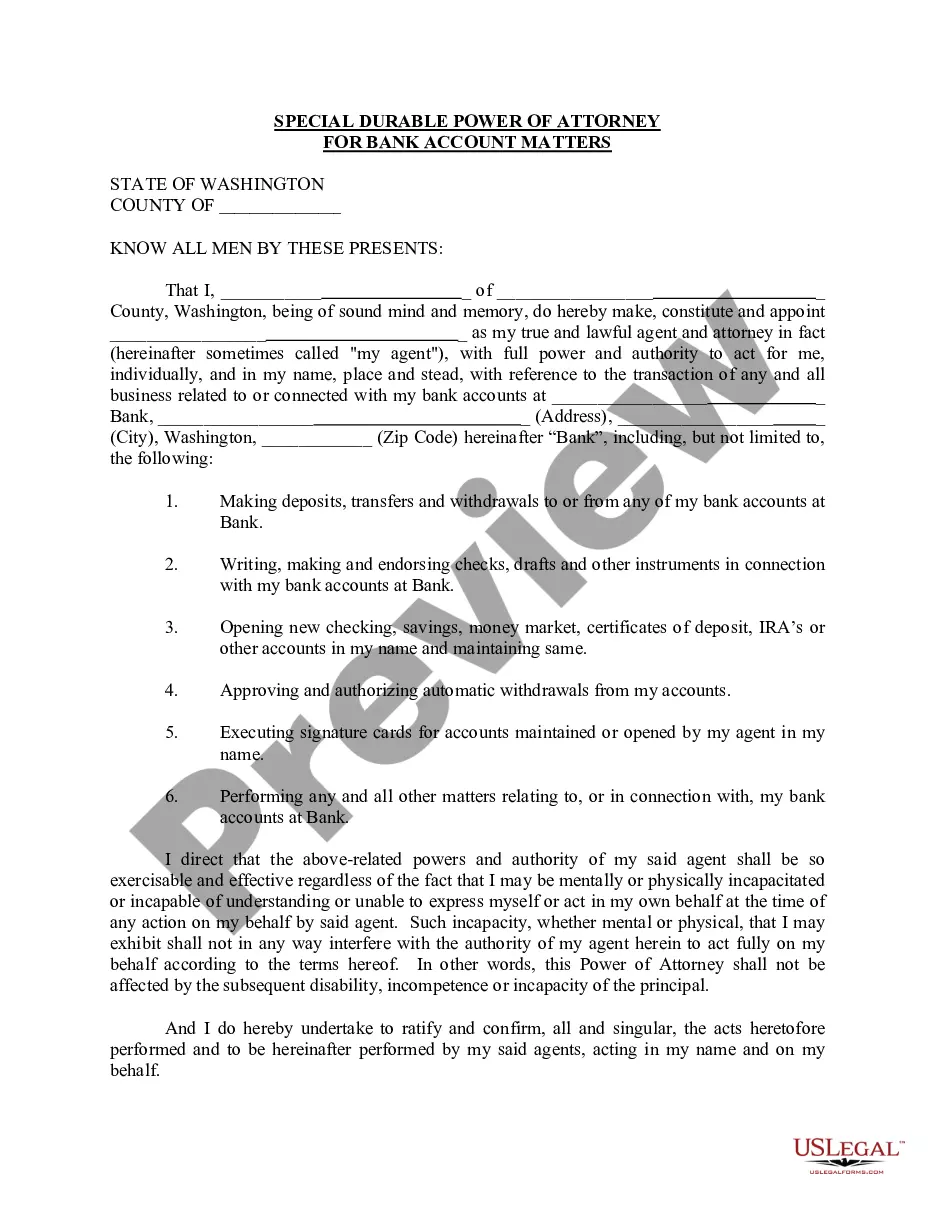

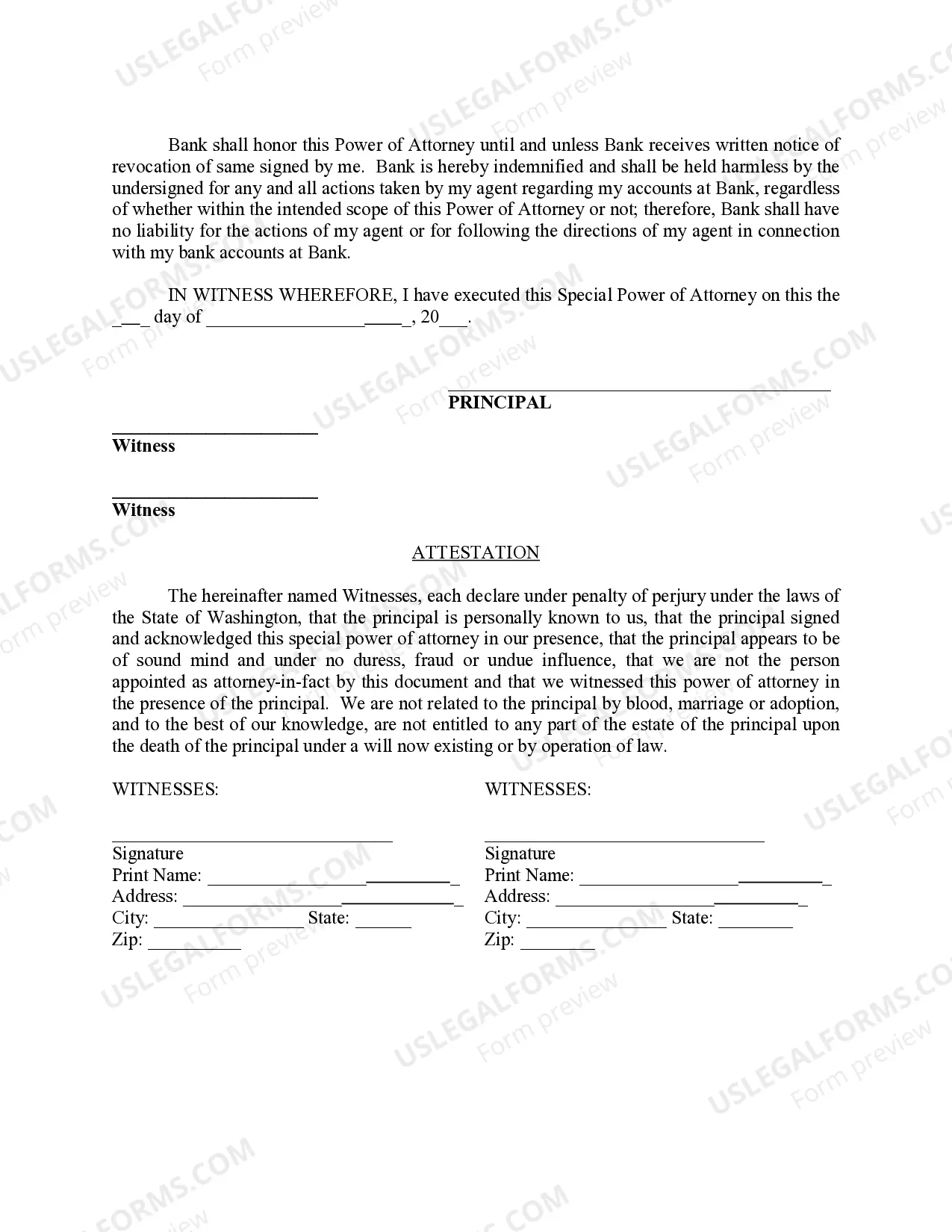

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Washington Special Durable Power of Attorney for Bank Account Matters

Description Special Power Of Attorney For Banking Purposes

How to fill out Washington Special Durable Power Of Attorney For Bank Account Matters?

Out of the multitude of platforms that offer legal samples, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates prior to buying them. Its comprehensive catalogue of 85,000 templates is grouped by state and use for simplicity. All the forms on the platform have been drafted to meet individual state requirements by licensed legal professionals.

If you have a US Legal Forms subscription, just log in, look for the template, click Download and gain access to your Form name in the My Forms; the My Forms tab keeps all of your saved forms.

Follow the tips listed below to obtain the document:

- Once you find a Form name, make sure it is the one for the state you need it to file in.

- Preview the template and read the document description prior to downloading the template.

- Search for a new template through the Search field if the one you’ve already found isn’t appropriate.

- Just click Buy Now and choose a subscription plan.

- Create your own account.

- Pay using a card or PayPal and download the template.

