Title: Washington Buy Sell Agreement Between Co-Owners of Real Property: An In-Depth Overview Introduction: A Washington Buy Sell Agreement Between Co-Owners of Real Property is a legally binding contract that governs the rights and obligations of co-owners in jointly owned real estate. This agreement outlines the conditions under which a co-owner can sell their share of the property to another co-owner or a third party, ensuring a fair and smooth transfer of ownership. Let's explore the key elements, types, and benefits of such agreements in Washington state. Key Elements: 1. Parties involved: The agreement identifies the co-owners and any third parties involved in the transaction. 2. Property details: Comprehensive information about the jointly owned real property, including its address, legal description, and boundaries, is included. 3. Sale conditions: The agreement lays out the circumstances under which a co-owner may sell their share, such as death, disability, divorce, disagreement, bankruptcy, or a desire to exit the investment. 4. Purchase price: A mechanism for determining the fair market value of the co-owner's share is established, either through an appraisal process or predetermined formula. 5. Right of first refusal: Co-owners may grant each other the first opportunity to purchase the departing co-owner's share before it can be sold to a third party. 6. Funding arrangements: The agreement may address financing options available to co-owners, such as obtaining a mortgage or using personal funds, to acquire the departing co-owner's share. 7. Closing procedures: The process for completing the sale, including the timeline, documentation, and division of costs, is detailed. 8. Dispute resolution: The agreement may contain provisions outlining the resolution of any disputes that may arise during the sale process. Types of Washington Buy Sell Agreements Between Co-Owners: 1. Cross-Purchase Agreement: In this type, each co-owner agrees to purchase the share of any departing co-owner. It is commonly used when there are only two co-owners. 2. Stock Redemption Agreement: Typically used in corporations that own real property, this agreement allows the corporation to buy back shares from a departing co-owner. 3. Entity Purchase Agreement: In this agreement, a separate entity, such as a limited liability company (LLC), is established to own the property. The entity buys back the departing co-owner's interest. 4. Hybrid Agreement: Co-owners may customize and combine elements from different types of agreements to suit their unique needs. Benefits of a Washington Buy Sell Agreement Between Co-Owners: 1. Clarity and Certainty: The agreement defines the conditions of sale, preventing disputes and ensuring a smooth transition. 2. Fair Valuation: By determining the price based on a predetermined formula or professional appraisal, the agreement minimizes disagreements over property value. 3. Protection of Interests: The agreement safeguards the interests of all co-owners by providing them with the first opportunity to purchase the departing co-owner's share. 4. Continuity and Stability: A well-drafted agreement can prevent unwanted third-party ownership, ensuring that the property remains within the existing group of co-owners. 5. Avoidance of Litigation: By addressing potential conflicts in advance, the agreement can minimize the need for costly and time-consuming legal proceedings. Conclusion: A Washington Buy Sell Agreement Between Co-Owners of Real Property establishes the terms and conditions for the sale of a co-owner's share in jointly owned real estate. By ensuring fair treatment, clarity, and seamless transitions, these agreements contribute to the overall stability and harmony among co-owners. From cross-purchase and stock redemption agreements to entity purchase and hybrid agreements, the specific type of agreement chosen depends on the co-owners' circumstances and preferences.

