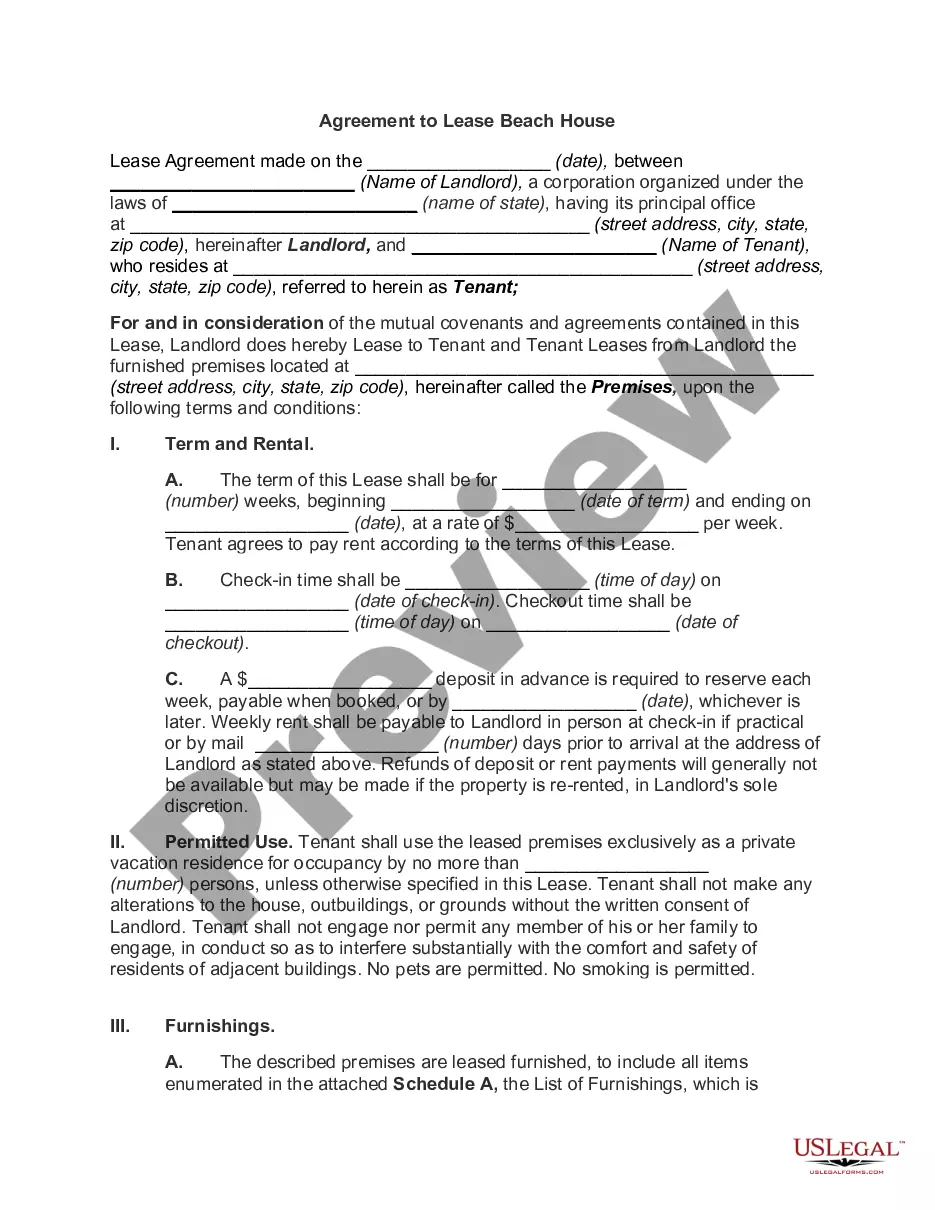

The Washington Assumption Agreement of Loan Payments is a legally binding agreement that allows a borrower to transfer their existing loan obligation to another party. This arrangement is commonly used in real estate transactions, where the buyer assumes responsibility for the mortgage loan instead of taking out a new loan. The Washington Assumption Agreement of Loan Payments outlines the terms and conditions under which the assumption takes place. It typically includes relevant details such as the loan amount, interest rate, monthly payment, loan maturity date, and any specific provisions associated with the original loan. There are two main types of Washington Assumption Agreement of Loan Payments: 1. Simple Assumption: This type of assumption agreement occurs when the new borrower assumes the existing loan with no changes to the loan terms or conditions. The new borrower agrees to make payments as specified in the original loan agreement until the loan is fully paid off. 2. Contractual Assumption: In this type of assumption agreement, the new borrower negotiates certain changes to the loan terms with the lender. This could involve modifying the interest rate, extending the loan term, or adjusting the monthly payment amount. Both parties must agree upon these modifications, and the terms are documented in the assumption agreement. The Washington Assumption Agreement of Loan Payments is a beneficial option for both buyers and sellers in real estate transactions. For sellers, it can help facilitate a quicker sale by allowing the buyer to assume the existing mortgage instead of applying for a new loan. This eliminates the need for the buyer to go through the time-consuming mortgage application process. Buyers, on the other hand, may find assumption agreements attractive if they can secure a more favorable interest rate or loan terms than what is currently available in the market. It can also be beneficial if the buyer does not qualify for a new loan due to credit or income limitations. It's important to note that assuming a loan is not without risks. The new borrower becomes responsible for performing due diligence on the property, ensuring that it is in good condition and that there are no hidden liabilities. Additionally, if the new borrower defaults on the loan, the original borrower may still be held liable. In summary, the Washington Assumption Agreement of Loan Payments allows for the transfer of an existing loan from one party to another. Simple and contractual assumption are the main types, each with its own set of terms and conditions. It is vital for both parties to carefully review the agreement and seek legal advice to ensure a smooth assumption process.

Washington Assumption Agreement of Loan Payments

Description

How to fill out Assumption Agreement Of Loan Payments?

