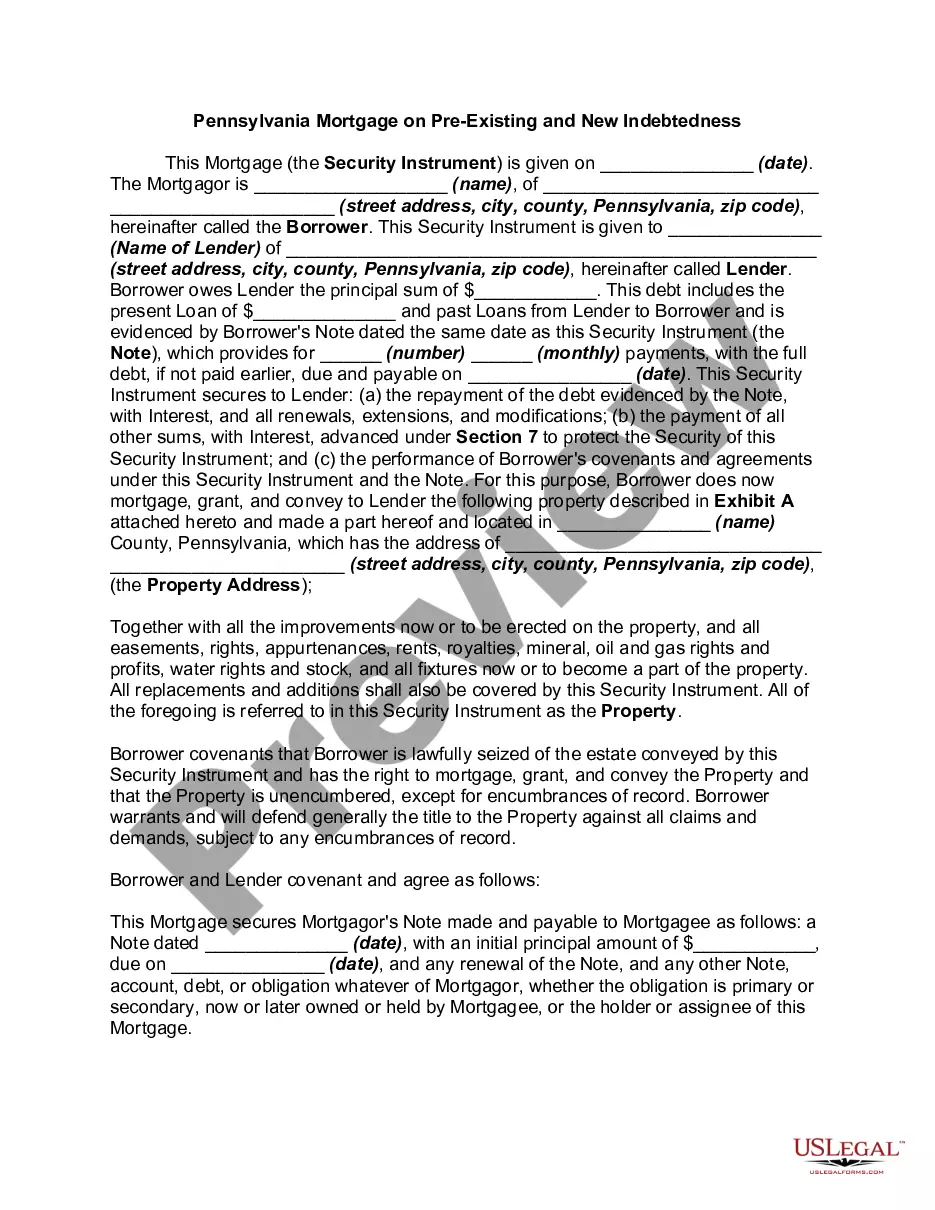

Washington Chattel Mortgage on Mobile Home is a legal term referring to a specific type of loan that is secured by a mobile home, which is considered personal property or chattel. Chattel mortgages allow individuals to obtain financing for the purchase or renovation of a mobile home, while using the home itself as collateral. In Washington state, there are various types of chattel mortgages available for mobile homes, each catering to different needs and circumstances. Some common types include: 1. Purchase Chattel Mortgage: This type of mortgage is used when an individual wants to buy a mobile home and needs financial assistance. With a purchase chattel mortgage, the lender provides the necessary funds to purchase the home, while the home itself serves as security for the loan. 2. Refinance Chattel Mortgage: A refinancing chattel mortgage is suitable for homeowners who already have an existing loan on their mobile home but wish to renegotiate the terms or obtain better interest rates. This option allows homeowners to replace their existing mortgage with a new one, providing them with the potential for lower monthly payments or extended loan terms. 3. Home Improvement Chattel Mortgage: Often, mobile homeowners require funds to improve or renovate their homes. A home improvement chattel mortgage can be secured to finance these improvements, allowing homeowners to upgrade their mobile homes, add extensions, or enhance the overall aesthetics and functionality. 4. Debt Consolidation Chattel Mortgage: This type of mortgage might be a viable option for individuals burdened with multiple debts, such as credit card bills or personal loans. By taking out a debt consolidation chattel mortgage, homeowners can combine all their outstanding debts into a single loan, simplifying their financial obligations and often benefiting from lower interest rates. Irrespective of the type, Washington Chattel Mortgages on Mobile Homes offer a flexible and accessible means of obtaining funds for mobile homeowners. They can be obtained through various lending institutions, including banks, credit unions, and private lenders. It's important for individuals interested in Washington Chattel Mortgages on Mobile Homes to carefully consider their financial situation, review the terms and conditions of different lenders, and assess their ability to repay the loan promptly. Seeking advice from legal professionals or mortgage brokers can also provide valuable insights and help borrowers make informed decisions.

