Washington Massage Therapist: Independent Contractor or Covered Worker? Is a question of whether massage therapists in Washington State are considered independent contractors or employees under the state's employment laws. This is an important distinction, as it determines whether message therapists are entitled to certain benefits and protections such as minimum wage, overtime pay, unemployment insurance, workers' compensation, and other job-related rights. Generally, massage therapists in Washington State are considered independent contractors if they are self-employed, meaning that they have their own business, set their own hours, and determine their own rates. However, if a massage therapist works for a massage therapy clinic or spa, they may be considered an employee and thus entitled to the aforementioned benefits and protections. There are also different types of massage therapist roles, such as medical massage therapists, estheticians, and spa technicians, each with their own set of rules and regulations.

Washington Massage Therapist: Independent Contractor or Covered Worker?

Description

How to fill out Washington Massage Therapist: Independent Contractor Or Covered Worker??

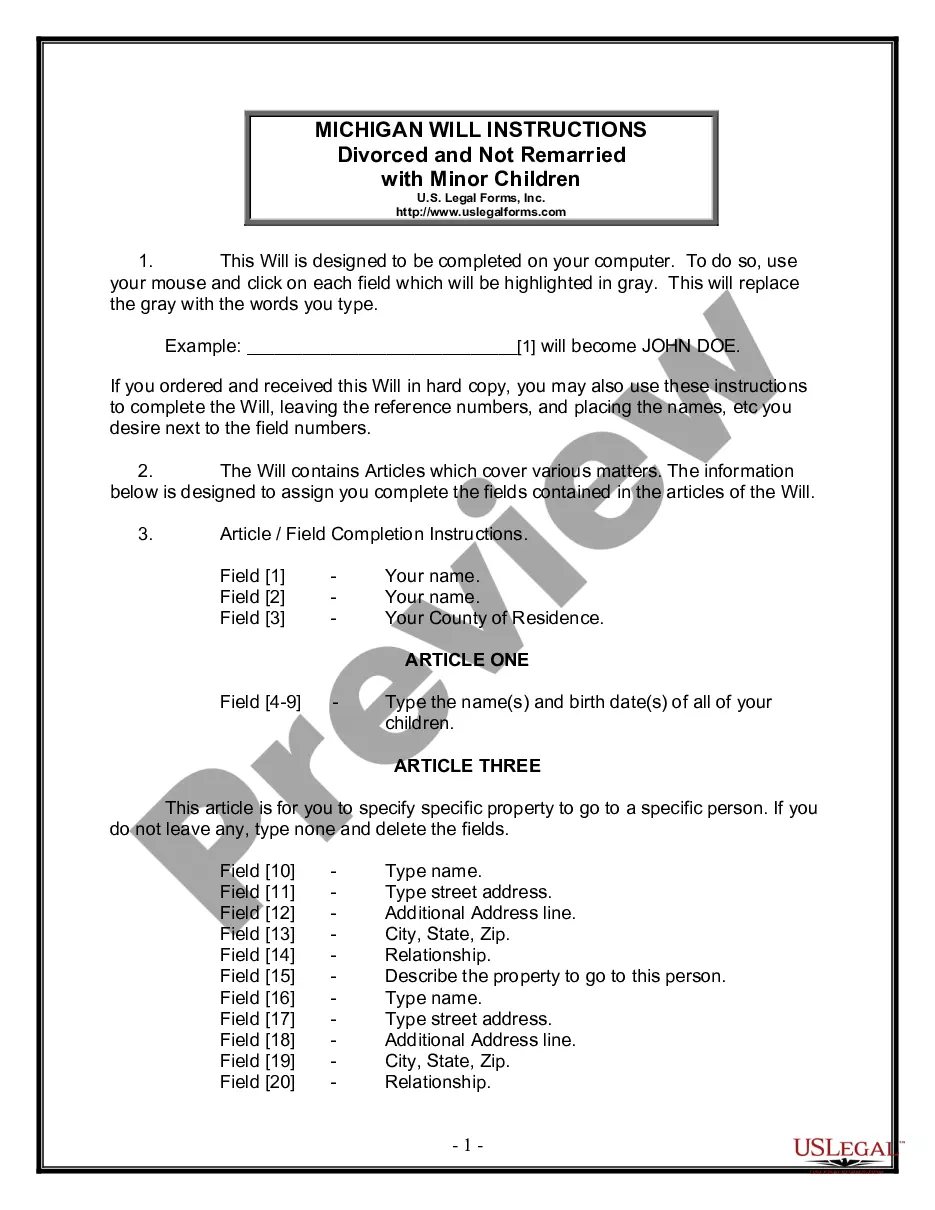

How much time and resources do you often spend on drafting official documentation? There’s a better opportunity to get such forms than hiring legal specialists or wasting hours browsing the web for an appropriate template. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, including the Washington Massage Therapist: Independent Contractor or Covered Worker?.

To get and complete an appropriate Washington Massage Therapist: Independent Contractor or Covered Worker? template, follow these easy steps:

- Examine the form content to make sure it complies with your state laws. To do so, read the form description or take advantage of the Preview option.

- In case your legal template doesn’t satisfy your needs, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Washington Massage Therapist: Independent Contractor or Covered Worker?. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Select the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely secure for that.

- Download your Washington Massage Therapist: Independent Contractor or Covered Worker? on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously purchased documents that you securely store in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing official paperwork with US Legal Forms, one of the most trustworthy web services. Sign up for us today!

Form popularity

FAQ

A 1099 worker is an independent contractor whom you pay for a specific task, while a W-2 employee is a person who receives a regular wage or salary for performing a role in your company.

The individual: Is customarily engaged in an independently established trade, occupation, profession, or business of the same nature as that involved in the service contract, or. Has a principal place of business that is eligible for a federal income tax business deduction; and.

Independent Contractors. All workers in Washington are entitled to workers' compensation unless they fit strict exemption definitions. Make sure you understand your business' requirements for covering workers, including independent contractors.

RCW 49.44. 160. ?Misclassify" and "misclassification" means to incorrectly classify or label a long-term public employee as "temporary," "leased," "contract," "seasonal," "intermittent," or "part-time," or to use a similar label that does not objectively describe the employee's actual work circumstances. RCW 49.44.

The law further states that independent contractor status is evidenced if the worker: (1) has a substantial investment in the business other than personal services, (2) purports to be in business for himself or herself, (3) receives compensation by project rather than by time, (4) has control over the time and place

An independent contractor works independently. An employee works under the control of the employer. An independent contractor must personally perform the task. An employee can delegate tasks.

1099 Independent Contractor Since they are self-employed, they pay their own employee and self-employment taxes, so you don't have to. Independent contractors aren't eligible for benefits such as insurance, paid time off, and overtime.

Some professions were able to get an exemption from the requirements of the bill. Massage therapists were not exempted or specified in the bill.