Are you in a position the place you need documents for either enterprise or personal functions virtually every time? There are tons of legitimate file layouts accessible on the Internet, but finding kinds you can rely isn`t simple. US Legal Forms provides thousands of develop layouts, like the Washington Assumption Agreement of Loan Payments, which are published in order to meet federal and state demands.

When you are previously familiar with US Legal Forms website and also have a free account, basically log in. After that, you can download the Washington Assumption Agreement of Loan Payments web template.

If you do not come with an accounts and would like to begin to use US Legal Forms, follow these steps:

- Find the develop you will need and ensure it is for your right town/state.

- Make use of the Review switch to examine the form.

- See the information to actually have chosen the proper develop.

- In case the develop isn`t what you`re seeking, make use of the Search industry to find the develop that meets your requirements and demands.

- Once you find the right develop, simply click Get now.

- Select the prices prepare you desire, fill in the desired information to generate your account, and buy the order with your PayPal or bank card.

- Choose a hassle-free document file format and download your copy.

Find every one of the file layouts you have purchased in the My Forms menu. You can get a extra copy of Washington Assumption Agreement of Loan Payments whenever, if possible. Just click the required develop to download or print the file web template.

Use US Legal Forms, by far the most considerable selection of legitimate kinds, to save efforts and prevent blunders. The support provides skillfully made legitimate file layouts which you can use for a variety of functions. Create a free account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

Updated March 7, 2022. In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

Under the payoff method, the FDIC must payout $250,000 but may pay out more, up to the original $350,00 value of the deposit, depending on the amount of proceeds received when the bank is liquidated. Under the purchase and assumption method, the bank is completely absorbed, and all accounts are paid their full value.

Purchase and assumption is a transaction in which a healthy bank or thrift purchases assets and assumes liabilities (including all insured deposits) from an unhealthy bank or thrift. It is the most common and preferred method used by the Federal Deposit Insurance Corporation (FDIC) to deal with failing banks.

Personnel & Administration (P&A)

A Resolution method in which a healthy Bank or a group of investors assume some or all of the obligations, and purchase some or all of the assets of the failed Bank.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract.

Seller represents that the Existing Loan is assumable. Buyer agrees to make application to the Lender to assume the Existing Loan, if required.