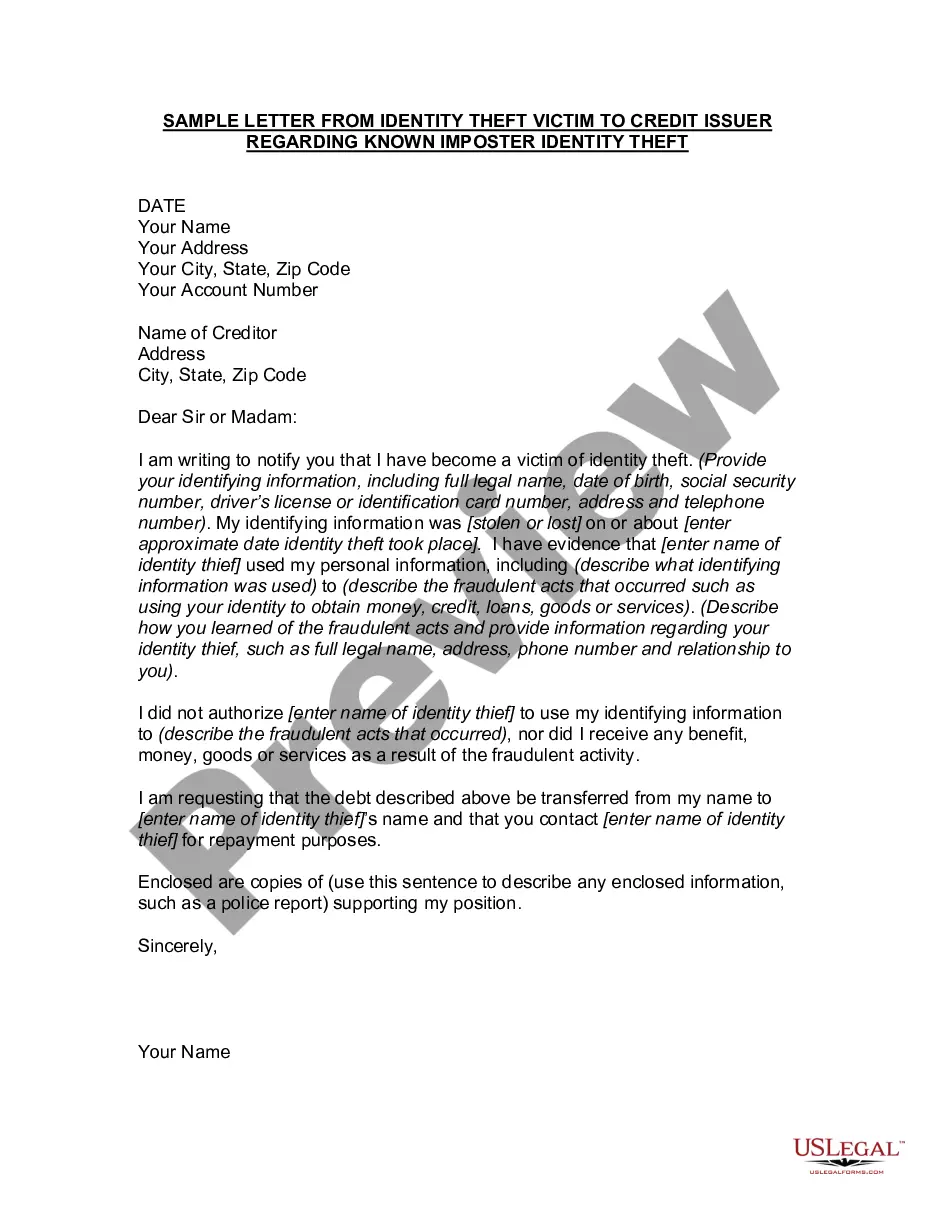

Title: Washington Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft Keywords: Washington, letter, identity theft victim, credit issuer, imposter identity theft, known imposter, detailed description 1. Washington Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft — Overview In Washington state, individuals who have fallen victim to identity theft caused by a known imposter can write a formal letter to their credit issuer to report the fraudulent activity and seek assistance. This comprehensive guide will outline the crucial elements to include in such a letter, ensuring victims effectively communicate their case and secure the necessary support from credit issuers. 2. Steps to Compose the Washington Letter from Identity Theft Victim to Credit Issuer a. Introduction: Begin the letter by addressing the credit issuer, mentioning their company name and relevant department as appropriate. Clearly state that the letter pertains to identity theft caused by a known imposter and provide a brief summary of the situation. b. Victim's Information: Include personal details, such as full name, address, contact number, and account number (if applicable). Specify that the letter is an official account of the identity theft incident and request immediate attention to resolve the matter. c. Nature of Known Imposter Identity Theft: Describe, in detail, how the known imposter has misused your identity. Include information like the timeframe of fraudulent activity, specific instances of fraudulent transactions, unauthorized account openings, or other misleading actions committed by the imposter. d. Supporting Documentation: Mention the enclosed documents that provide evidence of the known imposter identity theft. This may include police reports, copies of fraudulent transactions, correspondence with other relevant entities, or any other supporting material that strengthens your case. e. Request for Action: Clearly express your expectations from the credit issuer, such as freezing or closing any affected accounts, launching an investigation into the imposter's activities, removing fraudulent entries from credit reports, and ensuring comprehensive identity theft protection. f. Contact Information: Provide your preferred method of communication (phone or email) and furnish your contact details for further correspondence regarding the case. g. Closing: Thank the credit issuer for their prompt attention to the matter and emphasize the urgency of their response. Sign the letter with your full name and date it. 3. Different Types of Washington Letters from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft There might not be distinct classifications for different types of Washington letters in this context. However, based on the severity or complexity of the imposter identity theft, victims may need to modify the content and tone accordingly. Some variations could include: — Simple Washington Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft — Complex Washington Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft — Urgent Washington Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft By customizing the content to align with their specific circumstances, victims can ensure their letter effectively conveys the seriousness of the situation to credit issuers, increasing the likelihood of prompt action and resolution.

Washington Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft

Description

How to fill out Washington Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft?

If you have to complete, down load, or produce legitimate papers web templates, use US Legal Forms, the largest variety of legitimate types, which can be found online. Make use of the site`s simple and handy search to discover the documents you require. Various web templates for business and individual reasons are sorted by types and says, or key phrases. Use US Legal Forms to discover the Washington Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft in just a number of clicks.

If you are already a US Legal Forms buyer, log in to your bank account and click the Obtain key to get the Washington Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft. You can also accessibility types you formerly acquired from the My Forms tab of the bank account.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have selected the shape for that correct town/nation.

- Step 2. Take advantage of the Preview solution to look through the form`s content. Don`t forget to read the outline.

- Step 3. If you are not satisfied with all the type, use the Look for discipline towards the top of the monitor to find other versions from the legitimate type format.

- Step 4. Once you have found the shape you require, select the Get now key. Pick the prices plan you favor and add your credentials to register to have an bank account.

- Step 5. Process the purchase. You can use your charge card or PayPal bank account to complete the purchase.

- Step 6. Find the formatting from the legitimate type and down load it in your system.

- Step 7. Complete, change and produce or indicator the Washington Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft.

Every single legitimate papers format you buy is your own eternally. You possess acces to every type you acquired within your acccount. Click the My Forms segment and decide on a type to produce or down load once more.

Compete and down load, and produce the Washington Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft with US Legal Forms. There are millions of expert and condition-distinct types you can utilize for your business or individual requires.