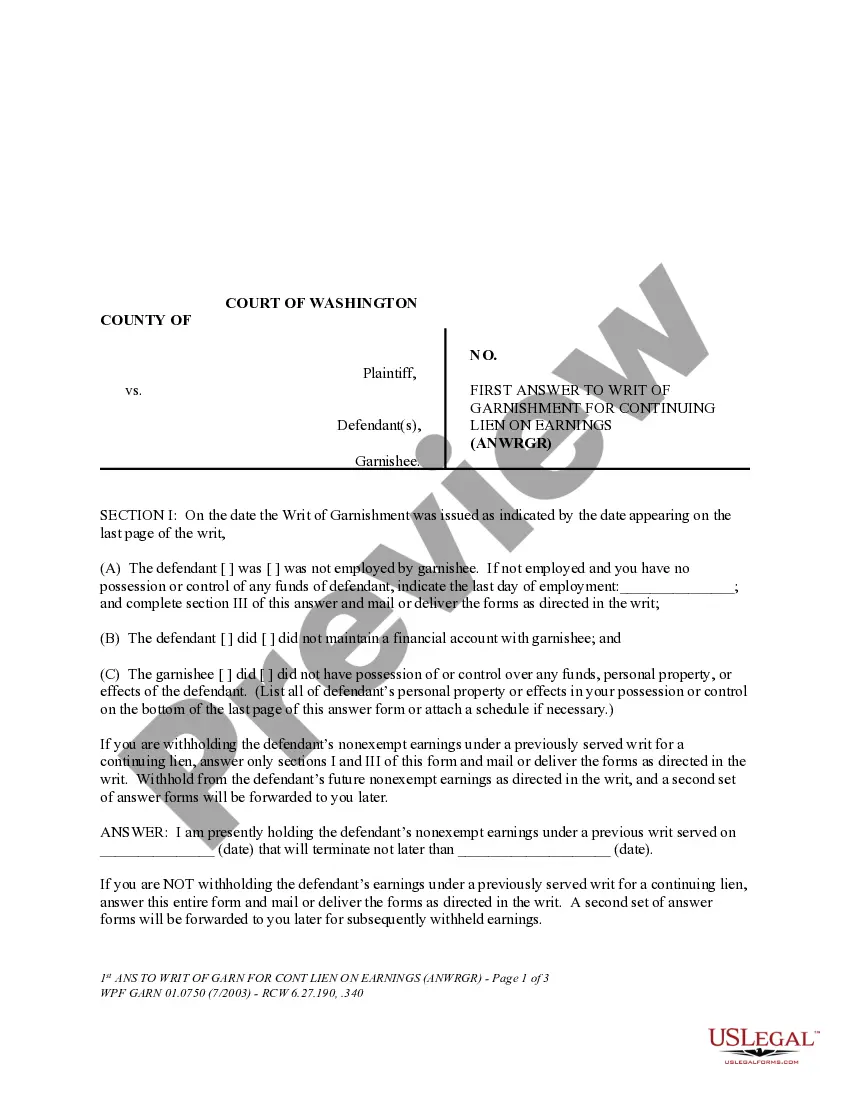

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

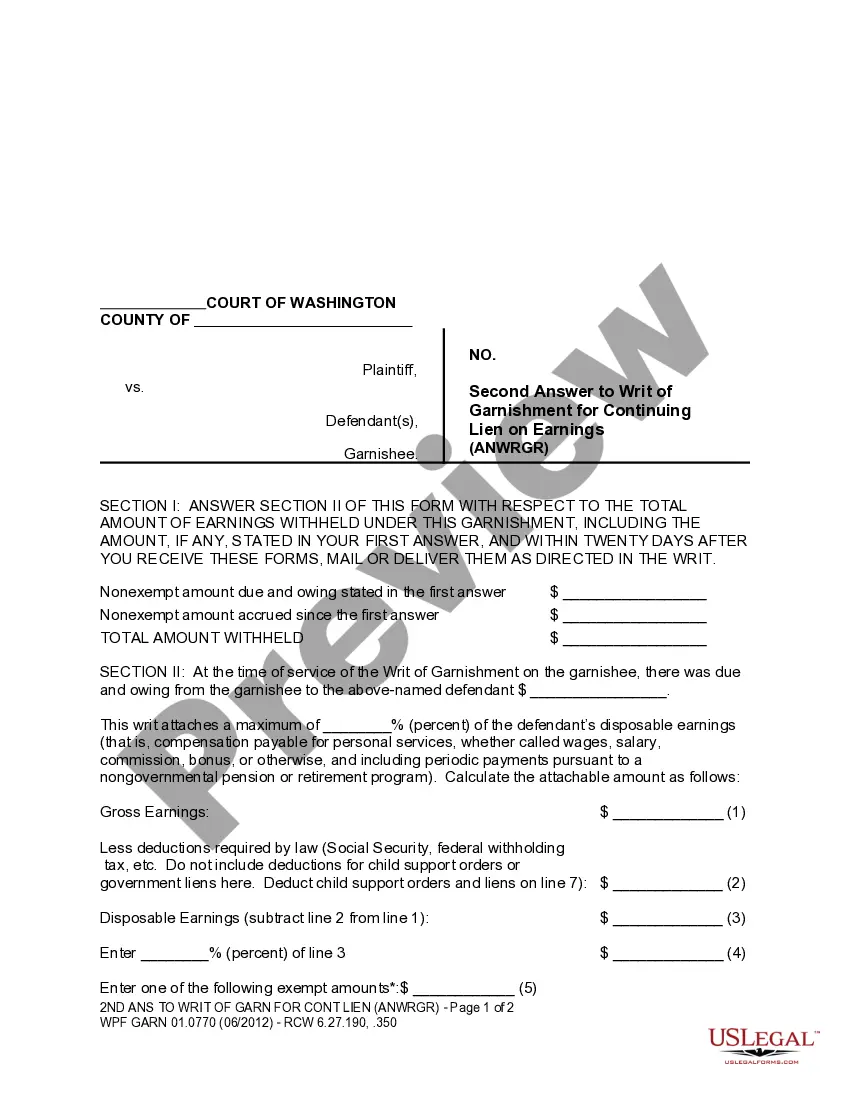

Wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support.

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

If your wages are being garnished or you are about to be garnished and you live in Washington