Washington Restricted Endowment to Educational, Religious, or Charitable Institution

Description

How to fill out Restricted Endowment To Educational, Religious, Or Charitable Institution?

Are you in a position where you frequently require documents for either corporate or specific tasks.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of templates, including the Washington Restricted Endowment to Educational, Religious, or Charitable Institution, which can be tailored to meet both federal and state regulations.

Access all the document templates you have purchased in the My documents section.

You can obtain an additional copy of the Washington Restricted Endowment to Educational, Religious, or Charitable Institution at any time by simply clicking on the desired form to download or print the document template.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Washington Restricted Endowment to Educational, Religious, or Charitable Institution template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and verify it is for your specific city or county.

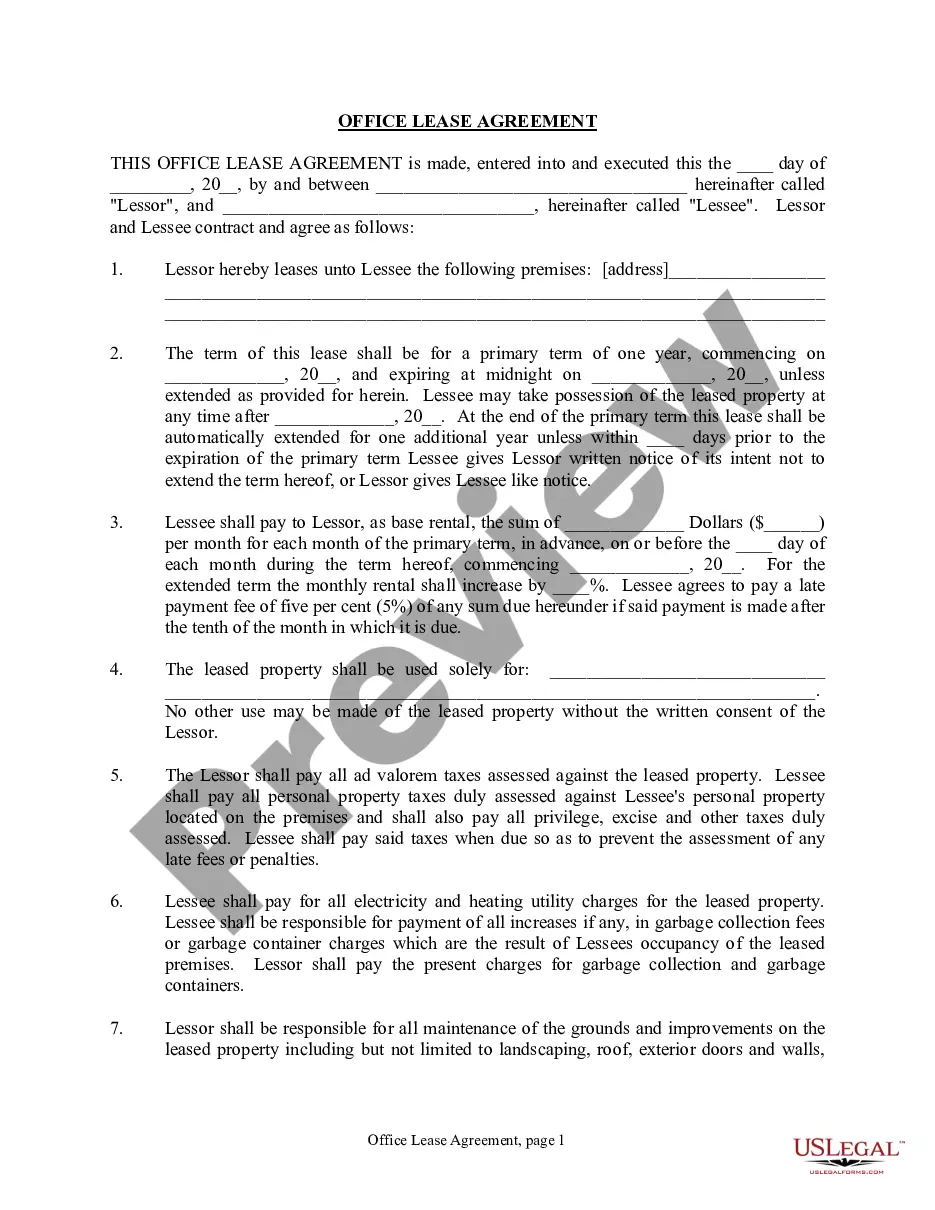

- Utilize the Preview button to review the document.

