Washington A Guide to Workers' Compensation Benefits For Employees of Self-Insured Businesses is a comprehensive guide that explains the rights and responsibilities of employees and employers for workers' compensation benefits in the state of Washington. It explains the process of filing a claim, the types of benefits available, and how to appeal a denied claim. It also provides information about the Washington State Department of Labor & Industries, which is responsible for regulating and enforcing workers' compensation laws. The guide includes information on how to obtain coverage, how to file a claim, and the types of benefits available, including medical coverage, temporary disability, permanent disability, death benefits, and vocational rehabilitation. In addition, the guide covers topics such as employer liability, medical treatment, and safety regulations. The guide is available in both print and digital formats. There are two types of Washington A Guide to Workers' Compensation Benefits For Employees of Self-Insured Businesses, one for employers and one for employees.

Washington A Guide to Workers' Compensation Benefits For Employees of Self-Insured Businesses

Description

How to fill out Washington A Guide To Workers' Compensation Benefits For Employees Of Self-Insured Businesses?

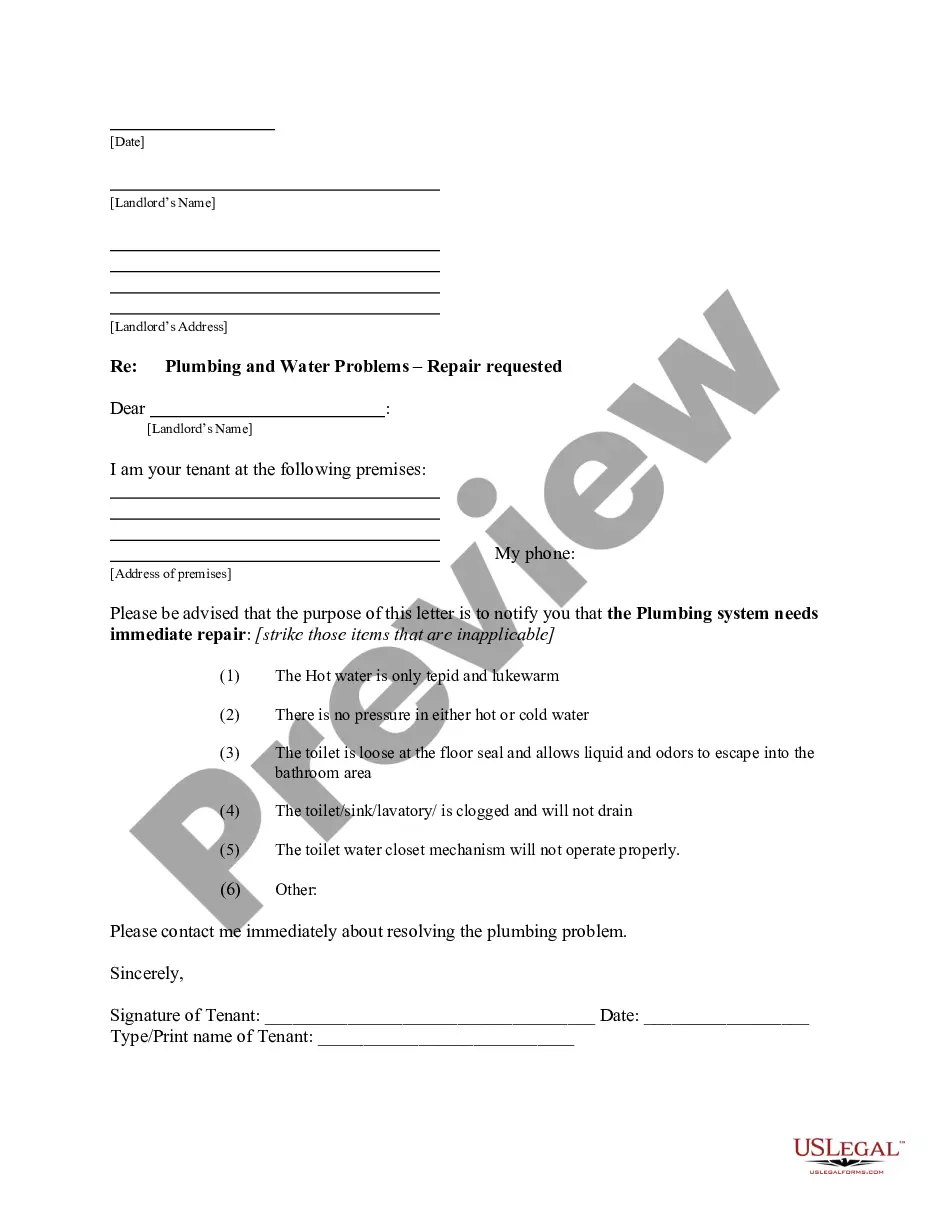

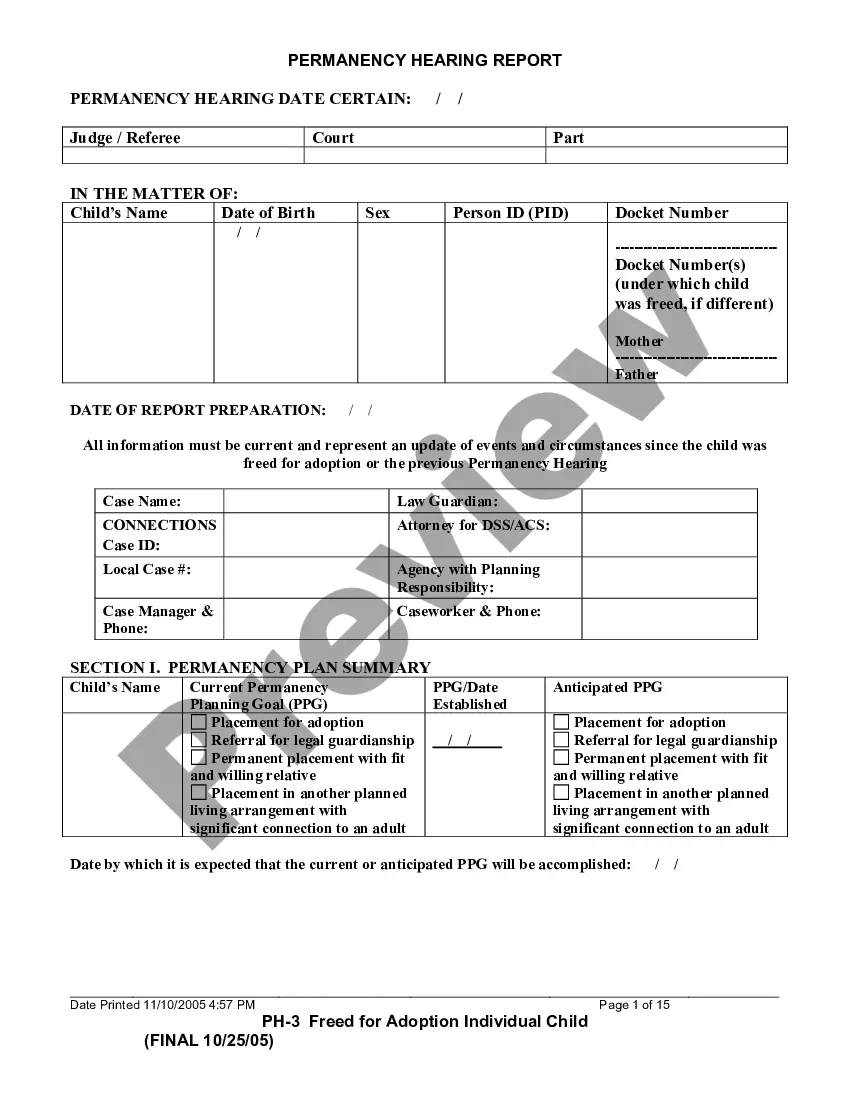

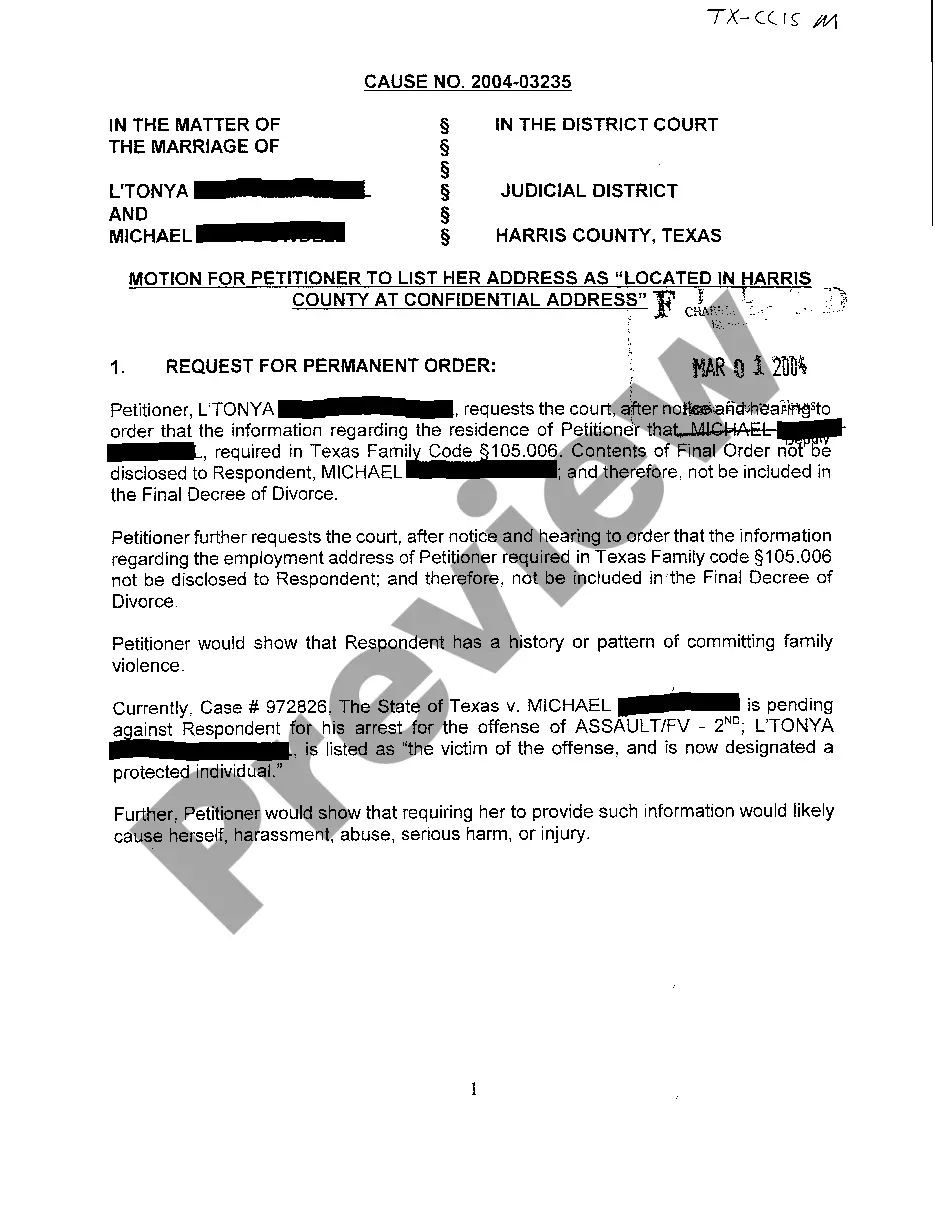

