Washington Acknowledgment by Charitable or Educational Institutions of Receipt of Gift is a formal document used by organizations to acknowledge the receipt of donations from individuals or entities for charitable or educational purposes. This acknowledgment serves as an acknowledgment of the contribution made and allows the donor to claim tax deductions, as allowed by law. One type of Washington Acknowledgment by Charitable or Educational Institution of Receipt of Gift is the standard acknowledgment letter. This letter includes essential information such as the name and address of the organization, the name and contact details of the donor, a description of the gift received, and the date of receipt. It may also include the IRS tax identification number of the organization, which is necessary for the donor's tax reporting requirements. Another type is the gift-in-kind acknowledgment, used when the donation consists of non-monetary items such as goods or services. This acknowledgment includes specifics about the donated items, their estimated value, and a statement that no goods or services were provided to the donor in return. This is important to ensure compliance with IRS regulations regarding non-cash donations. Furthermore, Washington Acknowledgment by Charitable or Educational Institution of Receipt of Gift may also vary based on the donation amount. For significant contributions that exceed certain thresholds, additional information may be required. This can include appraisals for donated property, disclosure of any goods or services provided in exchange for the donation, or specific acknowledgments for specific types of donations, such as vehicles or real estate. The main purpose of these acknowledgments is to establish a formal record of the donation, express gratitude to the donor, and provide them with the necessary documentation to claim tax benefits. Nonprofit organizations must carefully adhere to legal requirements in Washington when issuing these acknowledgments to ensure compliance with state and federal regulations surrounding charitable giving and tax deductions. In conclusion, Washington Acknowledgment by Charitable or Educational Institution of Receipt of Gift is a crucial document that helps organizations recognize and thank donors for their valuable contributions. It is important for organizations to understand the different types of acknowledgments and tailor them to match the specific donation type. By doing so, organizations can ensure transparency, compliance, and foster ongoing relationships with their generous donors.

Washington Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

How to fill out Washington Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

US Legal Forms - among the biggest libraries of legitimate kinds in the States - offers a wide range of legitimate file themes you may acquire or printing. Using the web site, you will get 1000s of kinds for organization and individual uses, categorized by classes, suggests, or search phrases.You will find the most recent variations of kinds much like the Washington Acknowledgment by Charitable or Educational Institution of Receipt of Gift in seconds.

If you currently have a subscription, log in and acquire Washington Acknowledgment by Charitable or Educational Institution of Receipt of Gift through the US Legal Forms library. The Download switch can look on each type you perspective. You gain access to all in the past saved kinds inside the My Forms tab of your respective profile.

If you want to use US Legal Forms for the first time, listed below are straightforward recommendations to obtain started:

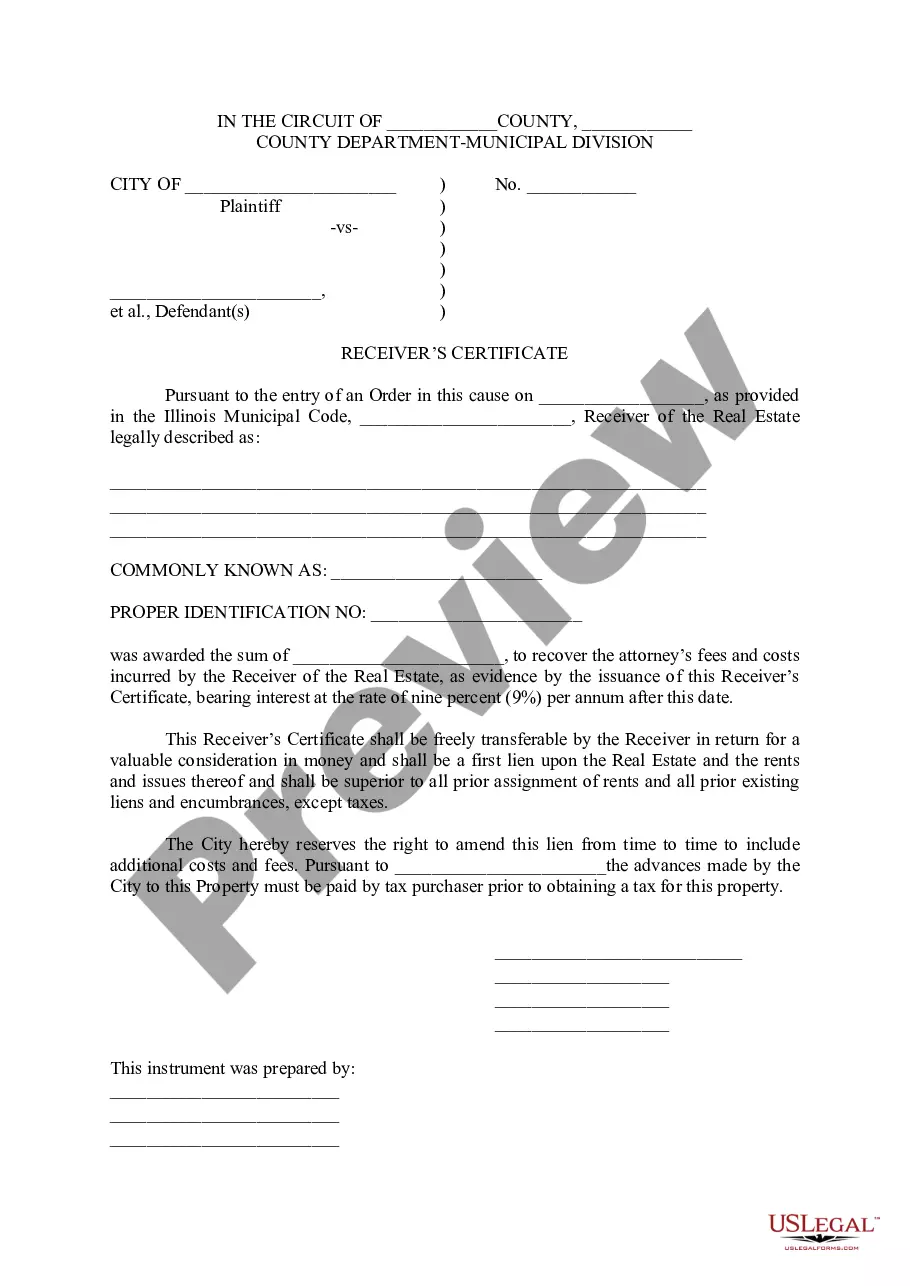

- Ensure you have picked the correct type for your city/region. Click the Preview switch to review the form`s articles. See the type explanation to ensure that you have chosen the proper type.

- If the type does not suit your demands, make use of the Search field near the top of the display to get the one which does.

- If you are happy with the form, confirm your option by clicking the Purchase now switch. Then, choose the pricing plan you favor and supply your references to sign up to have an profile.

- Procedure the deal. Use your bank card or PayPal profile to complete the deal.

- Select the format and acquire the form on your product.

- Make modifications. Load, modify and printing and sign the saved Washington Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

Each and every web template you put into your bank account does not have an expiry time and is yours permanently. So, if you would like acquire or printing one more duplicate, just visit the My Forms area and click on on the type you want.

Gain access to the Washington Acknowledgment by Charitable or Educational Institution of Receipt of Gift with US Legal Forms, the most comprehensive library of legitimate file themes. Use 1000s of specialist and status-specific themes that satisfy your small business or individual requires and demands.