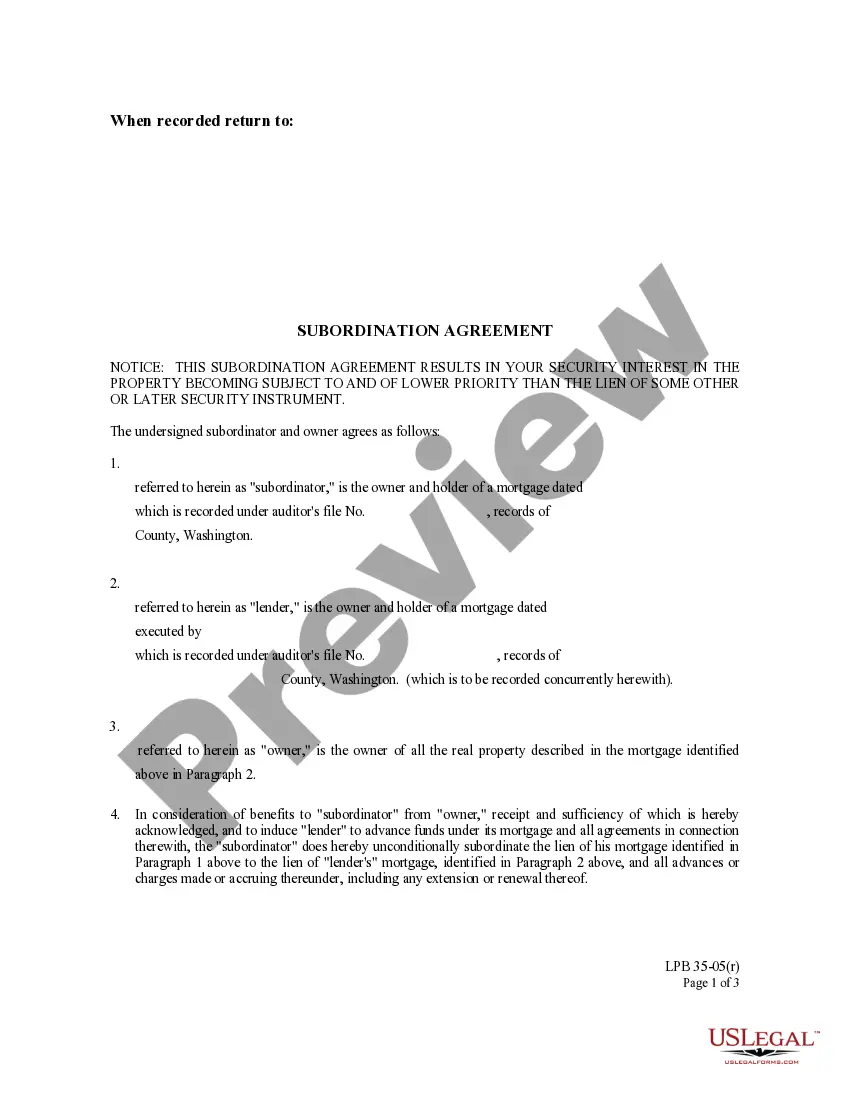

A Washington Subordination Agreement (also known as a subordination agreement and subordination of debt) is a legal contract between two or more parties that establishes the priority of debt payments. The agreement states that the lien holder (the party who holds the original debt) has priority over the subordinate party (the party who is taking out a second loan). There are four main types of Washington Subordination Agreements: 1. Mortgage subordination: This agreement is used when a borrower takes out a second loan or mortgage and the first loan must be subordinated in order to secure the second loan. 2. Tax lien subordination: This agreement is used when the IRS places a tax lien on property and the lien must be subordinated in order for the homeowner to receive a loan. 3. Judgment subordination: This agreement is used when a judgment has been placed against a property and the judgment must be subordinated in order for a loan to be taken out. 4. Lease subordination: This agreement is used when a leasehold estate is being created and the lease must be subordinated in order for the loan to be taken out.

Washington Subordination Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Washington Subordination Agreement?

US Legal Forms is the most straightforward and profitable way to locate appropriate formal templates. It’s the most extensive online library of business and individual legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable blanks that comply with national and local regulations - just like your Washington Subordination Agreement.

Obtaining your template requires only a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can obtain a professionally drafted Washington Subordination Agreement if you are using US Legal Forms for the first time:

- Read the form description or preview the document to guarantee you’ve found the one meeting your requirements, or locate another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and judge the subscription plan you like most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Washington Subordination Agreement and save it on your device with the appropriate button.

After you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more efficiently.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding formal paperwork. Try it out!

Form popularity

FAQ

A subordination clause serves to protect the lender if a homeowner defaults. If this happens, the lender then has the legal standing to repossess the home and cover their loan's outstanding balance first. If other subordinate mortgages are involved, the secondary liens will take a backseat in this process.

Does a personal loan agreement need to be notarized? No, a personal loan agreement does not need to be notarized to be legally binding ? it simply needs to be signed by each party to the agreement.

Subordination agreements ensure that a primary lender will be paid in the event the borrower takes on more debt. As with most legal documents, subordination agreements need to be notarized in order to be official in the eyes of the law.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

A subordination agreement must be signed and acknowledged by a notary and recorded in the official records of the county to be enforceable.

Purpose of a Subordination Agreement A subordination agreement is generally used when there are two mortgages and the mortgagor needs to refinance the first mortgage. It acknowledges that one party's interest or claim is superior to another in case the borrower's assets need to be liquidated to repay debts.

A Subordination Agreement focuses on creditor priorities and security claims, providing legal certainty to creditors when assessing repayment risk. If a credit event (or default) occurs, a subordination agreement provides a senior lender superior repayment rights than the subordinated lender.

The lender may require a subordination agreement to protect its interests in the event that the borrower deposits additional liens on the property, such as if the borrower were to take out a second mortgage.