Washington Agreement and Release for Working at a Novelty Store - Self-Employed

Description

How to fill out Agreement And Release For Working At A Novelty Store - Self-Employed?

US Legal Forms - one of the largest collections of authentic forms in the United States - offers an extensive selection of authentic document templates that you can acquire or print.

By using the website, you can access a multitude of forms for commercial and personal applications, organized by categories, states, or keywords. You can find the latest versions of forms like the Washington Agreement and Release for Working at a Novelty Store - Self-Employed in just a few minutes.

If you already have an account, Log In and obtain the Washington Agreement and Release for Working at a Novelty Store - Self-Employed from the US Legal Forms library. The Obtain button will be displayed on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Choose the format and acquire the form on your device.

Edit. Complete, modify, print, and sign the downloaded Washington Agreement and Release for Working at a Novelty Store - Self-Employed. Each template you added to your account has no expiration date and belongs to you permanently. So, if you want to acquire or print another version, simply go to the My documents section and click on the form you need.

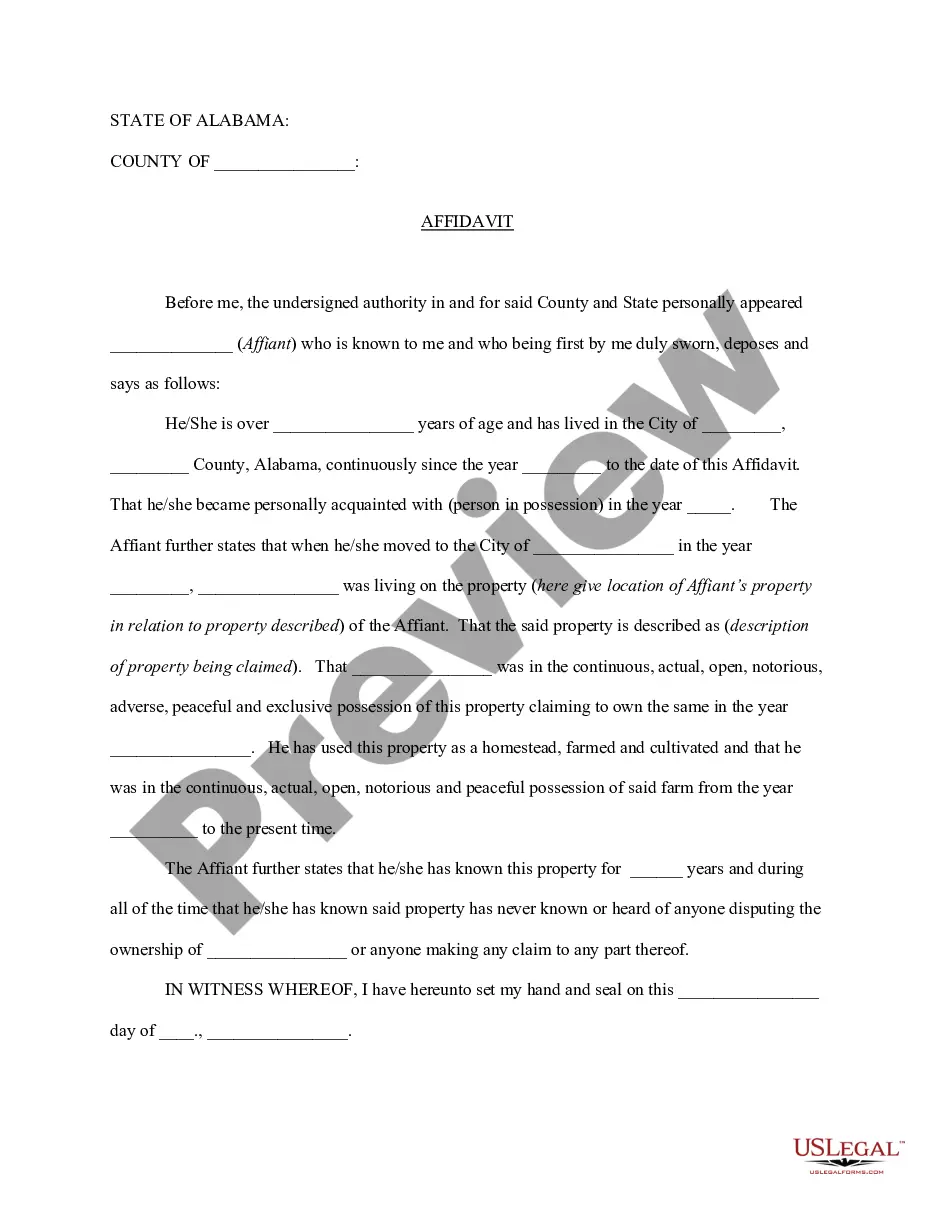

- Ensure you have selected the correct form for your region/county. Click on the Preview button to review the contents of the form.

- Review the form details to confirm that you have selected the appropriate form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, verify your selection by clicking the Acquire now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Form popularity

FAQ

To become self-employed in Brazil, familiarize yourself with local regulations, including obtaining any necessary permits. Consider how your operations may relate to a Washington Agreement and Release for Working at a Novelty Store - Self-Employed. Seeking guidance from a local expert or legal consultant can streamline the process and help you understand tax obligations and business structures available.

To account for self-employment, track all income and expenses related to your business diligently. This includes documenting all transactions that stem from your Washington Agreement and Release for Working at a Novelty Store - Self-Employed. By maintaining clear records and consistently categorizing your financial activities, you can ensure a precise overview of your business's financial health.

You can list your self-employment by detailing your business activities on the appropriate tax forms. Be specific about your role and responsibilities related to your Washington Agreement and Release for Working at a Novelty Store - Self-Employed. Adding accurate descriptions helps clarify your self-employment status and supports your income declarations.

