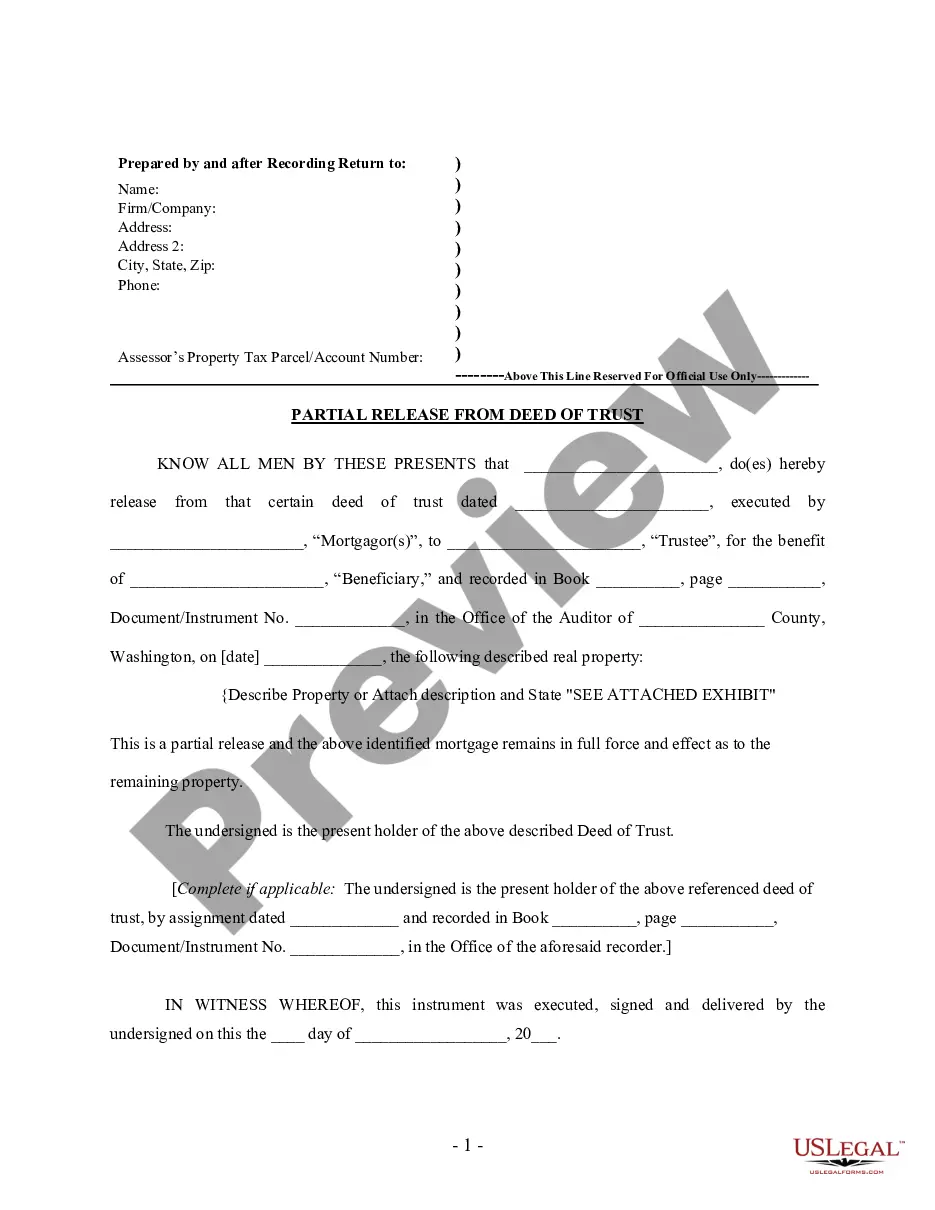

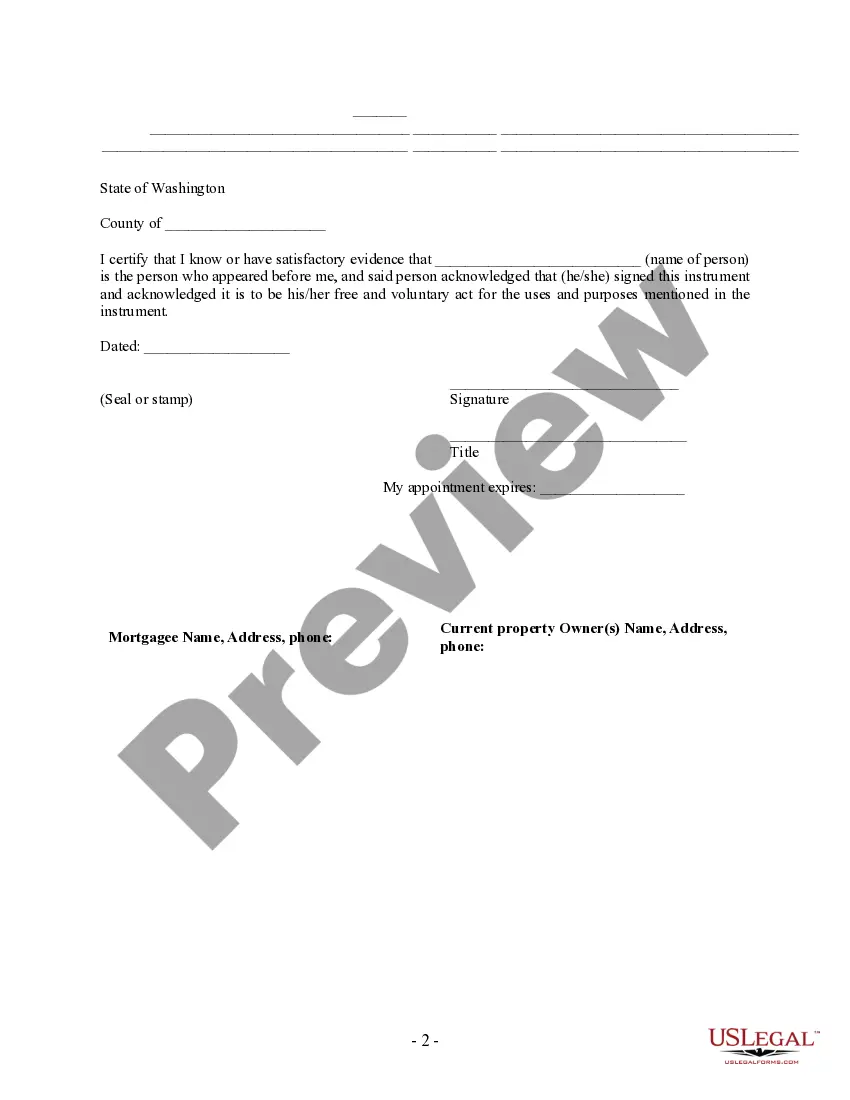

This form is for a holder of a deed of trust or mortgage (see title) to release a portion of the real property described as security. It asserts that the identified and referenced deed of trust or mortgage remains in full force or effect as to the remaining property.

Washington Partial Release of Property From Deed of Trust for Individual

Description Property Description On Deed

How to fill out Washington Partial Release Of Property From Deed Of Trust For Individual?

Out of the multitude of platforms that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates before purchasing them. Its comprehensive catalogue of 85,000 samples is categorized by state and use for simplicity. All the forms on the platform have been drafted to meet individual state requirements by qualified lawyers.

If you already have a US Legal Forms subscription, just log in, look for the template, click Download and gain access to your Form name from the My Forms; the My Forms tab holds all of your saved forms.

Follow the guidelines listed below to obtain the document:

- Once you see a Form name, make sure it is the one for the state you really need it to file in.

- Preview the template and read the document description just before downloading the template.

- Look for a new template through the Search engine in case the one you have already found is not appropriate.

- Simply click Buy Now and choose a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

After you’ve downloaded your Form name, you may edit it, fill it out and sign it with an web-based editor that you pick. Any document you add to your My Forms tab can be reused many times, or for as long as it remains the most updated version in your state. Our platform provides quick and easy access to samples that fit both attorneys as well as their customers.

Washington State Partial Release Form popularity

FAQ

Sign the deed of trust form in the presence of a notary. You'll have to provide your identification to the notary with a federally issued photo ID such as a Washington driver's license or military ID card. Once you sign the deed in front of the notary, the notary will then notarize the form.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

A deed of trust acts as an agreement between youthe homebuyerand your lender. It states not just that you'll repay the loan, but that a third party called the trustee will hold legal title to the property until you do. A deed of trust is the security for your loan, and it's recorded in the public records.

In financed real estate transactions, trust deeds transfer the legal title of a property to a third partysuch as a bank, escrow company, or title companyto hold until the borrower repays their debt to the lender. Trust deeds are used in place of mortgages in several states.

When you are ready to sign a deed of trust, the parties will need to sign in the presence of a notary public.The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.

A deed of trust (DOT), is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in an attached promissory note. This process is called a Trustee Sale.