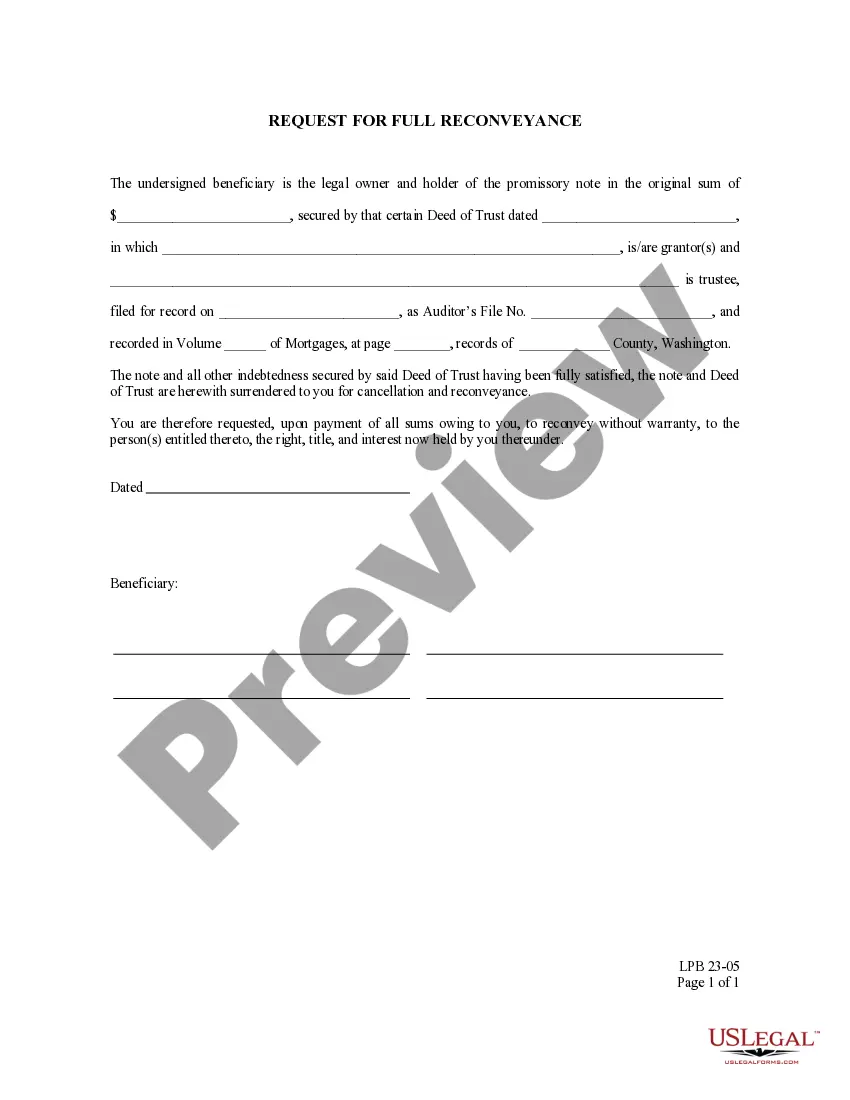

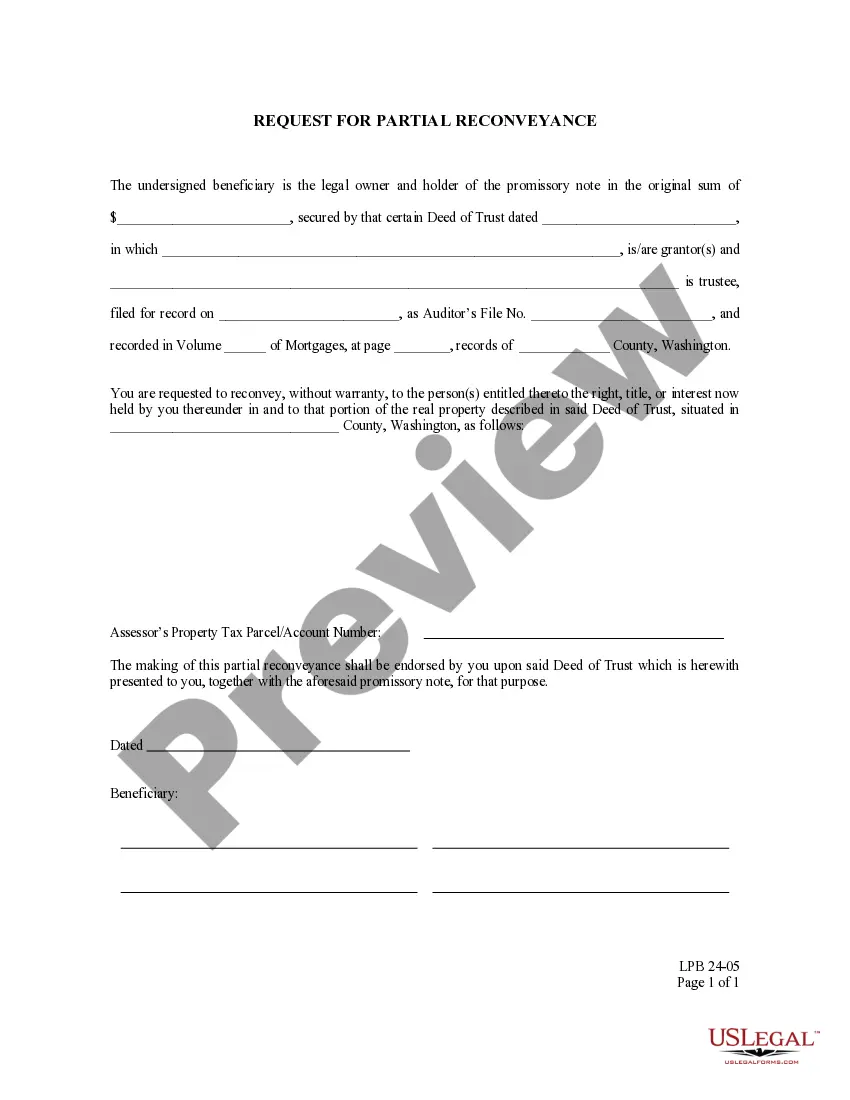

Washington Request for Full Re conveyance is a type of real estate document that is filed with a county recorder's office in order to release a deed of trust or mortgage on a property. This document is used to transfer the title of ownership from the lender to the borrower, allowing the borrower to own the property outright. It is also used to clear any liens, and to cancel any financial obligations associated with the property. There are two different types of Washington Request for Full Re conveyance: Voluntary Re conveyance and Statutory Re conveyance. Voluntary Re conveyance is used when a lender voluntarily releases the deed of trust or mortgage from a property. Statutory Re conveyance is used when the borrower meets certain criteria, such as paying off the loan in full, making timely payments for a certain period of time, or meeting other conditions outlined in the deed of trust. The Washington Request for Full Re conveyance document is typically signed by the borrower, the lender, and the county recorder's office, and must include specific information such as the address of the property, the amount of the loan, the parties involved, and the date of the request. Once filed, the document is recorded with the county recorder's office and the deed of trust or mortgage is released from the property.

Washington Request For Full Reconveyance

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Washington Request For Full Reconveyance?

Dealing with official documentation requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Washington Request For Full Reconveyance template from our library, you can be sure it meets federal and state laws.

Working with our service is straightforward and fast. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to obtain your Washington Request For Full Reconveyance within minutes:

- Make sure to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Washington Request For Full Reconveyance in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Washington Request For Full Reconveyance you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