Washington Chattel Mortgage on Mobile Home

Description

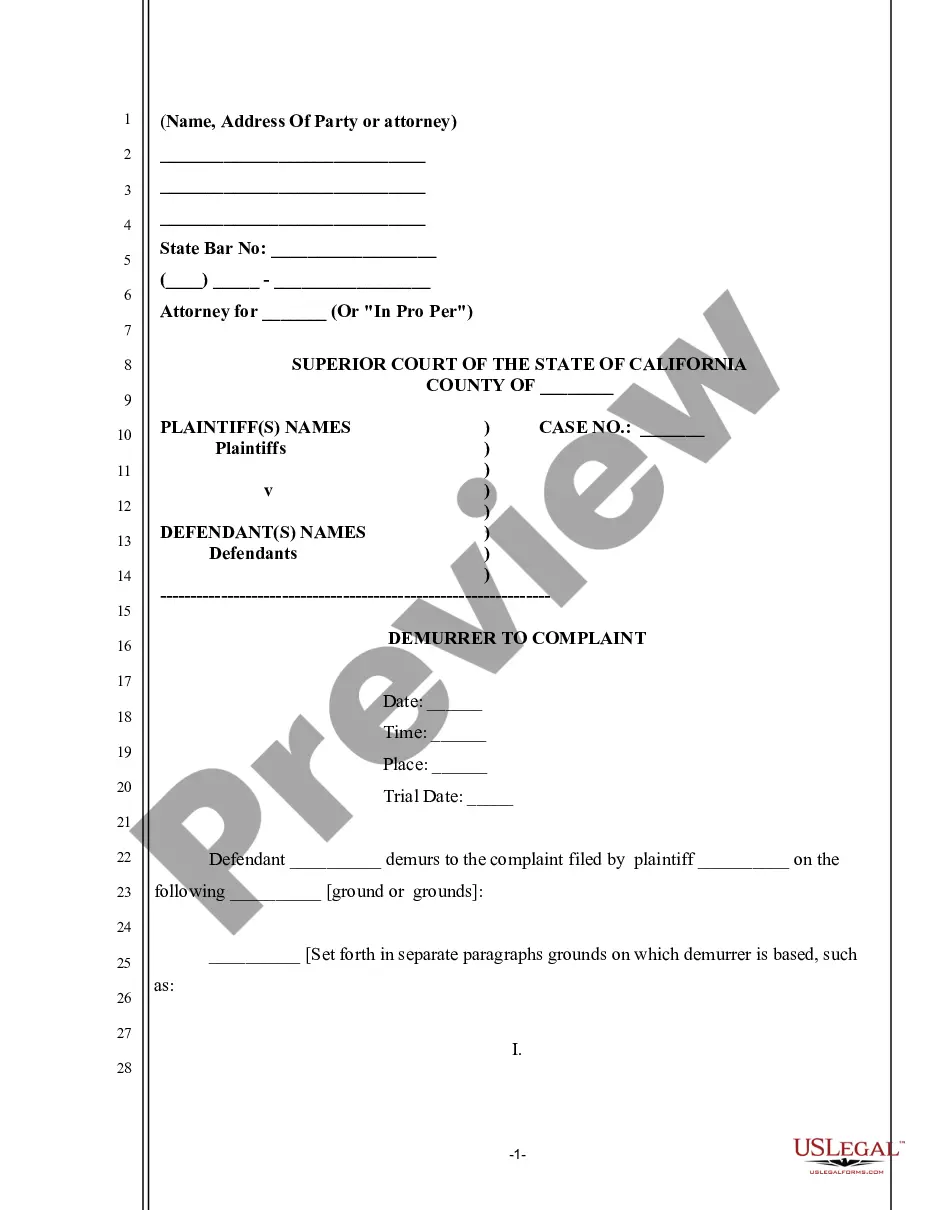

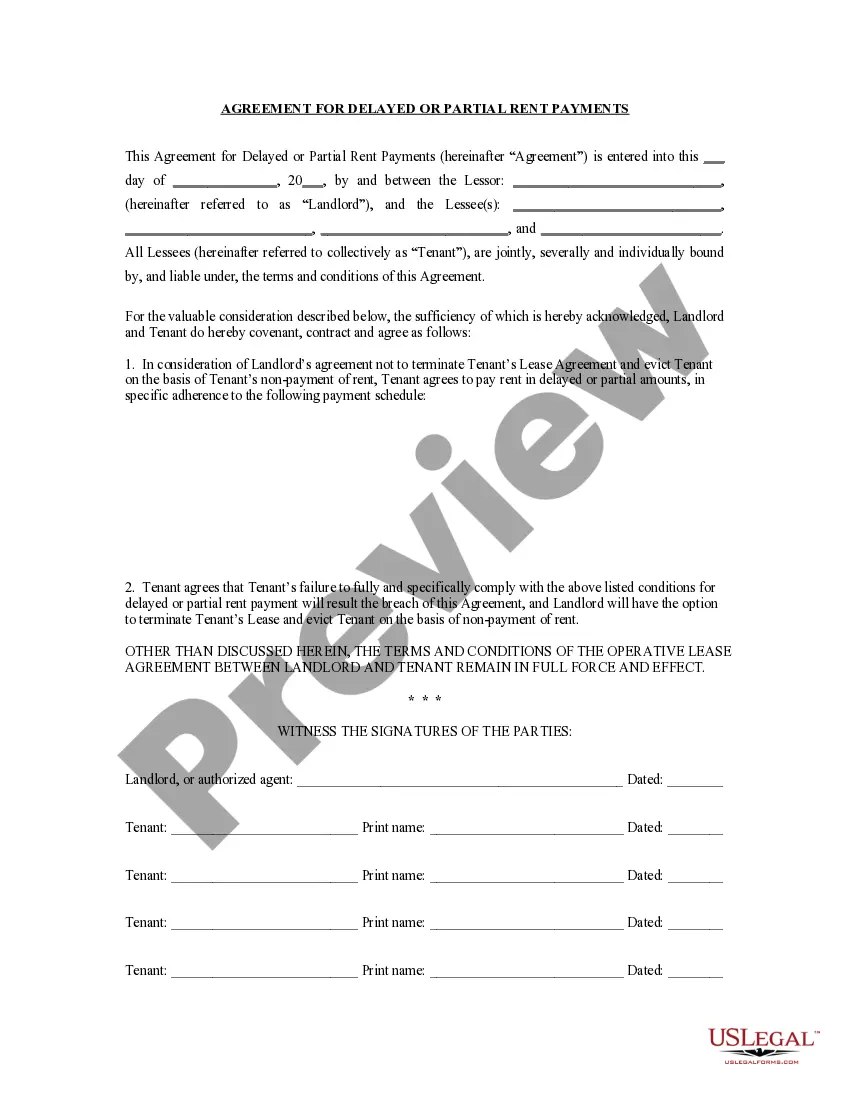

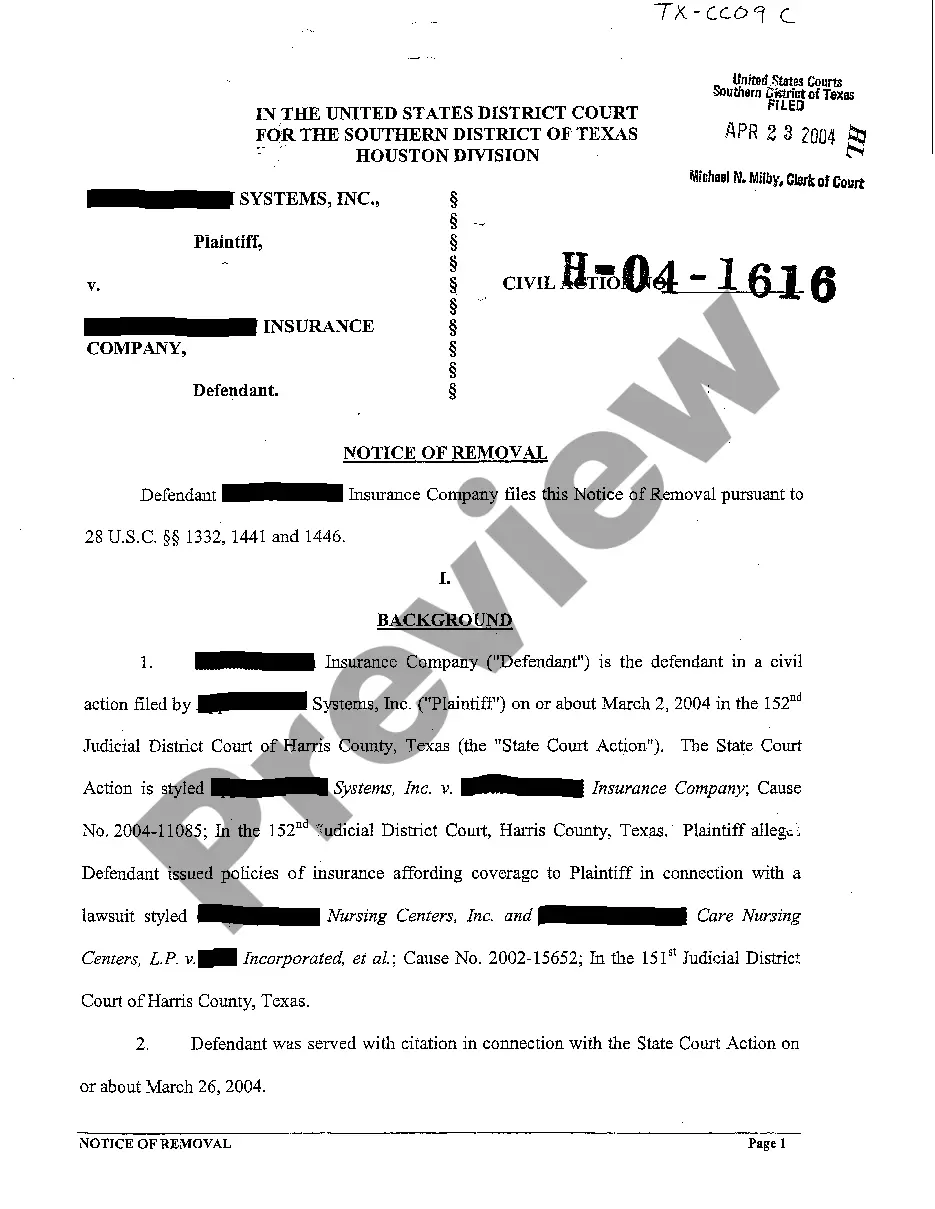

How to fill out Washington Chattel Mortgage On Mobile Home?

If you have to complete, obtain, or produce legal file themes, use US Legal Forms, the most important selection of legal kinds, which can be found online. Use the site`s simple and handy lookup to obtain the papers you require. Various themes for enterprise and individual functions are sorted by categories and states, or keywords. Use US Legal Forms to obtain the Washington Chattel Mortgage on Mobile Home with a handful of mouse clicks.

Should you be presently a US Legal Forms client, log in to the account and click on the Obtain button to obtain the Washington Chattel Mortgage on Mobile Home. You may also access kinds you earlier downloaded in the My Forms tab of your own account.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form for that proper city/land.

