The Washington General Guaranty and Indemnification Agreement is a legal document that outlines the terms and conditions under which a guarantor agrees to provide financial security and take responsibility for any potential losses or damages incurred by the borrower or the party being guaranteed. This agreement is commonly used in various business transactions to ensure that the creditor is protected in case of default or non-performance by the borrower. The Washington General Guaranty and Indemnification Agreement typically includes key provisions such as the identity of the parties involved, the amount and purpose of the guarantee, the duration of the guarantee, and the conditions under which the guarantor's obligations are triggered. It also specifies the rights and remedies available to the creditor in case of default, including possible legal actions, costs, and attorney fees. There are different types of Washington General Guaranty and Indemnification Agreements that can be used in various contexts. Some of these include: 1. Personal Guaranty: In this type of agreement, an individual agrees to personally guarantee the obligations of the borrower. This is often required in situations where the borrower may not have sufficient assets or creditworthiness to secure the loan on their own. 2. Corporate Guaranty: Here, a company or corporation guarantees the obligations of another entity. This type of agreement is commonly used when a subsidiary or affiliated company needs financial assistance or wants to boost its creditworthiness. 3. Continuing Guaranty: This type of agreement remains valid and in force for multiple transactions or a specified period. It provides ongoing assurance to the creditor that the guarantor will remain liable for any debt or obligation that arises during the agreed period. Overall, the Washington General Guaranty and Indemnification Agreement serves as an essential legal instrument to secure financial transactions and protect the interests of the creditor. It is essential for all parties involved to carefully review and understand the terms and conditions of the agreement before signing, as it imposes significant financial obligations and potential legal consequences.

Washington General Guaranty and Indemnification Agreement

Description

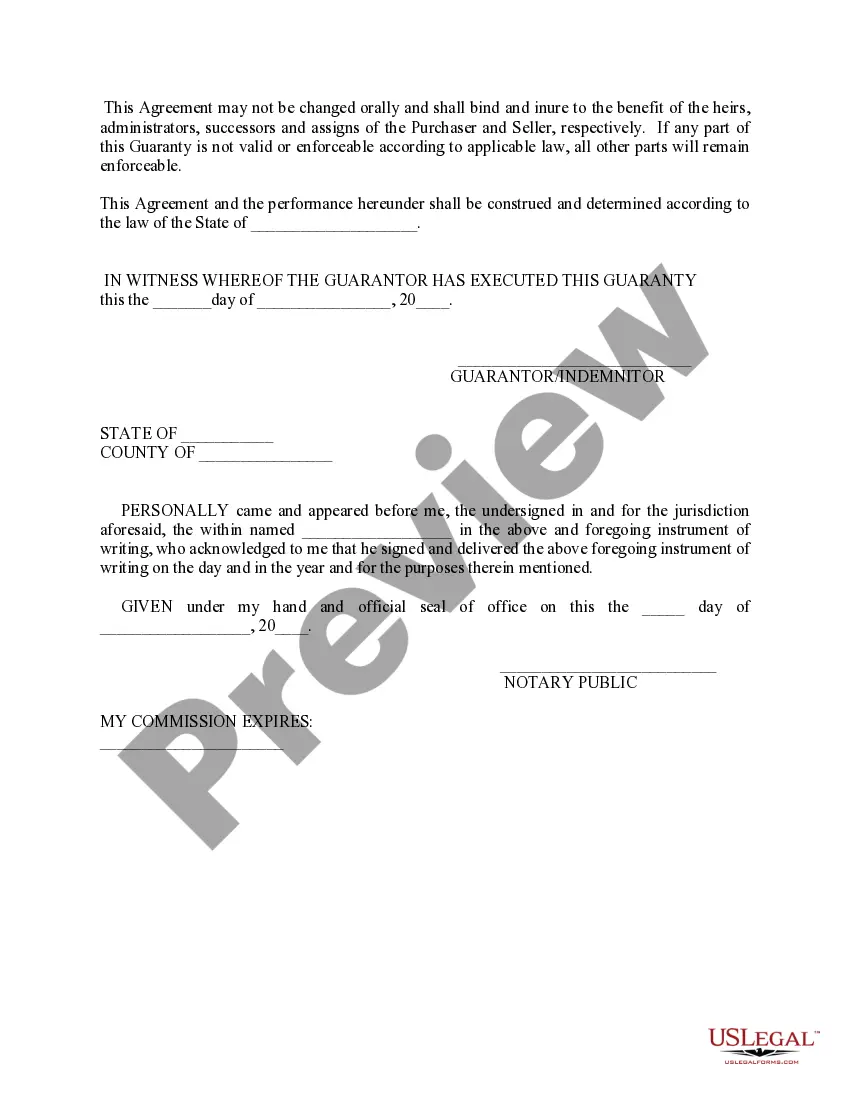

How to fill out Washington General Guaranty And Indemnification Agreement?

If you have to full, download, or print authorized file layouts, use US Legal Forms, the largest collection of authorized varieties, that can be found on the Internet. Utilize the site`s simple and convenient research to discover the documents you require. A variety of layouts for enterprise and individual reasons are categorized by categories and says, or key phrases. Use US Legal Forms to discover the Washington General Guaranty and Indemnification Agreement with a few clicks.

When you are presently a US Legal Forms customer, log in for your profile and click on the Download key to get the Washington General Guaranty and Indemnification Agreement. You may also entry varieties you in the past delivered electronically in the My Forms tab of your own profile.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have selected the form to the appropriate city/country.

- Step 2. Make use of the Review option to check out the form`s articles. Never forget to see the outline.

- Step 3. When you are unsatisfied with all the form, use the Look for discipline towards the top of the display to discover other variations of the authorized form design.

- Step 4. Once you have identified the form you require, go through the Buy now key. Opt for the rates plan you choose and add your accreditations to sign up to have an profile.

- Step 5. Method the purchase. You should use your Мisa or Ьastercard or PayPal profile to complete the purchase.

- Step 6. Find the format of the authorized form and download it in your gadget.

- Step 7. Complete, edit and print or signal the Washington General Guaranty and Indemnification Agreement.

Each authorized file design you acquire is your own permanently. You might have acces to each form you delivered electronically within your acccount. Go through the My Forms segment and pick a form to print or download again.

Compete and download, and print the Washington General Guaranty and Indemnification Agreement with US Legal Forms. There are thousands of expert and condition-particular varieties you can use for your enterprise or individual needs.