Washington Self-Insurer's Pension Bond is a type of surety bond that is required of employers who are self-insured for their employees' pensions in the state of Washington. This bond guarantees that the employer will make all necessary contributions to the pension fund in accordance with their pension plan. There are two types of Washington Self-Insurer's Pension Bonds: the Retirement and Indemnity Bond and the Pension Plan Bond. The Retirement and Indemnity Bond is used to guarantee payments to the pension fund in the event of the employer's death or incapacity. The Pension Plan Bond is used to guarantee the payment of claims, including those made by the employer's creditors, in the event of the employer's insolvency or bankruptcy. Both bonds are issued by surety bond companies and are subject to underwriting review.

Washington Self-Insurer's Pension Bond

Description

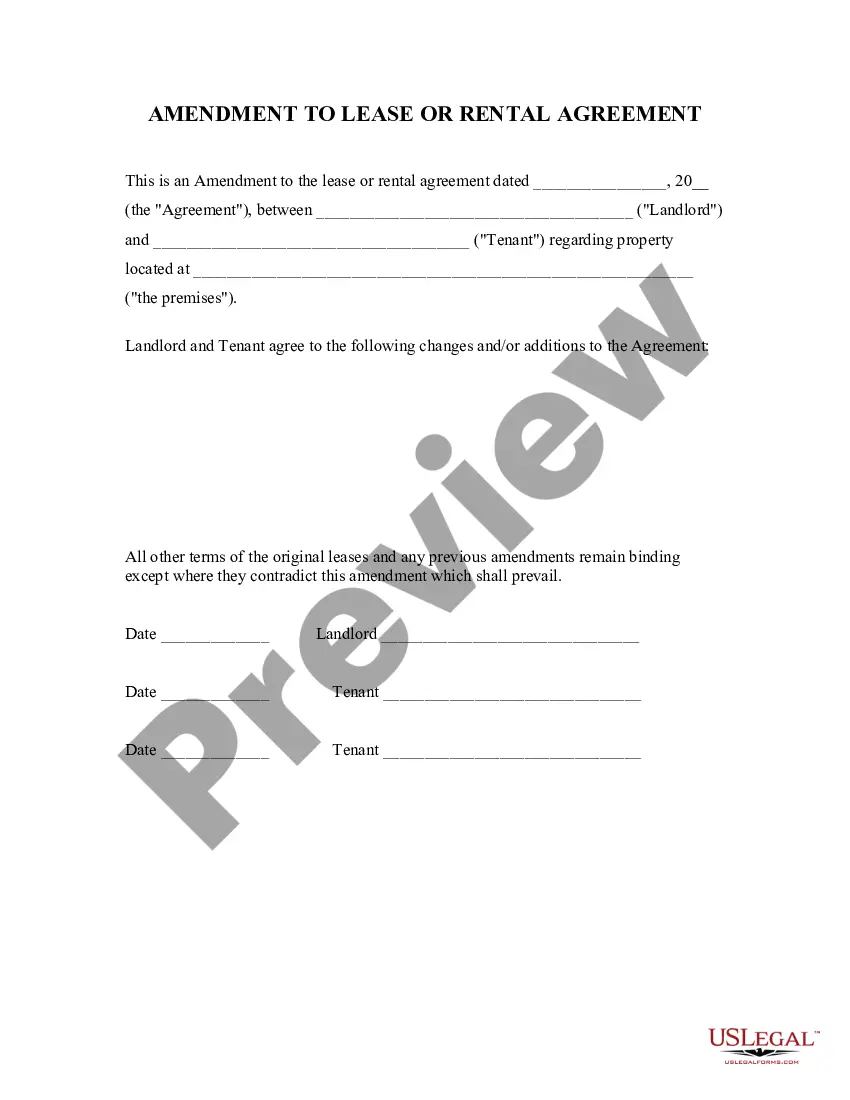

How to fill out Washington Self-Insurer's Pension Bond?

US Legal Forms is the most easy and profitable way to locate appropriate formal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and verified by legal professionals. Here, you can find printable and fillable templates that comply with national and local laws - just like your Washington Self-Insurer's Pension Bond.

Getting your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a properly drafted Washington Self-Insurer's Pension Bond if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to guarantee you’ve found the one corresponding to your requirements, or locate another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and choose the subscription plan you like most.

- Register for an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your Washington Self-Insurer's Pension Bond and download it on your device with the appropriate button.

Once you save a template, you can reaccess it whenever you want - simply find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your trustworthy assistant in obtaining the corresponding formal paperwork. Give it a try!

Form popularity

FAQ

Being self-insured means that rather than paying an insurance company to pay medical, dental and vision claims, we pay the claims ourselves, using a third-party administrator to process the claims on our behalf.

Each state regulates who may be self-insured for workers' compensation. Normally, a prospective self-insured submits a required application accompanied by audited financial data, prior workers' compensation loss history, and other information required by each state.

Self-insurance involves setting aside your own money to pay for a possible loss instead of purchasing insurance and expecting an insurance company to reimburse you.

Saving money may be the primary driver when companies decide to self-insure, but there are other benefits as well. Employers can eliminate costs for state insurance premium taxes. And they don't have to adhere to state-mandated coverage requirements.

insurer's bond is a type of surety bond that provides a promise to pay selfinsured losses in case the promisor (selfinsurer) is unable to meet its obligations.

To apply to be self-insured, an employer must complete and submit the following documents: Application for Self-Insurance Certification (F207-001-000) with a nonrefundable fee. Self-Insurance Certification Questionnaire (F207-176-000). Three years of audited financial statements in the name of the applicant.

There are two types of bonds that a principal can put forward ? a surety bond is a guarantee by a third party and a personal bond depends on the operator's assets.