Washington Receipt for Blocked Account (GR-8A) is a document issued by the Washington State Department of Revenue to certify that a taxpayer's account has been blocked. This document is used to provide evidence that the taxpayer has paid their taxes and that the account has been blocked. It is also used to prevent the taxpayer from using the account for any other purpose until the taxes are paid in full. There are two types of Washington Receipt for Blocked Account (GR-8A): one for an individual taxpayer and one for a business taxpayer. The individual receipt is used to block an individual taxpayer's account, while the business receipt is used to block a business taxpayer's account. Both receipts provide evidence that the taxpayer has paid their taxes and the account has been blocked. They also prevent the taxpayer from using the account for any other purpose until the taxes are paid in full.

Washington Receipt for Blocked Account (GR-8A)

Description

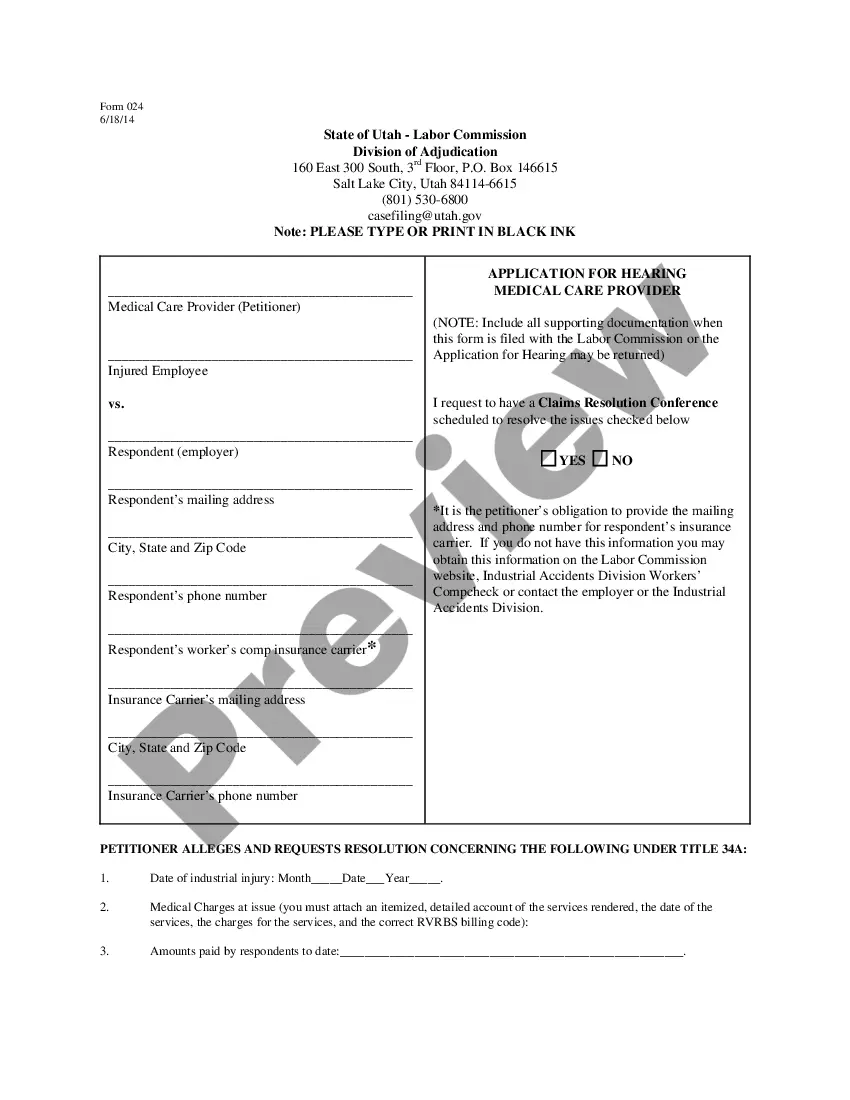

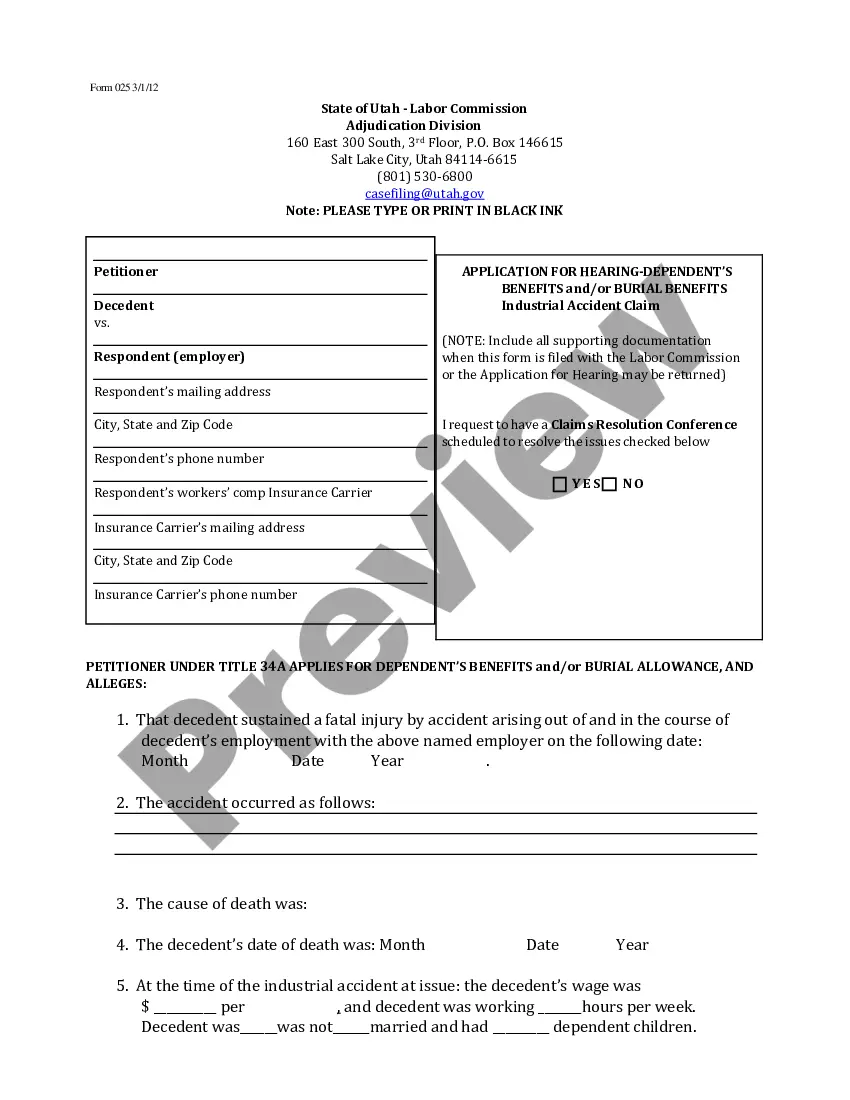

How to fill out Washington Receipt For Blocked Account (GR-8A)?

Working with legal documentation requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Washington Receipt for Blocked Account (GR-8A) template from our service, you can be sure it complies with federal and state regulations.

Dealing with our service is easy and quick. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to obtain your Washington Receipt for Blocked Account (GR-8A) within minutes:

- Make sure to attentively check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Washington Receipt for Blocked Account (GR-8A) in the format you need. If it’s your first time with our website, click Buy now to continue.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Washington Receipt for Blocked Account (GR-8A) you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

