The Washington Declaration Re Debtors Required Documents For Trustee is a document that provides the requirements for trustees to be appointed in the state of Washington. It outlines the qualifications for trustees and the documents that must be submitted to the court for the appointment of a trustee. The document includes information on the qualifications for trustees, the documents that must be submitted to the court, and any applicable fees. There are two types of Washington Declaration Re Debtors Required Documents For Trustee: the Washington Declaration of Trustee Appointment (WET) and the Washington Declaration of Trustee Removal (WAR). The WET outlines the requirements for appointing a Trustee in the State of Washington and the WAR outlines the requirements for removing a Trustee. Both documents must be completed and submitted to the court for the appointment or removal of a trustee.

Washington Declaration Re Debtors Required Documents For Trustee

Description

How to fill out Washington Declaration Re Debtors Required Documents For Trustee?

If you’re searching for a way to appropriately complete the Washington Declaration Re Debtors Required Documents For Trustee without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business situation. Every piece of documentation you find on our web service is created in accordance with nationwide and state laws, so you can be sure that your documents are in order.

Follow these simple guidelines on how to obtain the ready-to-use Washington Declaration Re Debtors Required Documents For Trustee:

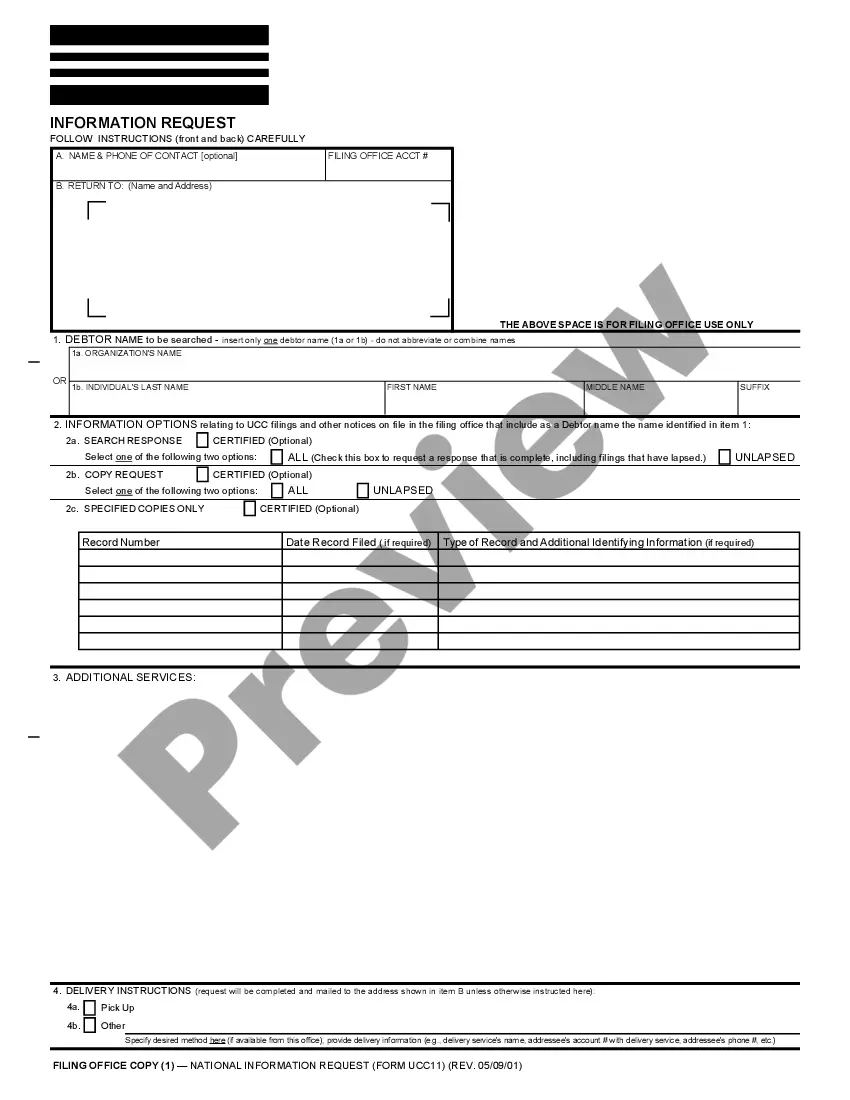

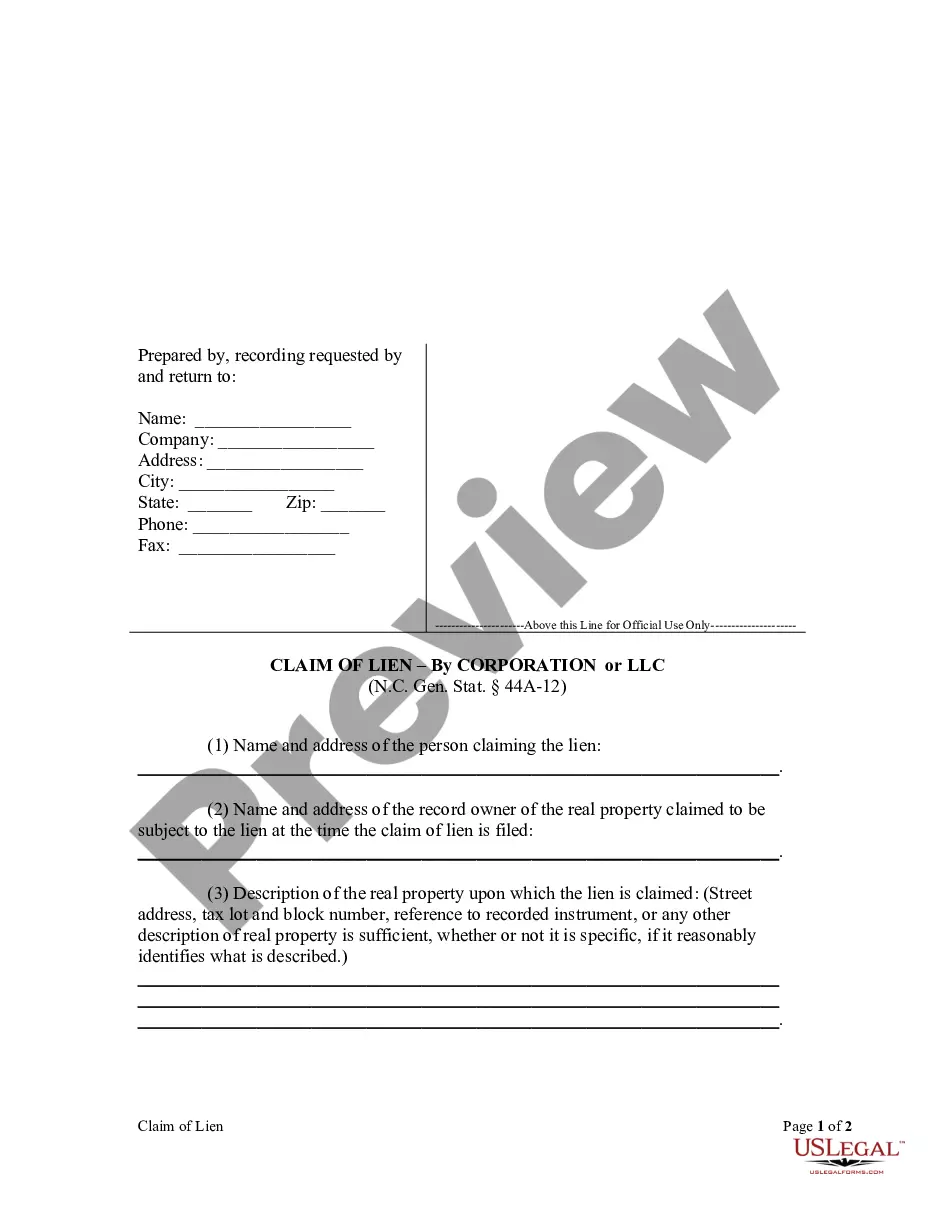

- Ensure the document you see on the page complies with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and choose your state from the list to find an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to get your Washington Declaration Re Debtors Required Documents For Trustee and download it by clicking the appropriate button.

- Import your template to an online editor to fill out and sign it rapidly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

You Must Tell The Truth At The 341 Meeting Of Creditors. The Trustee and any creditor or other party in interest is entitled to ask questions regarding your assets and liabilities, as well as any questions that are relevant to the administration of the bankruptcy case, or your right to a discharge.

Once you have paid off all of your chapter 13 bankruptcy debts, you will go to the bankruptcy court for one last hearing ? your discharge hearing. You have the option of directing your attorney to attend the hearing in your place. The bankruptcy judge will review all of your case details.

If you pay your Chapter 13 plan off early, you alter the agreed upon terms of your bankruptcy case. Now, you'll be responsible for paying your creditors all of your original outstanding debt, including the amount that would've been discharged.

Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing.

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

About 45 days after you've received your discharge, you will receive a document called a Final Decree. It's the document that officially closes your case. Once this document is received, you are no longer in bankruptcy.

The bankruptcy trustee will typically be entitled to claim any non-exempt portion of the settlement and distribute it to creditors.