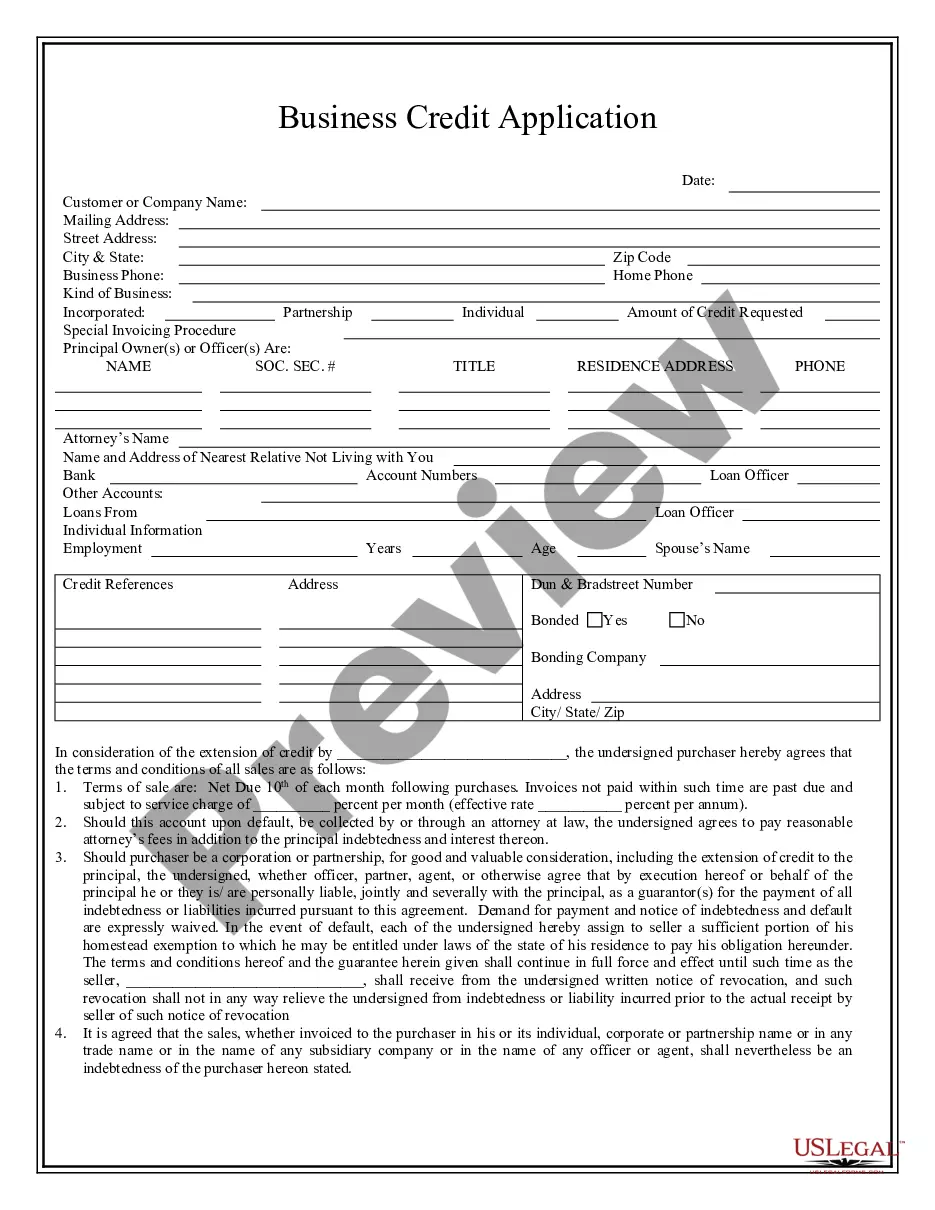

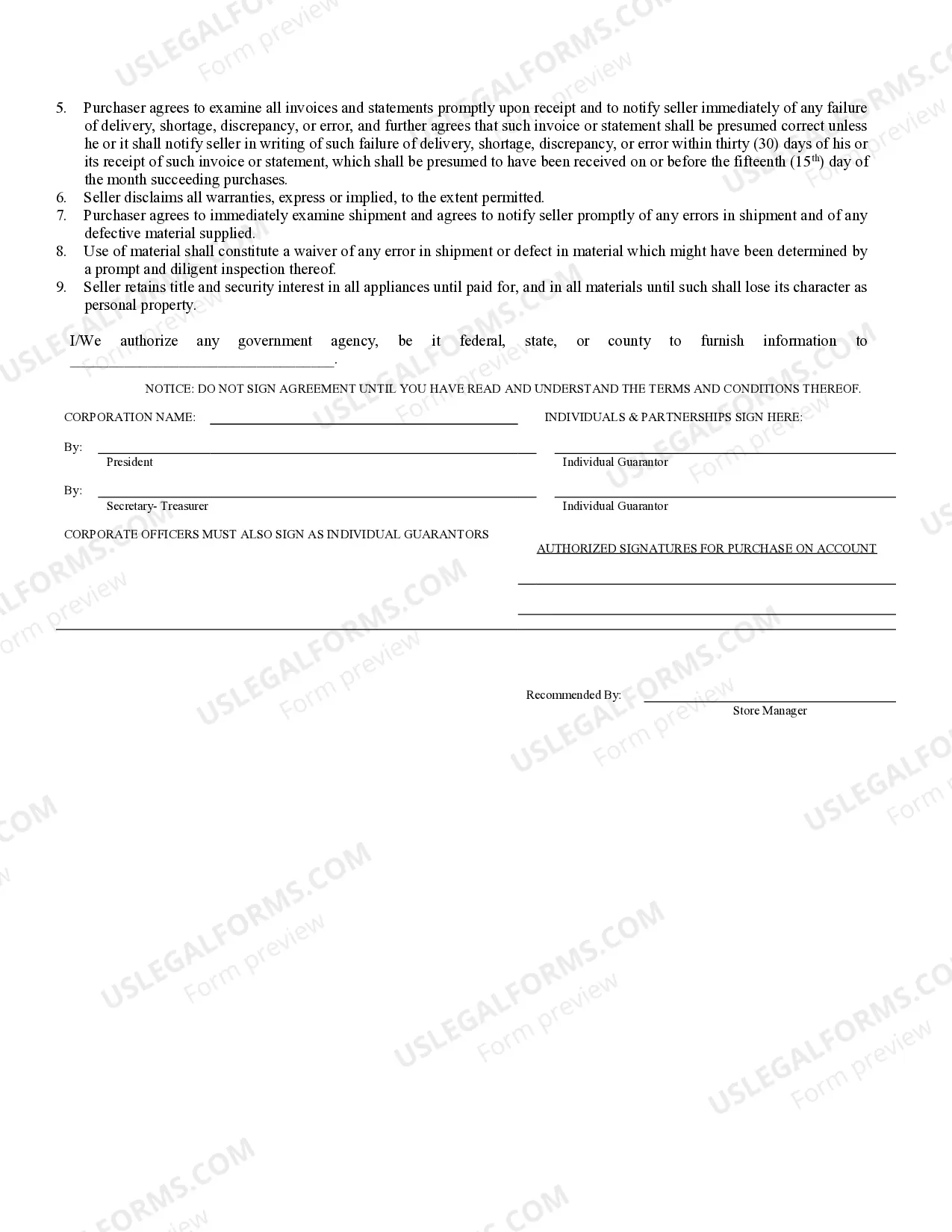

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Washington Business Credit Application

Description Washington Business Application

How to fill out Washington Business Credit Application?

Out of the large number of platforms that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates before buying them. Its extensive catalogue of 85,000 templates is categorized by state and use for simplicity. All the documents available on the service have already been drafted to meet individual state requirements by licensed lawyers.

If you have a US Legal Forms subscription, just log in, search for the template, click Download and obtain access to your Form name from the My Forms; the My Forms tab holds all of your saved forms.

Stick to the tips below to get the document:

- Once you see a Form name, ensure it’s the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the template.

- Search for a new template using the Search engine if the one you have already found is not proper.

- Click on Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the template.

Once you have downloaded your Form name, it is possible to edit it, fill it out and sign it with an web-based editor of your choice. Any document you add to your My Forms tab can be reused many times, or for as long as it continues to be the most updated version in your state. Our service offers easy and fast access to templates that fit both legal professionals as well as their customers.

Form popularity

FAQ

Two other goals for a credit application are to limit credit risk and to get a better understanding of a customer's business. The credit application is the credit professional's first, and sometimes only, opportunity to protect their company from risk of loss through credit sales and/or fraud.

Start a scenario using the Business Licensing Wizard. Apply online applications will take approximately 10 business days to process. By mail complete the Business License Application, along with any additional forms, and payment to the address on the form.

