The Washington Statement for Miscellaneous Services is a document that is used to determine the fees for various services provided by the state of Washington. This statement is issued by the Department of Revenue and lists the various services that are taxable and the associated fees. These services include but are not limited to: hotel and motel fees; vehicle rentals; repair and maintenance; storage; pet care; entertainment and amusement; and other services. The Washington Statement for Miscellaneous Services can be divided into two categories: general services and special services. General services are services that are provided to the public and are taxable. Special services are services that are provided to a specific customer and are exempt from taxation. The Washington Statement for Miscellaneous Services is an important document for businesses to understand the taxation of services within the state.

Washington Statement for Miscellaneous Services

Description

How to fill out Washington Statement For Miscellaneous Services?

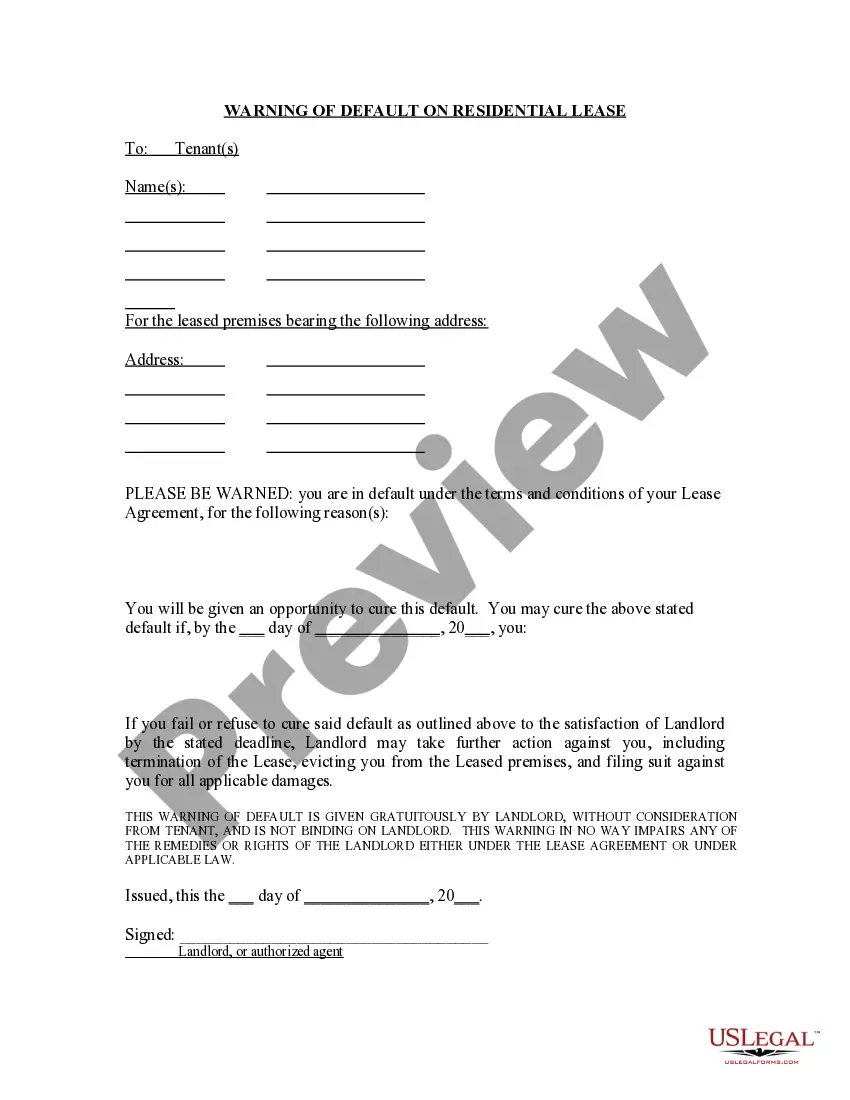

Working with legal paperwork requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Washington Statement for Miscellaneous Services template from our service, you can be sure it meets federal and state laws.

Working with our service is easy and quick. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to get your Washington Statement for Miscellaneous Services within minutes:

- Make sure to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Washington Statement for Miscellaneous Services in the format you prefer. If it’s your first experience with our service, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the Washington Statement for Miscellaneous Services you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!