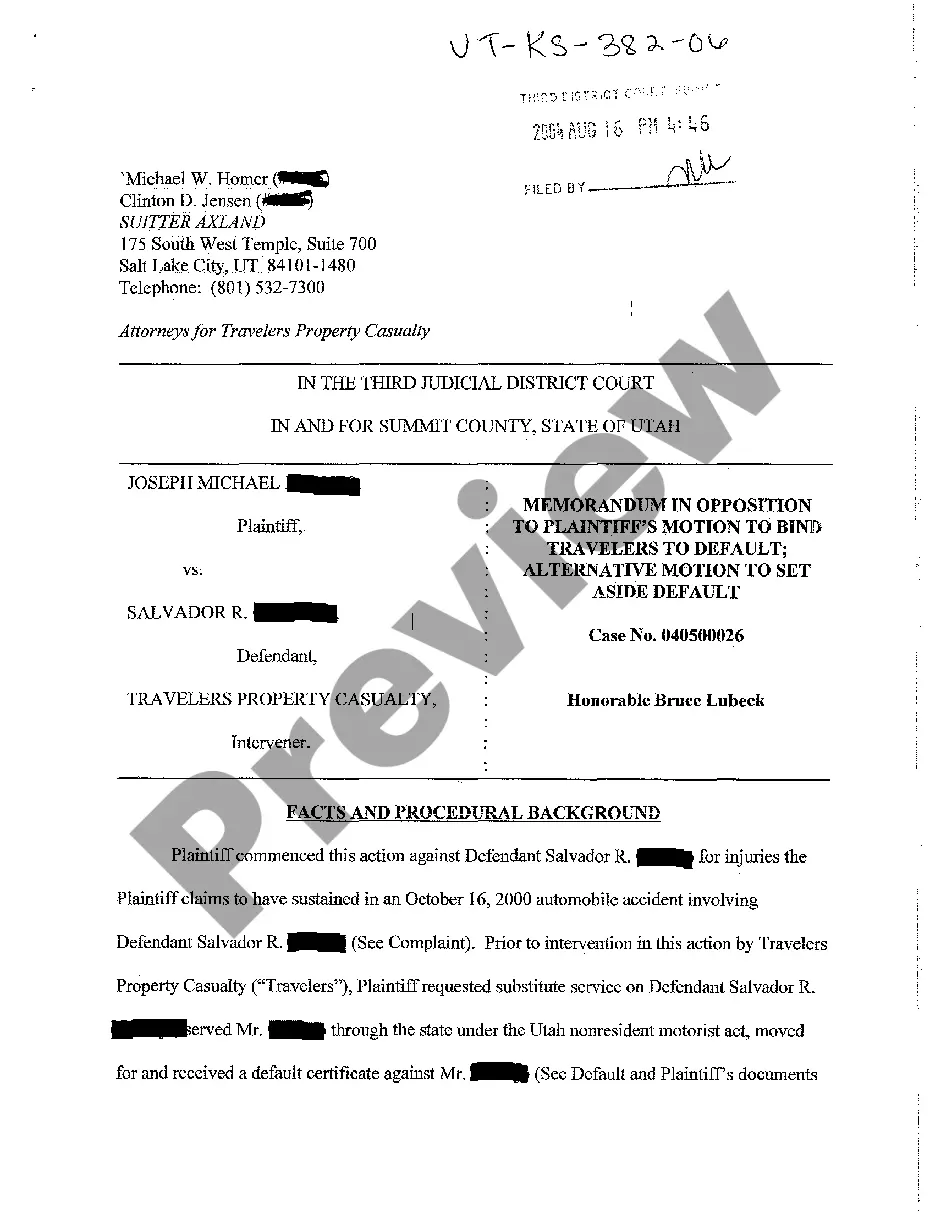

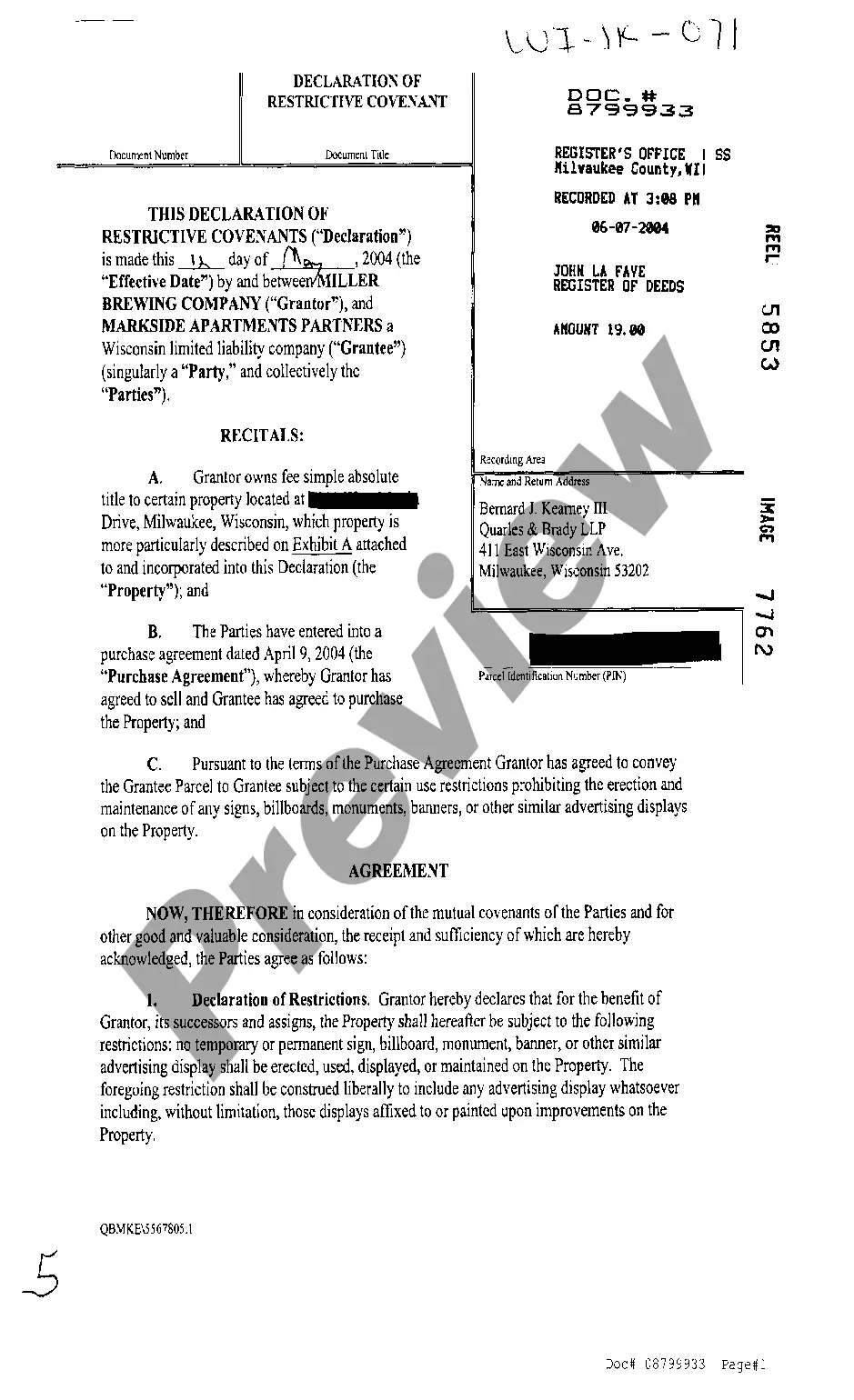

This is an official Washington court form for use in Garnishment cases, a Second Answer to Writ of Garnishment for Continuing Lien on Earnings.

Washington WPF GARN 01.0770 - Second Answer to Writ of Garnishment for Continuing Lien on Earnings

Description

How to fill out Washington WPF GARN 01.0770 - Second Answer To Writ Of Garnishment For Continuing Lien On Earnings?

Out of the great number of services that provide legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates before buying them. Its complete library of 85,000 templates is categorized by state and use for efficiency. All of the forms available on the service have already been drafted to meet individual state requirements by qualified legal professionals.

If you have a US Legal Forms subscription, just log in, look for the form, hit Download and get access to your Form name in the My Forms; the My Forms tab keeps all of your saved forms.

Follow the tips below to get the document:

- Once you discover a Form name, make certain it’s the one for the state you need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Look for a new sample via the Search field in case the one you have already found is not appropriate.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the document.

Once you’ve downloaded your Form name, you can edit it, fill it out and sign it with an online editor of your choice. Any form you add to your My Forms tab might be reused many times, or for as long as it continues to be the most updated version in your state. Our platform provides fast and easy access to templates that suit both legal professionals and their customers.

Form popularity

FAQ