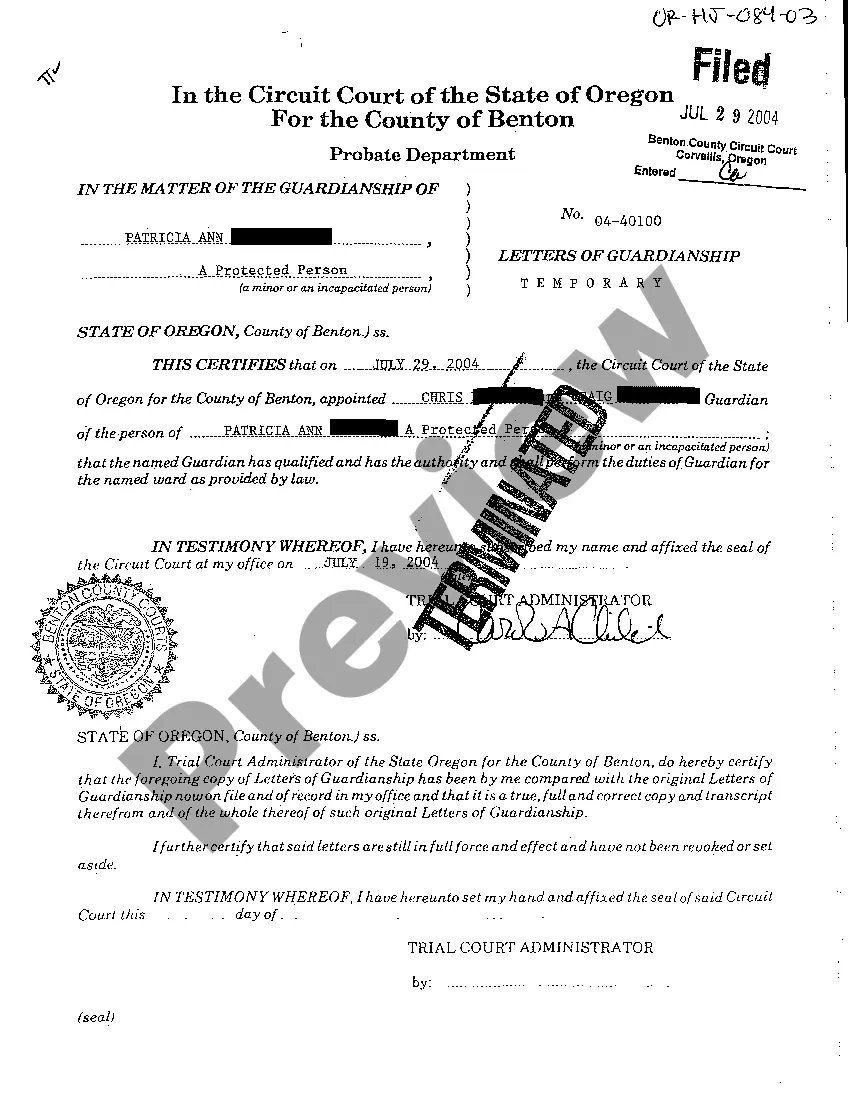

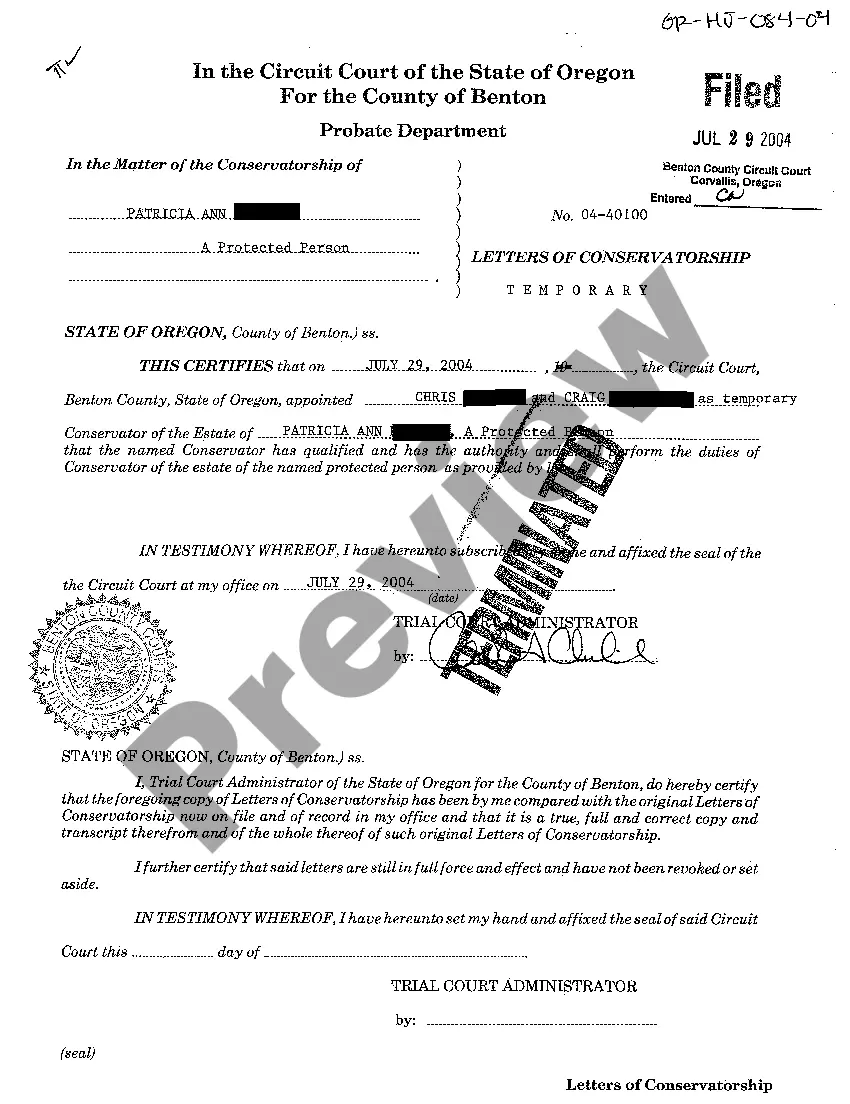

A Substitution of Trustee is a form filed when a successor trustee takes the place of a previous trustee. A successor is a person or entity who takes over and continues the role or position of another. For example, many grantors and their respective spouses act as the initial trustees of a revocable living trust.

The beneficiary is usually the lender or carry back seller. The beneficiary receives no legal interest in the property through the trust deed. Because of his secured relationship to the property, the beneficiary acquires an equitable interest to the extent permitted under the title rights given to the trustee.

