Washington Statement of Money Or Property Received Or Promised In Connection With This Case Other Than By Application Or A Plan

Description

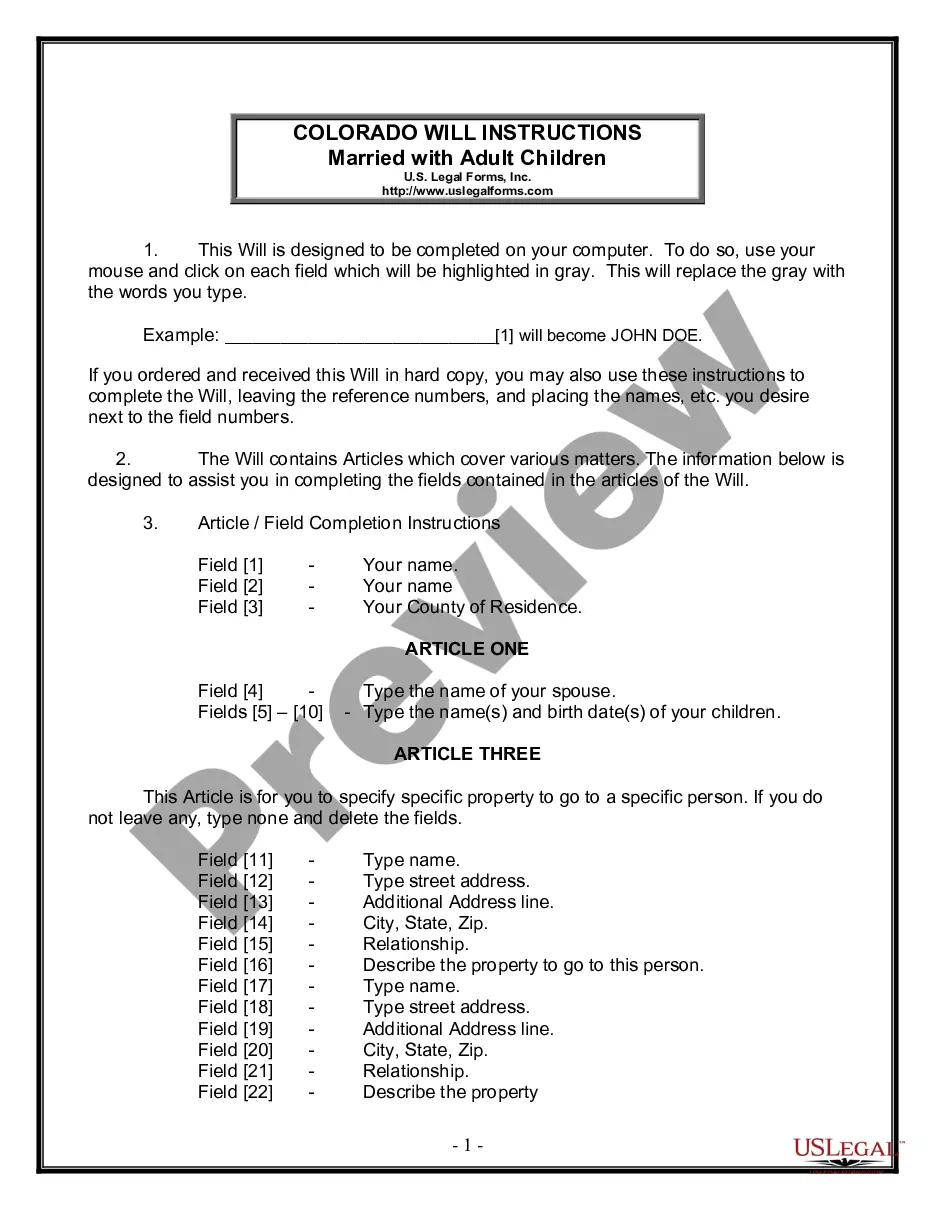

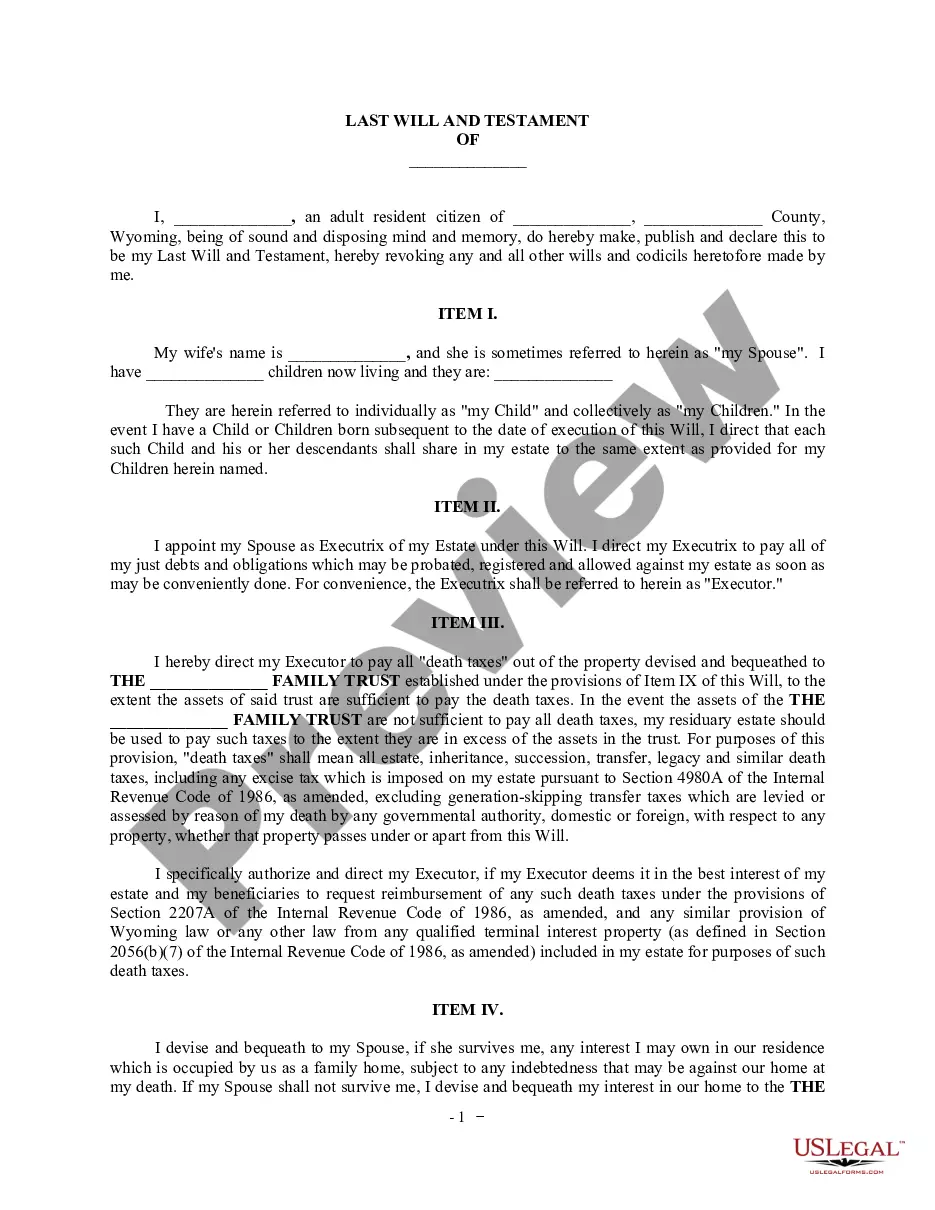

How to fill out Washington Statement Of Money Or Property Received Or Promised In Connection With This Case Other Than By Application Or A Plan?

If you’re searching for a way to appropriately prepare the Washington Statement of Money Or Property Received Or Promised In Connection With This Case Other Than By Application Or A Plan without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every individual and business situation. Every piece of paperwork you find on our online service is designed in accordance with federal and state regulations, so you can be sure that your documents are in order.

Follow these simple instructions on how to acquire the ready-to-use Washington Statement of Money Or Property Received Or Promised In Connection With This Case Other Than By Application Or A Plan:

- Make sure the document you see on the page complies with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Type in the form name in the Search tab on the top of the page and select your state from the list to locate an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your Washington Statement of Money Or Property Received Or Promised In Connection With This Case Other Than By Application Or A Plan and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it rapidly or print it out to prepare your paper copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

Do I owe capital gains tax when I sell real estate? No. Washington's capital gains tax does not apply to the sale or exchange of real estate.

