A Washington Promissory Note — Payable on Demand is a legally binding document that outlines the terms and conditions of a loan agreement between two parties — the lender and the borrower. In this type of promissory note, the borrower promises to repay the loan amount to the lender upon their demand or request. The note includes crucial information such as the names and contact details of both parties, the principal loan amount, the interest rate (if applicable), the repayment terms, and any additional provisions or agreements agreed upon by both parties. It serves as evidence of the loan transaction and the borrower's obligation to repay the debt. Keywords: Washington Promissory Note, Payable on Demand, legally binding document, loan agreement, lender, borrower, loan amount, interest rate, repayment terms, principal loan amount, additional provisions, obligation, debt. Different types of Washington Promissory Notes — Payable on Demand can include: 1. Personal Promissory Note — Payable on Demand: This type of promissory note is used for personal loans between individuals, friends, or family members. It allows for flexibility in terms of interest rates and repayment plans. 2. Business Promissory Note — Payable on Demand: This promissory note is specifically tailored for business-related loans. It can be used for various purposes such as financing business operations, purchasing assets, or investing in business ventures. 3. Secured Promissory Note — Payable on Demand: In this type of note, the borrower pledges collateral (e.g., real estate, vehicles, or valuable assets) to secure the loan. This provides the lender with an added layer of protection in case the borrower defaults on the loan. 4. Unsecured Promissory Note — Payable on Demand: Unlike a secured promissory note, an unsecured note does not require any collateral. This type of note is based solely on the borrower's creditworthiness and trustworthiness. 5. Demand Promissory Note for Loans with Interest: This promissory note includes an additional provision for charging interest on the loan amount. The interest rate is agreed upon by both parties and added to the principal loan amount, increasing the total repayment amount. Remember, it is essential to consult with a legal professional when drafting or using a promissory note to ensure it complies with Washington state laws and accurately reflects the agreed-upon terms between the lender and borrower.