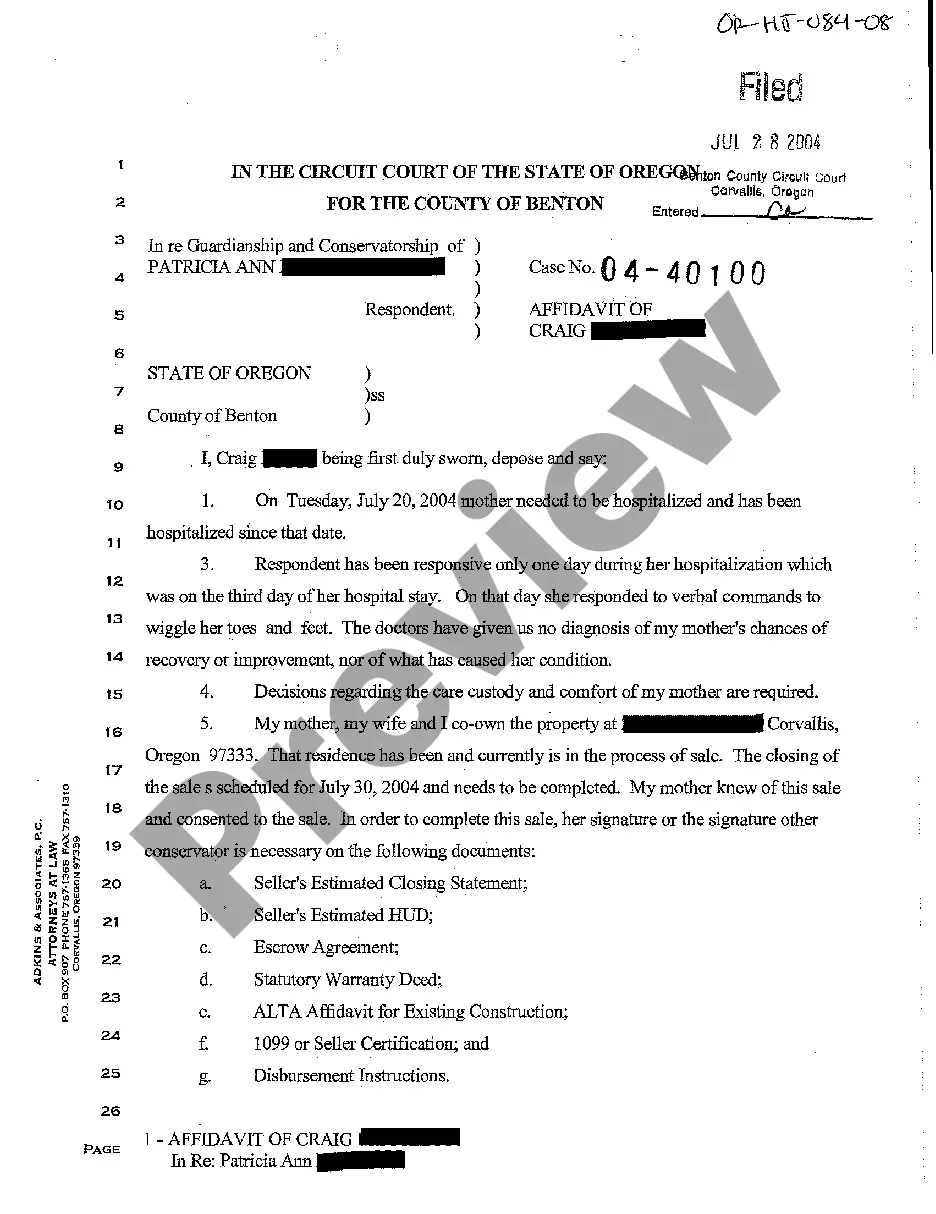

Once a loan has been paid off, and at the express direction of the lender (called the beneficiary), the trustee executes and delivers the deed of reconveyance to the trustor along with the original note (marked ?canceled? or ?paid in full?) and deed of trust.

In a nutshell, the Substitution of Trustee and Deed of Reconveyance is a legal document that evidences security interest is being release by a lender. In most cases, the document shows that a loan has been paid off. Property owners may even receive this document if they have refinanced a loan.

When a deed of trust/mortgage is paid in full, you can record a Full Reconveyance from the trustee stating publicly that the loan has been paid. The Full Reconveyance Form is completed and signed by the trustee, whose signature must be notarized.