Once you’ve downloaded your Form name, you can edit it, fill it out and sign it in an online editor of your choice. Any document you add to your My Forms tab might be reused many times, or for as long as it remains the most updated version in your state. Our platform offers quick and simple access to samples that fit both attorneys and their clients.

Form popularity

FAQ

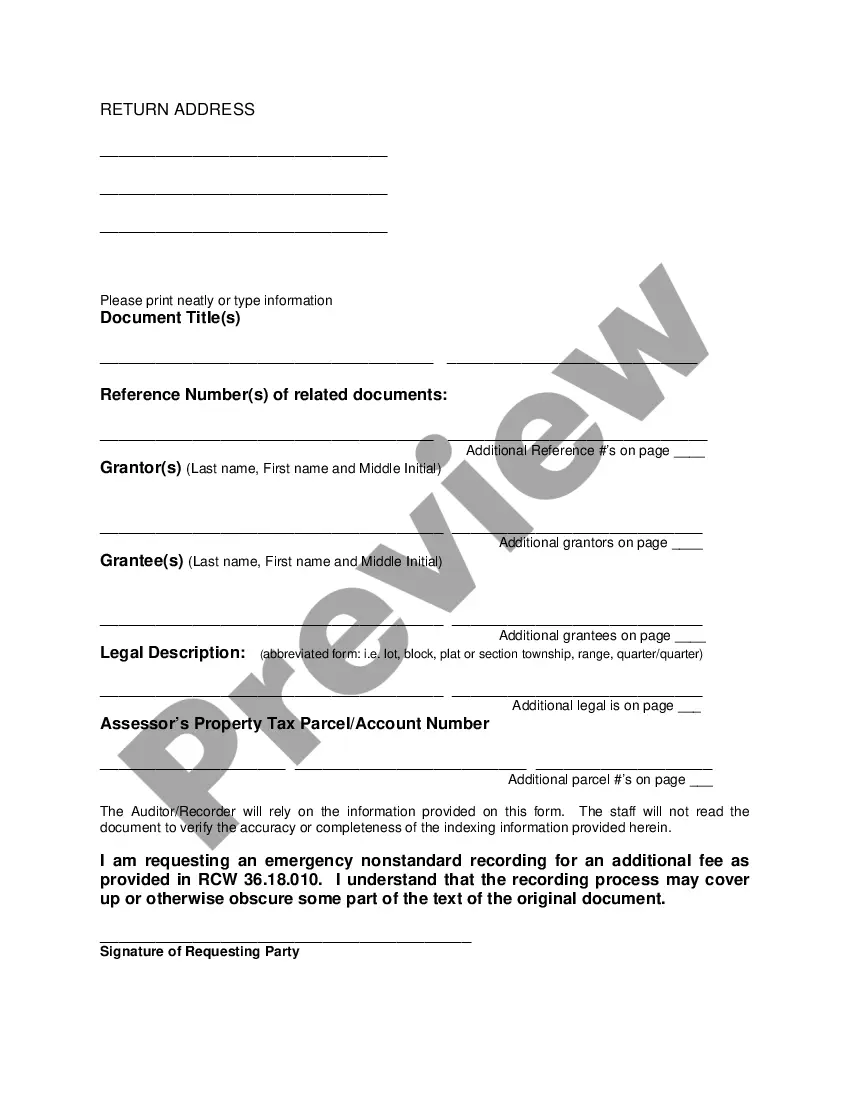

The Achilles heel of powers of attorney is that banks and other financial institutions sometimes refuse to honor them.When the power of attorney becomes necessary, it's often because the principal has become incapacitated.

