The Washington Revocable Living Trust for House is a legal document that allows property owners in the state of Washington to establish a trust for their residential property while maintaining control and flexibility during their lifetime. This type of trust offers numerous benefits, including privacy, probate avoidance, and potential estate tax savings. In a Washington Revocable Living Trust for House, the property owner (known as the granter) transfers the ownership of their house or other residential property to the trust, which is managed by a trustee appointed by the granter. The granter themselves usually serves as the trustee during their lifetime, retaining complete control over the property within the trust. One of the key advantages of a Washington Revocable Living Trust for House is that it allows the granter to avoid probate, the lengthy and expensive legal process of administering an estate. By placing the property in a trust, it passes directly to the named beneficiaries upon the granter's death, without the need for court intervention. This can save both time and money, ensuring a smooth transfer of ownership. Moreover, a revocable living trust offers privacy as its terms are not made public, unlike a will, which becomes a matter of public record after probate. This way, individuals can keep their affairs confidential and prevent any prying eyes from accessing sensitive financial information. Additionally, a Washington Revocable Living Trust for House allows the granter to retain control over their property while alive. It enables them to manage, sell, or mortgage the property as they see fit, without any restrictions imposed by the trust. This flexibility is particularly appealing to property owners who wish to retain decision-making authority over their valuable assets. While the concept and benefits of a Washington Revocable Living Trust for House remain constant, there may be various types tailored to the individual circumstances of the granter. Some common types include: 1. Single Granter Trust: This is the basic form of a revocable living trust established by a single individual, who also serves as the trustee. This type allows for efficient management of the property while alive and a smooth transfer of ownership upon death. 2. Joint Granter Trust: In this case, a married couple creates a shared revocable living trust for their house. Both partners are named as granters and trustees, allowing them to maintain joint control over the property. Upon the death of one spouse, the trust continues, and the surviving spouse retains full control and access to the property. 3. Testamentary Trust: Unlike the other types, a testamentary trust is not created during the granter's lifetime but rather takes effect upon their death. This trust is established within the granter's will and serves as a vehicle to manage and distribute the residential property according to their wishes. In summary, a Washington Revocable Living Trust for House provides property owners with control, privacy, and probate avoidance. Its various types cater to individual circumstances, ensuring flexibility and efficient estate planning. Consulting with an experienced estate planning attorney is highly recommended determining the most suitable type of trust for one's specific needs.

Washington Revocable Living Trust for House

Description

How to fill out Revocable Living Trust For House?

If you wish to finalize, download, or create authentic document templates, utilize US Legal Forms, the largest collection of valid forms, that is accessible online.

Take advantage of the site’s simple and user-friendly search to find the documentation you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get Now button. Select the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Utilize US Legal Forms to acquire the Washington Revocable Living Trust for House in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Washington Revocable Living Trust for House.

- You can also access forms you previously saved within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Confirm you have chosen the form for the correct city/state.

- Step 2. Use the Review option to scrutinize the form’s details. Don’t forget to check the information.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the page to locate other versions of the legal form template.

Form popularity

FAQ

A Washington Revocable Living Trust for House is often considered the best option for homeowners in Washington. This type of trust allows you to retain control over your property while providing a clear plan for how your assets are handled after you are gone. Using a reputable platform like uslegalforms can help you set up this trust effectively, ensuring it meets all legal requirements.

Yes, placing your house in a Washington Revocable Living Trust for House provides significant benefits, especially if you want to simplify estate planning. Washington's probate process can be lengthy and costly, but with a trust, your property can bypass this process. Moreover, a trust ensures your wishes are followed regarding how your property should be managed after you pass.

Putting your house in a Washington Revocable Living Trust for House helps you avoid probate, ensuring a smoother transfer of assets upon your passing. This means your loved ones can access your property more quickly and with less stress. Additionally, a revocable trust allows you to maintain control over your assets during your lifetime, providing flexibility for any changes you may want to make.

When you create a Washington Revocable Living Trust for House, you generally report income generated by the trust on your personal tax return. Since revocable trusts are not separate tax entities, the IRS treats them as part of your estate. This means you will include any income from trust assets on your Form 1040, just as you would with your other income. If you have questions about this process, consider using resources from UsLegalForms to ensure you comply with all tax requirements effectively.

To put your house in a Washington Revocable Living Trust for House, start by drafting the trust document, detailing your wishes for the property. Next, you will need to transfer the title of your house into the name of the trust, which typically involves filling out a new deed. This process may require assistance from an attorney or using a reliable service like uslegalforms to ensure that everything is done correctly. Once transferred, your house will be managed according to the terms set out in your revocable living trust, providing ease and peace of mind.

