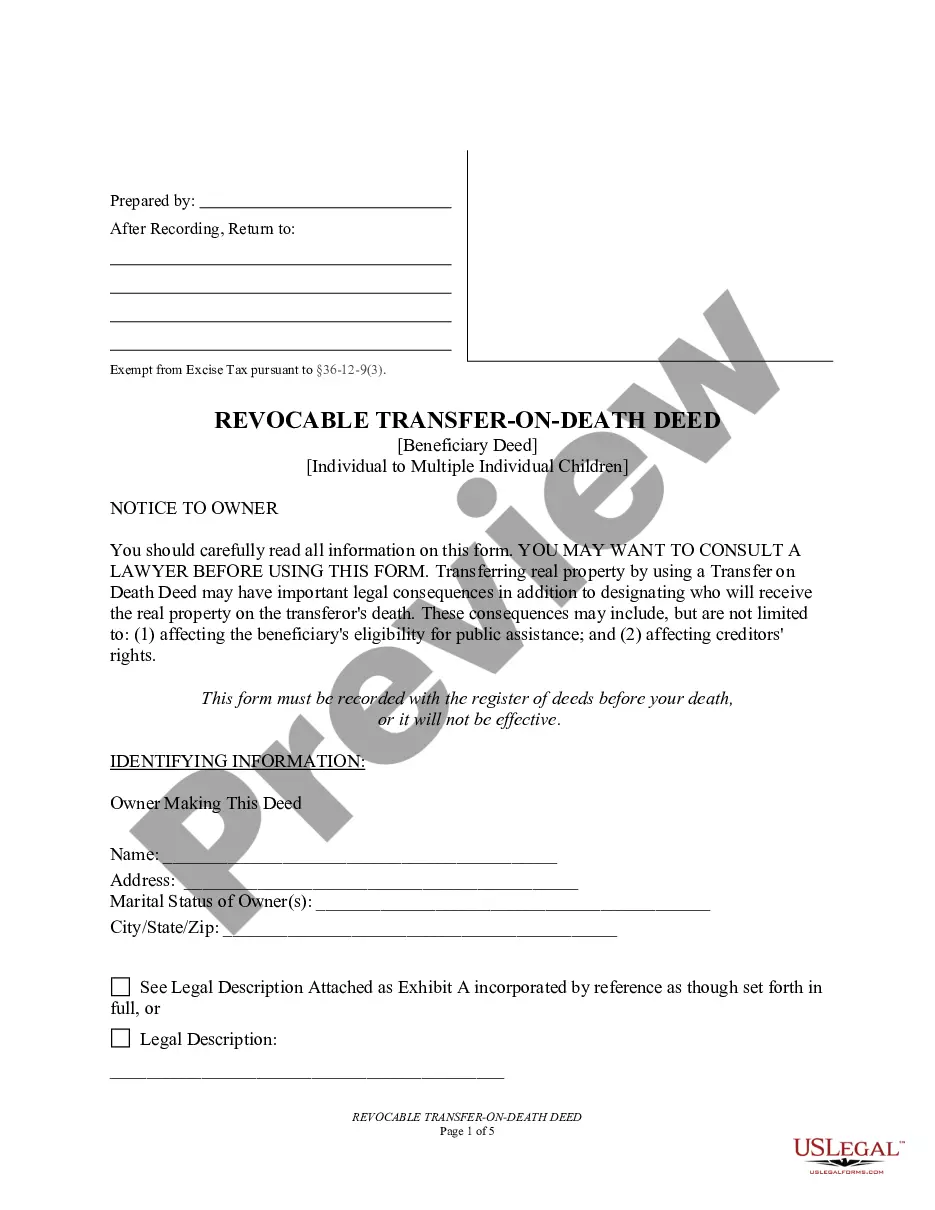

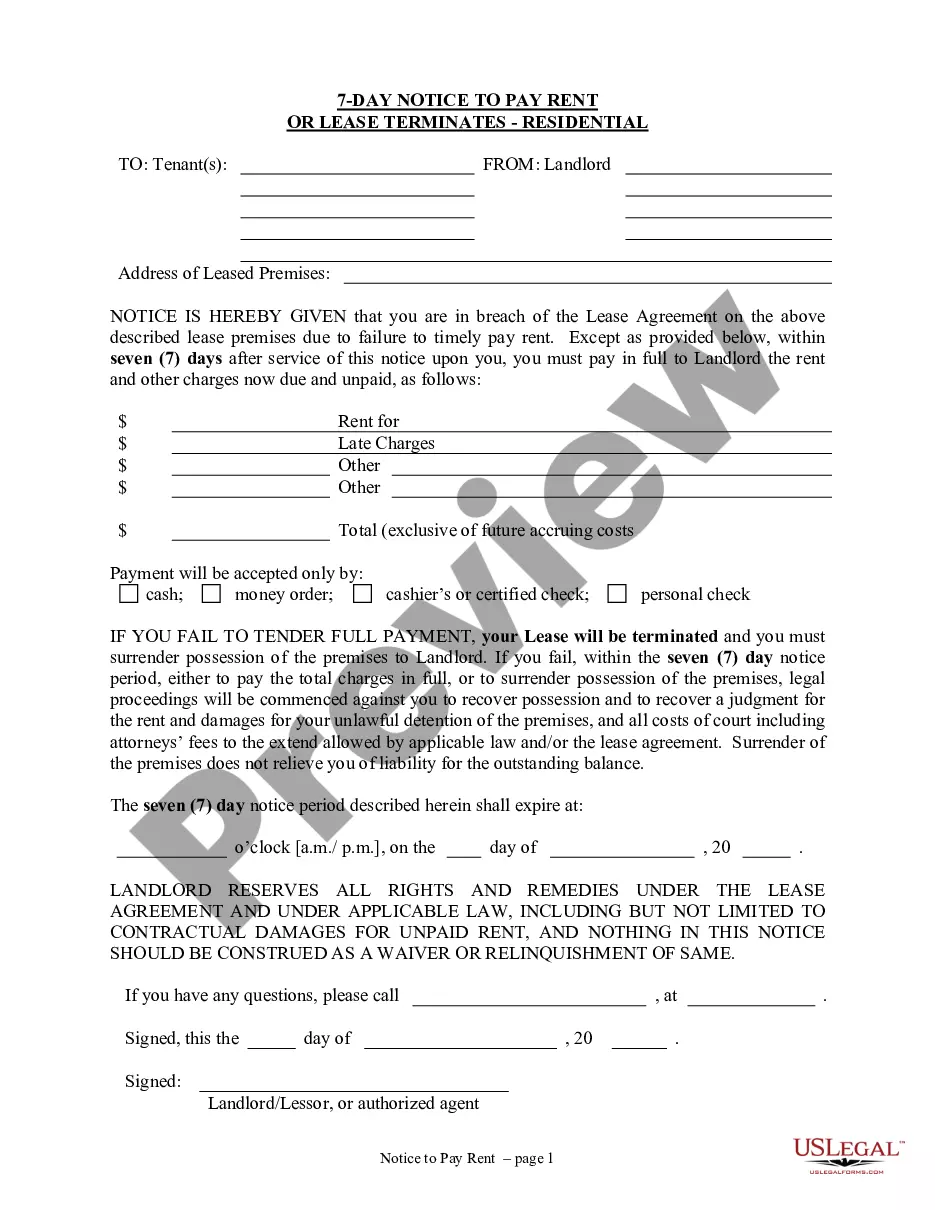

Employers' Guide to Workers' Compensation Insurance in Washington State is a comprehensive guide that provides employers with information about the state's workers' compensation laws and their requirements. This guide includes information on eligibility requirements, coverage limits, filing claims, benefits, dispute resolution, and payment of premiums. It also provides information about other related topics, such as employer liability, medical care, and safety standards. There are three types of Employers' Guide to Workers' Compensation Insurance in Washington State: the Employee and Employer Guide, the Employer's Guide to Self-Insurance, and the Employer's Guide to Private Insurance.

Employers' Guide to Workers' Compensation Insurance in Washington State

Description

How to fill out Employers' Guide To Workers' Compensation Insurance In Washington State?

US Legal Forms is the most straightforward and cost-effective way to find suitable formal templates. It’s the most extensive online library of business and individual legal paperwork drafted and checked by lawyers. Here, you can find printable and fillable templates that comply with national and local laws - just like your Employers' Guide to Workers' Compensation Insurance in Washington State.

Obtaining your template takes just a couple of simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the form on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Employers' Guide to Workers' Compensation Insurance in Washington State if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to guarantee you’ve found the one corresponding to your needs, or locate another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and select the subscription plan you like most.

- Create an account with our service, log in, and purchase your subscription using PayPal or you credit card.

- Select the preferred file format for your Employers' Guide to Workers' Compensation Insurance in Washington State and save it on your device with the appropriate button.