Notwithstanding any other provision of this chapter, if salary or wages are to be garnished to satisfy a judgment, the court shall issue a continuing writ of garnishment to the judgment debtor's employer which provides for the periodic payment of a portion of the salary or wages of the judgment debtor as the salary or

When a debtor discovers that his exempt wages have been garnished the first step is to file a motion with the issuing court a motion to dissolve the writ of garnishment on the grounds that the debtor is head of household. The motion should trigger the court to schedule a hearing on the exemption and garnishment.

Written proof of service is required, such as an affidavit of service or the signed return receipt. The writ must be served with 4 answer forms, 3 stamped envelopes addressed to the court, judgment debtor, and judgment creditor, and a $20 check payable to the garnishee defendant (except wage garnishments).

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

When a creditor obtains a writ of garnishment, the employer is the garnishee and the creditor is the garnishor.In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

A writ of garnishment is a process by which the court orders the seizure or attachment of the property of a defendant or judgment debtor in the possession or control of a third party. The garnishee is the person or corporation in possession of the property of the defendant or judgment debtor.

A writ of continuing garnishment serves as a lien and continuing levy against the nonexempt earnings of the judgment debtor, until such time earnings are no longer due; the underlying judgment is vacated, modified or satisfied in full; or the writ is dismissed.

A writ of garnishment is a process by which the court orders the seizure or attachment of the property of a defendant or judgment debtor in the possession or control of a third party. The garnishee is the person or corporation in possession of the property of the defendant or judgment debtor.