Background. The 2021 Washington State Legislature recently passed ESSB 5096 (RCW 82.87) which creates a 7% tax on the sale or exchange of long-term capital assets such as stocks, bonds, business interests, or other investments and tangible assets. This tax only applies to individuals.

Graduated REET Structure effective Jan. 1, 2023 for the state portion of REET Sale price thresholdsTax rate$525,000 or less1.10%$525,000.01 - $1,525,0001.28%$1,525,000.01 - $3,025,0002.75%$3,025,000.01 or more3%

The IRS allows no specific tax exemptions for senior citizens, either when it comes to income or capital gains. The closest you can come is a back-end tax-advantaged retirement account like a Roth IRA which allows you to withdraw money without paying taxes.

The IRS treats crypto as ?property,? which means you'll need to report certain crypto transactions on your taxes. You'll even be asked on the main form, Form 1040, whether you received, sold, sent, exchanged, or otherwise acquired ?any financial interest in any virtual currency.?

When you sell a home for more than you paid for it, the profit you make is considered a capital gain. Capital gains from a home sale are taxable, and the tax you pay depends on how long you've owned the house, how long you lived there, your tax filing status and income.

If you have more than one home, you can exclude gain only from the sale of your main home. You must pay tax on the gain from selling any other home. If you have two homes and live in both of them, your main home is ordinarily the one you live in most of the time.

How to avoid capital gains tax on real estate Live in the house for at least two years. The two years don't need to be consecutive, but house-flippers should beware.See whether you qualify for an exception.Keep the receipts for your home improvements.