Washington SIDES (Self-Insurance Electronic Data Reporting System) Data Change Request is a service provided by the Washington State Department of Labor and Industries (L&I) to employers and third-party administrators (TPAs) who are registered with the Washington Self-Insurance Program. This service allows employers and TPAs to submit requests to change their self-insurance data electronically, including changes to contact information, policy numbers, group and policyholder information, premium payment information, and changes to the policy period. There are three types of Washington SIDES (Self-Insurance Electronic Data Reporting System) Data Change Requests: 1. Basic Data Change Request: This is a request to update or correct an existing self-insurance policy or plan. It includes changes to contact information, policy numbers, group and policyholder information, premium payment information, and changes to the policy period. 2. New Policy Data Change Request: This is a request to add a new self-insurance policy or plan to an existing self-insurance program. It includes information about the policy, policyholder, premium payment information, and changes to the policy period. 3. Termination Data Change Request: This is a request to terminate an existing self-insurance policy or plan. It includes information about the policy, policyholder, and the date of termination.

Washington SIEDRS (Self-Insurance Electronic Data Reporting System) Data Change Request

Description

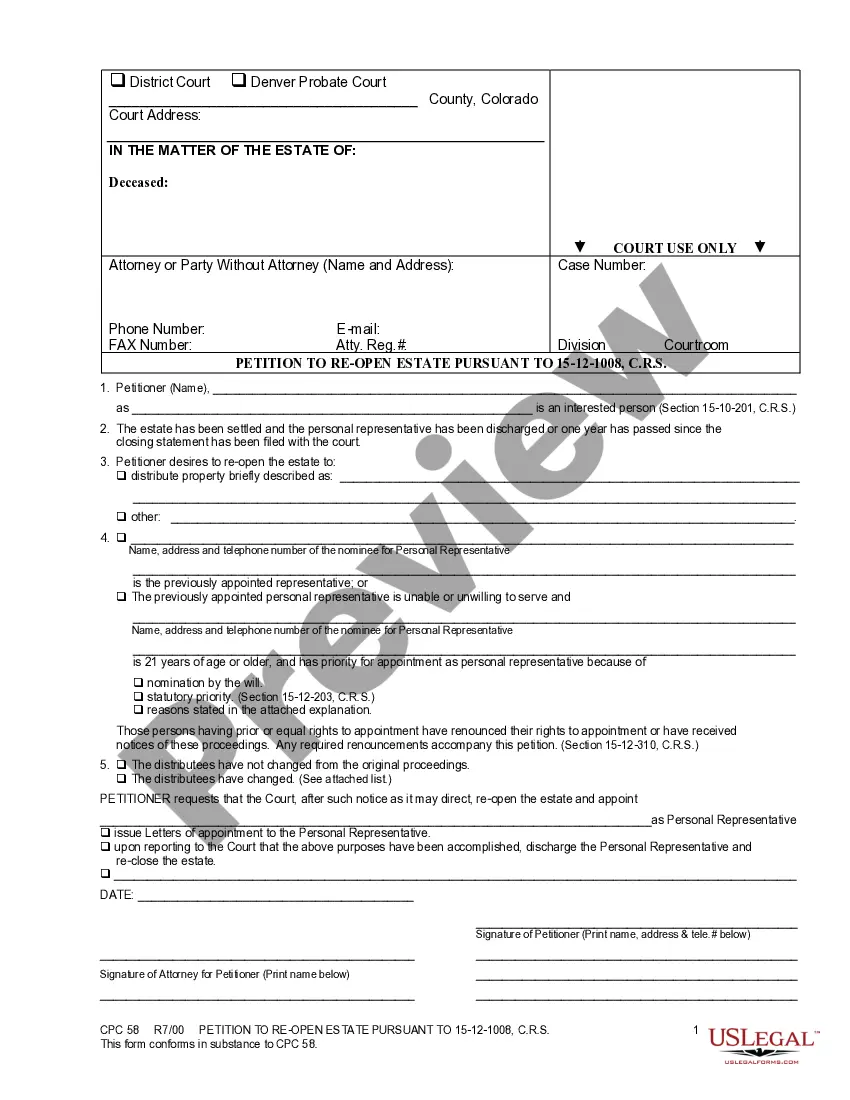

How to fill out Washington SIEDRS (Self-Insurance Electronic Data Reporting System) Data Change Request?

Handling legal paperwork requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Washington SIEDRS (Self-Insurance Electronic Data Reporting System) Data Change Request template from our library, you can be certain it complies with federal and state regulations.

Dealing with our service is straightforward and fast. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your Washington SIEDRS (Self-Insurance Electronic Data Reporting System) Data Change Request within minutes:

- Make sure to attentively check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Washington SIEDRS (Self-Insurance Electronic Data Reporting System) Data Change Request in the format you prefer. If it’s your first experience with our service, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Washington SIEDRS (Self-Insurance Electronic Data Reporting System) Data Change Request you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

Someone who is self-insured is taking on the financial risks associated with insuring their vehicle. This means if there is an accident, they are responsible for paying for all the damage they caused to the other driver and their property, as well as any damage to their own vehicle.

To apply to be self-insured, an employer must complete and submit the following documents: Application for Self-Insurance Certification (F207-001-000) with a nonrefundable fee. Self-Insurance Certification Questionnaire (F207-176-000). Three years of audited financial statements in the name of the applicant.

Each state regulates who may be self-insured for workers' compensation. Normally, a prospective self-insured submits a required application accompanied by audited financial data, prior workers' compensation loss history, and other information required by each state.

Here's how L&I calculates the premium rate for each of the business's risk classifications: Multiplying the business's experience factor by the sum of the Accident Fund, Medical Aid Fund, and Stay at Work base rates, and then. Adding the base rate for the Supplemental Pension Fund.

L&I maintains a list of self-insured employers. Your employer or their representative handles your paperwork and pays for the claim. They will give you a Self?Insurer Accident Report (SIF?2) form. Fill out the form completely and return it to your employer or their representative.

You'll pay less in premiums every year. If you're self-insured, you're not paying an insurance company every year to carry the risk of replacing your income if something happens to you. That's a huge benefit to you because you're saving money!

Employers with self-insured employee health programs pay for medical claims and fees out of current revenue?in effect, acting as their own insurers. It's the alternative to a fully insured plan, where employers pay a fixed premium to a third-party commercial insurance carrier that covers the medical claims.