Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm.

From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

DISSOLUTION BY ACT OF THE PARTIES

A partnership is dissolved by any of the following events:

* agreement by and between all partners;

* expiration of the time stated in the agreement;

* expulsion of a partner by the other partners; or

* withdrawal of a partner.

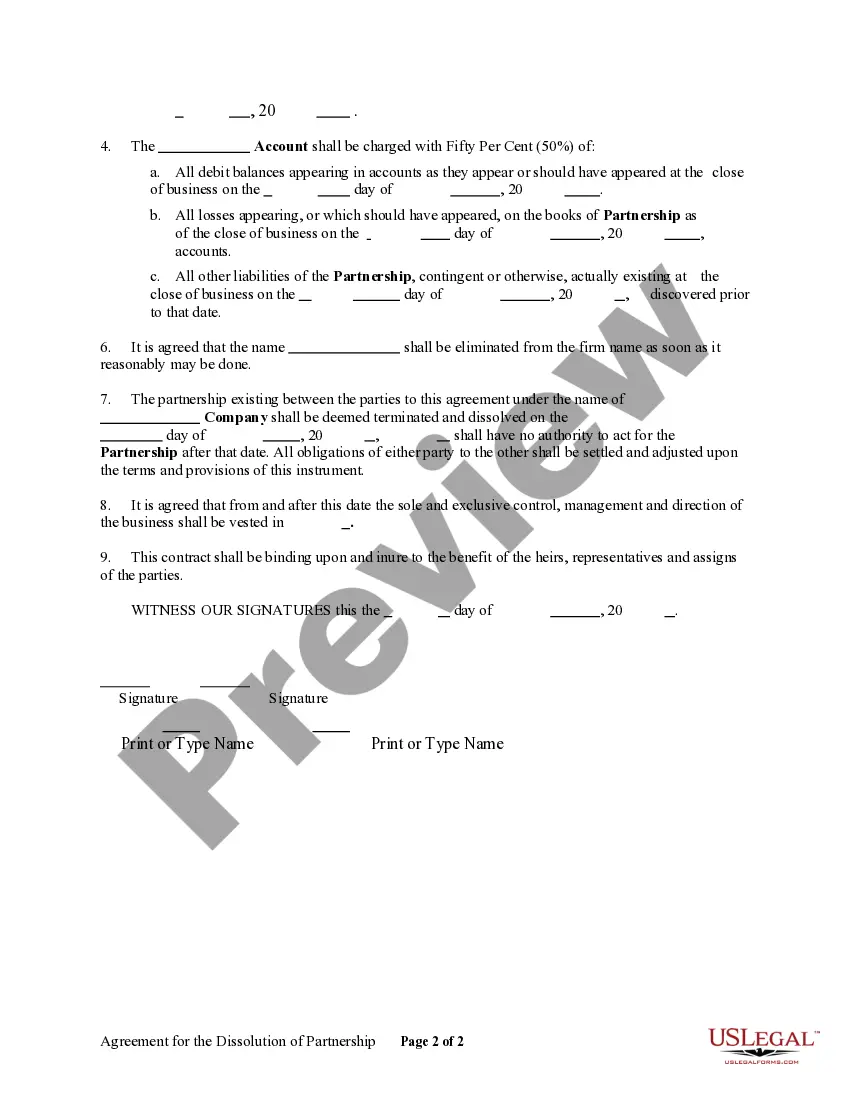

The Washington Agreement for the Dissolution of a Partnership is a legal document that outlines the terms and conditions for terminating a partnership in accordance with the laws of the state of Washington, United States. This agreement is specifically designed for partnerships based in Washington and ensures a fair and orderly dissolution process. The agreement begins with a preamble that identifies the partners involved and provides an overview of the partnership. It then proceeds to address various key elements necessary for the dissolution process. These elements include the effective date of dissolution, distribution of assets and liabilities, allocation of profits and losses, settlement of outstanding debts, and any remaining obligations of the partners. In terms of asset distribution, the agreement outlines the process of identifying, valuing, and dividing partnership assets among the partners. It specifies how the assets will be appraised, whether by an independent appraiser or by mutual agreement, and how disputes concerning the valuation will be resolved. Furthermore, it provides guidance on the division of cash, accounts receivable, inventory, real estate, intellectual property, and any other partnership assets. Liabilities are also addressed in detail. The agreement establishes the responsibilities of each partner in regard to the settlement of existing debts and liabilities. It outlines how creditors will be notified and involved in the dissolution process. This includes providing them with an opportunity to submit claims and establishing a timeframe for the settlement of these claims. The agreement also assigns responsibility for any outstanding taxes, leases, contracts, or legal disputes. Another crucial aspect covered in the agreement is the allocation of profits and losses. It determines how any remaining profits or losses will be divided among the partners, considering their respective contributions to the partnership. This ensures that each partner's share is determined fairly and provides a clear understanding of the financial implications of the dissolution. Additionally, the Washington Agreement for the Dissolution of a Partnership encompasses the partners' ongoing obligations, such as non-compete agreements or non-disclosure agreements. It specifies whether these obligations will remain in effect after the dissolution or if they will be terminated. This ensures that any potential competition or disclosure of sensitive information is appropriately addressed. While the standard Washington Agreement for the Dissolution of a Partnership covers most dissolution scenarios, it is important to note that there may be specific variations or customized agreements depending on the circumstances. For example, there might be agreements tailored for partnerships in specific industries, such as healthcare or real estate, that address industry-specific regulations or considerations. Nevertheless, the core elements mentioned above are likely to be present in any comprehensive agreement for the dissolution of a partnership in Washington.