Once you save a template, you can reaccess it anytime - simply find it in your profile, re-download it for printing and manual fill-out or upload it to an online editor to fill it out and sign more efficiently.

Take advantage of US Legal Forms, your trustworthy assistant in obtaining the required official paperwork. Give it a try!

Form popularity

FAQ

Coverage is mandatory. In return, your worker ordinarily cannot sue you for damages when a work-related injury or illness occurs. Employers purchase coverage through the Department of Labor & Industries (L&I). L&I manages all claims and pays benefits out of an insurance pool called the Washington State Fund.

The benefit amount is 60 to 75% of the wage you were earning, depending on how many dependents you have. The minimum and maximum L&I can pay is set by the state legislature. You may have better options available - ask your employer if there are other jobs you can do to earn your wage or salary while you recover.

How much does workers' compensation insurance cost in Washington? Estimated employer rates for workers' compensation in Washington are $1.34 per $100 in covered payroll. Your cost is based on a number of factors, including: Payroll.

Employers are responsible for paying all premiums due. However, in Washington State workers may also pay a share of the total hourly rate through payroll deduction.

An injured worker is entitled to no-fault accident and disability coverage whether covered by L&I's Washington State Fund or a self-insured employer. This ?workers' compensation? covers medical expenses and pays a portion of wages lost while a worker recovers from a workplace injury or occupational disease.

Who Pays for Work Comp Coverage in Washington. Generally the employer always pays for workers compensation. Washington is the only state that allows the employers to deduct a portion of the cost of workers' compensation from the employees' wages.

Work comp rates for all job classification codes are always expressed as a percentage of $100 in wages. An annual policy is always subject to an audit because it was based on estimated wages and not actual wages. In order to calculate the cost of the policy you only need to multiply each rate with its divided payroll.