Washington Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift In Washington state, charitable and educational institutions play a vital role in supporting various causes and improving the lives of individuals and communities. When these organizations receive pledged gifts from donors, it is essential to provide proper acknowledgment to ensure transparency, build donor trust, and maintain compliance with state regulations. The Washington Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift is a formal process that entails recognizing and documenting the receipt of a promised donation. This acknowledgment serves as evidence for both the donor and the institution, ensuring accountability and facilitating a smooth flow of financial operations. The following are some key details and types of Washington Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift: 1. Pledge Identification: The acknowledgment must include the identification of the pledged gift. This includes the donor's name, contact information, and the specific amount or type of donation pledged. 2. Institution's Information: The institution must provide its legal name, address, and contact details. This helps the donor and any relevant authorities to identify the recipient of the pledged gift accurately. 3. Donation Details: The acknowledgment should detail the purpose or designated fund for which the gift is intended. This ensures that the donor's intentions align with the institution's mission and objectives. 4. Donation Value and Date: The acknowledgment must clearly state the fair market value or estimated value of the pledged gift. Additionally, the date when the commitment was made, or the pledge was received, should be mentioned. 5. Payment Information: If the pledged gift involves multiple payment installments, the acknowledgment should outline the agreed-upon schedule and methods of payment. This information can help both parties ensure a smooth and organized transfer of funds. 6. Tax Reducibility: Charitable and educational organizations must specify whether the pledged gift is tax-deductible or if any limitations apply. This information is crucial for donors to understand the potential tax implications of their contribution. 7. Donor Instructions: If the donor has any special instructions or conditions associated with their pledged gift, such as anonymity or specific recognition, these should be clearly stated in the acknowledgment. 8. Signature and Official Seal: The acknowledgment should be signed by an authorized representative of the receiving institution and may include an official seal or logo to validate its authenticity. By following the Washington Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift guidelines, organizations can ensure compliance with state regulations and maintain healthy donor relationships. It is important for both parties to communicate openly and transparently throughout the pledge process to avoid any misunderstandings or conflicts. Overall, the Washington Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift serves as an essential document to formalize and honor the commitment made by donors, fostering a culture of philanthropy and collective impact in Washington state.

Washington Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift

Description

How to fill out Washington Acknowledgment By Charitable Or Educational Institution Of Receipt Of Pledged Gift?

US Legal Forms - one of many biggest libraries of legitimate forms in the USA - delivers a wide array of legitimate file web templates it is possible to acquire or print out. Utilizing the website, you will get thousands of forms for business and person uses, categorized by classes, claims, or search phrases.You will find the most up-to-date models of forms such as the Washington Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift in seconds.

If you already possess a monthly subscription, log in and acquire Washington Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift from your US Legal Forms local library. The Download option will show up on each and every kind you perspective. You gain access to all in the past downloaded forms within the My Forms tab of your respective account.

In order to use US Legal Forms initially, here are easy instructions to obtain started:

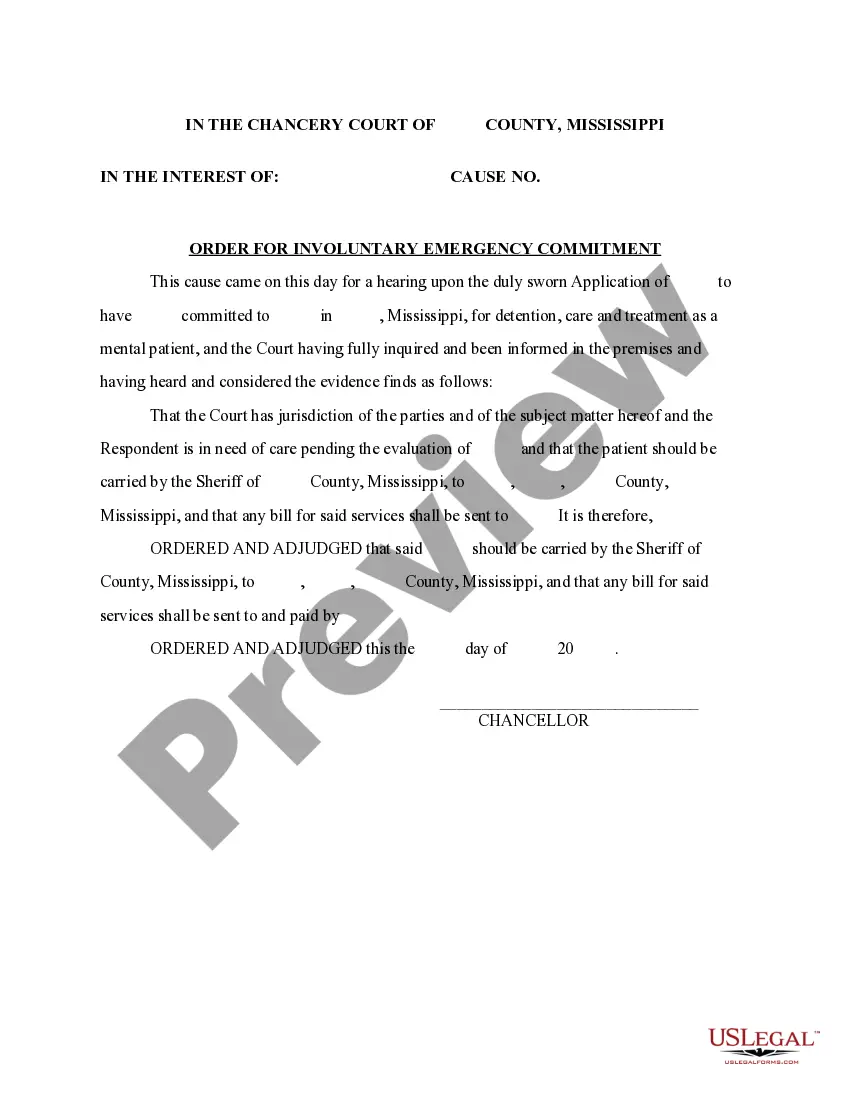

- Make sure you have chosen the best kind for your metropolis/county. Select the Preview option to examine the form`s content material. Look at the kind explanation to actually have chosen the correct kind.

- In the event the kind doesn`t suit your specifications, utilize the Search discipline on top of the monitor to obtain the one which does.

- Should you be pleased with the form, validate your decision by clicking on the Acquire now option. Then, select the costs plan you favor and supply your accreditations to sign up on an account.

- Process the deal. Make use of your Visa or Mastercard or PayPal account to complete the deal.

- Find the file format and acquire the form in your gadget.

- Make alterations. Fill out, revise and print out and signal the downloaded Washington Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift.

Each and every design you included in your bank account lacks an expiration particular date and is also yours for a long time. So, in order to acquire or print out an additional backup, just proceed to the My Forms area and then click in the kind you will need.

Get access to the Washington Acknowledgment by Charitable or Educational Institution of Receipt of Pledged Gift with US Legal Forms, by far the most substantial local library of legitimate file web templates. Use thousands of specialist and express-certain web templates that satisfy your company or person requirements and specifications.

Form popularity

FAQ

What do you need to include in your donation acknowledgment letter? The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

Each letter should include the following information: The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

10 Short Thank You Message For Donation Examples ?Your support means the world to us! ... ?We are so grateful for your donation and for being a part of our cause. ... ?Thank you for choosing to make a difference through your donation. ... ?From the bottom of our hearts, thank you for your generous contribution.

Dear [Donor Name], Today, I'm writing to ask you to support [cause]. By donating just [amount], you can [specific impact]. To donate, [specific action]. Thank you for joining [cause's] efforts during this [adjective] time?It's supporters like you that help us change the world every day.

Here are basic donation receipt requirements in the U.S.: Name of the organization that received the donation. A statement that the nonprofit is a public charity recognized as tax-exempt by the IRS under Section 501(c)(3) Name of the donor. The date of the donation. Amount of cash contribution.

Sample Donor Acknowledgement Letter for Non-Cash Donation On [DATE], you donated [DESCRIPTION ? WITHOUT MONETARY VALUE]. This gift is greatly appreciated and will be used to support our mission. In exchange for this contribution, you received [GOODS OR SERVICES ? WITH ESTIMATE OF FAIR MARKET VALUE].

The following is an example of a written acknowledgment where a charity accepts contributions in the name of one of its activities: "Thank you for your contribution of $250 to (Organization) made in the name of its Kids & Families program. No goods or services were provided in exchange for your donation."

You can acknowledge their generosity in much the same way you thank your other donors?with just a few differences. Thank the donor who recommended the grant, not Fidelity Charitable. ... Eliminate all references to the gift being tax-deductible. ... Use a thank-you as an opportunity to drive future engagement.