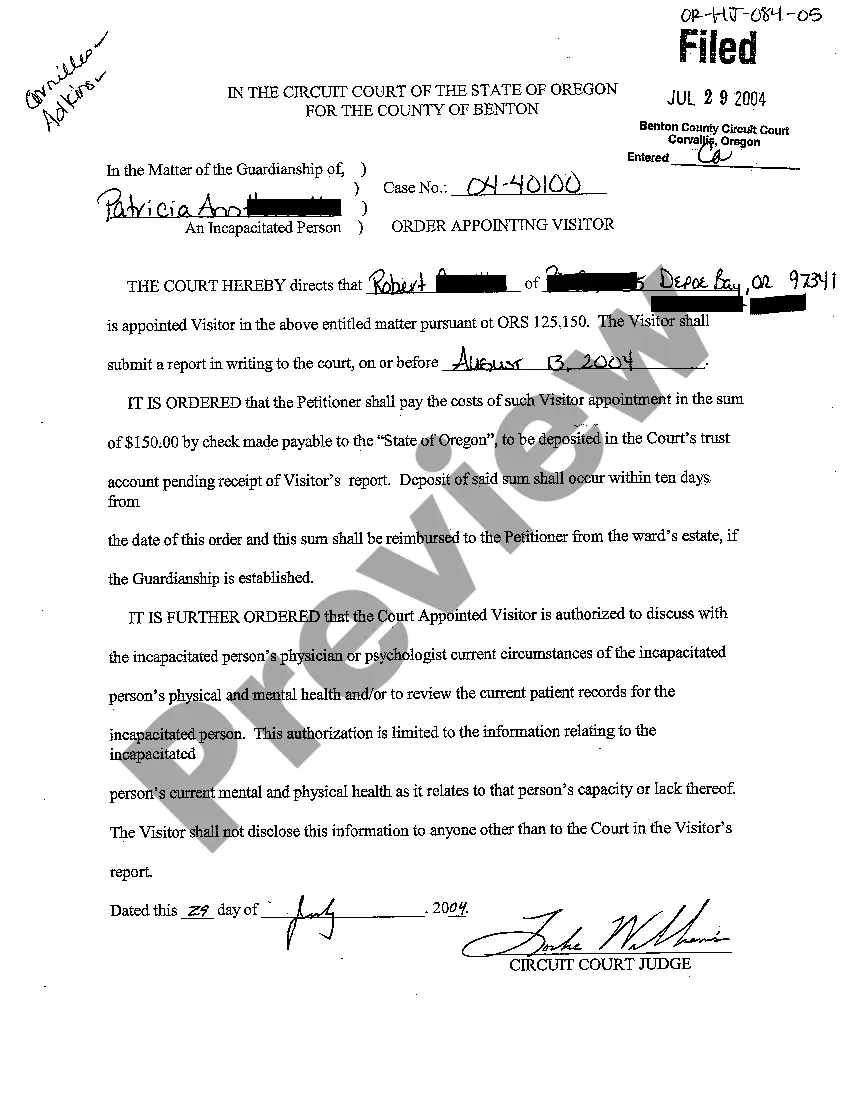

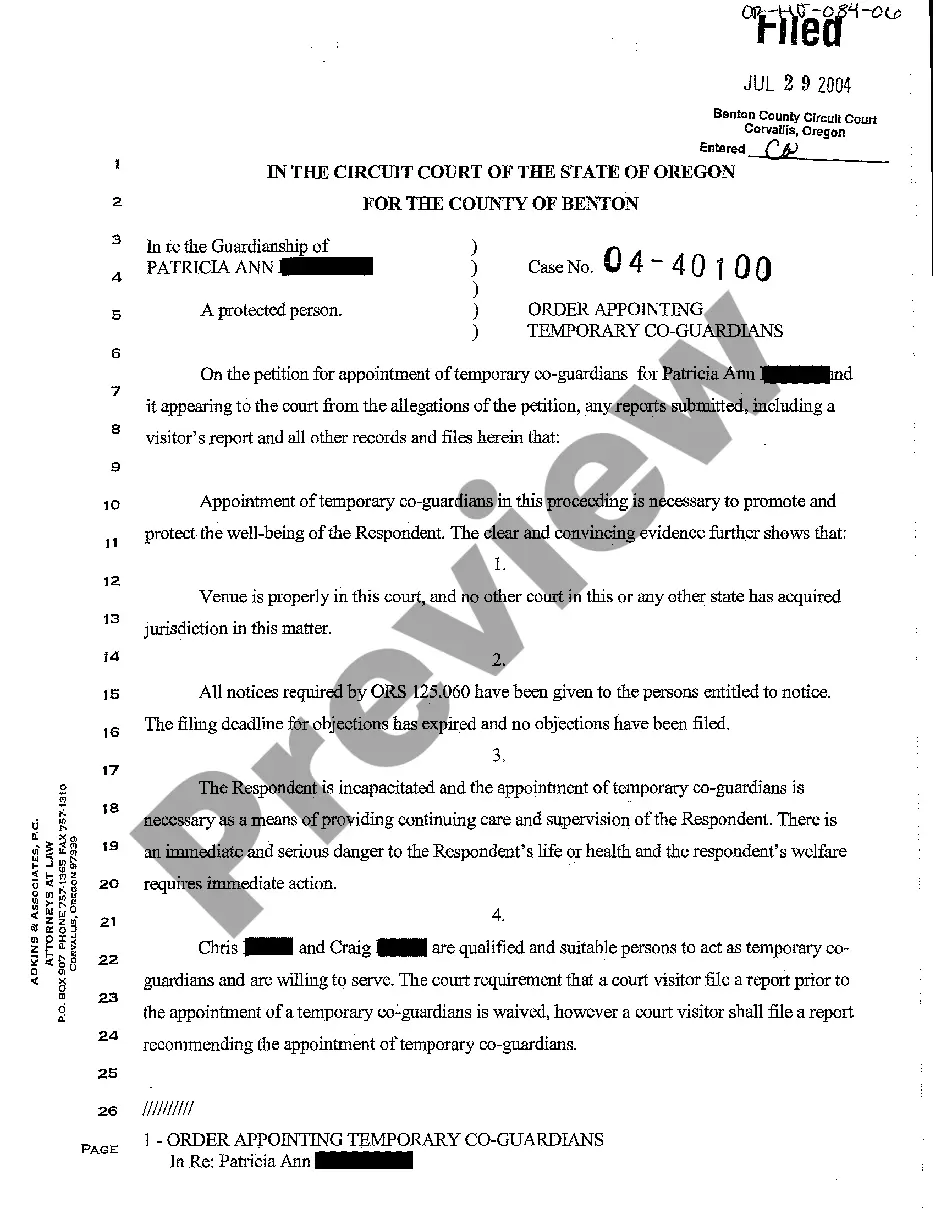

Washington Full Reconveyance for Deed of Trust Information Use this form when a Deed of Trust is paid in full, The Beneficiary/Lender sends written notice to the Trustee to reconvey title without warranty to the Grantor/Borrower entitled thereto all of the right, title and interest now held by said trustee.

The trustee holds the property in trust (for the benefit of the beneficiary-lender) until a recorded ?Full Reconveyance? (sometimes referred to as a deed of re- conveyance) reconveys the bare legal title back to the person(s) entitled to said title.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!