- Read the description to ensure that you have selected the correct form.

- If the form isn’t what you need, use the Lookup field to locate the form that meets your requirements.

- Once you find the appropriate form, click Purchase now.

- Select the pricing plan you prefer, fill out the required information to create your account, and make the payment using PayPal or credit card.

- Choose a compatible document format and download your copy.

Form popularity

FAQ

An endowment is a fund with specific restrictions on its use, ensuring it supports designated causes over time, while an unrestricted endowment allows the fund to be used at the discretion of the organization. Unrestricted endowment funds can be directed to any area of need, offering more fluidity in financial management. Recognizing the differences is vital, particularly for organizations navigating the complexities of a Washington Restricted Endowment to Educational, Religious, or Charitable Institution, as this understanding aids in strategic funding decisions.

Quasi-endowment and permanent endowment differ primarily in their spending rules. A permanent endowment is strictly designed to last indefinitely, with only earnings available for spending. On the other hand, quasi-endowments provide organizations the freedom to access both the principal and earnings, depending on their needs. This nuance is essential for managing a Washington Restricted Endowment to Educational, Religious, or Charitable Institution, as flexibility can play a critical role in financial planning.

An endowment is a fund that is designated to be preserved indefinitely, with only a portion of the earnings used for immediate needs, while a quasi-endowment allows for greater flexibility. Quasi-endowments can be used more freely by the organization, giving them the option to withdraw funds if necessary. Understanding these distinctions is crucial, especially when dealing with a Washington Restricted Endowment to Educational, Religious, or Charitable Institution, as it affects how funds can be managed and utilized.

Quasi-endowment funds are somewhat flexible and can be seen as a bridge between unrestricted and restricted funds. While they may have certain stipulations on their use, they do not have the same strict limitations as traditional endowments. Thus, the Washington Restricted Endowment to Educational, Religious, or Charitable Institution can provide clarity on what is considered restricted versus quasi-restricted, allowing organizations to plan their funding strategies effectively.

An endowment generally refers to a fund established to provide long-term financial support for a particular organization or cause, often with specific restrictions on its use. In contrast, a charity typically focuses on offering immediate assistance or support to people in need, without the long-term financial preservation aspect. Washington Restricted Endowment to Educational, Religious, or Charitable Institution emphasizes the structured management of funds to ensure sustainability over time, while charities emphasize direct support.

The four types of endowments are permanent, temporary, term, and quasi-endowments. Each type serves a unique purpose and is governed by specific terms set by the donor. Learning about these distinctions can help you make informed decisions regarding a Washington Restricted Endowment to Educational, Religious, or Charitable Institution.

An endowment fund is a financial asset intended to provide sustainable support to an organization or institution over time. Typically, the principal remains intact, while the earnings are used for operational costs or project funding. This is particularly relevant for a Washington Restricted Endowment to Educational, Religious, or Charitable Institution, as it ensures long-term financial stability.

An endowment under UPMIFA refers to funds generated for an institution's long-term support, with specific guidelines on how those funds can be invested and spent. UPMIFA encourages careful management of such funds to ensure their growth and ethical usage. When considering a Washington Restricted Endowment to Educational, Religious, or Charitable Institution, understanding UPMIFA's provisions is crucial.

A restricted endowment designates funds for a specific purpose, while an unrestricted endowment allows the institution to use the funds as needed. This distinction influences how institutions manage their investments and spending. Understanding these differences can aid you in choosing the right approach when establishing a Washington Restricted Endowment to Educational, Religious, or Charitable Institution.

The Uniform Prudent Management of Institutional Funds Act (UPMIFA) governs how certain endowments are managed, allowing institutions to invest and spend the fund principal responsibly. UPMIFA ensures that funds are used in alignment with the donor's intent and the institution’s mission. If you're navigating these waters, it's vital to know how UPMIFA affects a Washington Restricted Endowment to Educational, Religious, or Charitable Institution.