- Step 2. Make use of the Preview option to examine the form`s information. Don`t forget about to read the information.

- Step 3. Should you be unhappy using the kind, make use of the Search area near the top of the display to find other types of the legal kind format.

- Step 4. Once you have located the form you require, click the Get now button. Opt for the prices program you choose and include your qualifications to sign up to have an account.

- Step 5. Method the financial transaction. You can use your credit card or PayPal account to finish the financial transaction.

- Step 6. Select the structure of the legal kind and obtain it in your gadget.

- Step 7. Full, change and produce or signal the Washington Chattel Mortgage on Mobile Home.

Each and every legal file format you acquire is your own property forever. You may have acces to each kind you downloaded within your acccount. Click the My Forms segment and pick a kind to produce or obtain once again.

Contend and obtain, and produce the Washington Chattel Mortgage on Mobile Home with US Legal Forms. There are millions of professional and condition-particular kinds you can use for your personal enterprise or individual demands.

Form popularity

FAQ

Mobile homes are titled as vehicles and the titling options vary depending on the circumstance. Mobile homes can be titled and taxed as personal property. Mobile homes can also be affixed to the land and taxed as real property. The process of titling a mobile home can be complicated.

A chattel mortgage is used to purchase movable personal property, other than real estate, which serves as collateral for the loan until it's repaid. Farm equipment, livestock, farm assets, and mobile and manufactured homes are a few examples of property you could purchase with a chattel loan.

Mobile homes are manufactured homes and park models that are not classified by the state as travel trailers. Mobile homes are required to pay property tax rather than licensing tab fees.

Manufactured Home Loans in Washington When you are financing the land as well as the home itself, you're likely to use a conventional land or land construction loan. If you're financing just the home itself, you'll probably use a chattel loan.

We make it easy to get manufactured home loans or mobile home loans in Washington, with many types of programs from nationally recognized lenders. We offer a variety of options to fit your individual needs.

Chattel is any tangible personal property that is movable. Examples of chattel are furniture, livestock, bedding, picture frames, and jewelry.

A chattel mortgage is a loan for a manufactured home or other movable piece of personal property, such as machinery or a vehicle. The movable property, called ?chattel,? also acts as collateral for the loan.

Otherwise known as a ?Certificate of Title?, which comes in electronic or paper form, is proof of ownership of a mobile or manufactured home in the State of Washington.

Real property includes land; improvements attached to the land, such as buildings, and improvements to the land, such as driveways and utility services.

Although all mobile homes are assessed as real property, the collection of taxes is based on the ownership of the land.