Working with legal documentation requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Washington A Guide to Workers' Compensation Benefits For Employees of Self-Insured Businesses template from our service, you can be certain it complies with federal and state laws.

Dealing with our service is easy and fast. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to get your Washington A Guide to Workers' Compensation Benefits For Employees of Self-Insured Businesses within minutes:

- Make sure to carefully check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Washington A Guide to Workers' Compensation Benefits For Employees of Self-Insured Businesses in the format you need. If it’s your first time with our website, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Washington A Guide to Workers' Compensation Benefits For Employees of Self-Insured Businesses you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

In Western Australia, all workers must be covered by a valid workers' compensation insurance policy. The definition of a 'worker' is broad and extends to any 'contract of service' or 'contract for service' between a worker and employer.

In Western Australia, all workers must be covered by a valid workers' compensation insurance policy. The definition of a 'worker' is broad and extends to any 'contract of service' or 'contract for service' between a worker and employer.

Is there a time limit to make a claim for workers' compensation? You must make a claim for compensation as soon as practicable within 12 months of being injured or discovering the disease. If you are outside the time limit, you should get legal advice straight away.

An injured worker is entitled to no-fault accident and disability coverage whether covered by L&I's Washington State Fund or a self-insured employer. This ?workers' compensation? covers medical expenses and pays a portion of wages lost while a worker recovers from a workplace injury or occupational disease.

Employers with self-insured employee health programs pay for medical claims and fees out of current revenue?in effect, acting as their own insurers. It's the alternative to a fully insured plan, where employers pay a fixed premium to a third-party commercial insurance carrier that covers the medical claims.

Workers' Comp Exemptions in Washington Business owners, partners, members and officers are generally excluded from workers' comp coverage in Washington. The state has limits on the number of owners that can be excluded and the level of control required in order to be considered an owner.

Typically, Super is not payable on workers compensation claim. The exceptions are: if the Modern Award an employee is covered under states that super is to be paid; or. if the employee falls under an enterprise agreement, which specifies that Super is still to be paid whilst on workers compensation.

If you are uninsured, you are also liable to pay fines of up to $5000 per worker, as well as an amount equal to any avoided premiums going back five years. If you continue to be uninsured after the date of your conviction, you will commit a separate and further offence for every week you do so.