State, give Symmes Law Group a call at 206-682-7975 to stop your wage garnishment immediately or use our contact form to tell us about your case.

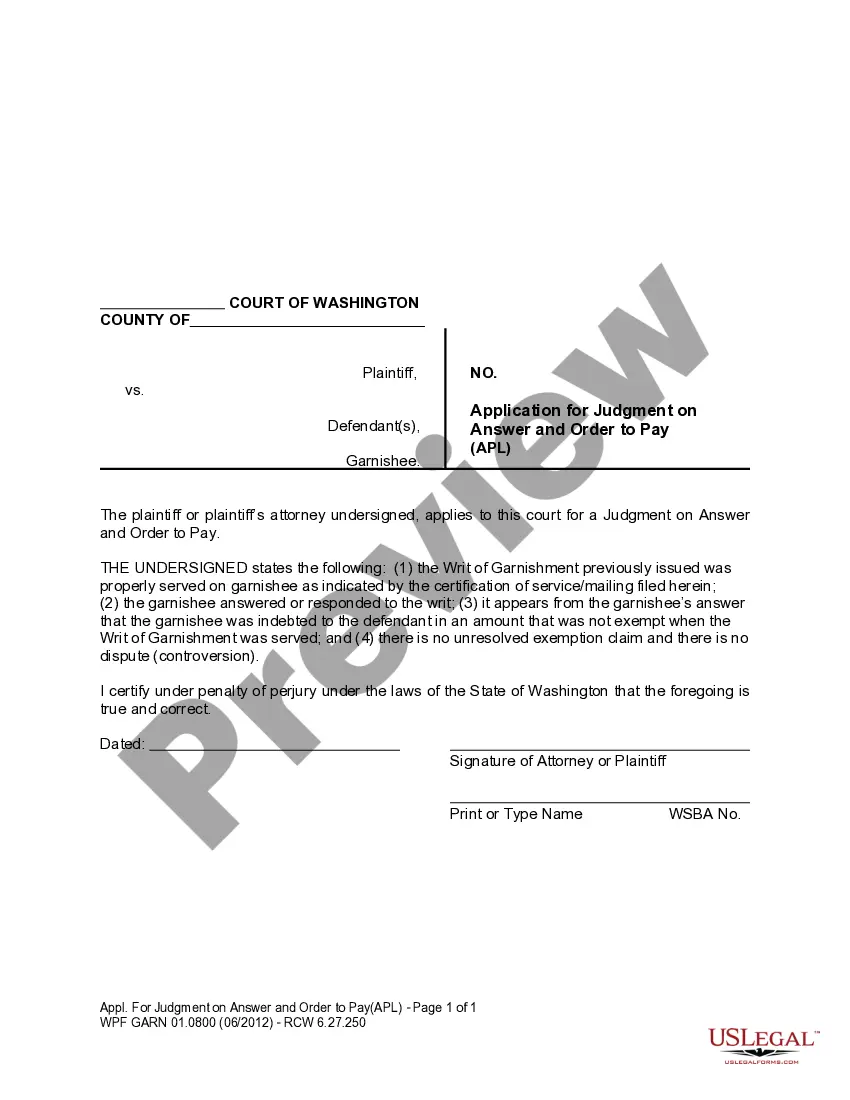

When a creditor obtains a writ of garnishment, the employer is the garnishee and the creditor is the garnishor.In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.