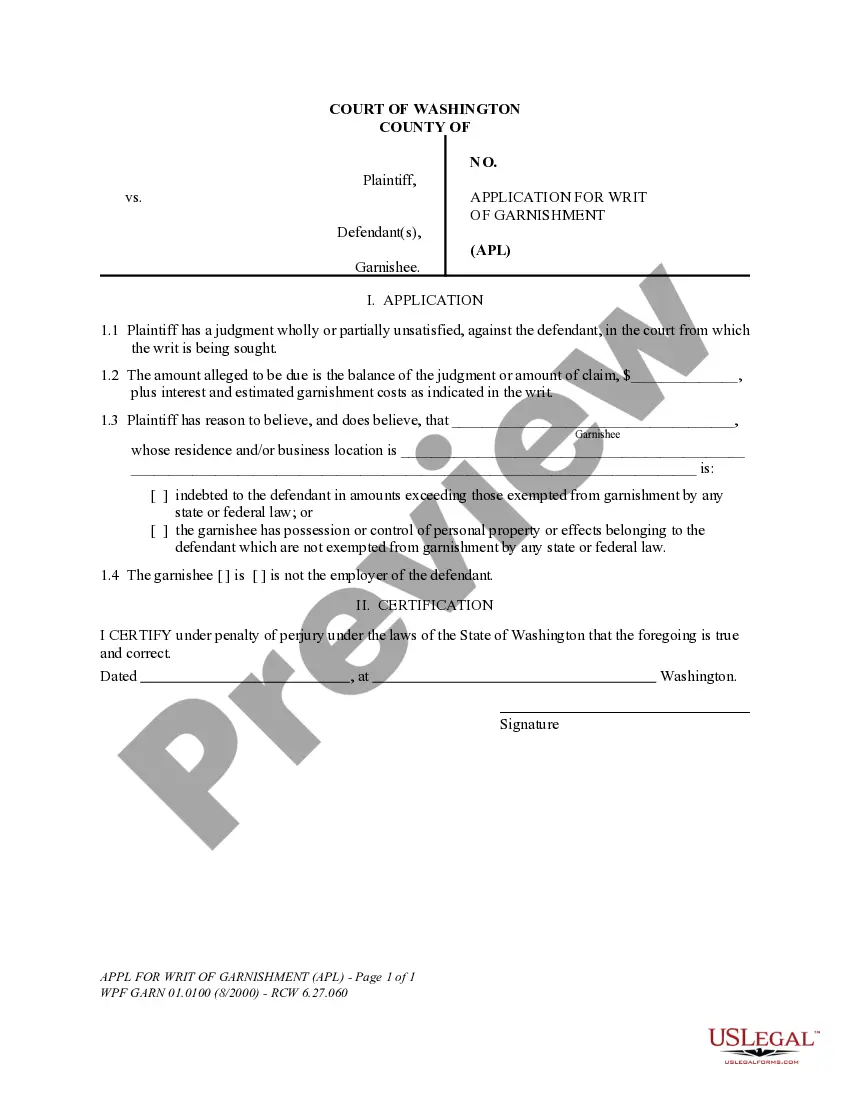

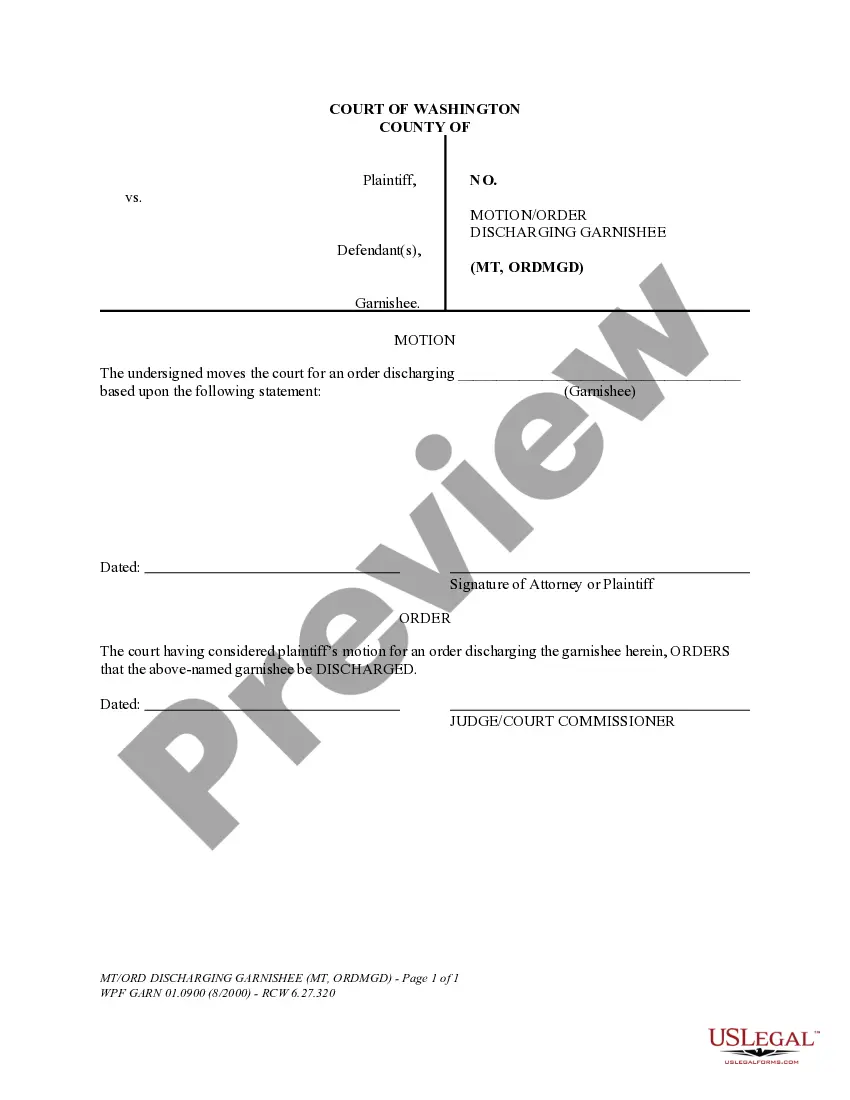

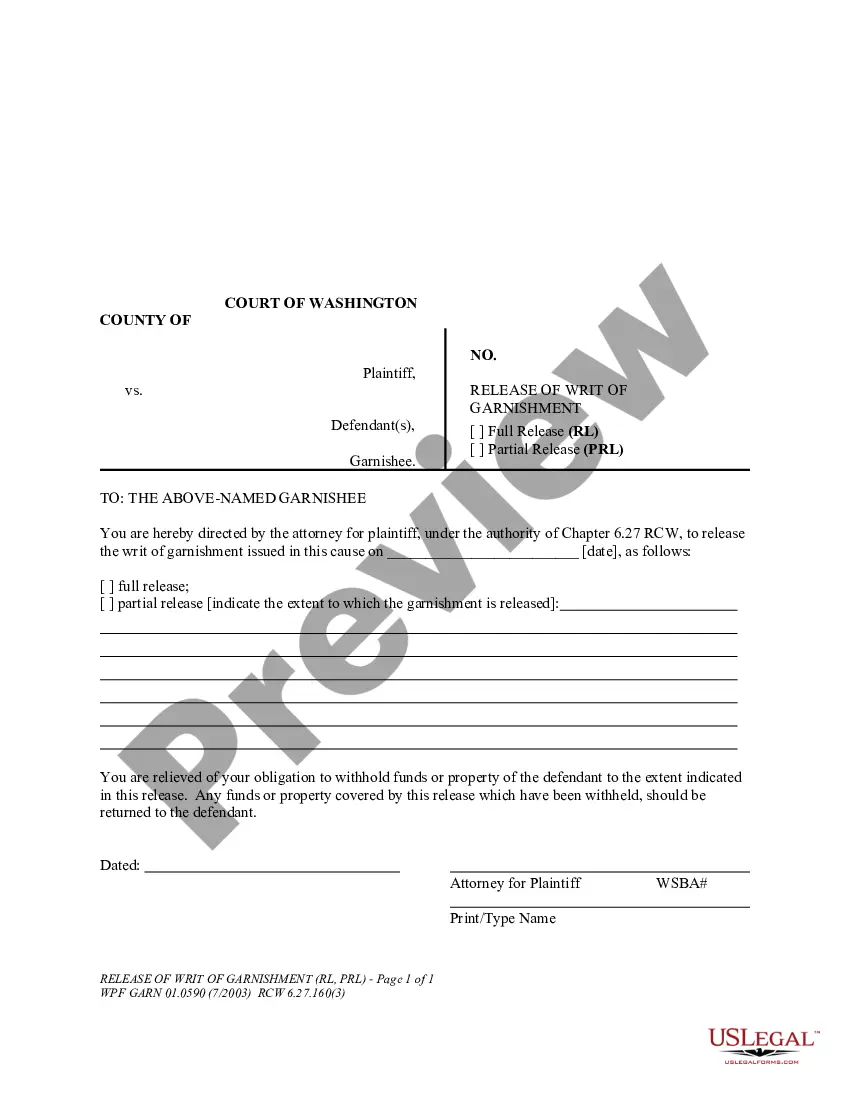

Washington Release of Writ of Garnishment is a legal document used to release a garnishment of wages or other funds. A garnishment is a legal process that allows creditors to collect a debt from a debtor by taking a portion of their wages or other funds. A Washington Release of Writ of Garnishment is a document used to cancel a garnishment and release the funds. There are two types of Washington Release of Writ of Garnishment: Voluntary Release and Court Order Release. A Voluntary Release is when the creditor voluntarily releases the garnishment without a court order. A Court Order Release is when a judge orders the creditor to release the garnishment. In both cases, the creditor must fill out the Release of Writ of Garnishment and submit it to the garnishee (the employer or the financial institution holding the funds) to release the garnishment.

Washington Release of Writ of Garnishment

Description

How to fill out Washington Release Of Writ Of Garnishment?