Yes, placing a house with a mortgage into a Washington Revocable Living Trust for House is possible. You will need to notify your lender as they may have specific requirements for the trust. Be mindful that while your mortgage does not generally prevent the transfer, you should review your mortgage agreement to ensure compliance. This can help avoid complications down the line.

While a Washington Revocable Living Trust for House offers benefits, it also has potential downsides. These include the initial setup costs and the ongoing management duties required for the trust. Additionally, any changes to the trust may necessitate legal assistance, which can incur further expenses. Understanding these factors can help you make an informed decision.

In Washington state, putting your house in a trust is a clear process. First, create the trust document, ensuring it specifies your property as a trust asset. Next, you will need to execute a new deed that transfers the house from your name into the trust's name. Consulting resources like US Legal Forms can provide templates to make this process easier and more organized.

Yes, you can place a house with a mortgage in a Washington Revocable Living Trust for House. However, it's crucial to inform your lender about the transfer. Your mortgage documents should not contain restrictions regarding putting property into a trust. Always check with your lender and review your options for seamless integration into the trust.

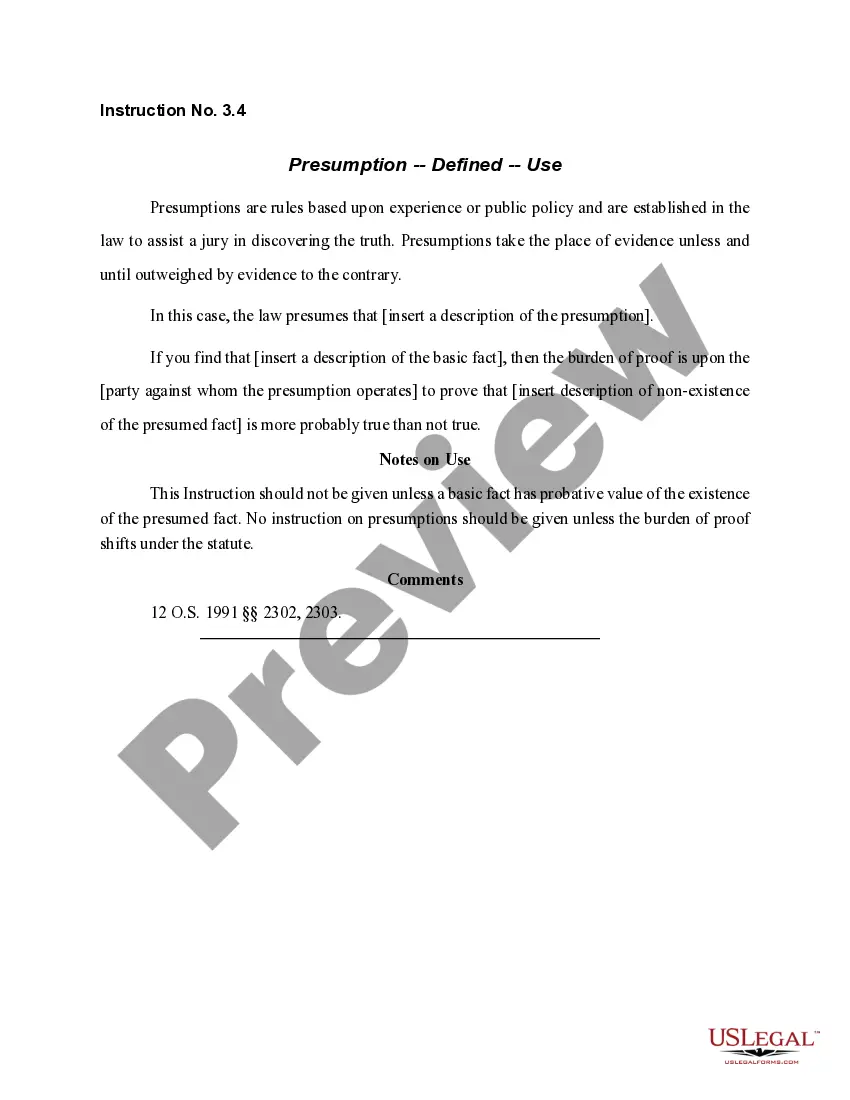

Filling out a Washington Revocable Living Trust for House requires straightforward steps. Begin by designating a trustee, who will manage the trust. Next, identify the assets you intend to transfer, such as your house, and provide details like property address and description. Finally, ensure all required signatures are in place, and consider consulting resources like US Legal Forms for reliable templates and guidance.