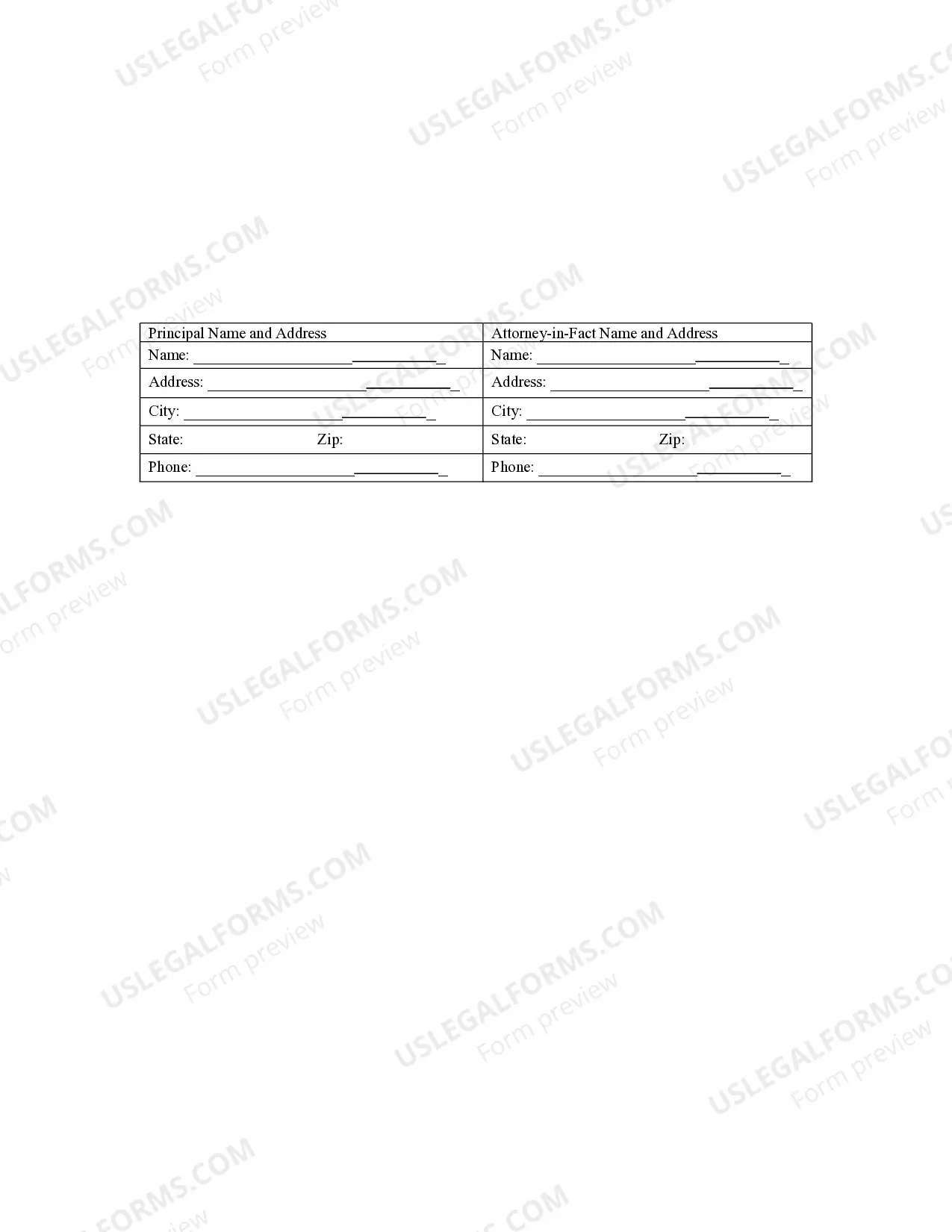

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power. If the document grants an agent power over that account, they must provide a copy of the document along with appropriate identification to access the bank account.

But because of the risk of abuse, many banks will scrutinize a POA carefully before allowing the agent to act on the principal's behalf, and often a bank will refuse to honor a POA.The agent fought back in court and won a $64,000 judgment against the bank.

Through the use of a valid Power of Attorney, an Agent can sign checks for the Principal, withdraw and deposit funds from the Principal's financial accounts, change or create beneficiary designations for financial assets, and perform many other financial transactions.

What's the difference between durable and general power of attorney? A general power of attorney ends the moment you become incapacitated.A durable power of attorney stays effective until the principle dies or until they act to revoke the power they've granted to their agent.

A power of attorney allows an agent to access the principal's bank accounts, either as a general power or a specific power.If you grant a power of attorney, check with your bank to find out whether the document you intend to use is sufficient. You may want to change the document or even change your bank.

Although third parties do sometimes refuse to honor an Agent's authority under a POA agreement, in most cases that refusal is not legal.In that case, the law allows you to collect attorney's fees if the third party unreasonably refused to accept the POA.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.