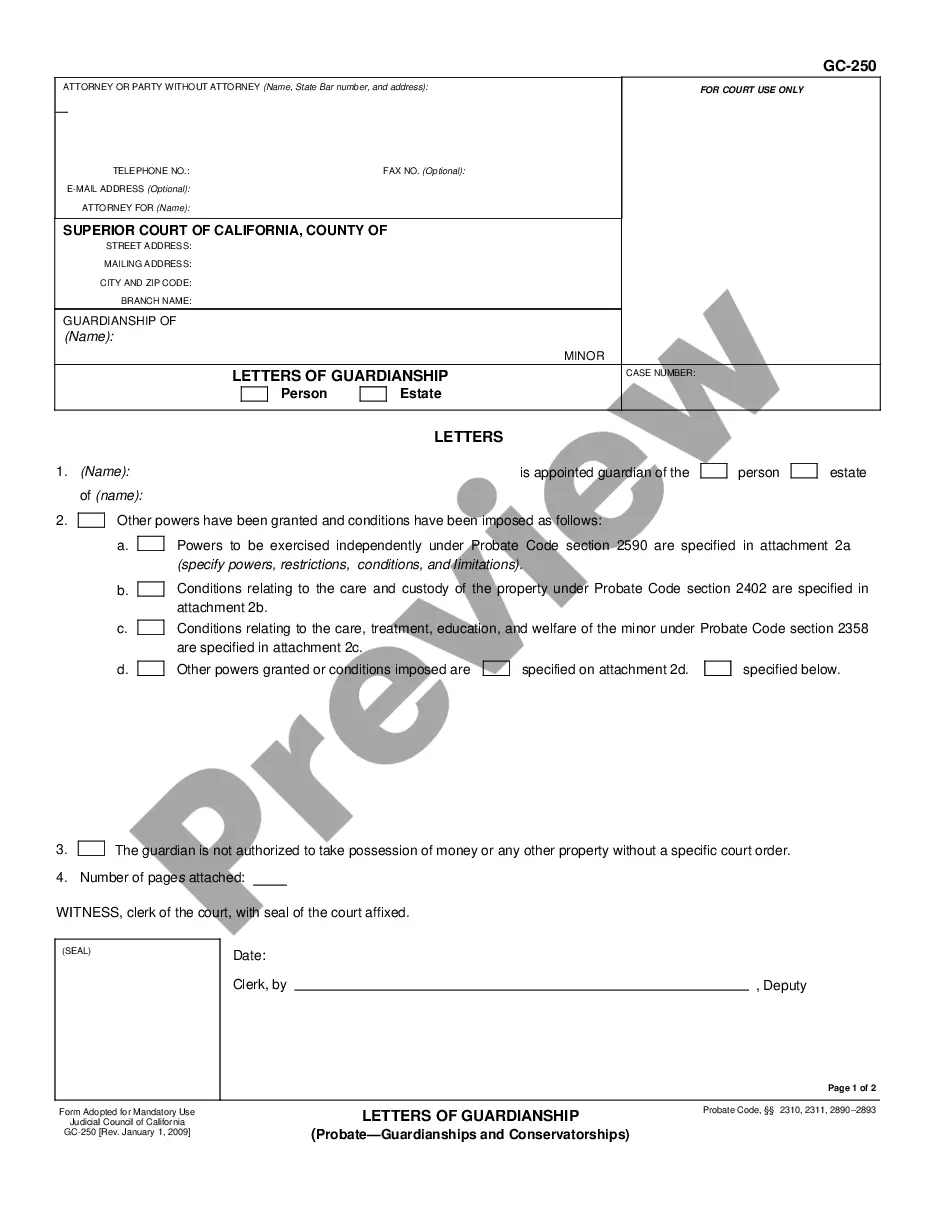

The bank clerk must sign the Receipt (MC-356). Then, you file the receipt with the probate clerk. Your receipt should be submitted with an endorsed copy of the order (MC-355) attached to it as indicated in #1 of form MC-356.

A court must approve and order any withdrawal of funds from a blocked account. The most common reason to petition a court to withdraw funds from a blocked account is to access a blocked account because the account was created for a minor who has subsequently turned 18.

Acknowledgment of Receipt of Order and Funds for Deposit in Blocked Account (MC-356) A bank or other financial institution uses this to acknowledge they have received a court order to deposit funds into a blocked account (form MC-355). Get form MC-356.

Filing a Petition with the Court You will need to file a petition with the courts to withdraw money from the account. The court will review your petition and make a judgment based on the information.

A blocked account in probate refers to cash or securities that are placed in a bank subject to withdrawal upon court order. A blocked account is a bank or other account created by court order, requiring a court order to deposit or withdraw funds.