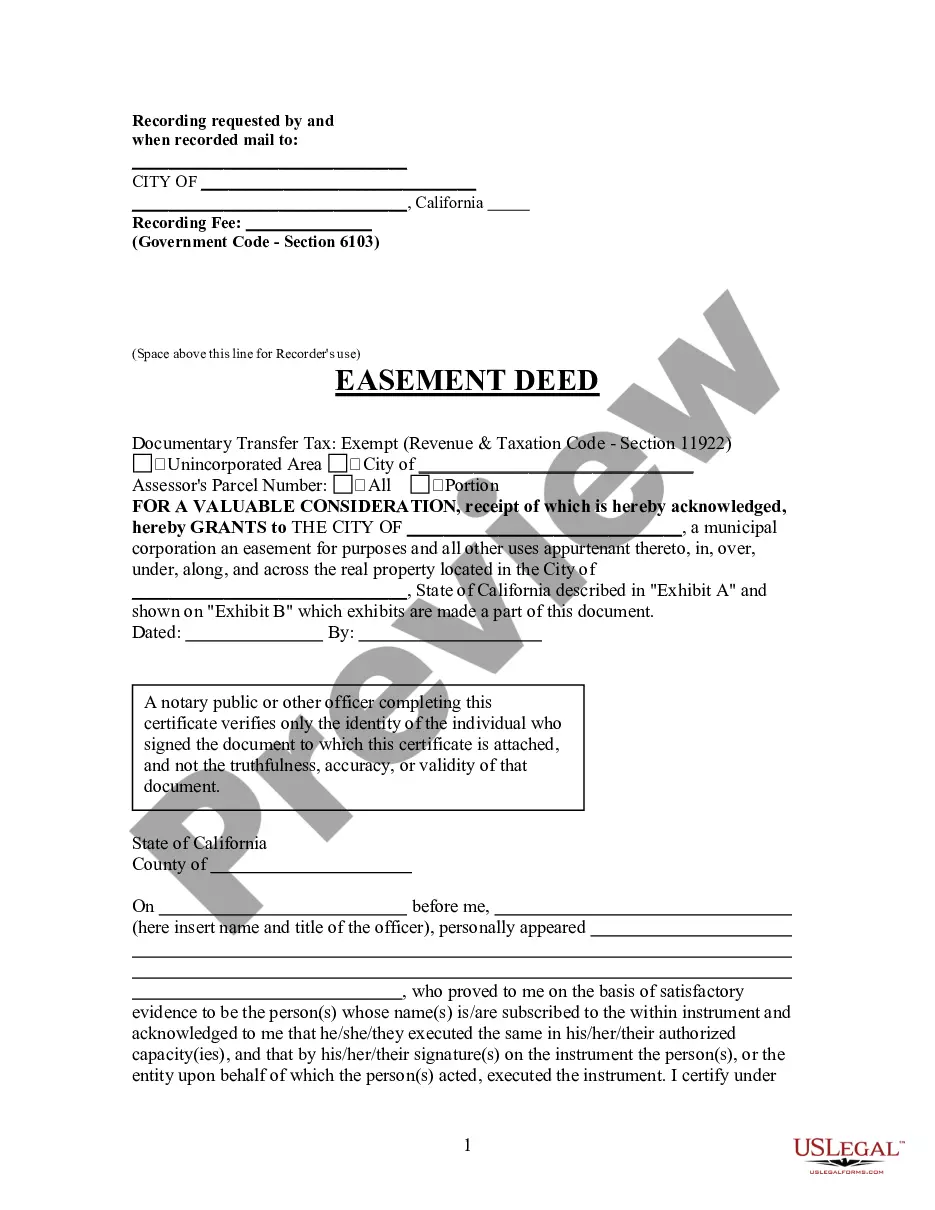

Washington Buy Sell Agreement Between Co-Owners of Real Property

Description

How to fill out Washington Buy Sell Agreement Between Co-Owners Of Real Property?

You may invest hrs on the Internet looking for the authorized record template that meets the federal and state specifications you need. US Legal Forms offers a huge number of authorized kinds that are evaluated by professionals. You can actually acquire or print out the Washington Buy Sell Agreement Between Co-Owners of Real Property from my services.

If you already have a US Legal Forms account, you are able to log in and click on the Acquire button. Afterward, you are able to comprehensive, edit, print out, or signal the Washington Buy Sell Agreement Between Co-Owners of Real Property. Every authorized record template you acquire is your own property for a long time. To have another copy associated with a bought form, visit the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms internet site initially, adhere to the easy guidelines under:

- Very first, make certain you have selected the proper record template for your region/area that you pick. Look at the form explanation to make sure you have picked the correct form. If offered, utilize the Review button to search through the record template too.

- In order to find another version of the form, utilize the Search discipline to find the template that meets your requirements and specifications.

- After you have located the template you desire, simply click Acquire now to carry on.

- Select the prices strategy you desire, key in your accreditations, and sign up for a free account on US Legal Forms.

- Complete the deal. You may use your charge card or PayPal account to pay for the authorized form.

- Select the structure of the record and acquire it to your system.

- Make modifications to your record if required. You may comprehensive, edit and signal and print out Washington Buy Sell Agreement Between Co-Owners of Real Property.

Acquire and print out a huge number of record layouts while using US Legal Forms website, that provides the most important collection of authorized kinds. Use skilled and condition-particular layouts to deal with your organization or specific needs.