Coping with official paperwork requires attention, accuracy, and using properly-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Washington Release of Writ of Garnishment template from our library, you can be sure it complies with federal and state laws.

Working with our service is easy and fast. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Washington Release of Writ of Garnishment within minutes:

- Remember to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Washington Release of Writ of Garnishment in the format you prefer. If it’s your first experience with our website, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Washington Release of Writ of Garnishment you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Second Answer Use the second answer form to tell the creditor what amounts you deducted from the employee's earnings. In filling out the form, calculate the exempt and non-exempt earnings in the same manner as in the first answer form, but indicate the actual amounts withheld as non-exempt earnings.

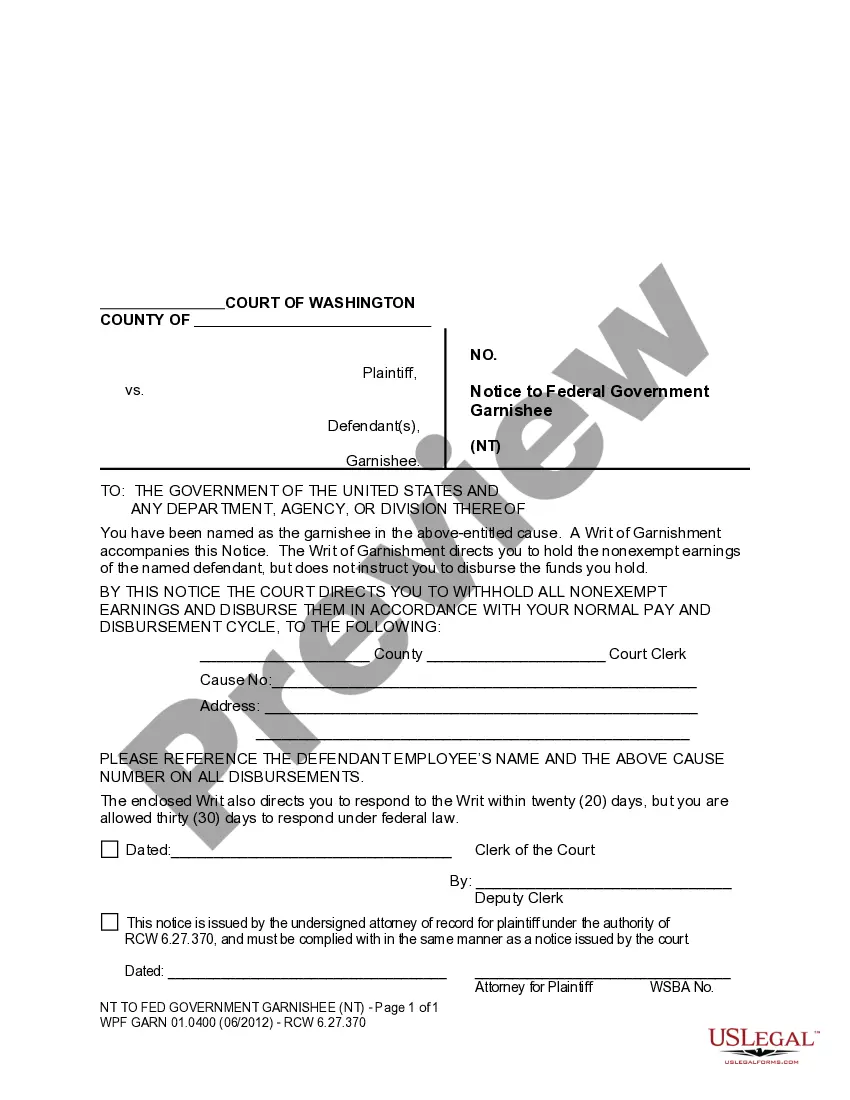

Accompanying the writ should be an ?Answer to Writ of Garnishment? form. This form is often called the ?First Answer.? The agency must complete the First Answer form and return it to the applicable court with a copy to the creditor (plaintiff) or the creditor's attorney, as well as a copy to the employee (defendant).

During the entire 60-day effective period of the garnishment, the employer must withhold the amount due to the judgment creditor from its employee's paycheck.

Washington Bank Account Levy Under Washington law, consumers must receive a notice of a pending garnishment. The consumer can claim an exemption of up to $500 in bank accounts for judgment garnishments.

Accompanying the writ should be an ?Answer to Writ of Garnishment? form. This form is often called the ?First Answer.? The agency must complete the First Answer form and return it to the applicable court with a copy to the creditor (plaintiff) or the creditor's attorney, as well as a copy to the employee (defendant).

(1) When a writ is issued under a judgment, on or before the date of service of the writ on the garnishee, the judgment creditor shall mail or cause to be mailed to the judgment debtor, by certified mail, addressed to the last known post office address of the judgment debtor, (a) a copy of the writ and a copy of the

Stopping Wage Garnishment in Washington. There are some options for protecting your wages from garnishment, such as by objecting to a writ of garnishment or filing an exemption claim with the court. You can also stop most wage garnishments by filing for bankruptcy. In most cases, the sooner you can do this, the better.