Business credit is the ability of a business to qualify for financing. Businesses have credit reports and scores just like people do.Your business credit report may be used by lenders, creditors, suppliers, insurance companies and other organizations evaluating a credit or insurance application or business deal.

A credit application is an application filed by a prospective borrower and submitted to a credit lender. A credit application can be submitted in writing either through online and offline modes or orally in person at the lender's premises.

Choose a name for your business. Choose the right type of business entity. Register your business with the Washington Secretary of State. Get your Federal Tax ID Number. Open a bank account and get a debit/credit card. Get a state business license. Register with the Washington Department of Revenue.

Choose a business name for your sole proprietorship and check for availability. File a Business License Application with the Washington Department of Licensing. Get an Employer Identification Number from the IRS. Report Any New Hires. Open a bank account for your business.

#1: Establish business credit. #2: Use good trade references. #3: Review your personal and business credit scores. #4: Know the line of credit's purpose. #5: Organize your financial records. #6: Prepare your business plan. #7: Fill out the application correctly.

The business credit application is your opportunity to prove that your business is an appropriate credit risk.These reports and business credit scores are used to decide not only if your business should be approved, but also what the terms of the loan or credit line will be if approved.

Choose a business name for your sole proprietorship and check for availability. File a Business License Application with the Washington Department of Licensing. Get an Employer Identification Number from the IRS. Report Any New Hires. Open a bank account for your business.