Washington Promissory Note - Payable on Demand

Description

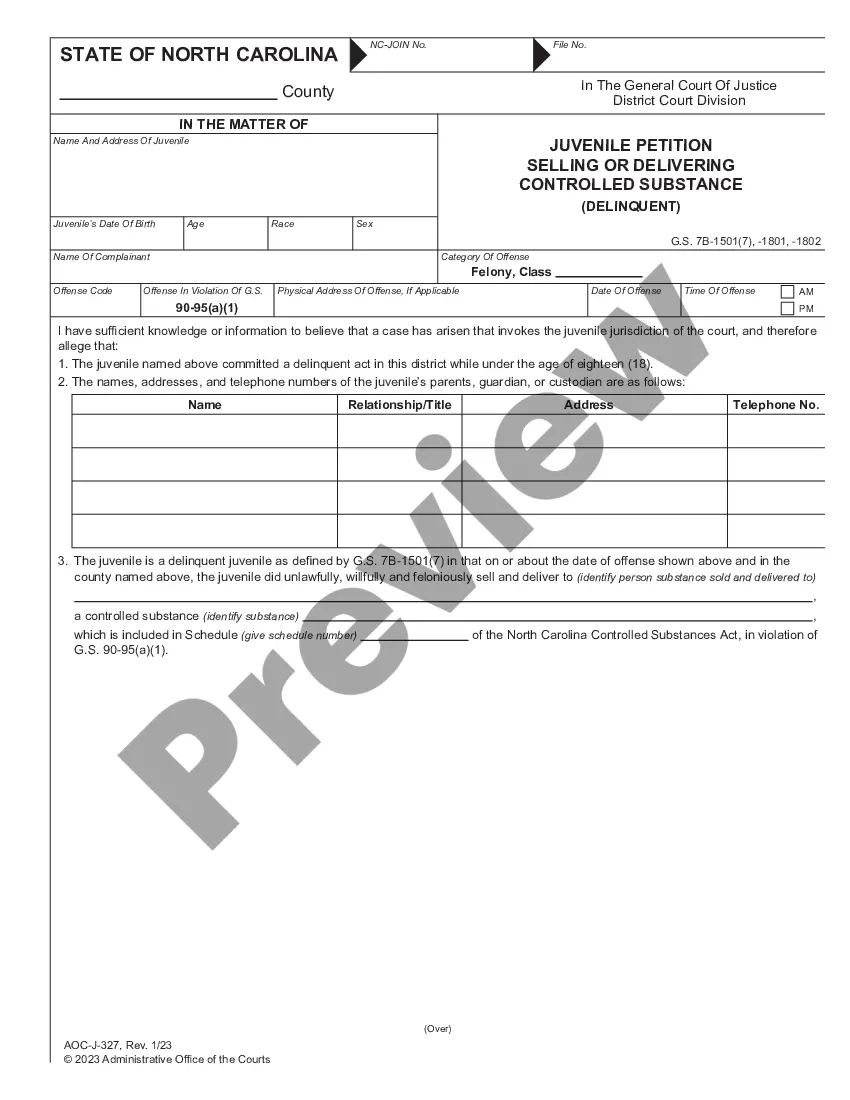

How to fill out Washington Promissory Note - Payable On Demand?

Finding the appropriate legal document template can be a challenge.

There are numerous templates available online, but how do you identify the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Washington Promissory Note - Payable on Demand, suitable for both business and personal needs.

You can preview the form using the Review button and read the form description to confirm it is the right one for you.

- All forms are verified by professionals and comply with state and federal regulations.

- If you are already registered, Log Into your account and click on the Acquire button to download the Washington Promissory Note - Payable on Demand.

- Use your account to browse the legal forms you have previously ordered.

- Head to the My documents tab of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have chosen the correct form for your area/region.

Form popularity

FAQ

A promissory note on demand refers to a financial agreement that allows the lender to request payment at any time. This type of note provides flexibility in repayment, which can benefit both parties under changing financial circumstances. By choosing a Washington Promissory Note - Payable on Demand, you ensure that your funding arrangements are adaptable and serve your immediate needs.

To demand payment on a promissory note, you should formally notify the borrower that you wish to collect the outstanding amount as per the terms of the note. It's essential to provide any required documentation and refer to the specific clause regarding demand repayment. Tools available on the US Legal Forms platform can help you create the necessary documentation to facilitate this request professionally and efficiently.

Yes, a promissory note can be structured to be payable to a specific person or entity. This ensures that the borrower knows exactly who the payment goes to, enhancing transparency in the transaction. A Washington Promissory Note - Payable on Demand further ensures that this payment can be requested at any moment, making it a versatile instrument for financial agreements.

A demand payment of a promissory note means that the lender can request repayment at any time. This feature offers flexibility for both parties, providing peace of mind to the lender, knowing they can receive their funds when needed. With a Washington Promissory Note - Payable on Demand, lenders enjoy this advantage while borrowers can prepare for possible repayment expectations.

In Washington state, the validity of a promissory note largely depends on the terms set within the document and the applicable statutes of limitations. Generally, the statute of limitations for written contracts, including promissory notes, is six years. Therefore, to ensure your Washington Promissory Note - Payable on Demand remains enforceable, it is best to settle any outstanding obligations within this timeframe.

An assignment of a Washington Promissory Note - Payable on Demand does not always need to be notarized, but doing so can provide additional legal protection. Notarization helps verify the identities of the parties involved and confirms the authenticity of the assignment. It's generally wise to consult a legal professional for specific guidance based on your circumstances.

Yes, a Washington Promissory Note - Payable on Demand can be valid even if it is not notarized, provided it meets the essential requirements for validity. However, not having it notarized can complicate the enforcement process in a legal dispute. It's often a good idea to consider notarization for added protection and credibility.

For a Washington Promissory Note - Payable on Demand to be valid, it must include the essential elements such as clear identification of the parties involved, the amount being borrowed, and the terms of repayment. It should also be signed by the borrower to ensure enforceability. Depending on the situation, having the note witnessed or notarized can add an extra layer of security.

To fill out a Washington Promissory Note - Payable on Demand, start by clearly stating the names of the borrower and lender. Next, include the principal amount being borrowed, as well as the interest rate and repayment terms. Be sure to sign and date the document to make it legally binding.

In Washington state, a promissory note does not necessarily need to be notarized; however, doing so can enhance its credibility. While notarization is not a formal requirement, it can serve as a beneficial proof of the agreement. When creating a Washington Promissory Note - Payable on Demand, consider the advantages of having it notarized to avoid future disputes. The US Legal Forms platform can help you with templates that meet legal standards.

Interesting Questions

More info

Nation Demand Registration Form Notices Coupon ID — valid characters only.