Washington Indemnity Agreement for an Event

Description

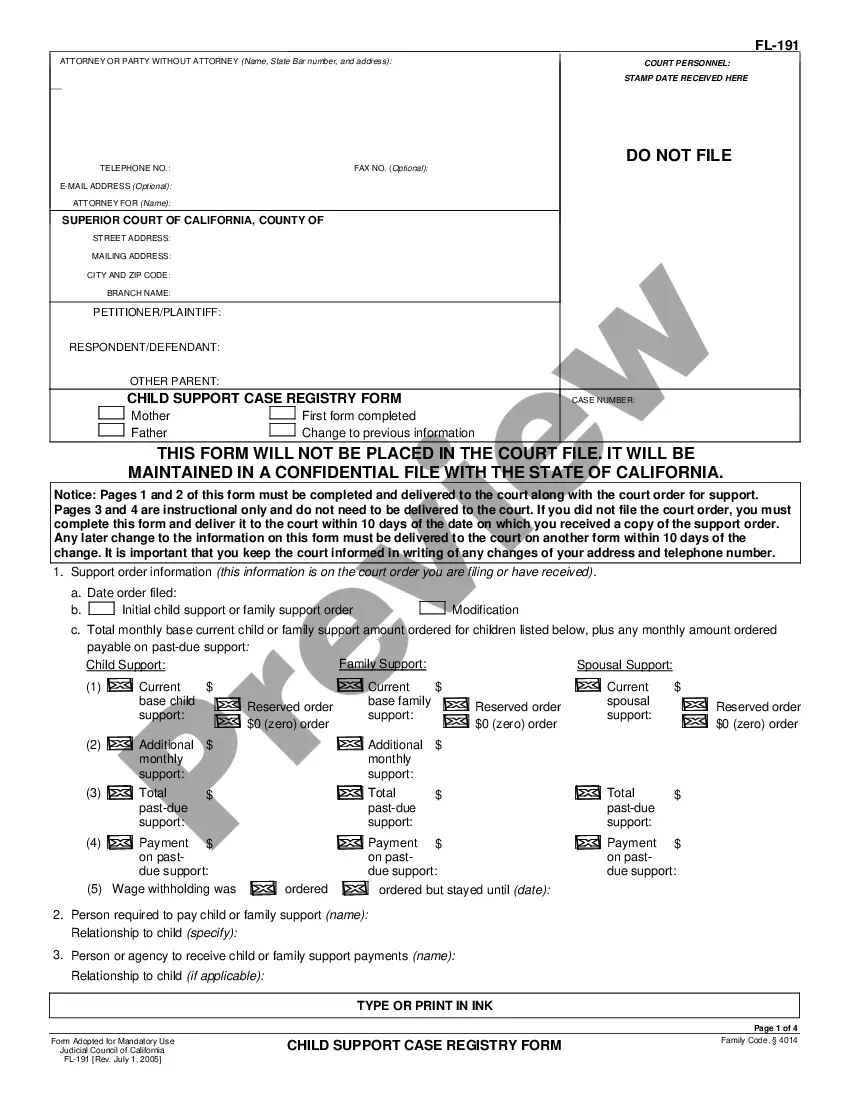

How to fill out Indemnity Agreement For An Event?

If you wish to complete, acquire, or print sanctioned record templates, utilize US Legal Forms, the largest collection of legal documents available online.

Employ the website's convenient and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Each legal document format you obtain is yours permanently. You will have access to every form you downloaded in your account. Select the My documents section and choose a document to print or download again.

Compete and acquire, and print the Washington Indemnity Agreement for an Event with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to find the Washington Indemnity Agreement for an Event in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Acquire button to obtain the Washington Indemnity Agreement for an Event.

- You can also access documents you previously downloaded in the My documents section of your account.

- If you are accessing US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to view the form's details. Always remember to read the overview.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternate types of your legal document format.

- Step 4. Once you find the form you need, click the Purchase now button. Select the payment plan you prefer and enter your details to register for the account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Fill out, modify, print, or sign the Washington Indemnity Agreement for an Event.

Form popularity

FAQ

Drafting a Washington Indemnity Agreement for an Event involves several key steps. First, clearly state the intent of the indemnity, followed by the definitions of terms used in the agreement. Next, outline the parties' rights and obligations, and include any disclaimers related to liability. You can take advantage of tools and templates available on platforms like USLegalForms to assist in drafting a comprehensive and legally sound document.

Generally, a Washington Indemnity Agreement for an Event does not require notarization to be valid. However, certain situations or jurisdictions may prefer or even mandate notarization to enhance the document's credibility. It's advisable to check local regulations or consult with a legal expert to ensure compliance. Using USLegalForms can provide insights into whether notarization is necessary in your specific case.

To write a Washington Indemnity Agreement for an Event, start by clearly identifying the parties involved and their roles. Next, specify the obligations that each party has in relation to the event, particularly concerning any liabilities. You should also include details about the event, covering aspects like dates and locations. Resources like USLegalForms provide valuable templates and guidance to help you craft an effective agreement.

The indemnity format refers to the structure or template used to create a Washington Indemnity Agreement for an Event. It typically outlines the responsibilities and liabilities of the parties involved. By using a clear format, the agreement helps ensure that all terms are understood, reducing potential disputes down the line. Utilizing resources like USLegalForms can simplify the process of obtaining a reliable indemnity format.

To fill out an agreement to indemnify, such as a Washington Indemnity Agreement for an Event, start by identifying the parties involved and the event date. Draft a clear statement naming the responsibilities of each party and the scope of indemnification. Once completed, ensure all involved parties review, sign, and date the agreement to finalize the understanding.

Filling out a Washington Indemnity Agreement for an Event as a bond form involves providing detailed information about the bond issuer and the obligation being guaranteed. You will need to include specifics about the event and any related conditions for indemnification. Make sure to follow any required formats to ensure compliance, as a well-prepared document minimizes the risk of disputes.

To properly fill out a Washington Indemnity Agreement for an Event, begin with your personal information, including your name and contact details. Include details about the event, such as its location and date. Clearly state the indemnification terms and conditions, then ensure all parties sign the document to confirm their agreement to the terms outlined.

An example of a Washington Indemnity Agreement for an Event might involve a vendor agreeing to indemnify a venue owner against any claims arising from the vendor's activities during the event. This contract outlines the responsibilities and protections for both parties, making it clear who is liable in case of accidents or damages. You can find sample agreements on platforms like uslegalforms to guide your drafting process.

To fill out a Washington Indemnity Agreement for an Event, start by carefully reading the document to understand its terms. Next, provide the required information, such as the names of the involved parties, the date of the event, and any specific terms of indemnification. Be sure to sign and date the agreement, ensuring all parties involved acknowledge their responsibilities.

Indemnification law in Washington state generally allows parties to establish terms for indemnification through contract agreements. These laws support the enforcement of indemnity agreements as long as they are clearly articulated and acknowledged by all parties. For those drafting a Washington Indemnity Agreement for an Event, awareness of these laws can enhance the enforceability of your agreement.