Washington Creditor's Receipt

Description

How to fill out Washington Creditor's Receipt?

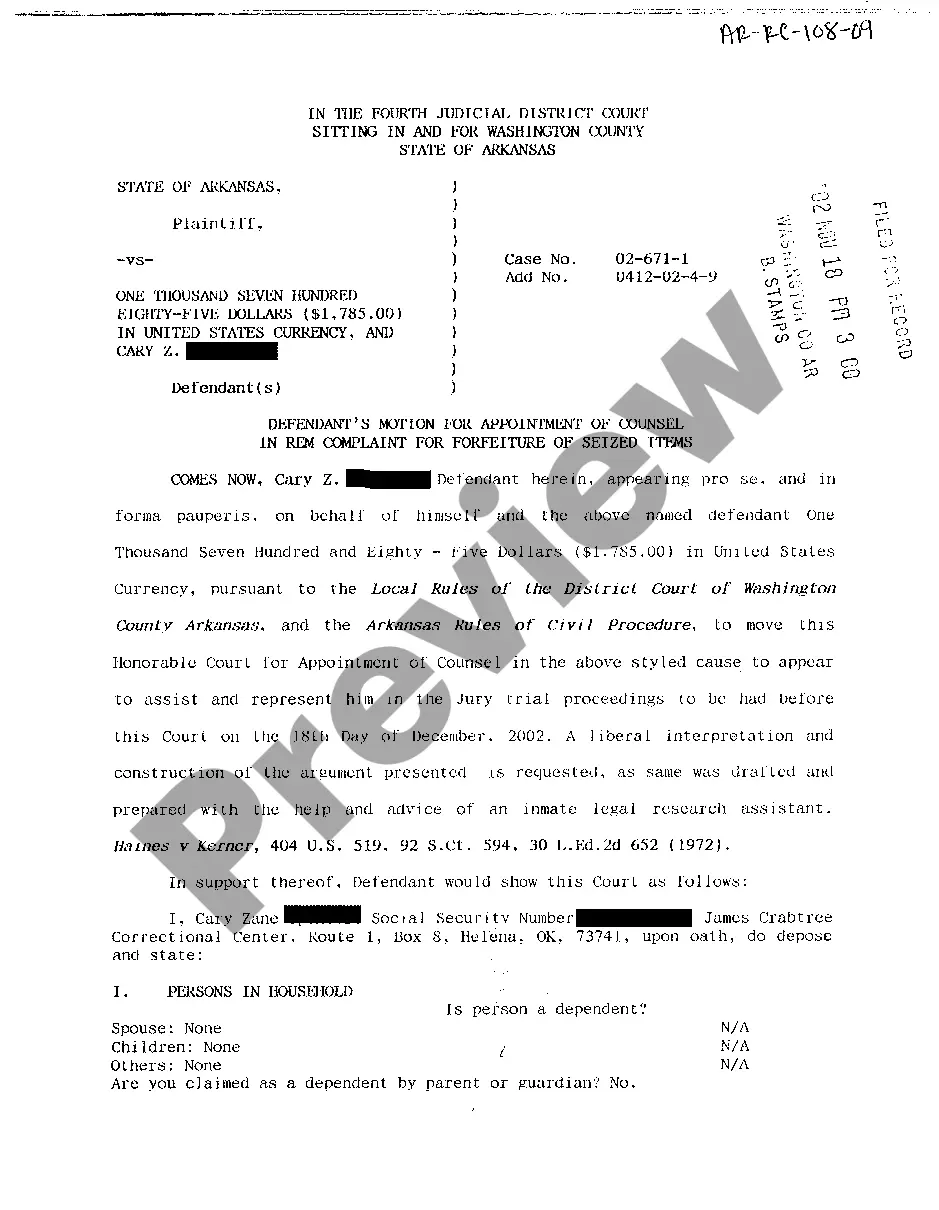

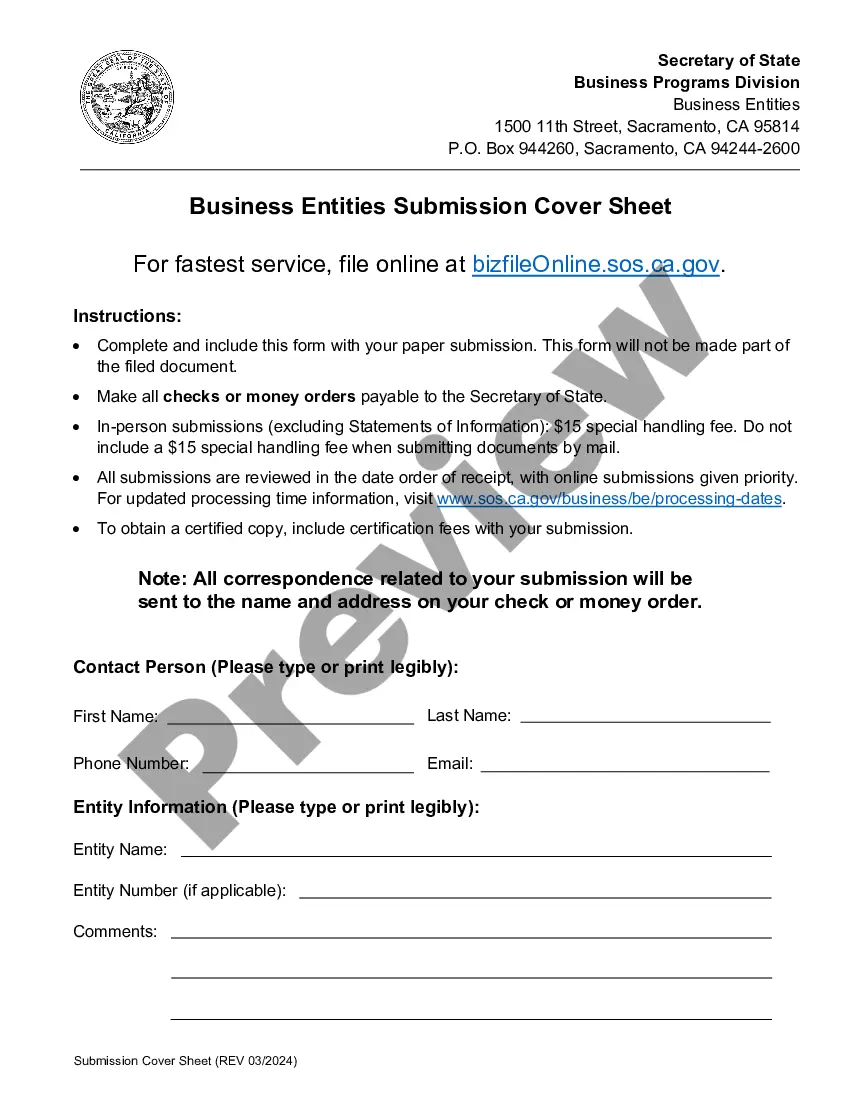

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state regulations and are checked by our experts. So if you need to prepare Washington Creditor's Receipt, our service is the perfect place to download it.

Getting your Washington Creditor's Receipt from our catalog is as easy as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the proper template. Afterwards, if they need to, users can take the same document from the My Forms tab of their profile. However, even if you are new to our service, signing up with a valid subscription will take only a few moments. Here’s a quick guide for you:

- Document compliance check. You should carefully review the content of the form you want and make sure whether it satisfies your needs and complies with your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable blank, and click Buy Now when you see the one you need.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Washington Creditor's Receipt and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service today to obtain any official document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

The State will indemnify you and Decedent's estate for (almost) all creditors who file Creditor's Claims after four months following first publication up until 24 months after date of death.

Otherwise, the estate remains liable (in most cases) until 24 months after date of death. This means that any heir or beneficiary who receives an estate asset remains liable for dilatory Creditor's Claims until the second anniversary of Decedent's death.

Claims?Duty to allow or reject?Notice of petition to allow?Attorneys' fees. (1) The notice agent shall allow or reject all claims presented in the manner provided in RCW 11.42. 070. The notice agent may allow or reject a claim, in whole or in part.

A claim against an estate is a written request for the estate to pay money that the decedent owed. Because probate laws vary from one state to another, different states have somewhat different procedures for notifying creditors and filing a claim against an estate.

Definition: Creditor Claims A creditor claim is a legal claim filed against an estate by a creditor to whom a decedent owed an obligation. A creditor who fails to bring a creditor claim within the time period specified by statute will lose the right to recover on the decedent's obligation.

The language that the Notice should contain can be found in RCW 11.40. 030. A sample Notice to Creditors is contained here (PDF) (Word). The Notice must be published once each week for three consecutive weeks.

Creditors and an Estate: The Executor is not obliged to pay a creditor until the account in which the claim is reflected has lain for inspection and any objections thereto have been disposed of. Once the Executor has lodged his account, payment should be made if no successful objection has been made to it.

Creditor's claim (sometimes referred to as a proof of claim) is a filing with a bankruptcy or probate court to establish a debt owed to that individual or organization.