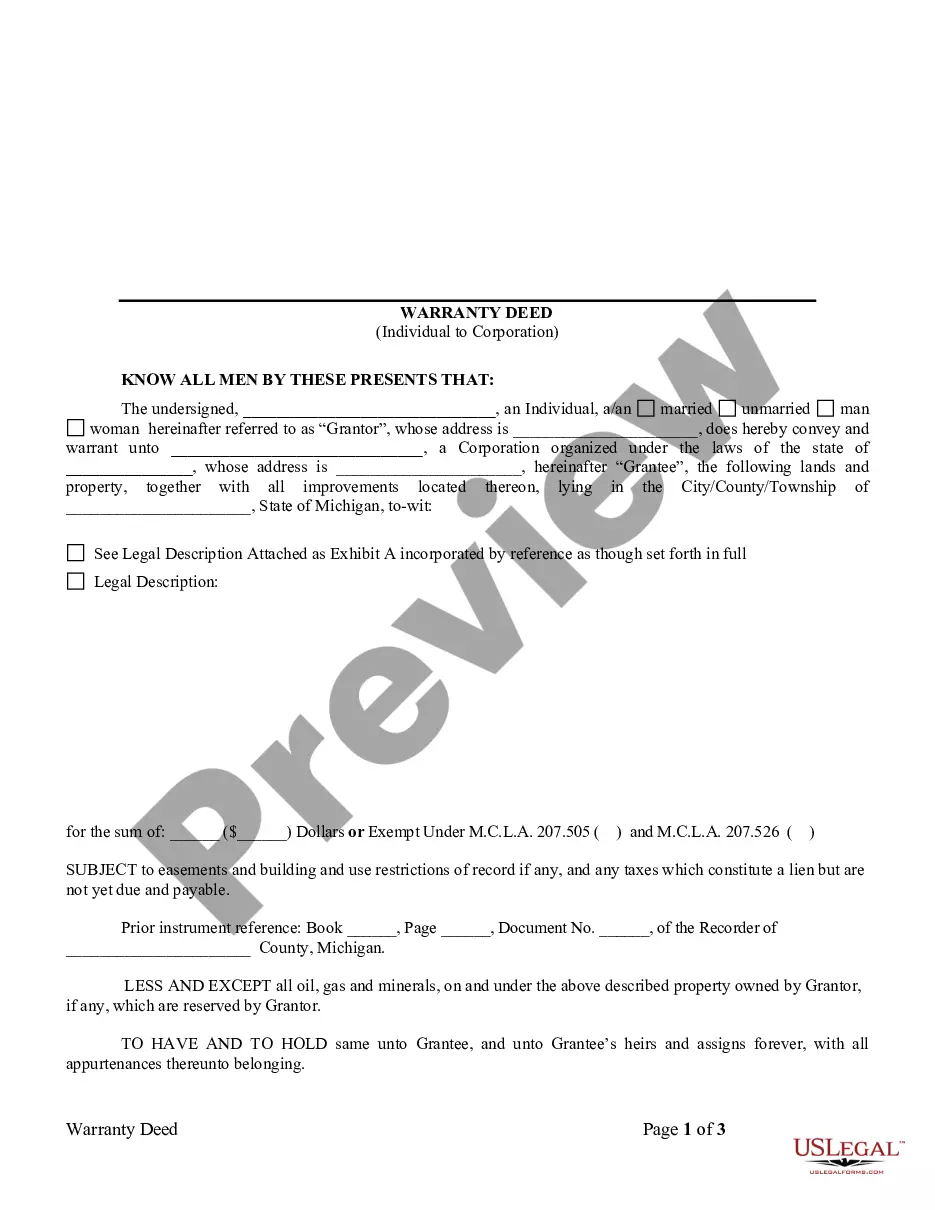

A Washington Deed of Trust is a legal document used in Washington State to secure a loan on a real estate property. The deed of trust is signed by the borrower (trust or) and the lender (beneficiary) and involves three parties: the trust or, the beneficiary, and the trustee. The trust or conveys title to the trustee, who holds the title as security for the repayment of the loan. The deed of trust serves as evidence of the debt and identifies the trust or’s obligation to repay the loan. There are two types of Washington Deeds of Trust: a traditional deed of trust and a statutory deed of trust. A traditional deed of trust is created in a private transaction between the trust or and the beneficiary, while a statutory deed of trust is created under Washington State law. The statutory deed of trust is the most commonly used deed of trust in Washington State. Both types of deed of trust give the trustee the authority to sell the property if the trust or defaults on the loan.

Washington Deed of Trust

Description

How to fill out Washington Deed Of Trust?

Coping with legal documentation requires attention, precision, and using properly-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Washington Deed of Trust template from our library, you can be sure it complies with federal and state regulations.

Working with our service is simple and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your Washington Deed of Trust within minutes:

- Remember to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for another official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Washington Deed of Trust in the format you prefer. If it’s your first time with our website, click Buy now to continue.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Washington Deed of Trust you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia,

Deeds of trust are used instead of mortgage loans in these states: Alaska. California. Colorado.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Promissory notes and deeds of trust are subject to Washington's six-year statute of limitations. Installment notes have two separate six-year limitations periods. The first applies to each payment and begins on the day it becomes overdue; the second applies to the entire debt and begins on the note's maturity date.

Use a Mortgage Deed if you live in: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.

Trust deeds are common in Alaska, Arizona, California, Colorado, Idaho, Illinois, Mississippi, Missouri, Montana, North Carolina, Tennessee, Texas, Virginia, and West Virginia.

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.