A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

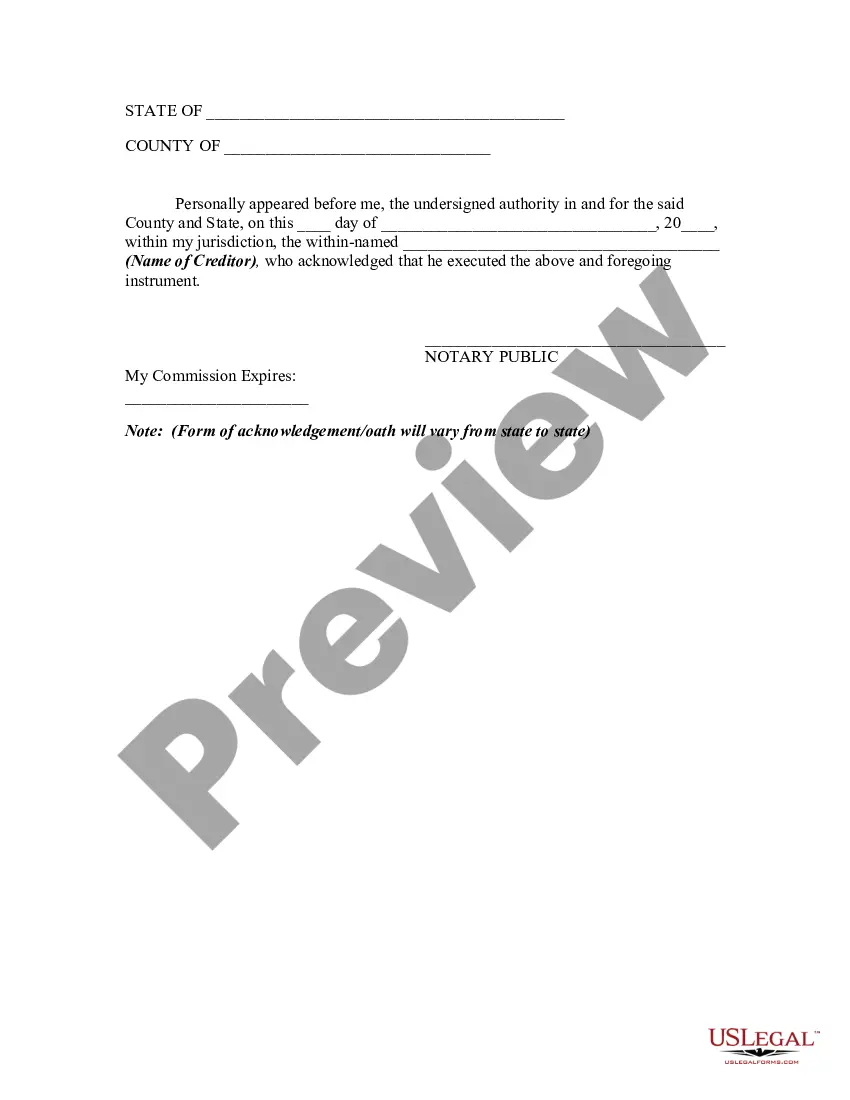

Title: Understanding the Washington Release of Claims Against an Estate By Creditor Keywords: Washington Release of Claims Against an Estate, Estate Creditor, Washington probate law, Claims release process, Types of Releases, Estate Creditors' Rights Description: The Washington Release of Claims Against an Estate By Creditor is a legal document used in the state of Washington to release and settle claims made by creditors against an estate. This process is governed by Washington probate law and aims to ensure the fair distribution of assets among the beneficiaries while protecting the rights of legitimate creditors. Types of Washington Release of Claims Against an Estate By Creditor: 1. General Release: A general release is a common method used by estate creditors to waive their rights to make further claims against an estate. By signing this release, the creditor agrees to accept the settlement or distribution provided by the estate and forego any future claims related to the debt. 2. Conditional Release: In some cases, creditors may agree to release their claims against an estate on the condition that they receive a specific portion of the debt owed to them. This conditional release ensures that the creditor is compensated partially and eliminates the need for further legal action. 3. Full Satisfaction and Release: This type of release is employed when a creditor receives full settlement of their claim from the estate. Once the creditor signs this release, it verifies that they have been paid in full, releasing the estate from any further obligations related to the debt. The Washington Release of Claims Against an Estate By Creditor protects both the estate and creditors' interests. It allows the probate process to continue smoothly, ensuring equitable distribution of assets to beneficiaries while acknowledging valid creditors' claims. Creditor releases are typically obtained by the personal representative of the estate, commonly known as the executor or administrator. It is essential to involve an attorney knowledgeable in probate law to ensure compliance with Washington state regulations and to draft a release that accurately represents the creditor's intentions. The release should include crucial details such as the creditor's name, contact information, the amount and nature of the debt being released, and the specific estate property or assets that will be used to satisfy the claim. Additionally, it must be signed and notarized to certify its authenticity and validity. By obtaining a Washington Release of Claims Against an Estate, creditors can formalize their agreement with the estate, protecting their rights and facilitating the administration of the probate process. Estate creditors should consult a legal professional familiar with Washington probate law to ensure they follow the proper procedures and protect their interests throughout the claims release process.