You will enter self-employed income directly on your tax return, usually on Schedule C or Schedule C-EZ, depending on your situation. This is where you detail your earnings from your Washington Agreement and Release for Working at a Novelty Store - Self-Employed activities. By documenting all relevant income, you ensure compliance and can take advantage of any eligible deductions that may reduce your taxable income.

To enter self-employment, begin by listing your business name or trade name. You can then include your self-employment income on your tax forms, typically on Schedule C, which details the income you earn as part of your Washington Agreement and Release for Working at a Novelty Store - Self-Employed. Make sure to keep accurate records of your earnings and business expenses for a smooth filing process.

The main difference between an employee and an independent contractor in Washington state lies in control and independence. Employees work under the direction of an employer, while independent contractors operate independently, often with more freedom in how they complete their tasks. Understanding these differences is crucial when drafting a Washington Agreement and Release for Working at a Novelty Store - Self-Employed, to clearly lay out your roles and responsibilities.

Yes, if you are a contractor performing construction work, you are required to obtain a contractor's license in Washington state. This ensures that you meet necessary standards and regulations. In the context of a Washington Agreement and Release for Working at a Novelty Store - Self-Employed, having the proper licensing adds credibility to your services and protects both you and your clients.

To become an independent contractor in Washington state, you need to establish your business structure, register your business, and obtain necessary permits. It is also essential to have a solid contract outlining your working relationship, such as a Washington Agreement and Release for Working at a Novelty Store - Self-Employed. Additionally, ensure you track your expenses and income for tax purposes.

Yes, freelancers may need a business license in Washington state depending on their business structure and location. Generally, cities will require you to obtain a license to operate legally. When setting up a Washington Agreement and Release for Working at a Novelty Store - Self-Employed, it’s wise to check local regulations to ensure compliance and avoid any unnecessary penalties.

In Washington state, independent contractors are generally not required to carry workers' compensation insurance. However, if you plan to hire employees or if you're working in specific industries, obtaining coverage may be necessary. To protect yourself while working under a Washington Agreement and Release for Working at a Novelty Store - Self-Employed, consider consulting with a legal expert or an insurance provider.